U.S. Personal Income & Spending Slow in July, but So Does the Month-to-Month Inflation

Summary

- Nominal income and spending rise less than expected.

- PCE price index actually declines slightly in July.

- Income gains led again by wages & salaries.

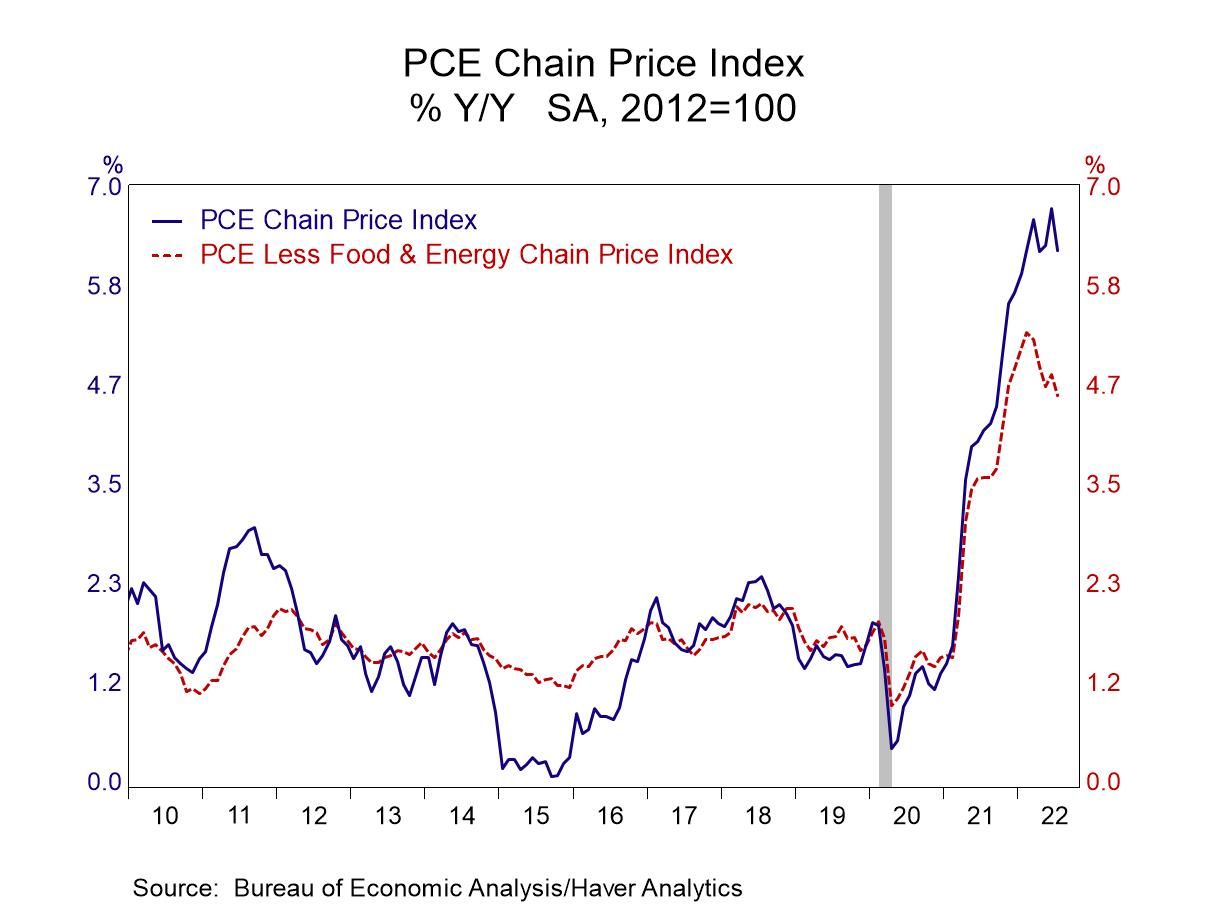

Inflation paused in July, as measured by the personal consumption expenditures price index. That index actually decreased 0.1% after a 1.0% increase in June. The year-to-year measure indicates that inflation is hardly over; it increased 6.3% from July 2021, down just slightly from June's 6.8% y/y increase.

The July decline in the price index was reflected in smaller increases in the nominal measure of personal income and consumption: Personal income increased just 0.2% m/m (4.6% y/y) in July following a 0.7% increase in June; that was revised marginally from 0.6% initially reported. The Action Economics Forecast Survey had expected a 0.6% monthly increase in July. Personal consumption expenditures rose 0.1% in July (+8.7% y/y) after a 1.0% increase in June; that was revised slightly from 1.1% reported last month. The Action Economics Forecast Survey had looked for a 0.4% monthly rise for July.

Energy was the main contributor to the July decline in the PCE price index, but other sectors saw slowing as well. Energy prices declined 4.8% in the month, but were still up 34.4% y/y; this followed a surge of 7.5% in June (43.4% y/y). Food prices were still strong in July, up 1.3% (11.9% y/y) after June's 1.0% increase (11.2% y/y). The "core" rate, that is, the total excluding food and energy, did increase but only by a very modest 0.1% in July (4.6% y/y) after June's 0.6% (4.8% y/y).

In July, the 0.2% rise in personal income was quite mixed. Wages and salaries were strong, up 0.8% (9.9% y/y), following 0.6% in June. Other incomes slowed, most showing outright declines for July. Dividend income did rise, by 0.4% (3.6% y/y), while interest income was flat (4.6% y/y). But proprietors' income decreased 1.3% (+2.6% y/y0, basically reversing June's 1.1% increase. Rental income also declined 1.3% (+10.0% y/y) after a 2.2% surge in June. Even transfer receipts decreased, falling 0.4% (-7.2% y/y) after a 0.5% increase in June. Personal taxes went up 0.3% (+20.8% y/y) in July, a bit less than June's 0.4% increase. This all led to a 0.2% increase in total personal income (+4.6% y/y); after taxes, disposable personal income was also up 0.2% in July, but just 2.2% y/y with that y/y surge in taxes.

The increase in personal consumption expenditures in July mainly featured a 10.1 drop in gasoline and other energy goods; this was still up 33.9% from a year ago, but that was much less than June's 53.6% y/y increase. Otherwise, spending on durable goods increased 1.3% in July (), after 1.4% in June; this included a 1.1% increase for motor vehicles and similar advances in furnishings and various other durable goods items. Spending on nondurable goods other than gasoline showed moderate increases, including 0.3% for food and beverages purchases for off-premises consumption and 0.9% for clothing and footwear. Services outlays rose 0.3% (8.0% y/y) after June's 0.7% rise. Notable among those line-items, housing costs rose 0.2% (8.4%) following June's 0.7% increase, and health care edged up just 0.1% (4.6% y/y and very similar to the prior four months' y/y increases in health care outlays) after June's 1.1% increase.

Personal taxes rose 0.3% in July after 0.4% in June. With the 0.2% increase in personal income, disposable personal income also rose 0.2% after June's 0.7% increase. Total personal outlays, which include consumption, interest payments and transfer payments, were up 0.15% after 1.00% in June. This combination of income and outlays yielded an increase in personal saving of 1.2% in July and a personal saving rate of 5.0%. This was the same as in June, which was revised slightly from 5.1% reported last month.

The personal income and consumption figures are available in Haver's USECON database with detail in the USNA database. The Action Economics forecasts are in AS1REPNA.

This week in Jackson Hole, Wyoming, the Kansas City Federal Reserve Bank is conducting its annual economic policy symposium. Fed Chair Jerome Powell spoke this morning. Here is his presentation.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates