Global| Nov 13 2018

Global| Nov 13 2018ZEW Experts Cut Assessments and Trim Expectations

Summary

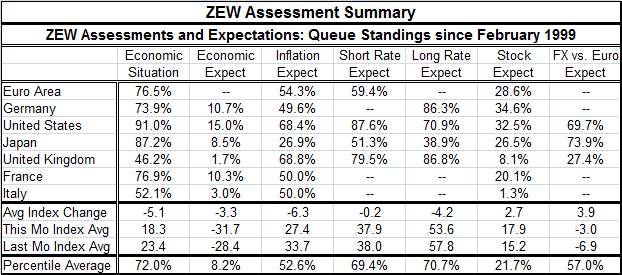

The average ZEW assessment of economic conditions slid by five points in November. Economic expectations on average were lower by 3.3 points. Inflation expectations were lower by 6.3 points while short- and long-term rate expectations [...]

The average ZEW assessment of economic conditions slid by five points in November. Economic expectations on average were lower by 3.3 points. Inflation expectations were lower by 6.3 points while short- and long-term rate expectations were cut with larger cuts coming for longer term rates. Despite all this, stock market expectations improved on the month.

The average ZEW assessment of economic conditions slid by five points in November. Economic expectations on average were lower by 3.3 points. Inflation expectations were lower by 6.3 points while short- and long-term rate expectations were cut with larger cuts coming for longer term rates. Despite all this, stock market expectations improved on the month.

The accumulated drop from the current-conditions peak of nine months ago for the average assessment is now showing the largest cumulative drop since January 2013. The average percentile assessment for the current indexes sits at a 72.0 percentile which is 20 ranking points above its median and therefore is still a relatively firm reading. Still, the average expectation has sunk to its weakest since December 2011. The average percentile standing is at a reading of 8.2, indicating that expectations have been this low or lower only about 8% of the time. That is a very poor result.

Weaker current conditions and a reduced outlook

The percentile standings for the current assessment have fallen the most sharply for EMU members. Italy suffered a 12-point percentile standing drop as its budget impasse with the EU Commission is taking its toll on the month-to-month standing. But there is also a toll on the EMU where the percentile standing fell 6.8 points month-to-month as the German standing fell by 8.1 percentile points month-to-month. France lost only 0.4 percentile points of ranking, the smallest loss on any EMU member in the table. Despite its Brexit troubles, the U.K. made a gain of 3.8 percentile points. The U.S. and Japan each shed only 1.3 percentile points in November month-to-month.

Expectations are not made for the EMU directly. But expectations fell sharply for France, Japan, the U.S., and Italy, in that order. In Germany and the U.K., expectations ticked slightly higher. It is particularly curious how much the German experts from ZEW downgrade U.S. expectations compared to the assessments we see in the U.S. and compared to the rhetoric we hear from the U.S. central bank.

Of course, the U.S. continues to have a very high current assessment as its standing is in the 91st percentile of its historic queue of data, above the 87th percentile standing for Japan and well above the 76th percentile standing for the euro area as a whole.

Less worry about inflation

Interestingly, inflation expectations have been cut in November. And Germany, that just reported an inflation headline that is the highest in over a decade, scores the lowest percentile standing for inflation expectations in this group with a 49.6 percentile standing, the only European country that is below its historic median (Japan, of course is even weaker). Apparently, the ZEW financial experts have come to accept as correct the ECB's focus on core inflation and have been willing to dismiss inflation overshoot as more nettlesome than problematic when that overshoot applies only to the headline and when it clearly stems from energy prices. This month, for example, the October German CPI is up by 2.5% year-over-year, but the ex-energy German inflation rate is up by only 1.7%. Yet, the survey diffusion point drop in for inflation expectations compared to its 12-month average is -12.4 for Germany. And in the November ZEW survey, month–to-month inflation expectations have dropped everywhere. Compared to 12-month averages, the drop is in double-digits for France and the euro area as well; it is nearly there at -9.2 survey points for the U.S. Inflation fears are fading as growth is weakening and macroeconomic expectations are going south fast.

Yet, interest rates will rise

Short-term interest rate expectations are lower month-to-month by small amounts but are barely changed year-over-year. The current queue standings are above the 50 percentile mark, indicating that in all surveyed rates are expected to rise more than their historic median tendency. Despite all the weakness, that ZEW experts still see, they expect rates to continue rising to some extent. Long-term rates echo these findings showing less pressure month-to-month and being little changed year-on-year with queue assessments above 50, pointing to greater than normal yield increases ahead except for Japan. For Japan the queue standing is still below 50% at 38.9%, representing an expectation for lingering low long-term rates.

The ZEW expectation for equities is little changed month-to-month and generally a lot lower year-over-year. Only the U.K. and Italy have negative outlooks in November, but both of those are improved from October. While the equity diffusion assessments are nearly all positive, the queue standings are all below neutral (50%), implying that while stock price gains are expected, it is weak gains that are expected. The highest stock market assessment (Germany) has a queue standing below its 35th percentile- well below its median which occurs at a 50% standing.

ZEW experts' outlook shows concern, not alarm

On balance, the ZEW experts see economic erosion in train and pull no punches about it. The cumulative erosion they chronicle is now substantial. However, the level of activity they see is still quite solid with only the U.K. below its median assessment and Italy barely above its median. Macroeconomic expectations show readings that are considerably direr. Since February 1999, they have been weaker from 3% to 15% of the time depending on the country being assessed. Inflation expectations are down from one month ago and off sharply lower from a year ago. The U.S. and U.K. have queue standings for expected inflation at their respective 68th percentiles. For all other countries, the readings are near a neutral queue standing of 50% except Japan, of course, that is much lower. ZEW survey contributors see rates continuing to edge higher and see stock prices rising but underperforming historic norms. The future is becoming less ebullient and more challenging.

Home on the range

This is not the picture that is consistent with what our central banks have been doing or planning to do. The ZEW experts either are wrong or this survey is a wake-up call for monetary policymakers. In the U.S., we have seen some evidence of industrial economic data topping. Interest sensitive sectors seem to be very sensitive and there is a clear topping in auto sales and weakness in various housing measures including house prices. But we have yet to hear a discouraging word from Fed officials who are still at home with their range of current policy options.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates