Global| Aug 17 2007

Global| Aug 17 2007Where Does the Oil Come From?

Summary

We speak often about oil demand, in which regions it has grown and where it is more restrained and how can we use oil more efficiently. But price, of course, results from both demand AND supply. So discussion of oil markets is not [...]

We speak often about oil demand, in which regions it has grown and where it is more restrained and how can we use oil more efficiently. But price, of course, results from both demand AND supply. So discussion of oil markets is not really complete without some consideration of supply conditions. Even if we believe supply is exogenous to consumers, we still need to understand how much is coming from where.

These details are arrayed nicely in Haver's OMI database, furnished by our partner source, Energy Intelligence, as part of their publication "Oil Market Intelligence". This company has representatives in fields around the world to assess the availability of this important resource.

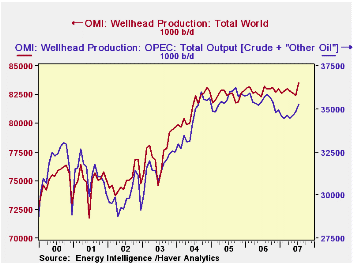

In July total oil available from wellhead production was 83,530 thousand barrels/day, compared with 82,434 in June and 83,266 in July 2006. For this July, there were also refining processing gains of approximately 2,000 barrels/day, so the supply of products was about in line with the separately measured product demand, 85,482 thousand barrels/day. The increase in supply for the month was 1.33%, the largest monthly rise since 1.73% in June 2004.

Among the leading producers, OPEC output was 35.3 million b/d, up from 34.8 mbd in June. It represents 42.2% of total world output. In recent years, OPEC's largest share was 44.3% in September 2005. For much of the time since 1990, their share hovered around 40%; it began to increase from that range during 2002.

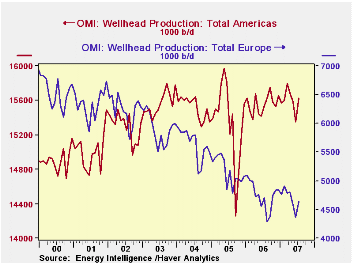

In examining the other regions' performance, it looks that higher prices are eliciting added output. Nearly every other major area of the world is participating, at least to some extent. Many of us tend to think that the "oil is running out", but there seems still to be some more. The most distinctive example is the new UK field in the North Sea. For all of Europe, this appears to have halted the steep downtrend in output, making it just about steady in July with the year-ago figure, off a mere 1.3%, compared with year-on-year declines last autumn of 10% and more. In the Americas, production is climbing slowly after the plunge and rebound associated with 2005's hurricanes; it's even steady in the US, and "other" countries, though small, are growing rapidly.

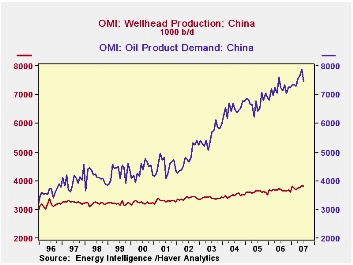

The main growth is in Asia. The OMI classifies Russia as an Asian producer. Its output is rising at about a 2.2% year-on-year pace and now accounts for about 11.6% of the world total. Other former Soviet republics are growing their output rapidly, albeit from a small base; they have enlarged their market share by 0.75% in just the past two years. In China, production is growing, but demand is growing so much faster. This imbalance is likely one reason for recent price spikes.

| World Oil Supply, Mil. Bbl/Day |

July 2007 | June 2007 | May 2007 | July 2006 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Total | 83.5 | 82.4 | 82.6 | 83.3 | 82.9 | 82.4 | 81.4 |

| OPEC | 32.3 | 34.8 | 34.6 | 35.7 | 35.4 | 35.6 | 34.4 |

| Americas | 15.6 | 15.3 | 15.6 | 15.5 | 15.6 | 15.4 | 15.5 |

| Europe | 4.6 | 4.4 | 4.6 | 4.7 | 4.7 | 5.2 | 5.6 |

| Russia | 9.7 | 9.6 | 9.6 | 9.5 | 9.4 | 9.2 | 9.0 |

| Other Asia | 9.0 | 8.9 | 8.9 | 8.6 | 8.5 | 8.2 | 8.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates