Asia| Nov 06 2023

Asia| Nov 06 2023Economic Letter from Asia: Investor Inclinations

In this week’s letter we focus on recent investor behaviors concerning Asia. We note the recent exodus of investor funds from the region, driven largely by outflows from Mainland China amid lingering uncertainties. We also examine investor pivots toward other areas in the region, including India and Vietnam, and note the distinct pull factors of those economies. India has become an increasingly attractive investment destination for portfolio flows, with opportunities supported by a relatively stable rupee and a still-positive yield spread over the United States. Vietnam continues to draw investment flows from all over the world, spurred by its manufacturing infrastructure and comparatively low labor costs. Finally, we give a nod to the latest yield developments in Japan, following the central bank’s decision last week to officially demarcate 1% as the upper 10-year yield limit.

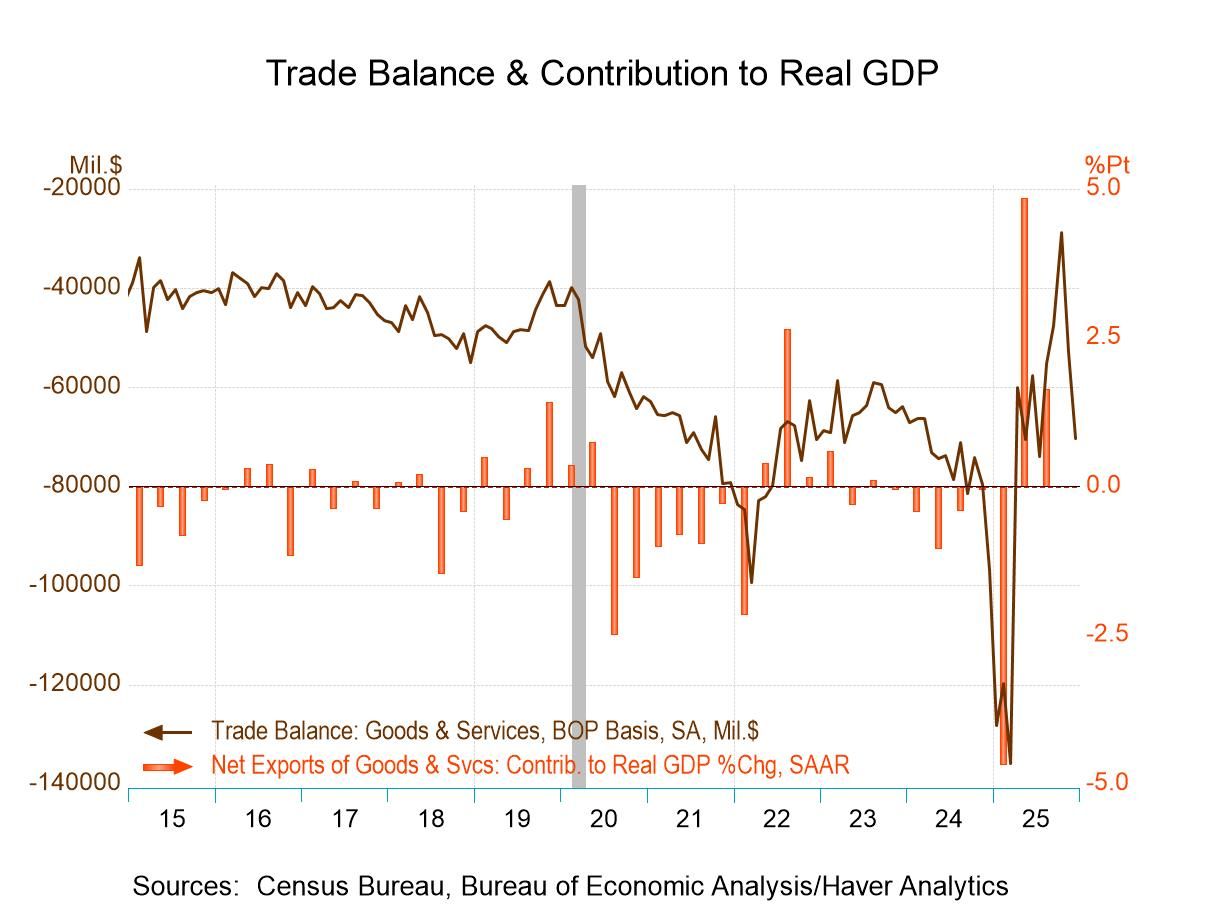

Foreign portfolio equity flows Foreign investors unwound about $15.6 billion of equity positions in Asia over September, after having already sold $20.2 billion of assets in August (chart 1). Almost all of the recent equity divestments are of Mainland China assets, with significant moves out of Taiwan and South Korea seen too. The selloffs come in contrast to the optimism displayed earlier this year when the major investment thesis for emerging Asia was about maximizing exposure to China’s reopening. Now, we have seen such optimism fade, with investors increasingly turning to other pockets of opportunity, such as India and Vietnam.

