France’s INSEE Survey Shows Weaker Manufacturing and Services

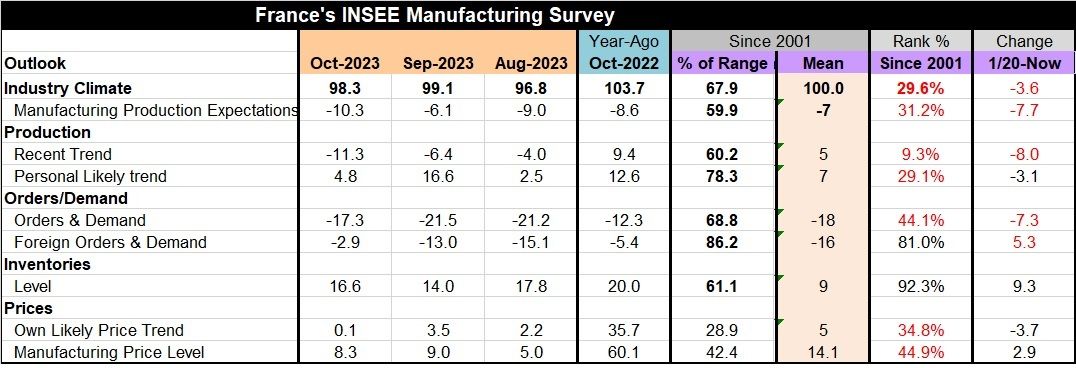

The INSEE industry climate gauge as a 29.6 percentile standing and the index fell month-to-month to boot. The index is still below (by 3.6 points) its level of January 2020 before the pandemic struck.

The INSEE manufacturing survey The manufacturing production outlook fell back to -10.3 in October from -6.1 in September, only slightly weaker than the August reading of -9.0. These expectations have been weaker since 2001 about 31% of the time and stronger nearly 70% of the time.

Production has a ‘recent trend’ that has worsened in the month as it fell to a diffusion value of -11.3 in October from -6.4 in September and -4.0 in August. This trend has been weaker historically by less than 10% of the time. Survey respondent also supply expectations for their own firm/industry as a ‘personal likely trend.’ This assessment fell to 4.8 in October from 16.6 in September – but it is higher in comparison to August. The reading for the own-firm trend is at a 29.1% standing, much better than for manufacturing overall but still a lower one-third of ranking value.

Orders and demand remained sub-par in October but improved to -17.3 from -21.5 in September and similar weakness in August. This entry has a percentile standing below its historic median at its 44.1 percentile. Foreign orders and demand have shown more persistent progress, rising to -2.9 in October from -13.0 in September; this series, quite contrarily, has a very strong 81-percentile standing. The French, in some sense, expect to be boosted by foreign economies. That remains to be seen since it is far from clear where this stronger growth is going to occur.

On the price front, the own-price responses are weaker than their August levels while for overall manufacturing prices, the expectation is for net stronger pressures. The own price ranking is at 34.8% with the manufacturing index at a 44.9 percentile.

The service sector survey The services climate index fell in October for the second month in a row and recent monthly responses are clearly weaker than in prior months. The climate indicator has a below median 43.5 percentile standing.

The outlook response worsened in October, falling to -9 from -5 in the previous two months. The outlook is below its median with a 37.5 percentile reading (medians on ranked data occur at the 50-percentile standing mark).

Sales, as observed over three months, have a -1 reading for the second month in a row and a 34.8 percentile standing. Expected sales over the next three months have fluctuated and fell to +2 this month from +3 in September and to a 49.4 percentile standing, marginally weaker than their historic median.

Sales prices, as observed over the past 3 months, fell to +5 in October from +8 in September and to an 89.3 percentile standing. Prices expected over the next 3 months also saw some cooling, falling to +5 from +9 and now has a 90.9 percentile standing.

The employment metric over the past 3 months slipped to -4 in October and to a 21.7 percentile standing. The expected employment conditions for 3 months ahead stepped up to +7 from +4 and moved up to a 70.8 percentile standing.

Despite a weaker outlook, plus weak and weakening sales expectations, employment expectations are rising on their merit- it is hard to understand except as unbridled optimism or even denial. The 70.8 percentile standing for expected employment dwarfs the standing for expected sales (49.4%), and for the outlook (37.5%) as well as for the current climate assessment (43.5%).

Summing up Together the services and manufacturing surveys show creeping weakness for responses that are already weak. Both manufacturers and services respondents see continuing price pressures despite some recent softening. Service sector expectations for prices remain quite elevated for the period ahead.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates