Global| Mar 21 2016

Global| Mar 21 2016What Does the Stubborn Euro Area Current Account Surplus Really Mean?

Summary

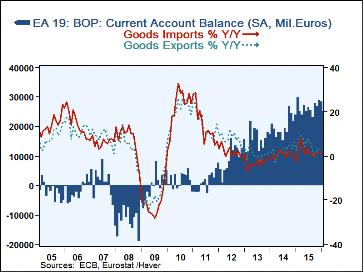

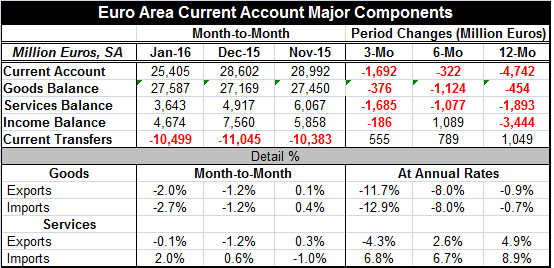

The chart in this article shows that the euro area current account surplus is still quite large. However, in the table data, we see month-to-month it is lower and that over three months it is lower and over 12 months it is lower. The [...]

The chart in this article shows that the euro area current account surplus is still quite large. However, in the table data, we see month-to-month it is lower and that over three months it is lower and over 12 months it is lower. The decline in the EMU surplus is not yet something that looks like a real reversal, but it looks more like the surplus has hit a plateau and is fluctuating at a still sizeable surplus level.

The chart in this article shows that the euro area current account surplus is still quite large. However, in the table data, we see month-to-month it is lower and that over three months it is lower and over 12 months it is lower. The decline in the EMU surplus is not yet something that looks like a real reversal, but it looks more like the surplus has hit a plateau and is fluctuating at a still sizeable surplus level.

However, underneath it there are trends that do seem to imply that the erosion is for real even if very slow-taking. Over 12 months, both merchandise and services export growth is weaker than growth for comparable imports. Those trends imply stronger import growth than export growth and a diminishing surplus. When we look at the changes in the current account, the goods trade balance, the services balance and the income balance, we find each of these is eroding over three months (from six months ago), eroding over six months (from 12 months ago) and eroding over12 months from the previous 12 months ago. Only the income balance shows a contrary enlargement over six months compared to 12 months. And current transfers continue to show decelerating net outflows. So while most of the sub account balance trends tend to show a deterioration of the current account surplus, the current transfer item is tending to boost it.

The impact of migrants?

It is hard to tell how much the inflow of migrants affect these data. If migrants are bringing assets into the area, they would be counted as a net inflow item. We know that in the case of Denmark there is something rotten. (I wish to remind you that the Danes are rated as the happiest people in the world in a recent survey despite having huge tax rates.) These ever-happy Danes voted to confiscate migrant wealth if migrants are applying for public benefits. Presumably these seizures would be counted up and treated as a net inflow item. Overall, of course, EMU area transfers are a net outflow item since there are many workers from abroad with jobs in France and in Germany in particular who send funds back home, generating regular and persistent outflows. The presence of these continuing outflows (the negative values under the transfers account) are an often cited as the reason Europe and Germany run a large surplus on the goods trade account to offset the impact of these outflows on a balance of payments basis. But Europe has been more than compensating for this for some time with persistent current account surpluses.The role of exchange rates

The EMU continues to be an economic region that defies conventional exchange rate rules for equilibrium. While to many it seems natural that Europe has a weak currency since ECB policy is expansive and interest rates are low or negative, it is also true that Europe has a substantial current account surplus and member Germany has one of the highest current account surpluses as ratio to GDP in the world. Since U.S. monetary policy by comparison has taken at least one step in the opposite direction, it seems sensible that the dollar should be stronger and the euro weaker, at least to a point. But these are just the cyclical developments that will come and go through the business cycle. What we see here is that since 2011 the EMU has run nothing but current account surpluses. Germany has been in a state of persistent surplus since 2003. Despite these surpluses, the euro exchange rate continues to fall exacerbating that imbalance (i.e. making the European surplus larger not smaller; one pill makes you larger and another pill makes you larger still!).

Trade as a one-sided driver of growth

One theme in international economics is that exchange rates simply are not moving to so as to re-equilibrate current account imbalances. We know that this is not just Europe but that a number of trade oriented Asian countries run surpluses, nothing but surpluses, and depend in trade as a driver of growth. Japan would still be posting significant surpluses if the Tsunami had not caused some second thinking about the role of nuclear power and led to a shutdown of all of Japan's nuclear plants which led to a substantial increase in the importation of oil.

Donald Trump IS ENDOGENOUS

Donald Trump in the U.S. has managed to put trade back on the front burner of the political discussion. Like most things Trump speaks of, it is hard to tell exactly what he plans to do, but his rhetoric is incendiary. While many Trump opponents caution about the danger of tariffs and laud the power of `free trade', it should be clear that there is NO FREE TRADE. We do not have FREE TRADE. Unless and until all the conditions of free trade are met, we will not have it. And having a market-determined exchange rate is one of the conditions that is not met and has not been met. Asian countries have piled up huge reserve of foreign exchange, an act which makes the dollar and euro stronger and the renminbi/yuan (etc.) weaker. When countries use reserve build-ups to target foreign exchange values, the result is not free trade and the gains from trade that are so often talked about do not occur. Instead, we get distortions from trade and we are suffering from that malaise today. Donald Trump has tapped into that discontent.

Prospects for real free trade are not good

Because of cyclical policies, I do not see this changing any time soon. And because of national policies, I do not see it changing in the future. But the absences of the conditions that are the foundation of free trade are the reasons for the excess imbalances in the world economy today. It is one reason why the U.S. economy performs so badly. We can look at German and EMU data on persistent surpluses, but looking at the U.S. data we see a current account deficit in place back to the early 1980s. This is a period far longer than cyclical developments could explain. It is a period so long that it reveals that U.S. trade partners have gamed the foreign exchange system to create a too-strong dollar so they could exploit export-led growth to the U.S. The main culprits may have changed over the years or shifted in importance, but the impact on the U.S. is clear. An overvalued dollar has made the U.S. a poor, uncompetitive place to invest and has deflected investment to overseas markets. Eventually the U.S. has suffered productivity weakness because it has been starved of investment. We see that manufacturing employment in the U.S. has been falling and service sector jobs rising. This has been a substitution of low productivity jobs for high productivity jobs. The resulting string of U.S. current account deficits has required foreign inflows of funds so foreigners have built up foreign exchange reserves or sovereign wealth funds to hold these assets which also are placeholders for their desired exchange rate values. But the end result has been that Asia has over exploited Western markets in general where debt levels are now too high. The Asian export-led growth strategy no longer works because of this excess debt. China in particular is busy trying to remake an economy with domestic demand instead of just a foreign supply focus. The shift is proving painful. Meanwhile, countries in the West are having their own slow-growth pains.

This is not America...

None of this should come as any surprise. You cannot call something free trade that is not free trade and expect to get the free trade result. A rose is a rose unless it's really a pile of dung; then it won't smell as sweet as its name. The rise of the political candidate Donald Trump in the U.S. has many causes. But rest assured that one of them is that the American people have discovered what a sham trade deals have been for the American people. They are tired of losing their jobs. The recent job losses to Mexico from Ohio in this presidential election year have been highlighted. One observer cracked after a water crisis broke out in Flint Michigan that he could remember when they manufactured cars in Michigan and you couldn't drink the water in Mexico. Some `jokes' cruelly hit the mark. This is one of them. And this is a reality that is not lost on Americans or on Michiganders where this long pro-union state has slipped in recent years and chosen to become a right-to-work state. Rest assured that the Donald Trump candidacy is not a fluke. The Republican leadership may be looking for a plan to untrack him, but Donald has support because he stands for things Americans want changed. They want someone to stand up for them. Fight the powers that be!

The land where nothing is what it seems

While the Fed is gloating over progress on the reduction in the unemployment rate and worried about inflation consequences of it, Donald Trump is getting support from all those not unemployed people who are not working and not looking for jobs because none exist in their communities. Reality in America has many different faces. Rest assured that European surpluses are related to the U.S. deficit as surely as is China's. And the failure of world leaders to come to grips with these facts or to try to set clear and fair rules of the game so that fair trade and free trade can flourish instead of rigged trade has become a real problem. A dysfunctional Republican party in the U.S. oddly is trying to figure out how to untrack their most popular candidate because they don't like him. The more that they try to unseat him, the more popular he is likely to become. The U.S. election cycle is getting interesting. The Democrats seem to have a clear leader who is headed for the nomination with all the votes she will need for nomination. The Republican party seems headed for self-destruction. Along the way, we should have no sense that either party gives a hoot about the dysfunctional global trading system that is behind much of the global malaise. Globally U.S. corporations have been able to game the system. They're willing to use inversions to escape taxes (Poof! No longer an American company). Europe is killing corporate tax deals to collect on what it calls illegal tax deals cut by some of its member countries. Firms have been willing to relocate plants for cheaper labor and close high wage plants in the developed world knowing that exchange rates will not adjust and take away the wage advantage they have just obtained with their investment. This aspect of global investment has hit both the U.S. and Europe hard and is bitter blow because it comes in tandem with huge labor saving gains in technology both because of software advances and the use of robotics. Real free trade with real free exchange rate determination is not even a topic on the agenda for any summit discussion or on the platform of any political party. But fairer trade is the focus of Donald Trump. And we are supposed to think that he is the wild man who is out of touch with reality. Is he?

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates