EMU Output Makes Solid Gain in June

The European Monetary Union (EMU) posted a 0.7% increase for industrial output in June, following a 2.1% increase in May. Industrial output is solid with a 2.6% growth rate over 12 months, 2.3% growth rate over six months and a 13.8% annualized rate of growth over three months. The tracking for manufacturing growth alone generally follows the same pattern with a 1% gain in June and 11.9% annualized rate over three months.

The June report completes data for the second quarter. In the second quarter, total output is up at a 4.5% annual rate; manufacturing output is up at a 2.3% annual rate. Output gains by sector are led by consumer durables at a 9.4% annualized rate. Consumer nondurables output rises at a 4.9% pace, capital goods output has come back strongly with a 5.6% annual rate increase, and intermediate goods output showed a decline at a 1.4% annualized rate.

All the sectors show increases in output compared to the pre COVID level of output in January 2020. Overall output is up 2.7% with manufacturing output up by 2.5% over that span. Consumer durables has the largest gain at 6.3% followed by consumer nondurables at 5.6%. The smallest gain is from the capital goods sector with a rise of 0.9%. Intermediate goods output is up by 2.2% over the span.

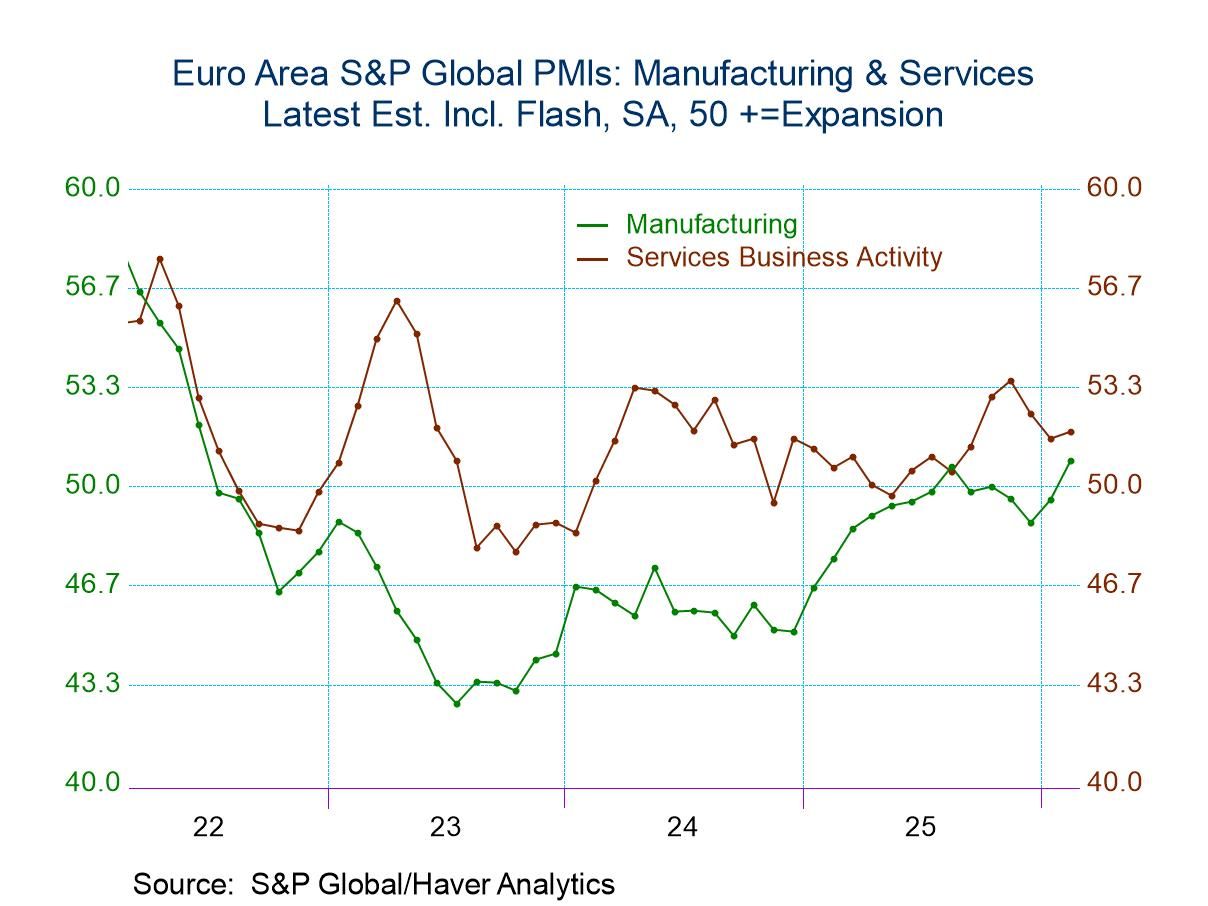

The manufacturing and industrial output performance numbers do not fit well with the manufacturing PMI as the manufacturing PMI show reduced activity in April, May, and June. In all three months manufacturing output progressed from the flat in April to up 1.8% in May and up 1.0% month-to-month in June. However, at a PMI diffusion value of 52, the manufacturing PMI gauge for the EMU does show expansion. But it doesn't show strength; it is showing persistent cooling.

This chart shows the tracking of manufacturing industrial production growth year-over-year versus the EMU manufacturing PMI value from S&P Global. The two series have a tracking relationship that more or less corresponds. The COVID spike appears as a sharp occurrence that comes and goes in the hard industrial production data. In the PMI data, there is a somewhat sharp ramp up accompanied by a cooldown that doesn't seem to track well the actual data. However, currently manufacturing is growing moderately year-over-year and seems to be in sync with the PMI reading in the low fifties. The sharp gains in production over the last three months are suppressed by the year-over-year calculation for industrial production as well as absent from the PMI data that show manufacturing weakening steadily since January.

While industrial output is up sharply in June gaining 0.7% after a 2.1% rise in May, output is nonetheless falling in seven of the 13 reporting emu countries in the table. In May, output fell in five of those countries. In April, there were month-to-month declines in output in six countries.

The sequential growth rates show that well there may be a relatively high frequency of output declines monthly but that is mere volatility. Declines in output are not as common over broader periods. Over three months there are output declines and only EMU members; the same is true over six months and four declines emerge over 12 months.

Looking at individual countries and month-to-month patterns, fewer than half show output is accelerating; only 46% of the reporters show output accelerating in June and in May that's after showing 53% accelerating in April. Over three months output is accelerating in 54.5% of the reporters comparing three-month growth rates to six-month growth rates. Over six months acceleration is in 53.8% of reporters comparing six-month growth rates to 12-month growth rates. But over 12 months there is very little acceleration with only 9.1% of reporters showing stronger growth over 12 months than they had shown over 12 months one year ago. Still, that does not make growth weak. The media IP growth rate for manufacturing is stronger than the weighted EMU total pace. Over 12 months it is 3.7% that steps up to 3.9% over six months and to 8.5% over three months. Based on unweighted median data, EMU manufacturing is accelerating.

Quarter-to-date growth in the European Monetary Union shows the prevalence of positive numbers across countries; the exceptions are Germany, Belgium, and France. There are only three exceptions but two of them are the two largest economies in the EMU.

On balance, growth in the EMU proves to be on solid footing. The European Central Bank is hiking rates and the manufacturing sector continues to put in solid – even improving- performance. The ECB is hiking rates because inflation is well over the top of the target, but it's acting carefully because it's concerned about access to energy and the potential for an energy shut off by Russia. This leaves the European Monetary Union in a delicate position since growth still appears to be relatively strong and that may mean that it's still building inflation pressure. The central bank has only begun to raise rates and doesn't have them up at a level high enough to provide any restriction against growing inflation – especially not given the strength we see in manufacturing. And the ECB is reluctant to be more aggressive because of the risk of energy supply being shut off. In the meantime, this leaves policy no man's land. Growth is not slowing; inflation is too high, and the ECB is behind the inflation-fighting curve not being aggressive. It’s not where any central bank wants to be.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

Global

Global