Global| Apr 26 2011

Global| Apr 26 2011Widening Interest Rate Differentials World Wide Are Encouraging Carry Trades

Summary

The monetary authorities in Japan and the United States appear to be more concerned about the pace of recovery than about inflation. They are showing little signs of raising their very low official rates--close to zero in Japan, and [...]

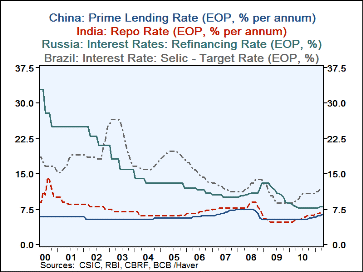

The monetary authorities in Japan and the United States appear to be more concerned about the pace of recovery than about inflation. They are showing little signs of raising their very low official rates--close to zero in Japan, and 0.125% in the Unites States. The monetary authorities in Europe and, particularly in the emerging nations of Asia and Latin America where growth has been strong have become more concerned over inflation and begun to increase interest rates. We've used the BRIC (Brazil, Russia, India and China) countries as surrogates for Emerging Countries. Their official interest rates are shown in the first chart. In most cases, tightening began at the beginning of this year. With the rise in interest rates in the emerging nations and the maintenance of low rates in the U. S. and Japan, interest rate spreads have widen, attracting the carry traders. Interest rates in Europe are lower than those in the emerging markets and even though they are rising, their differentials with the interest rates of Japan and the U. S. are less attractive to the carry trader than those of the emerging countries.

The essence of a carry trade is to borrow funds in a low interest country and invest the proceeds in a high interest country. Borrowing at roughly 1% in the U. S. or Japan and investing in Brazil at 12% is a tempting proposition, but such trades are profitable so long as the interest differential is large enough to compensate for possible adverse changes in the exchange rates and interest rates. For example if one borrows money in Japan and invests in Brazil, and the yen rises, the replacement cost of the loan will rise. If, on the other hand, the real falls, profits from the deal will fall. Similarly, rising interest rates in Japan or falling rates in Brazil will adversely affect the profitability of the deal.

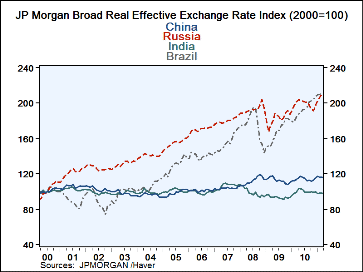

The JP Morgan Real Broad Effective Exchange Rates for the BRIC countries are shown in the Second Chart. The rising values of the Russian ruble and Brazilian reias have encouraged carry traders to invest in Russia and Brazil while the failure of the Chinese Yuan and the Indian rupee to appreciate significantly has made China and India somewhat less attractive prospects.

| Apr 11 | Mar 11 | Feb 11 | Jan 11 | |

|---|---|---|---|---|

| Official Interest Rates (%) | ||||

| Brazil | 12.0 | 11.75 | 11.25 | 11.25 |

| Russia | 8.0 | 8.0 | 7.75 | 7.75 |

| India | n.a. | 6.75 | 6.50 | 6.25 |

| China | 6.36 | 6.06 | 6.06 | 5.81 |

| JP Morgan Real Broad Effective Exchange Rate (2000=100) | ||||

| Brazil | 211.0 | 2102 | 209.0 | 207.6 |

| Russia | 210.9 | 207.1 | 203.0 | 197.6 |

| India | 97.9 | 97.9 | 97.8 | 100.1 |

| China | 115.9 | 115.9 | 116.7 | 115.1 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates