China's merchandise trade balance fell sharply in March to $84.7 billion from $108.0 billion in February. Exports fell by $23.4 billion and imports rose by $0.3 billion. As the data are not seasonally adjusted, the monthly ups and [...]

Introducing

Louise Curley

in:Our Authors

Publications by Louise Curley

Global| Apr 09 2007

Global| Apr 09 2007Economy Watchers in Japan Are More Confident about Current Conditions but Less Confident about the Outlook

The results of the latest survey of Economy Watchers in Japan are lackluster. After losing confidence in both current conditions and the outlook since early last year, the Economy Watchers have increased their confidence regarding [...]

Global| Apr 09 2007

Global| Apr 09 2007Economy Watchers in Japan Are More Confident about Current Conditions but Less Confident about the Outlook

The results of the latest survey of Economy Watchers in Japan are lackluster. After losing confidence in both current conditions and the outlook since early last year, the Economy Watchers have increased their confidence regarding [...]

Global| Apr 03 2007

Global| Apr 03 2007Profitability of U.K. Private Nonfinancial Corporations at a Record High: Largely a Reflection of the [...]

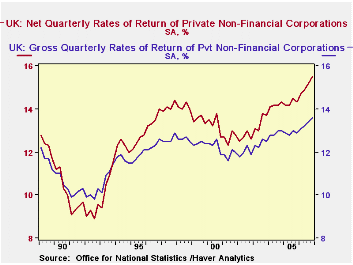

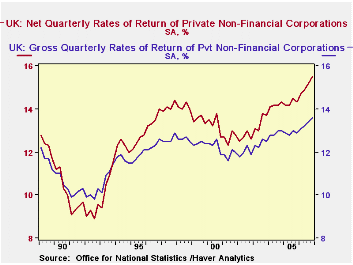

The net profitability of all private nonfinancial corporations in the United Kingdom was 15.5% in the fourth quarter of 2006. This rate was up from 15.2% in the third quarter and was the highest quarterly rate since the series began in the first quarter of 1989, as can be seen in the first chart, which shows net and gross profitability of U.K. corporations.

The net profitability of all private nonfinancial corporations in the United Kingdom was 15.5% in the fourth quarter of 2006. This rate was up from 15.2% in the third quarter and was the highest quarterly rate since the series began in the first quarter of 1989, as can be seen in the first chart, which shows net and gross profitability of U.K. corporations. Net profitability is defined as the net rate of return on capital employed. That is, it is the value of profits, allowing for depreciation, divided by the value of inventories and the depreciated value of fixed assets. Gross profitability is defined as the gross return on capital employed, that is, the value of profits before depreciation charges divided by the value of inventories and fixed assets before depreciation . These tend to be lower than the net rates of return, as shown in the first chart.

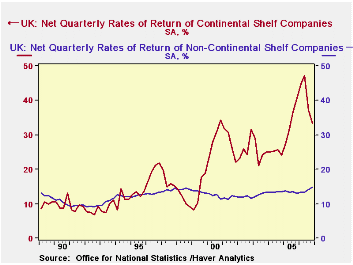

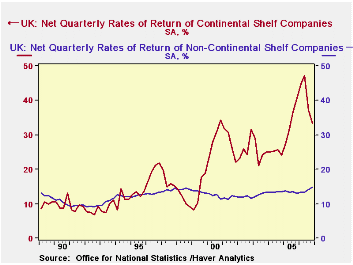

While the net profitability of Continental Shelf companies (companies engaged in the extraction of oil and gas) declined to 33.5% from 37.3% in the third quarter, the profitability of the nonshelf companies rose to 14.7% from 14.2% in the third quarter. The rates of return for the Continental Shelf corporations are more volatile than those of the nonshelf corporations as can be seen in the second chart. The volatility of the Continental Shelf corporations is due, in large part, to variations in the prices of oil and gas.

Net profitability is defined as the net rate of return on capital employed. That is, it is the value of profits, allowing for depreciation, divided by the value of inventories and the depreciated value of fixed assets. Gross profitability is defined as the gross return on capital employed, that is, the value of profits before depreciation charges divided by the value of inventories and fixed assets before depreciation . These tend to be lower than the net rates of return, as shown in the first chart.

While the net profitability of Continental Shelf companies (companies engaged in the extraction of oil and gas) declined to 33.5% from 37.3% in the third quarter, the profitability of the nonshelf companies rose to 14.7% from 14.2% in the third quarter. The rates of return for the Continental Shelf corporations are more volatile than those of the nonshelf corporations as can be seen in the second chart. The volatility of the Continental Shelf corporations is due, in large part, to variations in the prices of oil and gas.

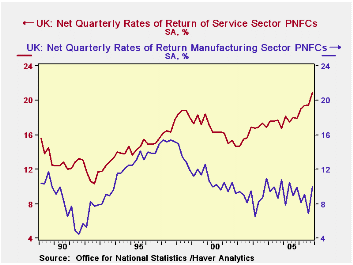

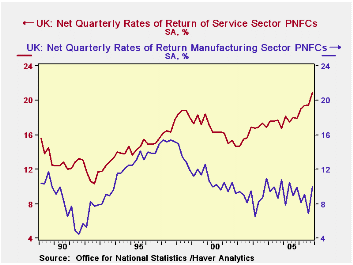

Of the nonshelf companies, it is the corporations engaged in the service industries that have accounted for the rise in the overall profitability of the private nonfinancial companies. Net profitability in the service and manufacturing industries are compared in the third chart. Rates of return in the manufacturing industry tend to be lower than those in the service industries due, in part, to the greater capital intensity of the manufacturing industry relative to that of the service industry corporations, but the gap between rates of return in the manufacturing and service industries has widened as profitability in the service industries has improved and that in the manufacturing industries deteriorated.

NET PROFITABILITY OF PRIVATE NON FINANCIAL CORPORATIONS IN THE UK (%) Q4 2006 Q3 2006 Q4 2005 Q/Q Dif Y/Y Dif 2006 2005 2004 All Corporations 15.5 15.2 14.3 0.3 1.2 15.1 14.3 14.2 Continental Shelf Corporations 33.5 37.3 40.6 -3.8 -7.1 40.7 34.1 25.1 Nonshelf Corporations 14.7 14.2 13.0 0.5 1.7 13.9 13.4 13.5 Manufacturing Corporations 10.0 6.9 9.9 3.1 0.1 8.5 9.3 9.7 Service Industry Corporations 20.9 19.5 17.9 1.4 3.0 19.7 17.9 17.4  Global| Apr 03 2007

Global| Apr 03 2007Profitability of U.K. Private Nonfinancial Corporations at a Record High: Largely a Reflection of the [...]

The net profitability of all private nonfinancial corporations in the United Kingdom was 15.5% in the fourth quarter of 2006. This rate was up from 15.2% in the third quarter and was the highest quarterly rate since the series began in the first quarter of 1989, as can be seen in the first chart, which shows net and gross profitability of U.K. corporations.

The net profitability of all private nonfinancial corporations in the United Kingdom was 15.5% in the fourth quarter of 2006. This rate was up from 15.2% in the third quarter and was the highest quarterly rate since the series began in the first quarter of 1989, as can be seen in the first chart, which shows net and gross profitability of U.K. corporations. Net profitability is defined as the net rate of return on capital employed. That is, it is the value of profits, allowing for depreciation, divided by the value of inventories and the depreciated value of fixed assets. Gross profitability is defined as the gross return on capital employed, that is, the value of profits before depreciation charges divided by the value of inventories and fixed assets before depreciation . These tend to be lower than the net rates of return, as shown in the first chart.

While the net profitability of Continental Shelf companies (companies engaged in the extraction of oil and gas) declined to 33.5% from 37.3% in the third quarter, the profitability of the nonshelf companies rose to 14.7% from 14.2% in the third quarter. The rates of return for the Continental Shelf corporations are more volatile than those of the nonshelf corporations as can be seen in the second chart. The volatility of the Continental Shelf corporations is due, in large part, to variations in the prices of oil and gas.

Net profitability is defined as the net rate of return on capital employed. That is, it is the value of profits, allowing for depreciation, divided by the value of inventories and the depreciated value of fixed assets. Gross profitability is defined as the gross return on capital employed, that is, the value of profits before depreciation charges divided by the value of inventories and fixed assets before depreciation . These tend to be lower than the net rates of return, as shown in the first chart.

While the net profitability of Continental Shelf companies (companies engaged in the extraction of oil and gas) declined to 33.5% from 37.3% in the third quarter, the profitability of the nonshelf companies rose to 14.7% from 14.2% in the third quarter. The rates of return for the Continental Shelf corporations are more volatile than those of the nonshelf corporations as can be seen in the second chart. The volatility of the Continental Shelf corporations is due, in large part, to variations in the prices of oil and gas.

Of the nonshelf companies, it is the corporations engaged in the service industries that have accounted for the rise in the overall profitability of the private nonfinancial companies. Net profitability in the service and manufacturing industries are compared in the third chart. Rates of return in the manufacturing industry tend to be lower than those in the service industries due, in part, to the greater capital intensity of the manufacturing industry relative to that of the service industry corporations, but the gap between rates of return in the manufacturing and service industries has widened as profitability in the service industries has improved and that in the manufacturing industries deteriorated.

NET PROFITABILITY OF PRIVATE NON FINANCIAL CORPORATIONS IN THE UK (%) Q4 20 06 Q3 20 06 Q4 20 05 Q/Q Dif Y/Y Dif 2006 2005 2004 All Corporations 15.5 15.2 14.3 0.3 1.2 15.1 14.3 14.2 Continental Shelf Corporations 33.5 37.3 40.6 -3.8 -7.1 40.7 34.1 25.1 Nonshelf Corporations 14.7 14.2 13.0 0.5 1.7 13.9 13.4 13.5 Manufacturing Corporations 10.0 6.9 9.9 3.1 0.1 8.5 9.3 9.7 Service Industry Corporations 20.9 19.5 17.9 1.4 3.0 19.7 17.9 17.4

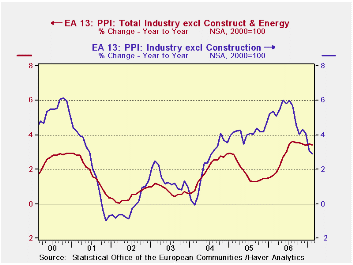

Euro area and UK PPI Trends· The Euro area 13 PPI rose by 0.3% in February. Excluding energy the rise was 0.3% as well. Trends show that PPI inflation pressures are elevated. And while the PPI is not the main focus of ECB policy, the pressure on prices is widespread across main EU countries. The bank of England has even recently said it was going to look beyond headline inflation as legacy issues might damp that calculation in the coming months. Central banks are becoming more concerned about embedded inflation pressures.

Euro Area and UK PPI TrendsM/M SAAR Euro area 13 Feb-07 Jan-07 3-Mo 6-MO Yr/Yr Total (Excl Construction) 0.3% 0.2% 2.1% 0.2% 2.9% yes"> Excl Energy

0.3% 0.5% 3.4% 2.7% 3.4% Capital Goods 0.1% 0.5% 2.9% 2.3% 2.0% Consumer Goods 0.2% 0.3% 2.4% 1.2% 1.6% Intermediate & Capital Goods 0.3% 0.6% 3.9% 3.4% 4.4% Energy 0.4% -0.7% -1.8% -7.5% 1.0% Manufacturing 0.4% 0.1% 2.3% -0.4% 2.5% Germany 0.3% 0.0% 1.0% 0.3% 2.8% yes"> Excl Energy

0.3% 0.2% 2.2% 2.4% 3.0% France 0.3% 0.1% 1.1% -0.7% 2.0% yes"> Excl Energy

0.2% 0.5% 2.2% 1.9% 2.8% Italy 0.4% 0.0% 2.4% 0.2% 4.0% yes"> Excl Energy

0.3% 0.6% 4.3% 3.0% 4.2% UK -0.8% -1.4% -6.7% 1.4% -1.4% yes"> Excl Energy

0.4% 0.5% 3.7% 3.1% 3.4% Euro area 13 Harmonized PPI excl Construction. The EA 13 countries are Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Slovenia and Spain 6COLSPAN

by Robert Brusca April 3, 2007Trend across categories and countries do not show a steadily accelerating inflation rate that central banks would clearly abhor. But they do show that pressures that had dissipated have re-emerged in the 3-month inflation rates. Excluding energy, inflation trends across the main countries show the same tendency except in Germany and in France where the pace of PPI ex-energy inflation is staying fairly constant, just above the 2% pace.

The headline inflation rate is moving steadily lower, but ex-energy inflation is considerably more stubborn around 3.5%, well above the ECB ceiling rate of 2% (for the HICP).

Global| Apr 02 2007

Global| Apr 02 2007Tankan Survey Shows Overall Confidence Holding Steady: Business Confidence Declines in Large Japanese [...]

Japan's Tankan released today showed that the headline large manufacturers' business condition DI (Diffusion Index) declined to 23% in March from 25% in December. These same firms forecast that the DI would decline further in June to [...]

Global| Mar 27 2007

Global| Mar 27 2007Despite the Ups and Downs Confidence Is Strong in Germany, the Czech Republic, Italy and Slovenia

A batch of confidence indicators, released today, shows that business confidence in Europe continues healthy. Confidence has improved in Germany and the Czech Republic, but faltered in Italy and Slovenia. In Germany, the March [...]

Business leaders in France became slightly more optimistic in March. The composite business climate indicator, computed by INSEE (Institut Nationale des Statistisque et Etudes Economique) rose 0.93% to 109 from 108 in February and was [...]

Global| Mar 20 2007

Global| Mar 20 2007Inflation in the UK :The CPI, Core CPI, RPI and RPIX

Inflation, as measured by the year over year increase in the Consumer Price Index (CPI) was 2.78%, nine basis point over January, but still below December's high of 2.97%. This is the measure that the Bank of England focuses on in [...]

Global| Mar 19 2007

Global| Mar 19 2007Japanese Department Store Sales And Total Consumer Spending

February department store sales in Japan, which are not seasonally adjusted, were 1.15% above those of February 2006, the highest year to year increase since last March. While the year to year increase is reassuring, it does not [...]

Global| Mar 19 2007

Global| Mar 19 2007Japanese Department Store Sales And Total Consumer Spending

February department store sales in Japan, which are not seasonally adjusted, were 1.15% above those of February 2006, the highest year to year increase since last March. While the year to year increase is reassuring, it does not [...]

Global| Mar 13 2007

Global| Mar 13 2007German Financial Types Become a Little More Positive on the German Outlook, and a Little Less So for the Euro Area [...]

The ZEW Indicator of Economic Sentiment for Germany, which assesses the outlook in the next six months, based on the opinions of investors and analysts, rose 2.9 points in March to 5.8%. While the current level is a substantial [...]

- of78Go to 45 page