Global| Sep 20 2011

Global| Sep 20 2011ZEW Survey: German Investor Increasingly Gloomy

Summary

Pessimism is increasing among German institutional investors and financial analysts. The latest ZEW report, which covers the period September 2nd to September 20th shows that the excess of pessimists over optimists rose 5.7 percentage [...]

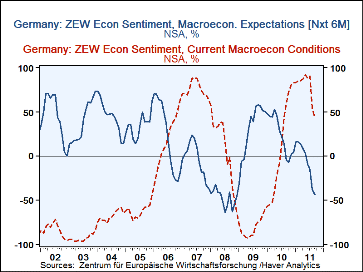

Pessimism is increasing among German institutional investors and financial analysts. The latest ZEW report, which covers the period September 2nd to September 20th shows that the excess of pessimists over optimists rose 5.7 percentage points from 37.6% in August to 43.3% in September. This was the seventh month of declining optimism and increasing pessimism from February, when there was an excess of optimists of 15.7% and well below the excess of optimists of 57.7% in September, 2009. Part of the increased pessimism was the result of a worsening of current condition. The excess of optimists among the participants in the survey declined to 43.6% from 53.5% in August and from 90.6% in July. More important, however, has been the increased seriousness of the debt crisis in the Euro Area and fears of a slowdown in global economic activity. The increased pessimism is evident in the first chart that shows the financial community's appraisal of current conditions and their expectations for conditions six month ahead.

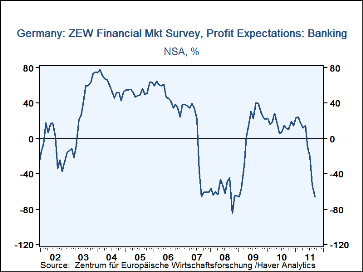

The increased pessimism regarding macro current economic conditions and expectations is reflected in a downward reappraisal of the profit outlook. Profit expectations have been lowered in all but two of thirteen industries covered in the survey. The excess of pessimists regarding profits in the Utility industry declined in September to 34.7% from 43.4% and in the Consumption/Trade industry to 12.7% from 13.4%. Even with some improvement in these industries, the participants still expect declines in profits. The participants are most pessimistic regarding the outlook for profits in the Banking industry. The excess of pessimists is currently 66%, roughly the same magnitude reached in the height of the 2008 financial crisis, as can be seen in the second chart.

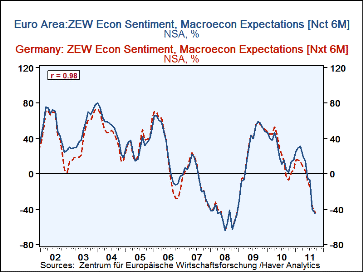

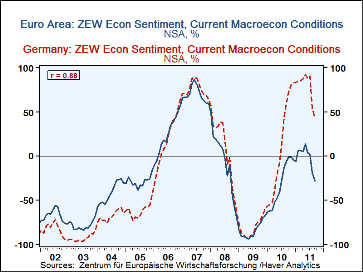

In addition to surveying current conditions and expectations in Germany, ZEW also surveys the participants' views on current conditions and expectations the entire Euro Area. Because Germany is the largest economy in the Euro Area, views on the Euro Area are heavily influenced by what goes on in Germany. The third chart compares the views on expectations for Germany and for the Euro Area. The high correlation between the two series in a measure of a high degree of association. The fourth chart tells a slightly different story. It compares the views on the current conditions in the Euro Area and in Germany. The decline in the correlation from 0.98 to 0.88 is largely due to the divergence in the views of current conditions in Germany and in the Euro Area beginning around 2010. The financial troubles in Greece, Ireland, Portugal and Spain began to affect their economic activity about that time and may account for much of the divergence in the views on current conditions in Germany and the Euro Area.

| GERMANY | Sep 11 |

Aug 11 |

July 11 |

June 11 |

May 11 |

Apr 11 |

Mar 11 |

Feb 11 |

|---|---|---|---|---|---|---|---|---|

| Expectations 6 months ahead (% balance) | -43.3 | -37.6 | -15.1 | -9.0 | 3.1 | 7.6 | 14.1 | 15.7 |

| Current Conditions (% balance) | 43.6 | 53.5 | 90.6 | 87.6 | 91.5 | 87.1 | 85.4 | 85.2 |

| EURO AREA | ||||||||

| Expectations 6 months ahead (% balance) | -44.6 | -40.0 | -7.0 | -5.9 | 13.6 | 19.7 | 31.0 | 29.5 |

| Current Conditions (% balance) | -27.9 | -19.1 | 2.3 | 3.8 | 13.6 | 5.6 | 6.4 | 6.1 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates