Italian Industrial Output Turns to Decline

Industrial output for manufacturing in Italy fell by 1.4% in September after increasing by 0.5% in July and 2.4% in August. Italian output is flat over 12 months, falls at a 0.2% annual rate over six months and then posts this strong 5.8% annual rate of increase over three months. September’s drop interrupts a pair of gains in July and August to blunt the three-month gain which itself is an interruption of an incipient declining trend sequential trend.

Quarter-to-date growth September marks the end of the quarter so the quarter-to-date calculations give us the preliminary quarterly results for Italian industrial output. Manufacturing output is declining at a 0.2% annual rate in the quarter; the decline led by a 7.6% annual rate decline from intermediate goods, reinforced by a 2.7% annual rate decline in consumer goods output, but with capital goods softening the blow with a substantial 6.1% annual rate of increase in the third quarter.

Monthly data show one decline in the last three months for consumer goods output- that was in July. Capital goods show increases in each month of the quarter. Capital goods output is the weakest gain rising at a 0.1% month-to-month in September, after rising by 1.9% in August and in July rising by 2.2% month-to-month. Intermediate goods output is down by 1.8% in September, after rising by 0.8% in August, and after a decline of 0.7% in July.

Manufacturing trends are mixed across sectors Over the sequential period from 12-months to 6-months to 3-months, Italian output shows very different trends in train by sector. For output overall, there's no change over 12 months, a slight decline over six months and then strength over three months leaving this series without a clear trend in place. Consumer goods follow that same sort of pattern with a 3.4% gain over 12 months, a 1.1% annual rate increase over six months and a strong 7.4% annual gain over three months. Consumer goods output does not give any clear sense of trend, but it does show increases on all three horizons. Capital goods show increases on all three horizons and clear acceleration. Capital goods output rises at a 2% annual rate over 12 months, at a 2.5% annual rate over six months, ballooning to an 18.1% annual rate gain over three months. However, intermediate goods bring these trends back to earth with a 4.9% annual rate decline over 12 months, the same 4.9% annual rate decline over six months, and a decline of 6.8% at an annual rate over three months. These results leave the manufacturing trends mixed and the sector trends in some cases moving in opposite directions. It all adds up to no clear signal from manufacturing.

Since COVID… output lethargy Manufacturing has been weak since COVID struck. The aggregate increase in Italian output has been only 0.1% since January 2020 with consumer goods output up by 1.2%, capital goods output up by 0.6% and intermediate goods output lower about 1%.

Sector rankings With those kinds of trends, it's surprising that the rank standing for the 12-month changes in output are as strong as they are. For output overall and data back to the year 2000 show manufacturing output growth has a standing in its 52.7 percentile. Consumer goods have a standing in their 85.6 percentile- quite strong. Capital goods have a standing in its 60.6 percentile. Intermediate goods once again provide the counterpoint with a much weaker standing, in its 18.2 percentile - a standing clearly below its historic median which occurs at a ranking of 50%. Strength and weakness in manufacturing appears to be a tug of war between solid performance in the consumer sector and weak performance from intermediate goods.

Italian industrial indicators Three industrial indicators for Italy provide a bit more context as to industrial performance. The EU industrial confidence index, the ISTAT current orders and the ISTAT outlook for production, provide these references.

EU industrial confidence: The EU industrial confidence measure has negative readings for July, August, and September; these readings gradually erode over this sequence of months. The averages for the sequential readings, however, show improvement from -12.1 over 12 months to an average of -8.3 over six months to an average of -6.3 over three months. Still, in the quarter-to-date EU industrial conference had a negative reading; it is up by only 1.2 points since COVID struck. The ranking for industrial components is done on the level of the index (a net diffusion index); on that basis it has a 41.1 percentile rank standing, below its historic median.

ISTAT current orders: The ISTAT current order series (a net diffusion index) shows negative numbers in each of the last three months but negative numbers that transit toward less weakness moving from -7 in July to -2 in September. Sequentially, over 12 months, six months and three months, the sequential averages are barely changed. Compared with the level in January 2020 before COVID struck, current orders are higher by 11 points and, ranked on data from the year 2000, the current order series has a 79.5 percentile standing, a relatively high reading for orders.

ISTAT production outlook: The production outlook index shows negative readings declining from -3 in July to -6 in September with an improvement in August in between. The sequential averages show a 12-month average of -18, a six-month average of -8 and a three-month average of -9 indicating there has been some improvement over three and six months compared to the conditions that prevailed over 12-months on average. In the quarter-to-date, the index has a reading of -4.3. Compared to the level since before COVID struck, in January 2020, the outlook is lower by eight points. The rank standing for the level of the orders index in September is at its lower 11th percentile, a very weak reading.

Summing up-output trend dissonance These are on balance somewhat confused and certainly mixed readings for the Italian manufacturing and industrial portion of the economy. Over 12 months output is flat and over shorter horizons the trends for industrial production are mixed. There's been very little increase in industrial production since COVID struck and the rank standings by sector vary from standings in the 80th percentile for consumer goods to the lower 1/5 of its range for intermediate goods. Industrial indicators don't clarify things very much as ISTAT shows an 80-percentile standing for current orders but only an 11% standing for the outlook on production – can you say dissonance? The EU confidence measure is below its median of 50 with the standing in its 41st percentile.

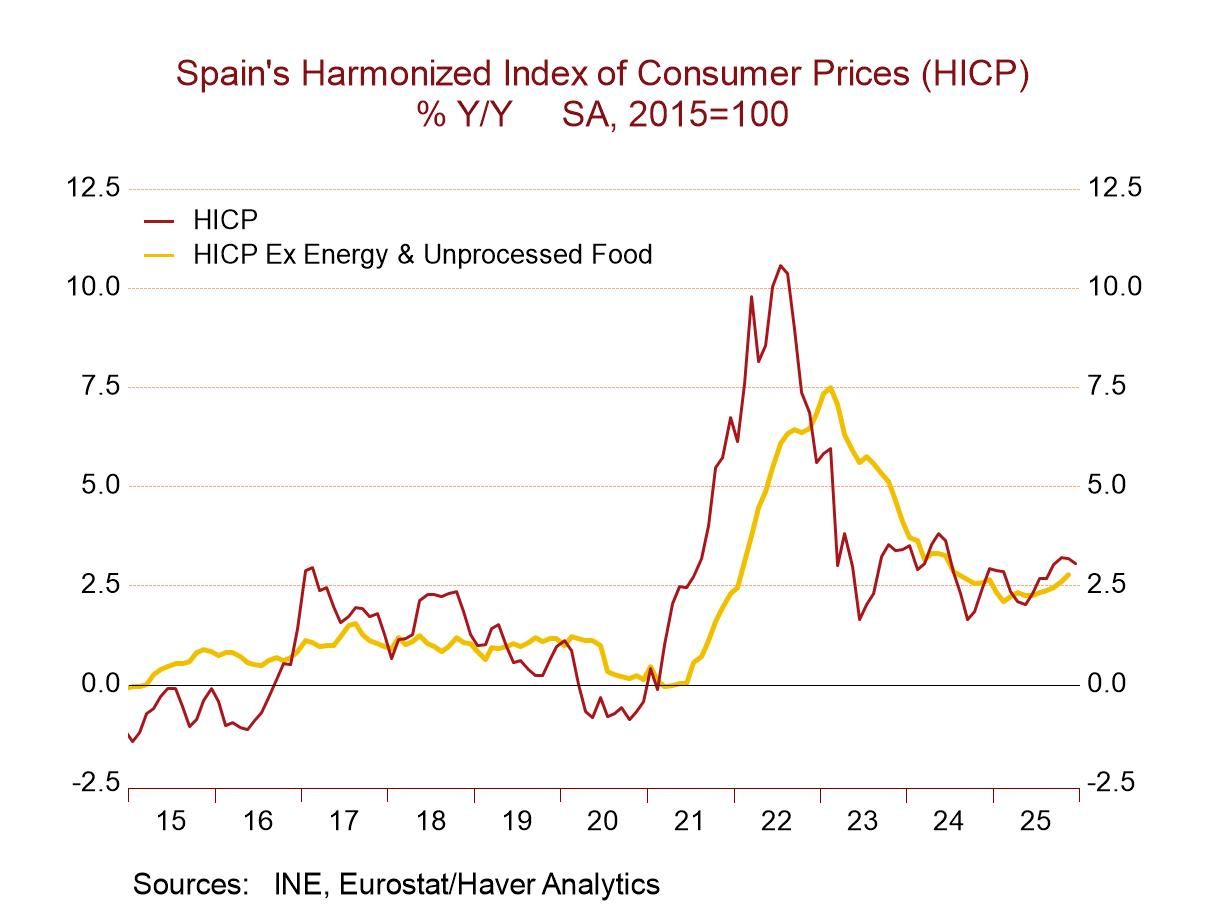

More broadly... Conditions in Europe continue to be under pressure with inflation still very high and it's still very high in Italy itself as well as in the European Monetary Union. The European Central Bank, of course, has been raising rates and is continuing to raise rates, concerned about the level of inflation and to keep inflation from becoming entrenched. There's weakness across Europe, there's weakness in the U.K., and there's inflation globally. The environment is a very difficult one for doing business and it’s hard to mount too much optimism. In addition, the war between Ukraine and Russia continues to press on. Ukraine has made some progress against Russia, but that may only make the situation seem a little bit more dangerous because it puts Russia off its guard and may encourage it to do something reckless. Of course, Ukraine losing ground would be worse- it’s just a way to point out the hopelessness of an ongoing war there. Globally, economies are weak. The OECD leading indicators released yesterday show weakness spanning industrialized and developing economies. Italy's data are hardly a bright spot; however, the mixed nature of data is not bad performance given the conditions of the global economy and the environment that marks this period.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.