Chart 1: Emerging Asia portfolio equity flows

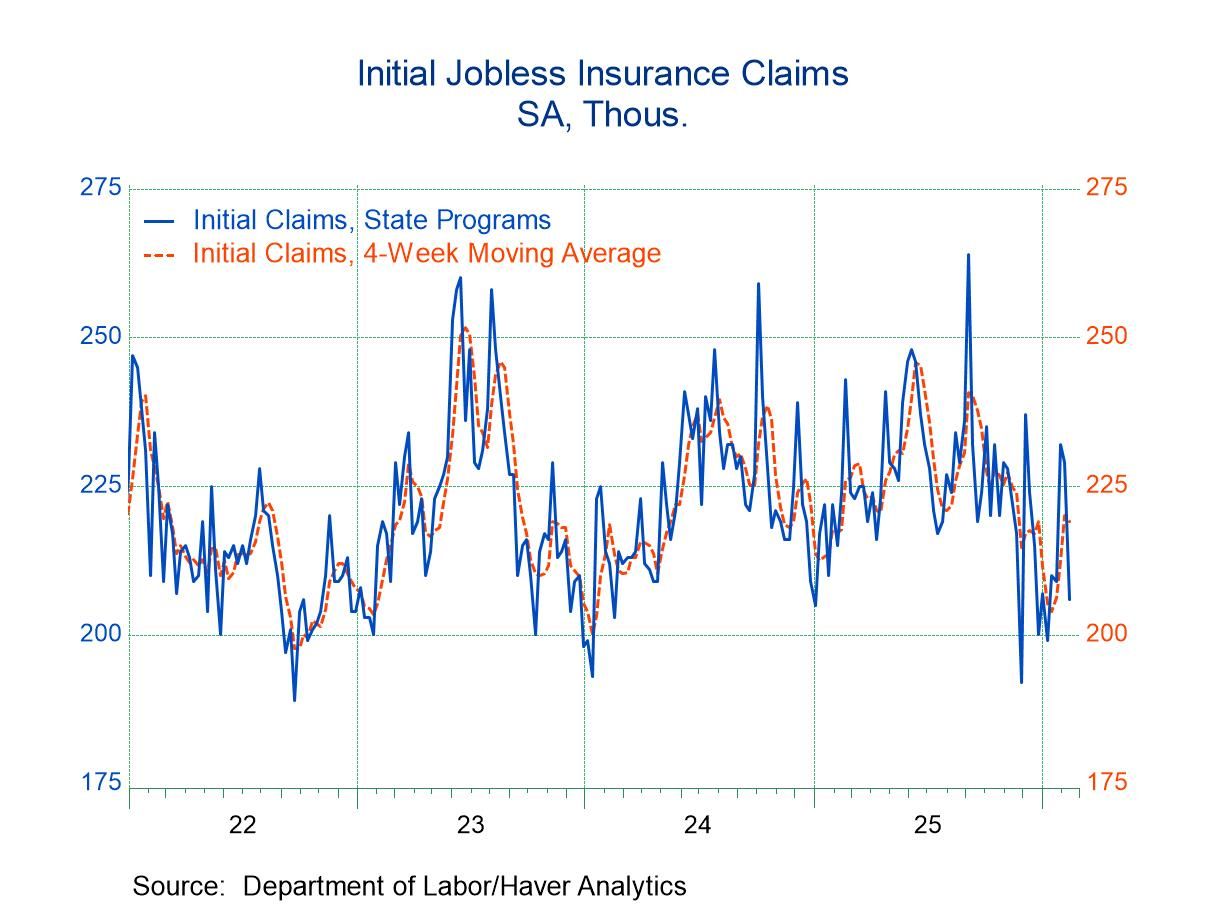

Uncertainty on China Investor qualms about China’s economic prospects continue to linger, partially expressed through the aforementioned exodus of foreign investor funds. These doubts, however, are not entirely unfounded given China’s persistent troubles, such as those in the property sector. Further, unease about China’s economic policy has been on the rise, with newspaper mentions of such uncertainties having surged in recent months (chart 2). All this is despite chief economists having recently strengthened their optimism about China in light of its improved economic performance over Q3.

Chart 2: China’s confidence and uncertainty indicators

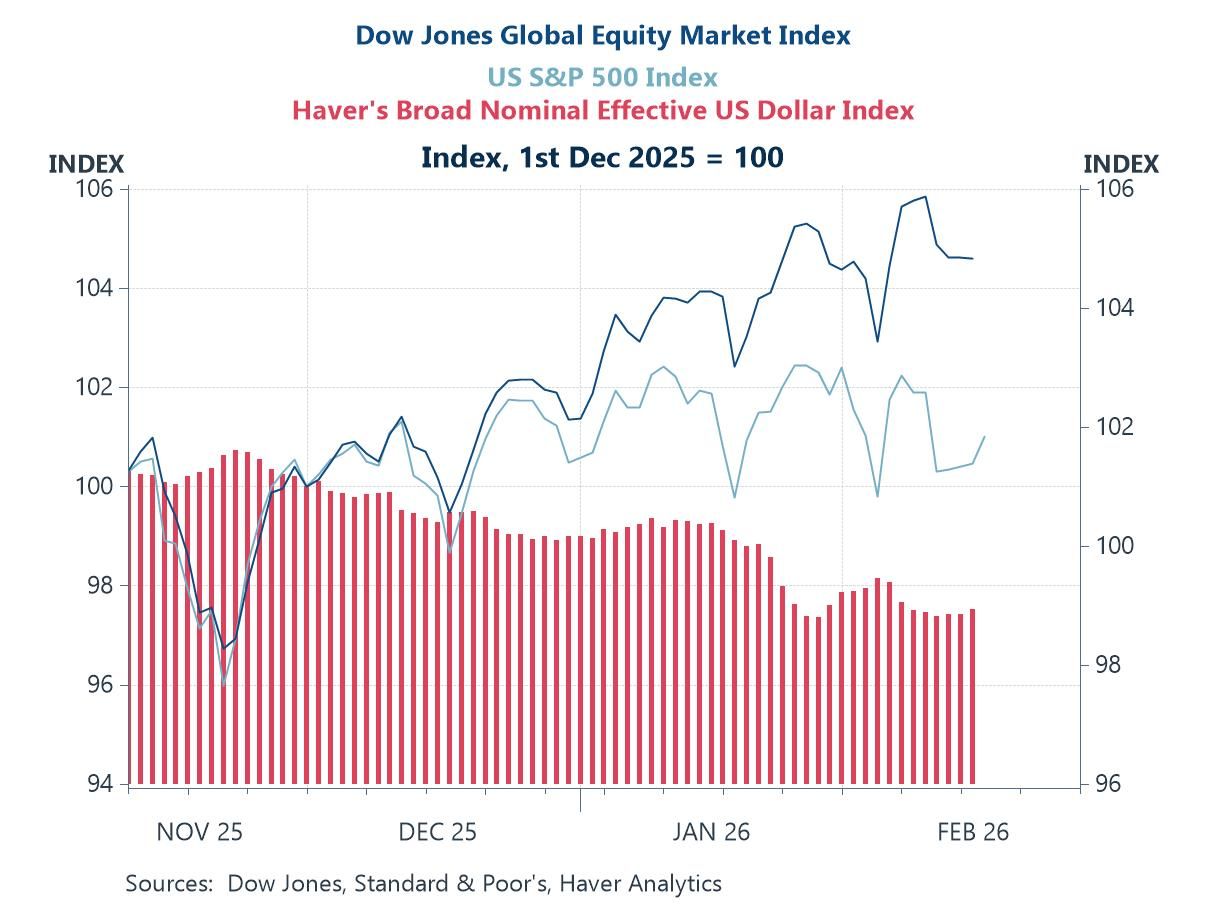

The case for India Examining other parts of emerging Asia, we find that India has much promise as a portfolio investment destination. Firstly, it is one of the few remaining Asian economies to maintain a positive sovereign yield spread over the United States (chart 3). This is especially so after the Fed’s protracted tightening cycle and the recent US Treasury yield surge, which was triggered by speculation of more Fed rate hikes ahead. Such a positive yield spread allows foreign investors, as a baseline, to earn interest income when borrowing in dollars and investing in rupees. Secondly, the Indian rupee has displayed exceptional resilience against the US dollar this year, even as the latter appreciated significantly against most other Asian currencies. The rupee’s sturdiness – and the prospect of it keeping stable – is attractive to foreign investors concerned about unhedged losses arising from currency effects. With that said, the rupee’s durability is likely partially because of the Reserve Bank of India’s (RBI) repeated interventions to support the currency. However, while the RBI’s moves have offset much of the recent weakness of the rupee, they have also dragged on the central bank’s reserves, which fell to a five-month low in September.

Chart 3: India vs. United States currency and yield performance

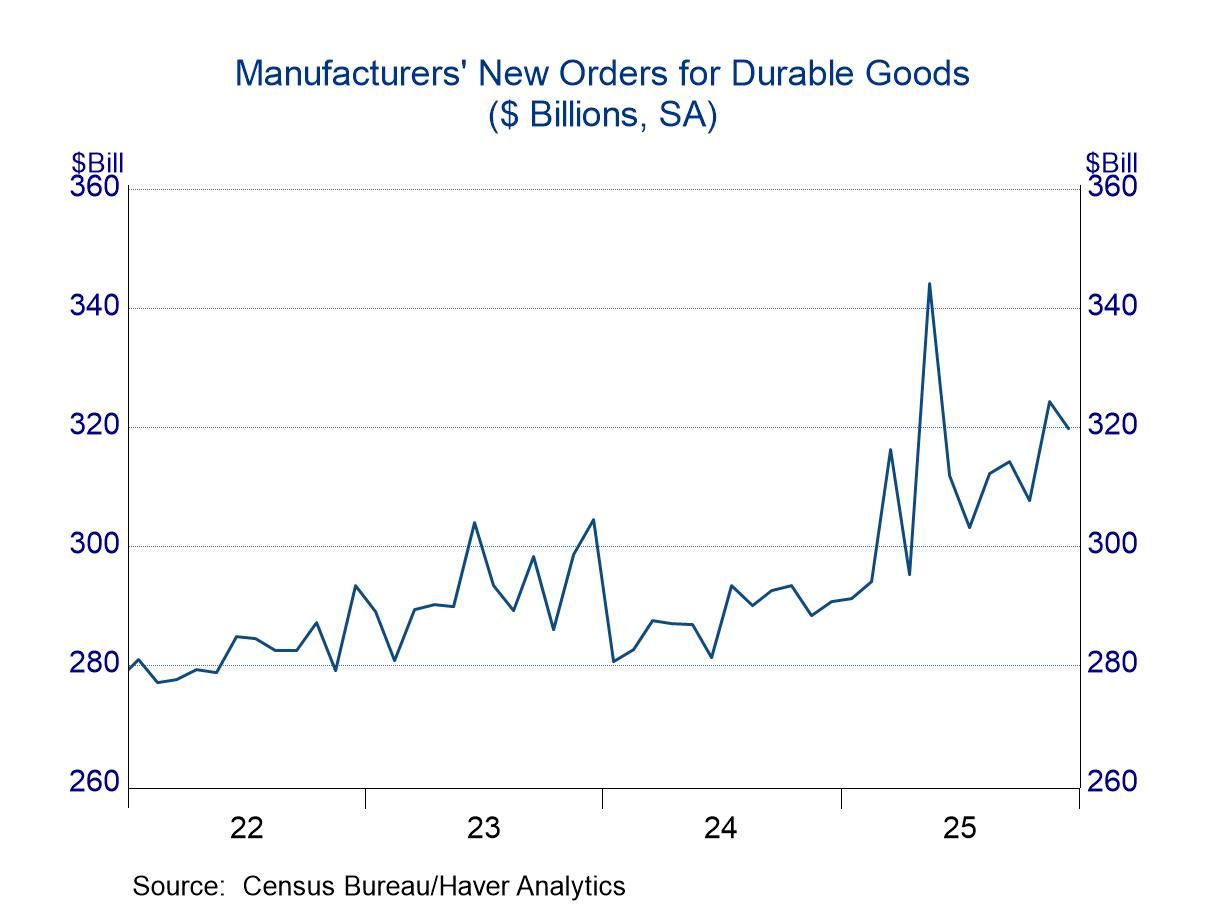

Opportunities in Vietnam India aside, Vietnam has become increasingly attractive as a destination for foreign funds too, especially in the realm of direct investment. In particular, Vietnam has seen an uptick in foreign direct investment (FDI) projects, driven by a surge in manufacturing (chart 4). In dollars, new registered capital for licensed FDI projects surged to $5.1 billion in October, up 80% from a year ago. Much of the economy’s allure can be credited to its manufacturing infrastructure and comparatively low labor costs. As such, conditions in Vietnam are viable for manufacturers pursuing some supply chain diversification away from China, an approach known as the “China Plus One” strategy. Further out, Vietnam is looking to reduce its reliance on low-end manufacturing and to move itself up the value chain. One way Vietnam is doing this is by exploring the production of high-end goods, such as semiconductors.

Chart 4: Number of licensed foreign direct investment projects in Vietnam

Regional mutual fund allocations Some investors have gradually rotated out of China over the past few years, amid uncertainties regarding the economy. Specifically, Asia ex-Japan equity mutual funds saw their 3-month average allocations to China fall to about 30% in September, from 40.3% in October 2022 (chart 5). Meanwhile, average equity allocations to India have risen steadily, to about 15.4%, from just 8.3% in mid-2020. Allocations to Vietnam, while still relatively small, have climbed too, to 0.9%, from 0.7% earlier this year.

Chart 5: Asia ex-Japan mutual fund allocations

A callout to Japan 10-year sovereign yields surged further in Japan last week after the Bank of Japan (BoJ) decided to officially raise its upper 10-year yield bound to 1% (chart 6). The central bank’s latest move gives investors added space to express their views on 10-year Japanese Government Bonds (JGBs), which have been heavily sold in past weeks. Zooming out, we also note reduced distortions in Japan’s yield curve over time, as the BoJ gradually eased its lid on 10-year yields. Previously, Japan’s yield curve had a distinct kink at the 10-year tenor, due to the BoJ’s then-0.5% cap, while other yields were allowed to rise freely. Further out, yields in Japan are looking likely to face more upward pressures ahead, especially if the BoJ’s normalization of monetary policy becomes all the more imminent.

Chart 6: Japan 10-year sovereign yield vs. foreigner bond buying

Tian Yong Woon

AuthorMore in Author Profile »Tian Yong joined Haver Analytics as an Economist in 2023. Previously, Tian Yong worked as an Economist with Deutsche Bank, covering Emerging Asian economies while also writing on thematic issues within the broader Asia region. Prior to his work with Deutsche Bank, he worked as an Economic Analyst with the International Monetary Fund, where he contributed to Article IV consultations with Singapore and Malaysia, and to the regular surveillance of financial stability issues in the Asia Pacific region.

Tian Yong holds a Master of Science in Quantitative Finance from the Singapore Management University, and a Bachelor of Science in Banking and Finance from the University of London.