The German industrial sector falters German industrial output in January fell for the second month in a row; it has a sequential pattern of growth rates becoming progressively weaker from 12-months to six-months to three-months. This is not a good pattern or development. Orders also fell sharply in January, dropping by 11.1% month-to-month. At least the orders progression is not as clearly negative as it is for industrial output, but over three months real manufacturing orders are declining at a 1.8% annual rate even though the 12-month and six-month growth rates of orders still show solid positive growth results.

These data are up-to-date through January, so they do not contain any effects of the new conflict in the Middle East.

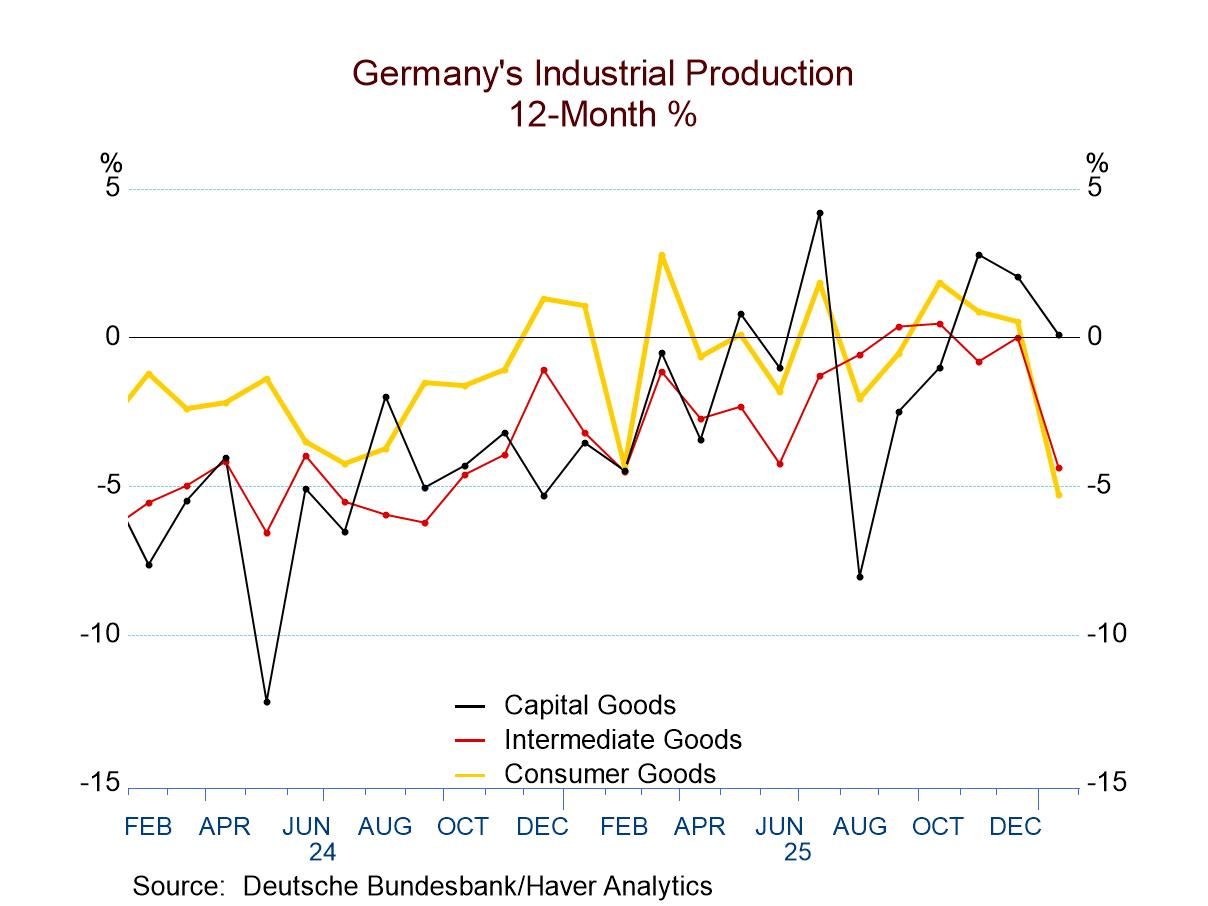

Sequential output trends German industrial output trends show progressively weaker numbers from 12-months to six-months to three-months. Consumer goods output and intermediate goods output show progressively weaker sequential results. Capital goods output shows a skinny rise of 0.1% over 12 months, a 6.6% decline at an annual rate over six months, and then a lesser pace of decline of 2.8% over three months. Capital goods output is not getting progressively weaker; however, it has been weakening and the trend is disappointing.

