Consumer Credit Growth Moderates in February

by:Tom Moeller

|in:Economy in Brief

Summary

- Revolving credit usage strengthens.

- Nonrevolving credit growth slows.

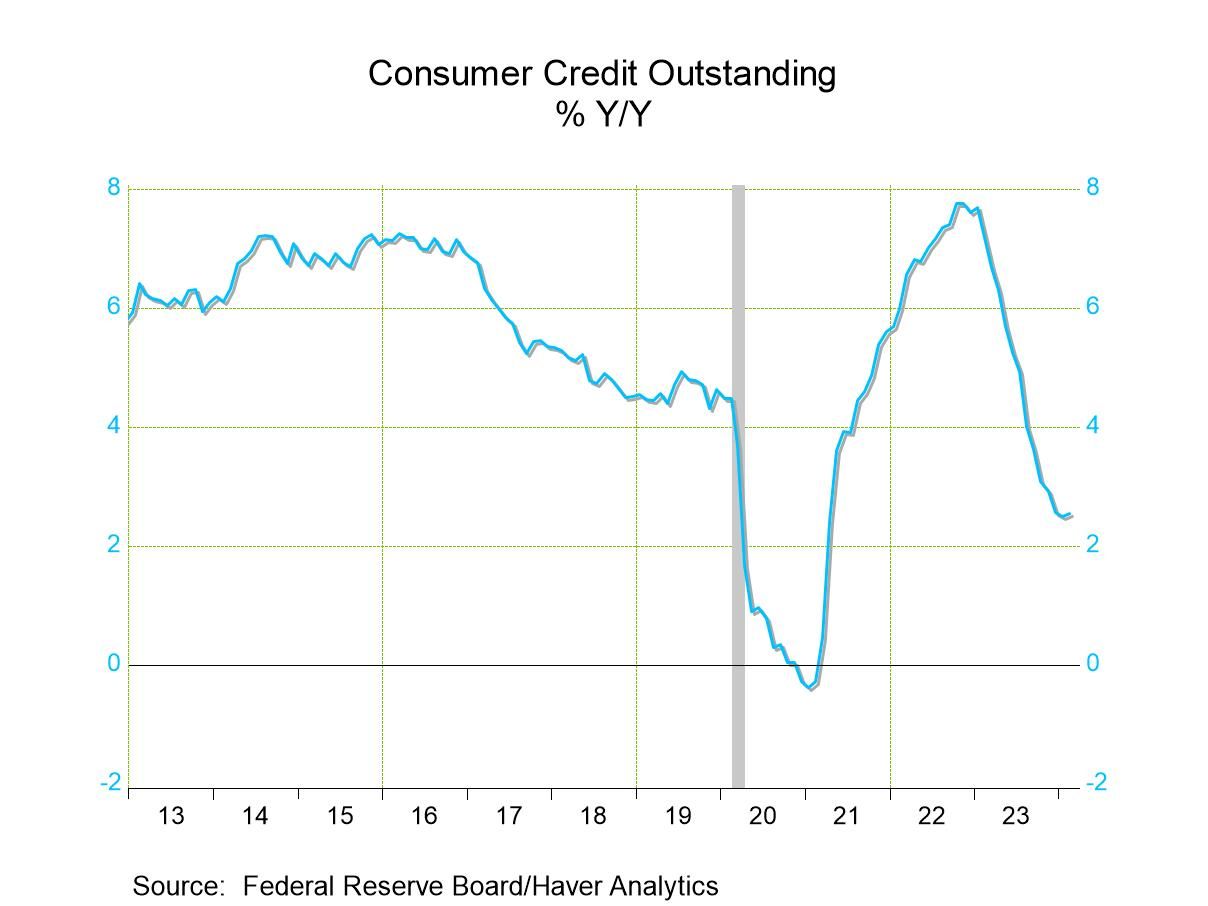

Consumer credit outstanding rose $14.1 billion (2.5% y/y) during February following a $17.7 billion January increase, revised from $19.5 billion. These figures compare to a $3.2 billion gain during December of last year. A $15.7 billion rise had been expected in the Action Economics Forecast Survey. The ratio of consumer credit outstanding to disposable personal income held steady at 24.4% in February, below the December 2022 high of 25.4%.

Revolving credit outstanding rose $11.3 billion (9.0% y/y) in February after an $8.6 billion increase in January. Borrowing at banks rose 9.9% y/y but finance company loans fell 2.0% y/y. Credit union loans increased 8.1% y/y.

Nonrevolving credit balances increased $2.9 billion (0.4% y/y) in February following a $9.1 billion January gain. Borrowing at banks fell 2.2% y/y, while finance company loans grew 7.4% y/y. Credit unions loans increased 1.6% y/y but federal government loans decreased 1.3% y/y. The total of nonrevolving credit includes secured and unsecured credit for big-ticket items, such as autos, mobile homes, trailers, durable goods and vacations.

The value of student loans outstanding fell 2.1% y/y in Q4’23, while motor vehicle loans increased 3.7% y/y in Q4’23.

The consumer credit figures from the Federal Reserve Board are break-adjusted and calculated by Haver Analytics. The breaks in the series in 2005, 2010 and 2015 are the result of the incorporation of data from the Census and the Survey of Finance Companies, as well as changes in the seasonal adjustment methodology. The consumer credit data are available in Haver’s USECON database. The Action Economics forecast figures are contained in the AS1REPNA database.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates