Global| Jan 31 2014

Global| Jan 31 2014Unemployment in the European Union

Summary

The unemployment rate dropped by a small margin in the European Union while it remained fixed at 12% in the European Monetary Union. However the numbers of unemployed are dropping relatively sharply in both the EU and the EMU. [...]

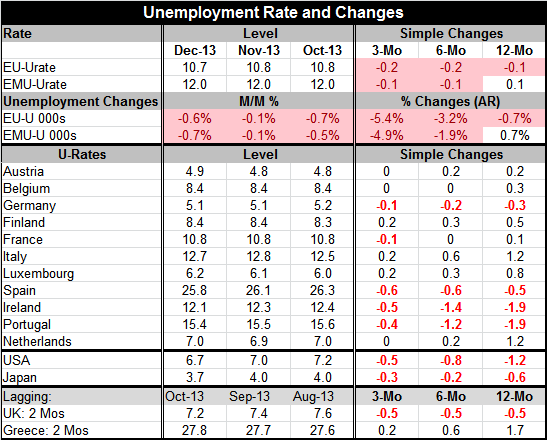

The unemployment rate dropped by a small margin in the European Union while it remained fixed at 12% in the European Monetary Union. However the numbers of unemployed are dropping relatively sharply in both the EU and the EMU. Unemployment declines over the past three months on the order of 5% at an annual rate have been seen in the number of unemployed in both the EU and the EMU. The unemployment rate in the EMU has declined over three months and six months while the unemployment rate in the EU has declined over three months, six months and 12 months.

The unemployment rate dropped by a small margin in the European Union while it remained fixed at 12% in the European Monetary Union. However the numbers of unemployed are dropping relatively sharply in both the EU and the EMU. Unemployment declines over the past three months on the order of 5% at an annual rate have been seen in the number of unemployed in both the EU and the EMU. The unemployment rate in the EMU has declined over three months and six months while the unemployment rate in the EU has declined over three months, six months and 12 months.

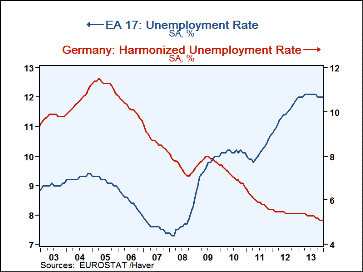

As the table shows, there has been a great deal of variation in the levels of unemployment and in the changes in the rates of unemployment across Europe. The highest unemployment rate in December is in Spain at 25.8%. But lagging data from Greece show the unemployment rate in October at 27.8%. In Austria the unemployment rate is 4.9% and in Germany it is 5.1%. After those two, the lowest rate goes up to 6.2% in Luxembourg and to 7% in the Netherlands. For all of the EU, the rate is 10.7%. For the EMU, the rate is 12%. The EMU has a higher rate likely because of its single currency restriction, which has led to greater dislocations owing to the inability of monetary policy to target problems on a local level.

In terms of changes in unemployment rates, of the 11 EMU members with data available through December listed in the table, five of them have unemployment rates declining over the last three months. Austria, Belgium, and the Netherlands have unemployment rates flat over the last three months Luxembourg, Italy, and Finland have unemployment rates rising over the last three months. Among those nations with falling unemployment rates, the unemployment rate has fallen by 6/10 of a percentage point in Spain, by 0.5 of a percentage point in Ireland and by 0.4 of a percentage point in Portugal with minor declines of 0.1 of a percentage point in each in Germany and in France. Over six months the list of those with rates lower versus higher are pretty much the same as three months and in the same is true over 12 months.

By comparison the unemployment rate in the US fell by 0.5 percentage points over three months, by 0.8 percentage points over six months and by 1.2 percentage points over 12 months. In Japan, unemployment rates fell by 0.3 percentage points over three months, by 0.2 percentage points over six months and by 0.6 percentage points over 12 months. Rates outside of Europe are falling faster than the falling within Europe.

The UK is a member of the EU but not of the fixed currency area. Its unemployment declines are steady at 0.5 percentage points over three months, six months and 12 months. Greece, on the other hand, that has lagging statistics like the UK, shows unemployment rising by 0.2 percentage points over three months, by 0.6 percentage points over six months and by 1.7 percentage points over 12 months. Greece is still backtracking in terms of its unemployment rate based on data available through October 2013.

While we still see progress in growth in Europe, German retail sales declined unexpectedly around the Christmas season falling by 2.5% in real terms compared to November. This reversed a 0.9% November rise. While Germany has posted solid growth rates and consistent growth rates, it continues to fail to stimulate its retail sector, a sector that could create benefits to be exploited by other EMU members. Germany continues to have the largest current account surplus in the world.

In assessing growth potential in the euro area, European Central Bank governing Council member Ewald Nowotny said on Friday that the euro area would be moving out of recession but that there would be weak growth this year and that he expected there to be continuing differences in the performance among various member countries. This is clearly something that we see in the data looking back at past performance.

Looking ahead, there is an expectation of improvement. But there is no expectation that the improvement will be strong. The ECB, while trying to promise to create economic conditions that will continue to foster growth, is also concerned about banks and rules are being implemented to ensure that banks will continue to have sufficient capital to operate safely in the euro area. All in all, there is no reason to lose optimism that the European region is improving; however, there is reason to be modest about setting expectations about what that will mean.

It is also worth mentioning that there continue to be difficulties in various developing economies around the world. But the Federal Reserve in the US, having just announced another step up in its tapering program, indicating that it's going to pull stimulus out of the economy at a slightly faster rate than before, was greeted by global markets that shuddered in the aftermath of that revelation. Head of India's central bank governor Raghuram Rajan was warned of the breakdown in global policy coordination in the wake of the Fed's policy announcement. I, however, am unaware of any pledge for there to be global policy coordination. That process seems largely to have stopped after the so-called Louvre Accord which famously failed to stop the yen's continued rise vs. the dollar.

In the aftermath of that failure, central banks focused somewhat more attention on getting their own houses in order instead of on exchange rate manipulation and macro-policy coordination. That shift in emphasis would seem still to be the order of business in today's economy.

Trade has continued to expand apace, which means that the global linkages have become stronger and capital flows more abundant. And we continue to have countries that have structural deficits and surpluses that suggest that they are either living beyond their means persistently or not developing their own domestic demand sufficiently and relying on the evolution of demand abroad- always a dangerous position to be in.

To suggest that a country, like the US, that has been running structural deficits since the early 1990s (and largely worsening deficits), should continue to over-stimulate its economy for the sake of growth in developing nations seems to be extremely shortsighted. If the value and the dependability of the reserve currency is to be preserved, the economy of the reserve currency country needs to be strong. The US has a lot of work to do in that regard and over-stimulating the economy is not one of the items on that list.thank you.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.