METI Indexes Show a Mixed May; Industry Weaker; Services Stronger

The just-released METI sector indexes for May show that the industry index has stepped down to 103.2 from 105.5 in April. The tertiary index, an indicator for the services sector, moved up to 102.0 from 100.8.

More on METI The graph shows that year-on-year growth for both sectors is positive, which is a good sign. The growth rate for the industry index is at its 78th percentile while the growth rate for services is at its 90th percentile. Both indexes log growth rates rankings over the past year that are solid and positive in comparison with their own histories.

However, in terms of levels, the industry index is extremely weak, at a 9.4-percentile standing. The level of industrial activity in May is in the lower 10-percentile of activity among all months since 1990. That is impressively disappointing. Comparing the services level historically we obtain a solid reading, at its 81st percentile. Of course, over time these indexes should grow; even an 81-percentile standing is not particularly strong. However, for industry having an index level that says weak as 9.4% on data since 2009, the ranking tells us that industry in Japan has been lagging recently, since it is a real activity index, not a diffusion index.

The table also looks at the growth in the industry and tertiary sectors from January 2020 just before COVID struck the worldwide economy. On that basis, the industry index is lower by 5.1% and the services sector is higher by only 0.4%, the former very weak, the latter, a small gain over such a long period of time.

Other Metrics The Economy Watchers Index In addition to the METI indexes, the table offers the economy watchers readings (a diffusion index). In May, the economy watchers index moved up to 55 from 54.6 in April; the growth rate of the index has a 55.2 percentile standing. However, the economy watchers index level was at 95.3%. So, the index level was solid/strong, but its growth rate over the last year is weaker than for the METI indexes. The economy watchers indicator for the service sector in May ticked up to 59.2 from 59.1; it has only a 47.6 percentile standing on growth, which puts it below its median growth rate since 1990 although for the service sector the index level has a 97.7 percentile standing. Strictly speaking, the standings of an index like METI, versus a diffusion index, like the economy watchers, are not directly comparable- one measures breadth, the other activity in absolute terms. The economy watchers index for employment overall moved up to 57.1 in May from 55.8 in April. The ranking of the growth rate is below its median at a 47.6 percentile standing and the standing of the index level, at its 76-percentile, a relatively a moderately firm standing for an index level on diffusion. The economy watchers survey also has a future gauge; in May, it slipped to 54.4 from 55.7; the growth of the future gauge sits in its 65.7 percentile, above its historic median. The index level for the future index is also relatively high at a 93-percentile standing. All the various components of the economy watchers index are higher compared to January 2020.

The Teikoku Index The Teikoku index is another diffusion index that looks at various sectors. Teikoku in May shows a slight improvement for manufacturing at a 41.5 diffusion reading; still with a diffusion value below 50 indicating contraction, but ever-so-slightly less contraction than a month ago as the reading ticked up from 41.4 in April. The growth ranking for the index is at its 53.1 percentile, modestly above its historic median. With the index level at a 57.6 percentile standing, the assessment is not particularly impressive. For services in May, the Teikoku index moves up to 51.6 from 50.8; the growth rate of services over the past year has a 79-percentile standing, a relatively solid standing with an index level standing at 87.2%. The Teikoku indices show all the components somewhat higher compared to their respective levels of January 2020, apart from construction that's lower on balance from its January level by 3.1 points.

Leading Economic Index The final metric in the table is the leading economic index. As of May, that index moved up to 109.5 from April’s 108.1. The growth rate for the leading index has a ranking at the 41.9 percentile which puts it below its historic median growth rate. The index level for the LEI is a weak 35-percentile standing, another relatively weak response based on the level of an activity index. However, leading index is higher by 7.7% from its level in January 2020, before the COVID virus struck the world economy; that’s something.

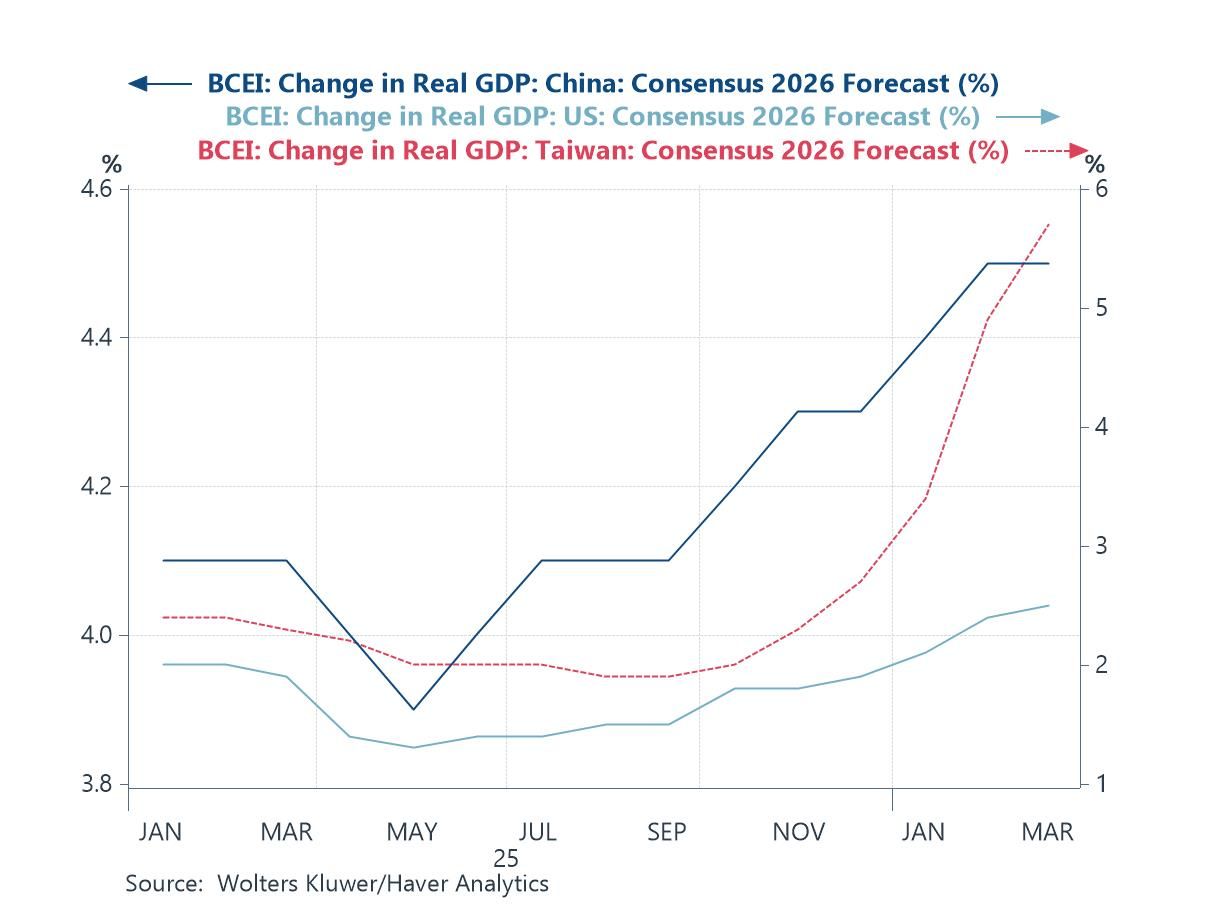

Summing up On balance, these various metrics reveal a relatively stronger services sector compared to industry or manufacturing in Japan. This is also a global phenomenon; it has helped to preserve relatively elevated levels of employment globally as well as in Japan. The performance of manufacturing/industry is assessed more unevenly across these surveys with a smattering of weak readings. The METI index’s take on industry is particularly weak, especially in terms of the ranking for the index level at 9.4%. The feedback on the services sector and its components is generally upbeat on the economy watchers index: performance of three services subsectors is slightly below their respective median performance. Japan's economy is importantly attached to the global economy through the presence of its multinational corporations. Its largest trade partner, China, has been struggling with uneven performance as illustrated by its most recent quarterly result for GDP. The U.S. economy has been logging growth but not particularly robust growth and that's Japan's second largest trading partner. In this environment, it's not surprising that the Japanese economy is struggling to some extent, especially in manufacturing. Inflation in Japan has risen above the Bank of Japan's guideline, but the bank has taken no steps to corral inflation, unlike other global central banks. Japan still views itself as breaking out of a period of pronounced deflation, although its attitude towards inflation may be changing. This will be something to continue to watch.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

Global

Global