U.S. Financial Accounts Show Less Sizable Borrowing in Q3

Summary

- Federal government pays down some debt in Q3.

- Household mortgages and consumer credit both expand less in Q3.

- Business corporations borrowed more in bonds and loans.

Borrowing in the U.S. economy totaled $3.069 trillion, seasonally adjusted annual rate, in the third quarter, noticeably less than Q2's $5.297 trillion. The Q3 amount is 13.2% of GDP, down from 23.3% in Q2. Thus, the latest quarterly borrowing pace is closer to the pre-pandemic range of 11% to 14% of GDP since the recovery following the Great Recession of 2008-2009.

The pattern of borrowing shifts by sector was mixed in Q3. The main shift was in liabilities of the federal government. In Q2, that sector borrowed $2.315 trillion following $2.122 trillion in Q1. But in the latest quarter, the federal government paid down $327 billion of debt securities and loans, even including a small amount of standard marketable securities. These are seasonally adjusted annual rates, as noted, and this quarter is the first such paydown since Q2 2007. Not seasonally adjusted, the Treasury borrowed $147 billion, the smallest amount since Q2 2019.

Households and the financial sector also borrowed less in Q3 than they had in Q2, while nonfinancial businesses and the foreign sector borrowed more. For the household sector, borrowing totaled $1.068 trillion, equal to 5.9% of disposable personal income. The borrowing again emphasized 1-4 family home mortgages, as it has for the last year, since mortgage interest rates have remained near record lows. In Q3 2021, this amount was $882 billion, down modestly from $890 billion in Q2. Consumer credit expanded less markedly in Q3 than it had been; in Q3, it rose at a $227 billion annual rate, less than the $337 billion in Q2. The Q3 amount is 1.3% of disposable income, down from 1.9% in Q2; in the five years ending in 2019, that is, before the pandemic, this measure averaged 1.4%.

Domestic financial institutions borrowed $794 billion in Q3, also less than in Q2, which saw banks, insurance companies, securities dealers and other finance companies reduce their borrowing from $1.079 trillion in Q2. This latest amount is still sizable for this sector; in the five years through 2019, they average $316 billion seasonally adjusted annual rate each quarter.

Nonfinancial corporate businesses' borrowing did increase in Q3 and there was a moderate upward revision to Q2. From just $124.8 billion in Q2, these companies are now reported to have borrowed at a $174 billion annual rate. Then, in Q3, they increased debt at a $677 billion annualized pace. Corporate bond borrowing was $308 billion in Q3, up from just $74 billion in Q2, and loans also expanded at a $308 billion pace. This borrowing equals 27.9% of capital outlays, up from 7.4% in Q2.

Foreign borrowers, both private and governmental institutions, borrowed $784 billion in Q3, up from $166 billion in Q2.

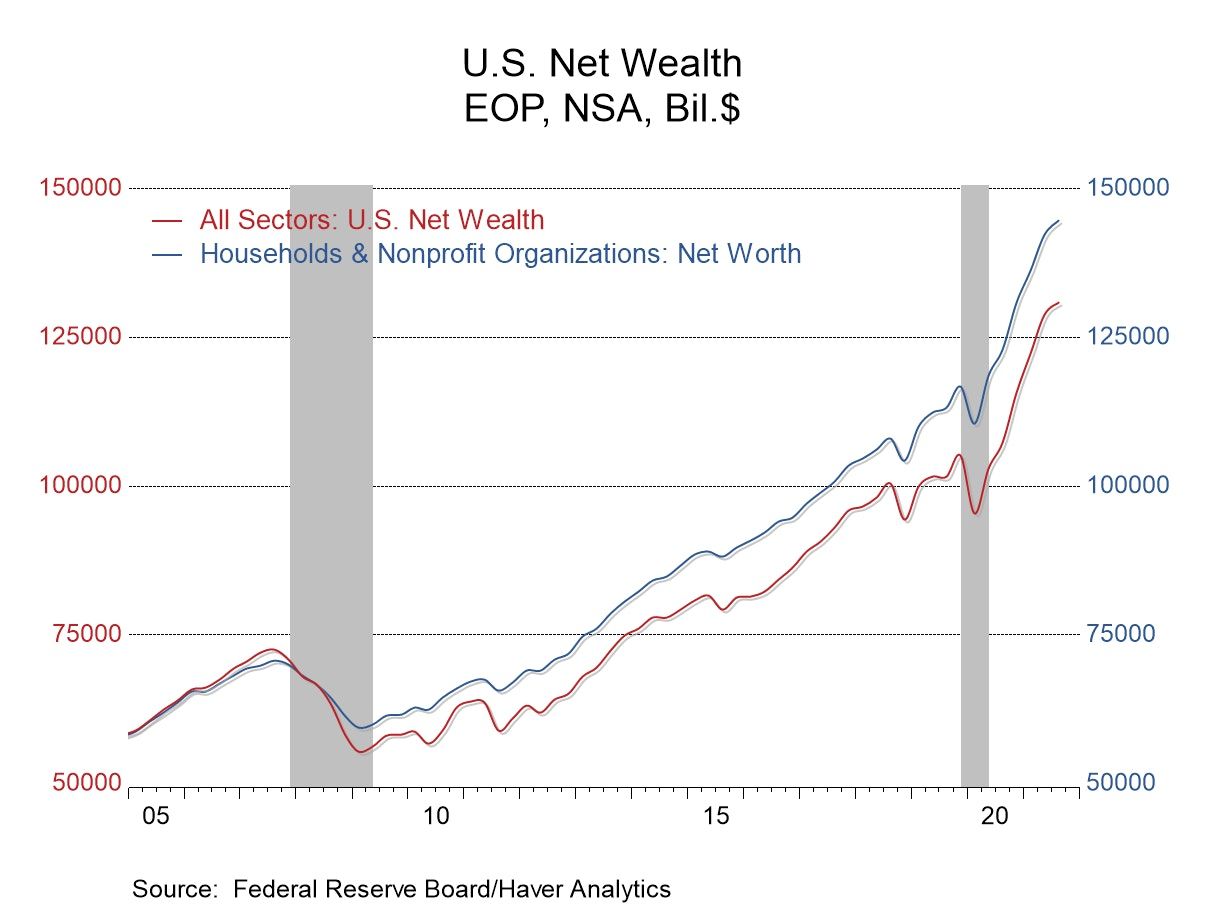

Net wealth in the U.S, economy rose $2.058 trillion in Q3, less than the $6.494 trillion in Q2 (quarterly amounts, not seasonally adjusted or annualized), Household net worth increased $2.362 in Q3, down from a $6.141 trillion advance in Q2. That did reflect an upward revision from $5.849 trillion in Q2 reported before.

The Financial Accounts data are in Haver's FFUNDS database. Associated information is compiled in the Integrated Macroeconomic Accounts produced jointly with the Bureau of Economic Analysis (BEA); these are carried in Haver's USNA database as well as in FFUNDS.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates