U.K. Distributive Trades Readings Weaken and Outlook Weakens

The distributive trades survey shows weakening in October for the retail sales (Yr Ago) and sales (time of year). Wholesale sales weakened for sales (Yr Ago) and remained at a very weak reading for orders (Yr Ago) as Sales (time of year) got marginally better in the month-to-month reading but remains at a very weak level.

Expectations for November weakened across the board in retailing compared to October. For wholesaling, they were nearly the same, with the expectations with the net negative readings in November for sales (time of year) that improved compared to October, but it still logged a very weak reading. Improvments month-to-month are a technical assessment, not a statement of an ongoing trend.

Retailing’s reported (current) results log net negative readings for nearly all observations except stocks over the last three months. Retail expectations are the same except their lone positive reading is near-term for October.

Wholesaling reported trends are uniformly deteriorating through time. The negative readings become increasingly weak – or become more severely weak and stay there. Expectations for wholesaling do not follow suit. They are more erratic and cannot be categorized as trending. However, what is disturbing about the expectations is that readings have become suddenly weaker over the last month or last two months in the case of sales (time of year).

Current conditions are generally stronger than their 12-month averages for retailing and weaker for wholesaling. But expectations are strikingly weaker in comparison with their 12-month averages for wholesaling while they are mixed on that comparison for retailing.

There is nothing strong in this month’s survey – not even ‘firm.’ Nothing reassuring. These monthly comparisons of stronger and weaker are only to assess where things are trending – very short term. The readings per se are weak - uniformly weak. All readings rank below their respective 50% mark that designates the location of the median. The strongest reading among activity variables, setting aside stocks, is the October standing of reported orders (compared to a year ago) at 42%. The 29% reading for retailing under expectations also for sales (compared to a year ago) is the next strongest reading.

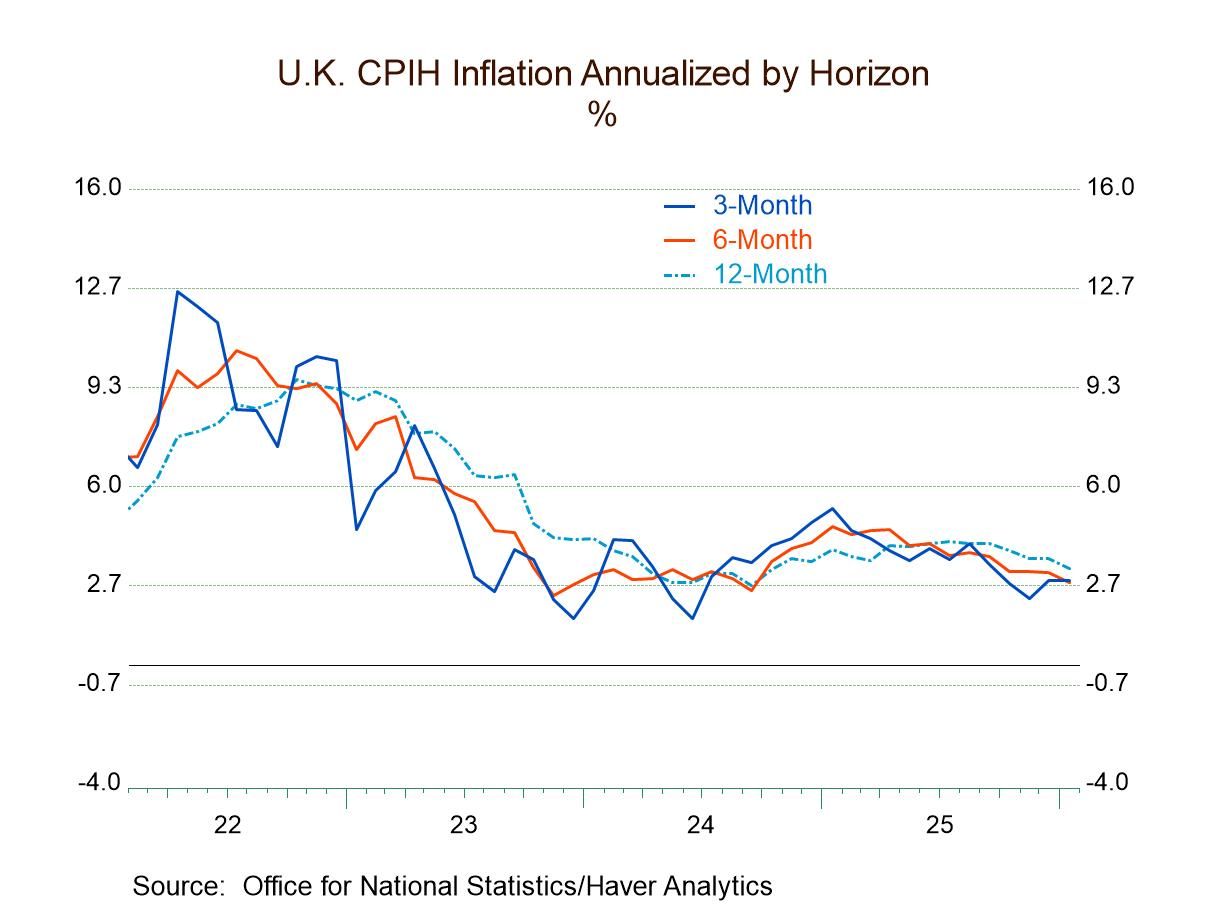

Expectations are weaker in terms of rankings than the current (reported) readings. The difference is much larger for retailing than for wholesaling. But all the rankings are weak. The chart shows that readings are languishing in a morass of weakness after a post-covid rebound. There is not any clear road to better times ahead here.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.