Global| Feb 10 2021

Global| Feb 10 2021Wholesale I/S Ratio Moves Down in December as Sales Outpace Inventories

Summary

• Inventories increased 0.3%, while sales jumped 1.2% in December. • Wholesale inventory-to-sales ratio declined to 1.29. Wholesale inventories grew 0.3% in December (-1.6% year-over-year). Wholesale inventory swings can have a [...]

• Inventories increased 0.3%, while sales jumped 1.2% in December.

• Wholesale inventory-to-sales ratio declined to 1.29.

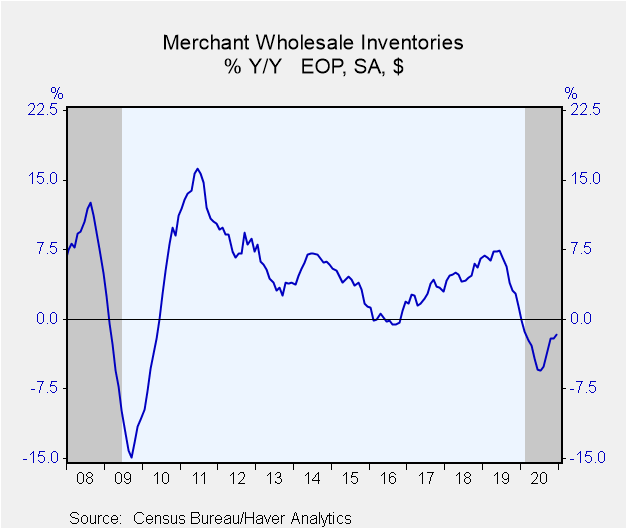

Wholesale inventories grew 0.3% in December (-1.6% year-over-year). Wholesale inventory swings can have a meaningful impact on GDP. In the fourth quarter, inventory rebuild added 1.04 percentage points (ppt) to the overall 4.0% annualized increase in GDP.

Durable goods inventories edged up 0.1% in December (-3.9% y/y) with declines in machinery and automotive, the two largest categories, offset by gains in electrical and professional & commercial equipment, the ones ranked third and fourth. Nondurables rose 0.6% (1.9% y/y). Drug inventories, which make up over a quarter of nondurables, grew 2.2% (12.0% y/y). Groceries, the second largest category, fell 2.0% (-0.6% y/y).

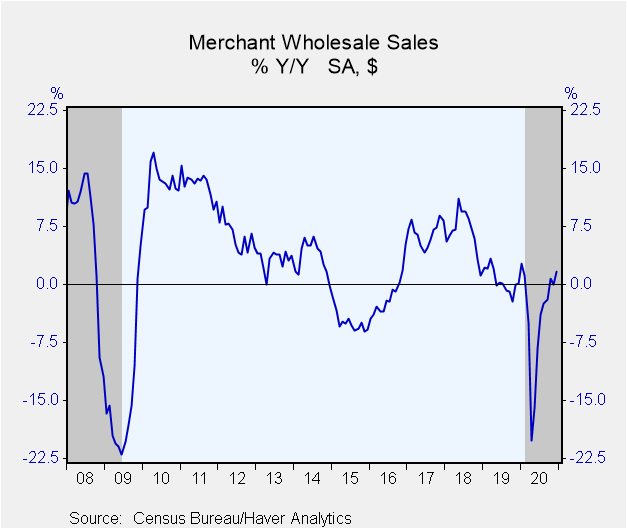

Wholesale sales jumped up a greater-than-expected 1.2% during December (1.7% y/y). The Action Economics Forecast Survey anticipated a 0.6% rise. Durable goods sales rose 0.4% (4.9% y/y) as autos accelerated 2.6% (10.4% y/y). Nondurable wholesales gained 2.1% (-1.1%) as petroleum products jumped 12.7% (-22.2% y/y), likely the result of a 12.4% surge in seasonally adjusted oil prices (-21.3% y/y).

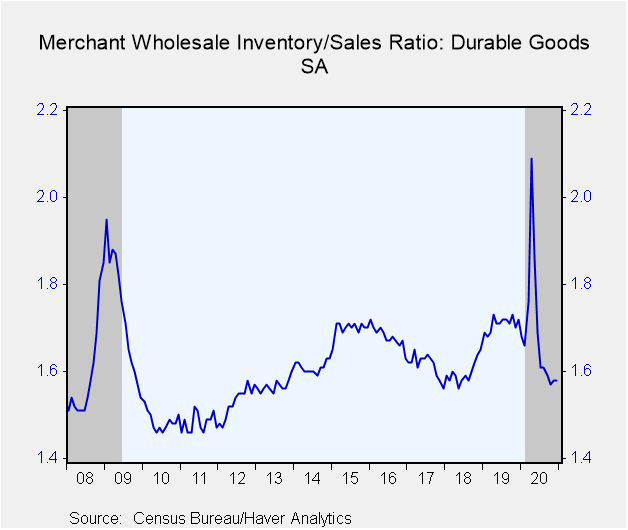

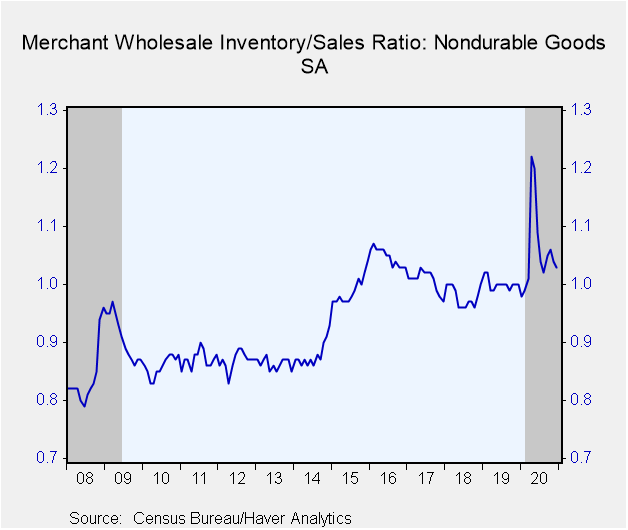

The inventory-to-sales (I/S) ratio at the wholesale level declined to 1.29 in December from 1.31. After hitting a record 1.63 in April – data goes back to 1980 – it is now below pre-COVID-19 levels and at a two-year low. The durable goods ratio, which has been hovering around two-year lows, was unchanged at 1.58. Meanwhile, the nondurable I/S ratio ticked down to 1.03, meaningfully lower than April's 1.22 record, though still elevated relative to the pre-COVID period. The durable and nondurable series go back to 1992.

The wholesale trade figures and oil prices are available in Haver's USECON database. The expectations figure for inventories is contained in the MMSAMER database. Expectations for sales are in the AS1REPNA database.

| Wholesale Sector - NAICS Classification (%) | Dec | Nov | Oct | Dec Y/Y | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| Inventories | 0.3 | 0.0 | 1.3 | -1.6 | -1.6 | 1.4 | 6.5 |

| Sales | 1.2 | 0.3 | 1.7 | 1.7 | -4.3 | 0.5 | 6.8 |

| I/S Ratio | 1.29 | 1.31 | 1.31 | 1.34 (Dec '19) | 1.37 | 1.34 | 1.28 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates