Vehicle Registrations Losing Momentum in Europe

Registrations for cars in Europe for March fell by 8.8% month-to-month after falling by 1% in February. January, however, had been a strong month for registrations in Europe. The sequential trends are mixed and do not show a clear way forward. The 12-month change in sales/registrations falls 4.7%. Over six months registrations fall harder at an 11.9% annual rate, but then over three months registrations gain at a 7% annual rate. These data are prone to volatility. To adjust for that, I execute the same calculations on three-month average data to smooth out the volatility and let the trend shine through. Unfortunately, this procedure still does not produce a clearer picture of trend.

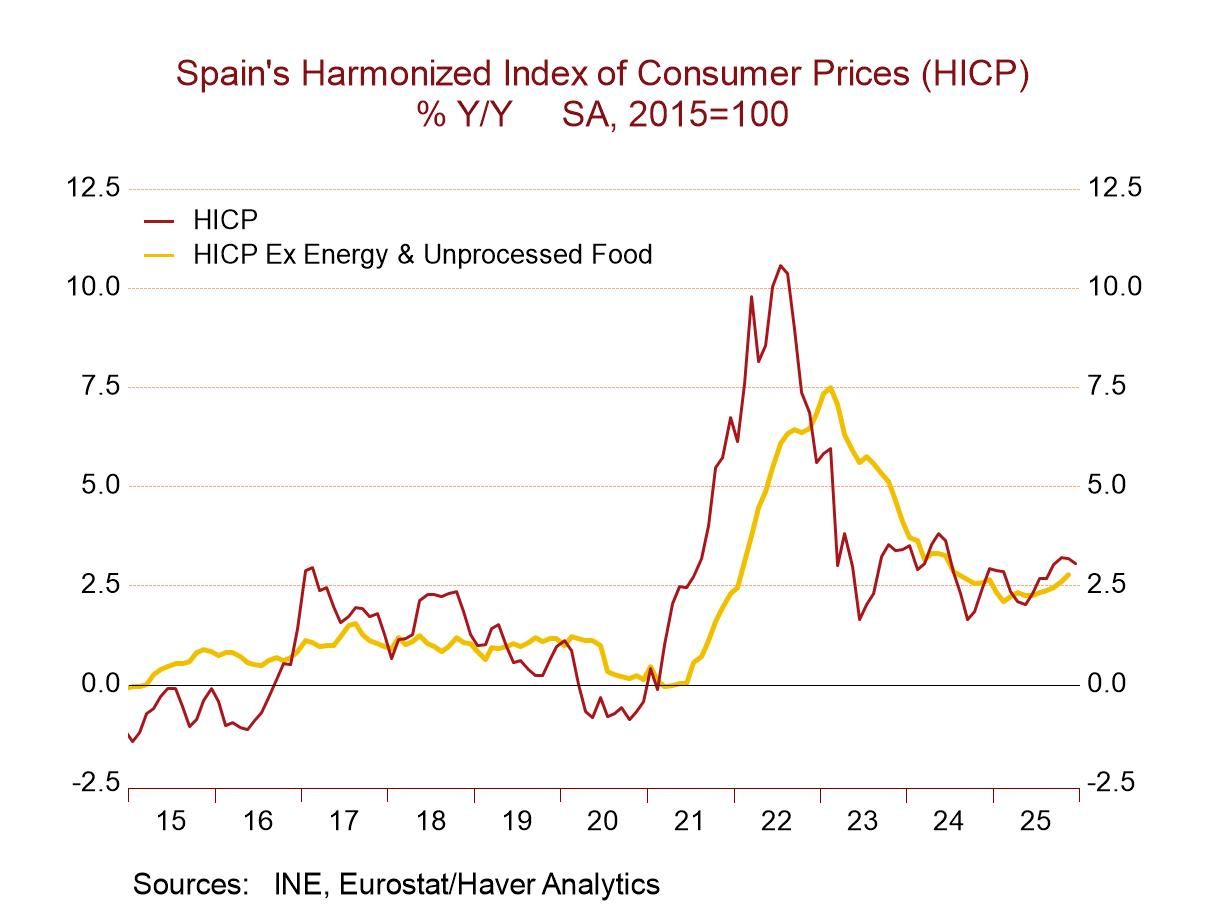

Chart 1, executed on year-over-year growth rates, shows registrations gradually losing momentum among reporting countries. Sequential growth rates across countries finds Germany and Spain with accelerating sales/registrations. France and Itay with fairly clear trends showing decelerating sales. Meanwhile, the U.K. trend shows confusion with no clear pattern emerging.

Looking very broadly, all reporting countries show registrations lower in March everywhere except for France, in 2024 compared to January 2020 before Covid struck. France is the lone exception that shows registrations in March higher by just 2.2% than they were over four years ago. That is not exactly a stunning success.

Europe has been struggling. Weakness in vehicle sales is not news. After Covid, vehicle registrations dropped sharply then recovered but dropped again in the wake of Russia’s invasion of Ukraine. In early 2022 registrations bottomed out and rebounded into 2023, but by later in 2023 the rebound had run its course and trends turned flat and since have decayed.

The ECB is set to provide some help if it can follow through. Markets expect an ECB rate cut in June of this year. But U.S. and U.K. experiences might provide some caution or counterpoint as inflation has kicked up its heels in the U.S. and put the Fed’s well-telegraphed plan to ease on the back burner. In the U.K., inflation has simply slowed its progress and seems to be moving sideways.

Global economic conditions have been disrupted and under pressure dating back to the Great Recession. That recovery was drawn out and slow with unemployment rates falling continuously in recovery but slowly in the recession aftermath. Then Covid struck and created a new disruption that since has been magnified by the Ukraine invasion, Hamas’ attack on Irael, Israel’s response to ferret out Hamas, and now Iraq’s attack on Israel has given way to the re-emergence of an active axis of evil with Iran, China and North Korea providing support and arms to Russia in its aggression toward Ukraine. It is not clear when the global economy will ever be the same as these shocks and alliances disrupt global activity and drive wedges between countries that used to trade freely. The global economy is in a very disrupted and dangerous state of play.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.