EMU Inflation Rate Continues Low- But Is the Pace of Decline Deescalating?

Inflation in the European Monetary Union rose 0.6% in December (as implied by the flash rate) after falling 0.2% in November. Still, the sequential inflation rates show deceleration in progress with the 3-month pace at 0.3%, the 6-month pace at 2.5%, and the 12-month pace at 2.9%. The annual rate of expansion for inflation is clearly in a deescalating mode as 2023 ends. Hooray!

However, will the end of 2023 also be end of that good news?

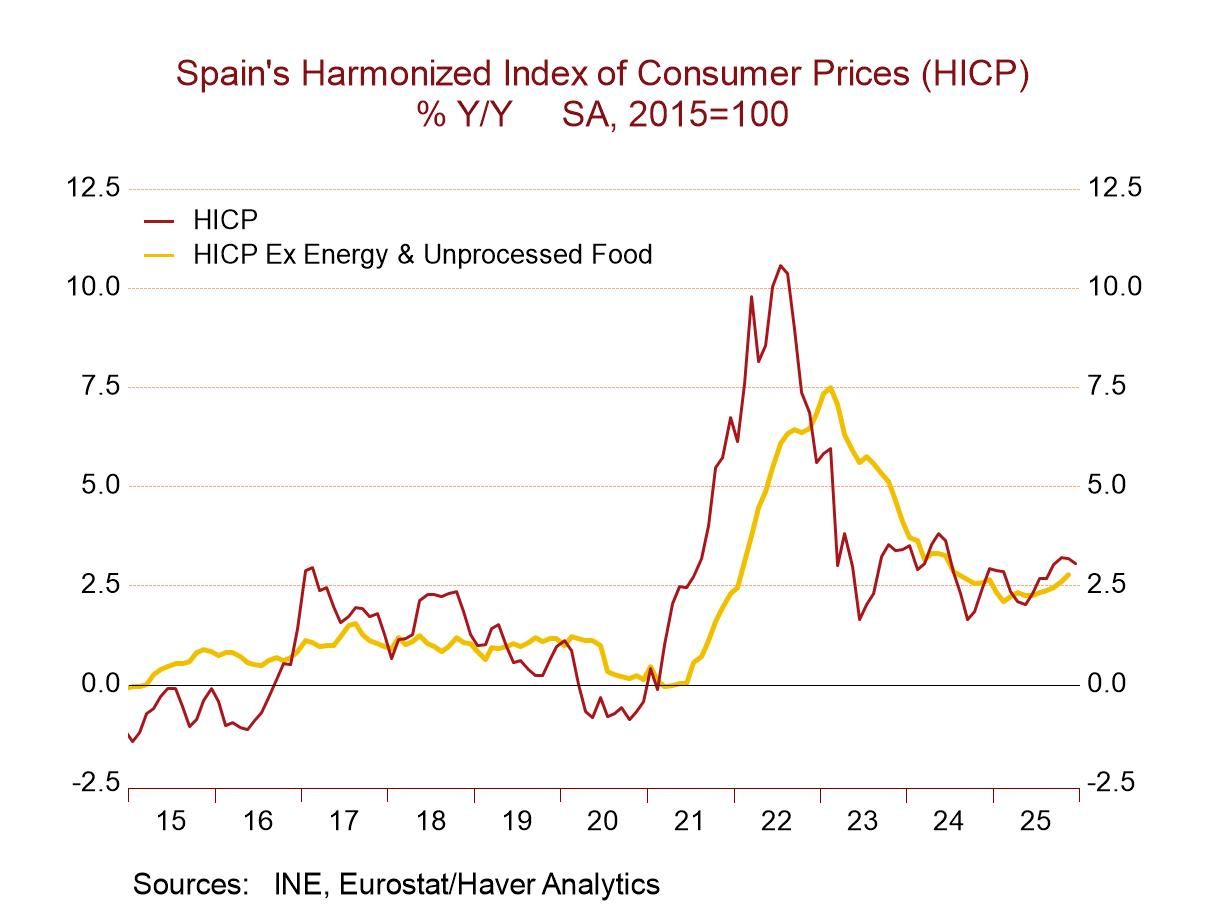

Sequential inflation rates for Germany, France, Italy, and Spain show decelerations from 12 months compared to 12 months ago and for 3 months compared to 6 months ago, but the middle picture of inflation over 6 months compared to 12 months ago is mixed, with Germany and France showing inflation continuing to decelerate marking a full trend deceleration for the year, while Italy and Spain saw some inflation pick up between 12 months and 6 months. In the case of Italy, it was a minor uptick where the year-over-year inflation rate was 0.5% and the 6-month pace moved up to 0.7%. That can almost be written off as rounding error especially since the next sequential 3-month inflation rate subsequently collapsed falling at a 3.5% annual rate. In Spain, the backtrack is a little bit more substantial as the 12-month inflation rate at 3.3% moved up to a 4.5% annual rate pace over 6 months, more than a percentage point of acceleration, but then fell sharply and declined at a 1% annual rate over 3 months.

All these trends appear to be quite solid and headed on the deceleration path. If we look at the bottom of the table, there I memorialize Italian core inflation and German inflation excluding energy. There, once again, we see for Germany the ex-energy inflation rate, as we move the calculation to shorter horizons, goes from 3.6% to 2.5% to 2.1% - a clear decelerating path. Italy does exactly the same thing in a lower register with inflation at 3.2% over 12 months, decelerating to 1.2% over 6 months, and then going dead flat over 3 months. When energy prices are removed, the inflation picture remains quite good and that's significant because during this period oil prices have been falling. Brent prices fell 2.9% in October, 9.2% in November, and 6.3% in December. Over the last three months, Brent prices expressed in euros have been falling at a 53% annual rate. Clearly, the ECB’s inflation fight has a tailwind.

Small hints that inflation’s slide lower might be less slippery

Adverse large country trend developments- Inflation rates year-over-year are still quite good for this grouping of the large EMU economies. But in the trends, there we see the seeds of something that the ECB is not going to be as happy about. • German year-over-year inflation is up 3.8% in December; that's stronger than its 2.2% pace in November and it's the strongest gain since September 2023. • For France, the inflation rate in December year-over-year is 4.1%, higher than it was in November at 3.8%. But for France, that's still below the October pace of 4.5%. • Italy continues to be the best inflation performer overall with year-over-year December inflation at 0.5%, the same as in November at 0.5%, substantially lower than October's 1.7% and September's 5.6%. Inflation in Italy has fallen fast and fallen to a low level and it's showing signs of sticking there. • Spain logs in at a 3.3% growth rate for inflation in December, the same as its November pace of 3.3% and those are both a little lower than October's 3.5% but the same as September's 3.3% and above the inflation rates that were run in Spain from May 2023 to August 2023. Spain shows some clear signs of inflation having bottomed and beginning to progress sideways or even to backtrack to somewhat higher levels. These same concerns have to attach to Germany and France where some of those same trends are now in their incipiency.

The question for the ECB is going to be what’s next. What are these trends going to do next? Although the short-term trends from 3-months to 6-months to 12-months continue to behave, and look quite solid, (as we've seen) they can be misleading. Whereas the year-over-year trends are based on more solid stuff; the fact that the year-over-year progress has ground to a halt or started to backtrack in different places is a warning signal, probably a signal to the ECB that it should not think about it adopting the Fed’s aggressive tone for cutting interest rates. In fact, so far, the ECB has given none of those signals. Christine Lagarde has been quite stoic in her view that the ECB is not talking about rate cuts and is determined to get back to its inflation target.

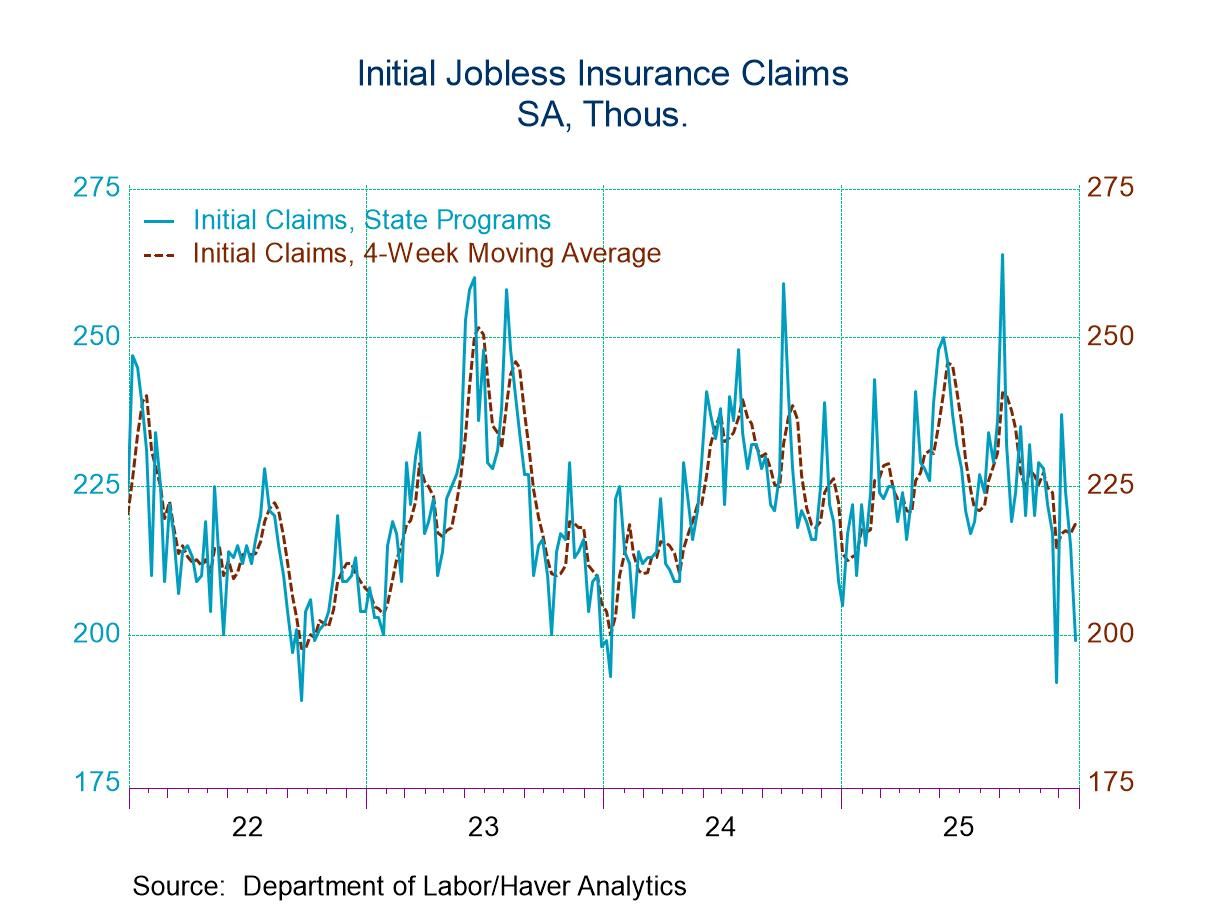

Meanwhile...across the pond- December job growth data from the U.S. today puts the Federal Reserve in a different position than it thought it was in. Job growth was stronger than expected in December, average hourly earnings growth (wages) continues to be excessive relative to achieving the Fed's target unless there's a productivity miracle. The unemployment rate in the U.S. is a very short stone’s-throw from its 50-year low. And yet… inflation continues to sail on the top of the Fed’s target. Markets are planning for rate cuts this year, for some, as soon as May. Many had expected these same trends to transfer to the European Central Bank; however, the European data don't seem to be consistent with that and now the U.S. data are beginning to raise question marks about whether the U.S. data are going to be consistent with as well.

Closing out 2023- That is an interesting way to close out the year of 2023, and to raise the curtain on 2024. Today's European inflation report and U.S. job report by no means set the course for interest rates by their respective central banks for the year ahead. However, they are stark reminders that the things that people in markets expect are just that- they are based on expectations. And expectations have a way of either being fulfilled or disappointed. In the U.S., the game is being played for much larger stakes because it's a presidential election year; that may make the Federal Reserve more reluctant to shift its policy without some very, very, clear reasons to do it. In the case of the ECB, it seems that policy is relatively happy doing what it's doing, as unemployment rates in Europe remain quite low by their recent historic experience, and inflation risk is progressing to come to heel, giving the ECB a chance to think that it might be able to hold rates at these levels and continue to make progress. Hope springs eternal. We’ll see how that plays out. Welcome to 2024 and the reality of 2024—the year is no longer just a forecast or a concept…it’s a forecast in progress.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.