Global| Jun 17 2014

Global| Jun 17 2014ZEW Expectations Stumble Again

Summary

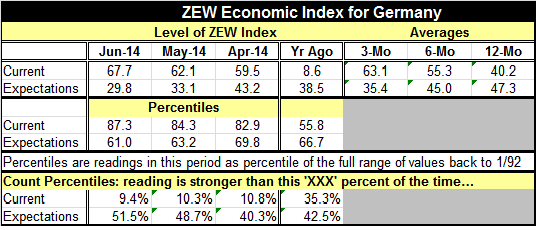

Germany's ZEW current conditions reading rose to 67.7 in June from 62.1 in May. The June current conditions reading is higher only about 9.4% of the time. On the other hand, the expectations reading fell significantly to 29.8 from [...]

Germany's ZEW current conditions reading rose to 67.7 in June from 62.1 in May. The June current conditions reading is higher only about 9.4% of the time. On the other hand, the expectations reading fell significantly to 29.8 from 33.1. The June expectations reading is higher 51.5% of the time. Expectations, nonetheless, have just fallen below the median.

Germany's ZEW current conditions reading rose to 67.7 in June from 62.1 in May. The June current conditions reading is higher only about 9.4% of the time. On the other hand, the expectations reading fell significantly to 29.8 from 33.1. The June expectations reading is higher 51.5% of the time. Expectations, nonetheless, have just fallen below the median.

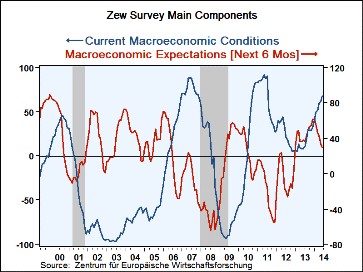

The drop in expectations over the last five months amounted to a net loss of 31.9 points. Over a five year span, expectations fall more sharply than this only about 18% of the time. This is a significant slide in expectations despite the very high current reading.

As the current index shows, the German economy continues to perform well. The European Central Bank has moved to take some special steps to provide credit to try to stimulate activity in the euro area. While the euro area economic data are still somewhat irregular, they continue to press on to higher levels and to show continuing expansion. Germany is helped by having a better economic environment around it.

While the irregularity in the growth among the various euro area members is an issue that the euro area needs to come to grips with, the main negative factor over the last month or so has been the ongoing and deteriorating nature of the global geopolitical environment. This is the likely culprit for the decline in German expectations.

The D-Day ceremonies that brought Mr. Putin to France created opportunities for him to have some brief meetings with President Obama as well as the newly elected president in Ukraine. However, those meetings do not seem to have created any watershed change in Ukraine's circumstance. Ukraine continues to confront rebels in its eastern territories and there continues to be violence and bloodshed. Just last week, the Russian firm Gazprom announced that it was halting the provision of gas to Ukraine and would only provide gas that had been paid for. This steps up Ukraine -Russian tensions.

In addition, over the last week or so there has been a new outbreak of conflict in Iraq. Conditions in Libya seem to have deteriorated and there is some renewed conflict there. All in all, the geopolitical environment seems to have deteriorated. Some this deterioration may have come too late to have been reflected in the recent ZEW poll.

The ZEW index was not expected to show a drop in its expectations component this month. The fact that it took the ZEW financial experts by surprise, lends some credibility to the idea that expectations are reacting to noneconomic factors.

However, Russia may soon have to confront another unpleasant reality involving its relationship to the West. The former Soviet republics of Moldova and Georgia are planning to sign a trade and political pact with the European Union this month even though Russia has warned them not to do it.

Returning to the economic and financial assessments of the ZEW experts, we see that they have rated stocks and the prospect of corporate profitability as weaker with a 2.8 reading in June compared with a 3.5 rating in May. The 2.8 reading is the weakest sense November of 2012. Still, the ZEW upgraded eight of the 13 sectors that it assesses in its monthly report.

The financial experts assessment of bonds improved to -6.3; it's still a negative reading but the strongest reading since June 2013.

The German economy continues to perform well, as the ZEW financial experts point out with their sterling rating of the current state of the German economy. However, the outlook has been eroding over the last six months. Moreover, the expectations index drop over the last five months has been worse historically only about 20% of the time. It would appear that something has to give. Either expectations have to stop being cut or the current condition assessment has to show some effect of all these adverse expectations.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.