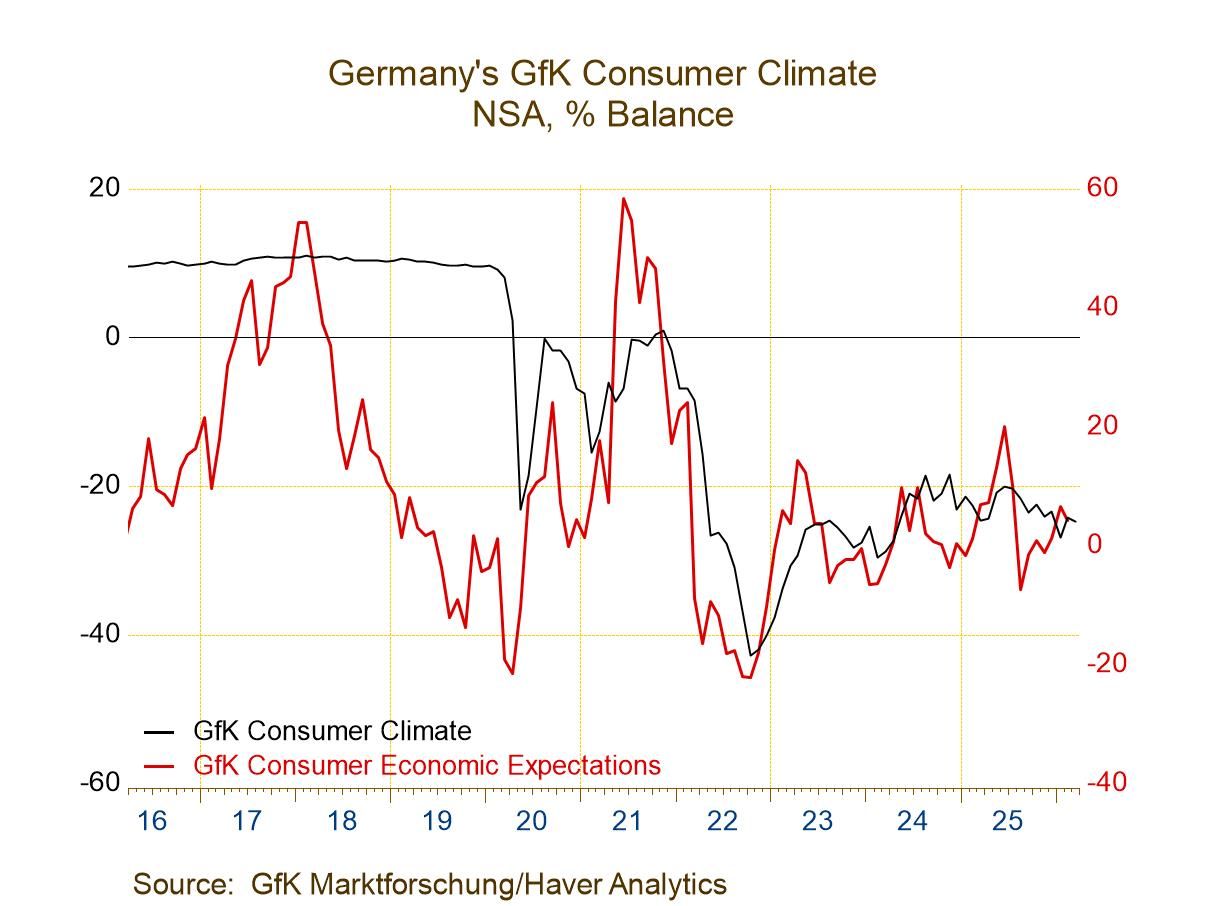

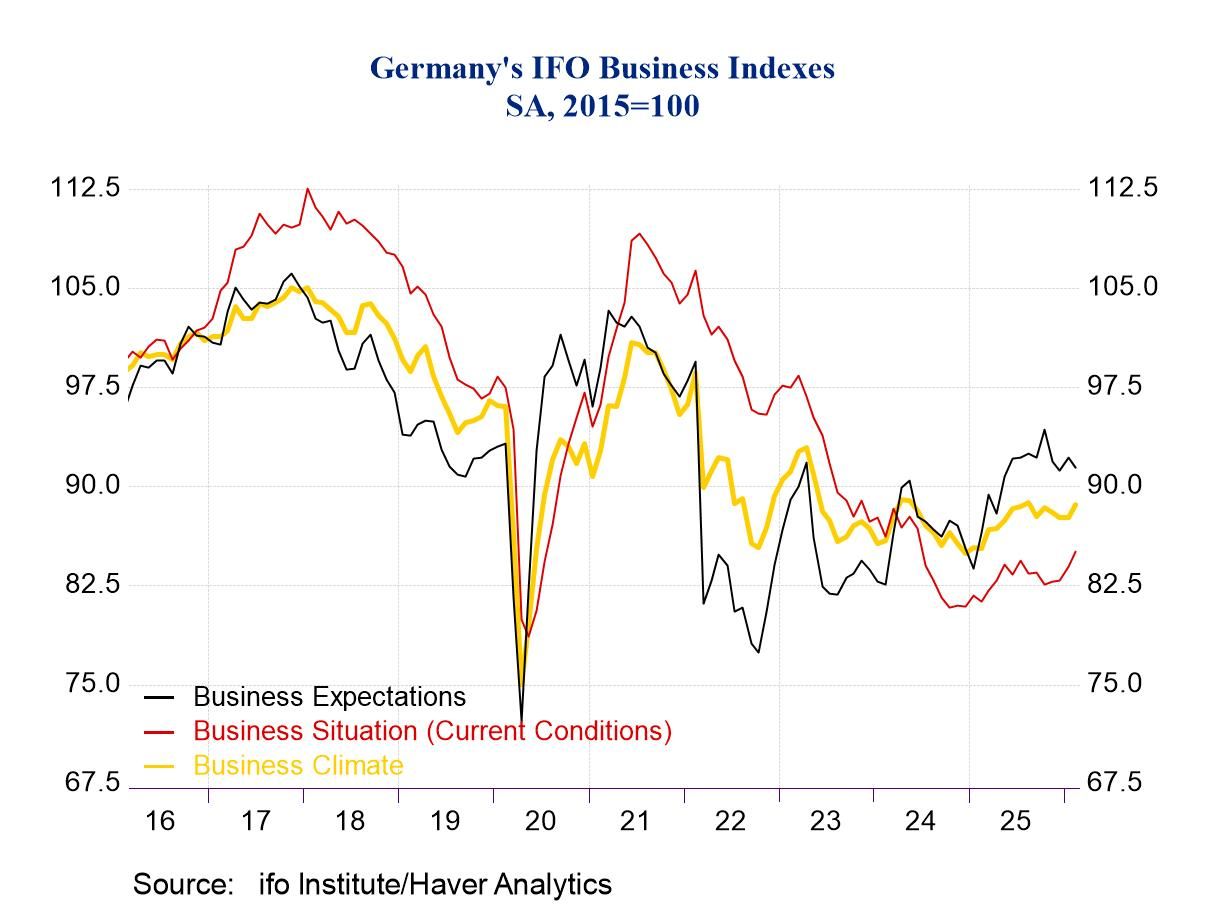

German survey results are less dire Other indicators of German industrial activity generally show improved monthly results. All four of the metrics in the table show improved survey values in January compared to December, but December had showed weakness relative to November across the board for those 4 metrics. The message from progressive averages in the table, from these other indicators, is that not much has changed that would allow us to discriminate strongly among activity performances reported over 12 months, six months, or three months. In the end, the three-month values are generally slightly stronger than the 12-month values, but not in a way that looks significant, and even that result does not hold for the ZEW current index.

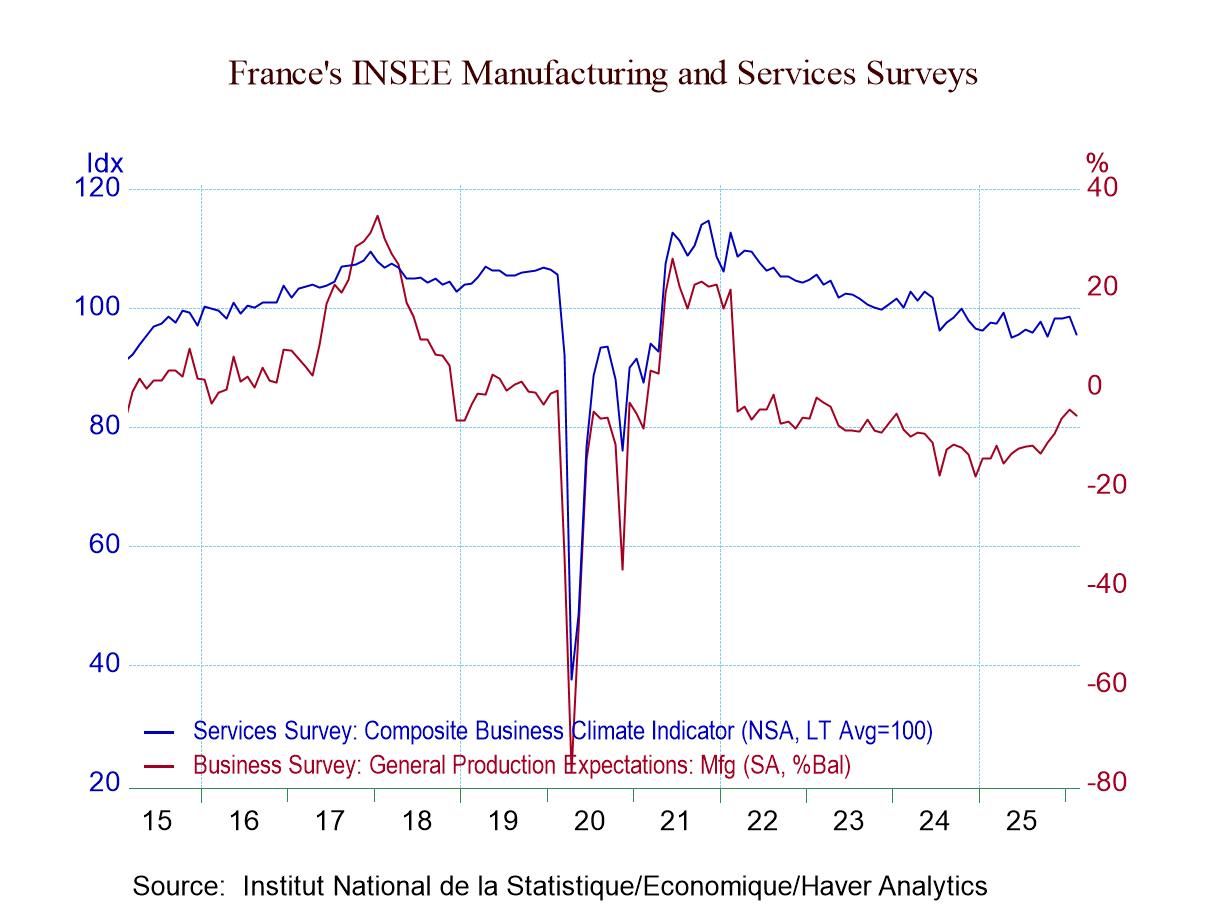

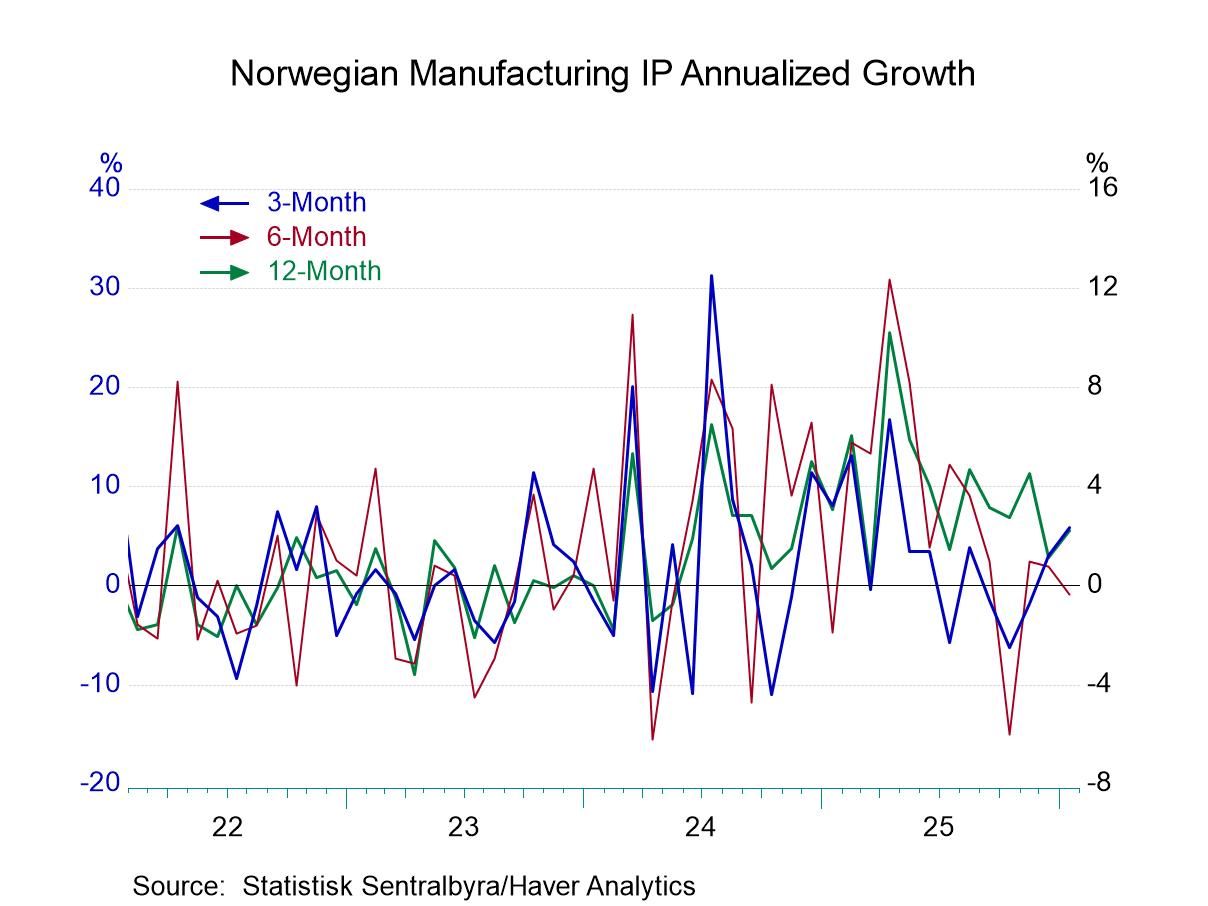

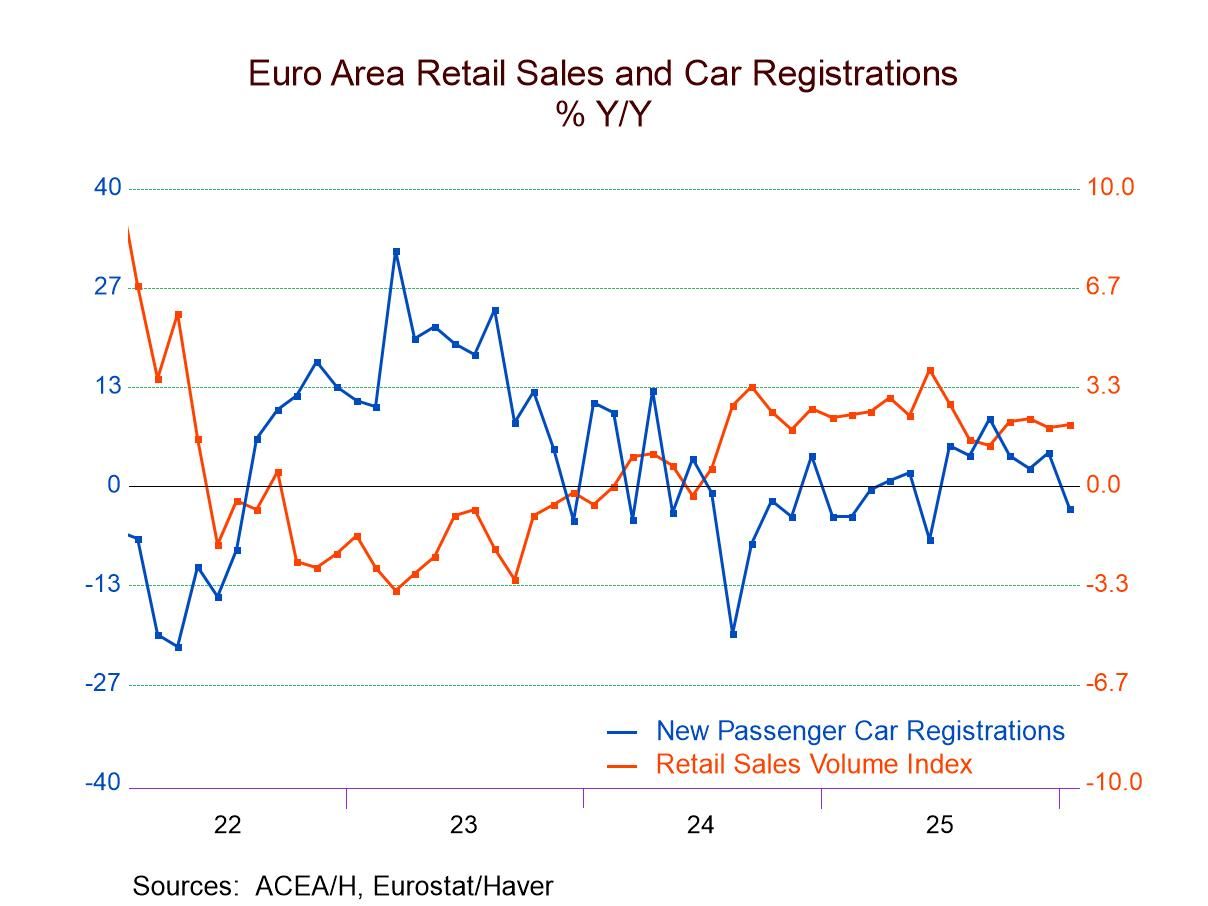

Industrial production in other Europe Industrial production trends for other European reporters show declines in output in January of a fairly substantial magnitude in Spain and in Ireland, against strong increases in Portugal, Sweden, and Norway, and the more modest increase in France. IP in January shows cross-currents and a good deal of extremism in other Europe. The progressive trends for manufacturing production show Spanish and Irish trends deteriorating sharply from 12-months to six-months to three-months France and Portugal report uneven results that do not clarify what the underlying trend is doing. However, in northern Europe, Sweden and Norway are showing sharply accelerating growth from 12-months to six-months to three-months.

Quarter-to-Date (as of January) In the quarter to date, German manufacturing output is falling overall and for all its major components. German real manufacturing orders are falling at a 30.3% annual rate in the quarter to date, which is a nascent statistic since only January data are available now. The other industrial indicators show positive trends for most measures, with the IFO manufacturing expectation being the exception, as it weakens. Industrial production for other Europe shows sharp quarter-to-date declines in Spain and Ireland, with extremely strong quarter-to-date results in Sweden and Norway; there is strong performance from Portugal and a solid increase from France.

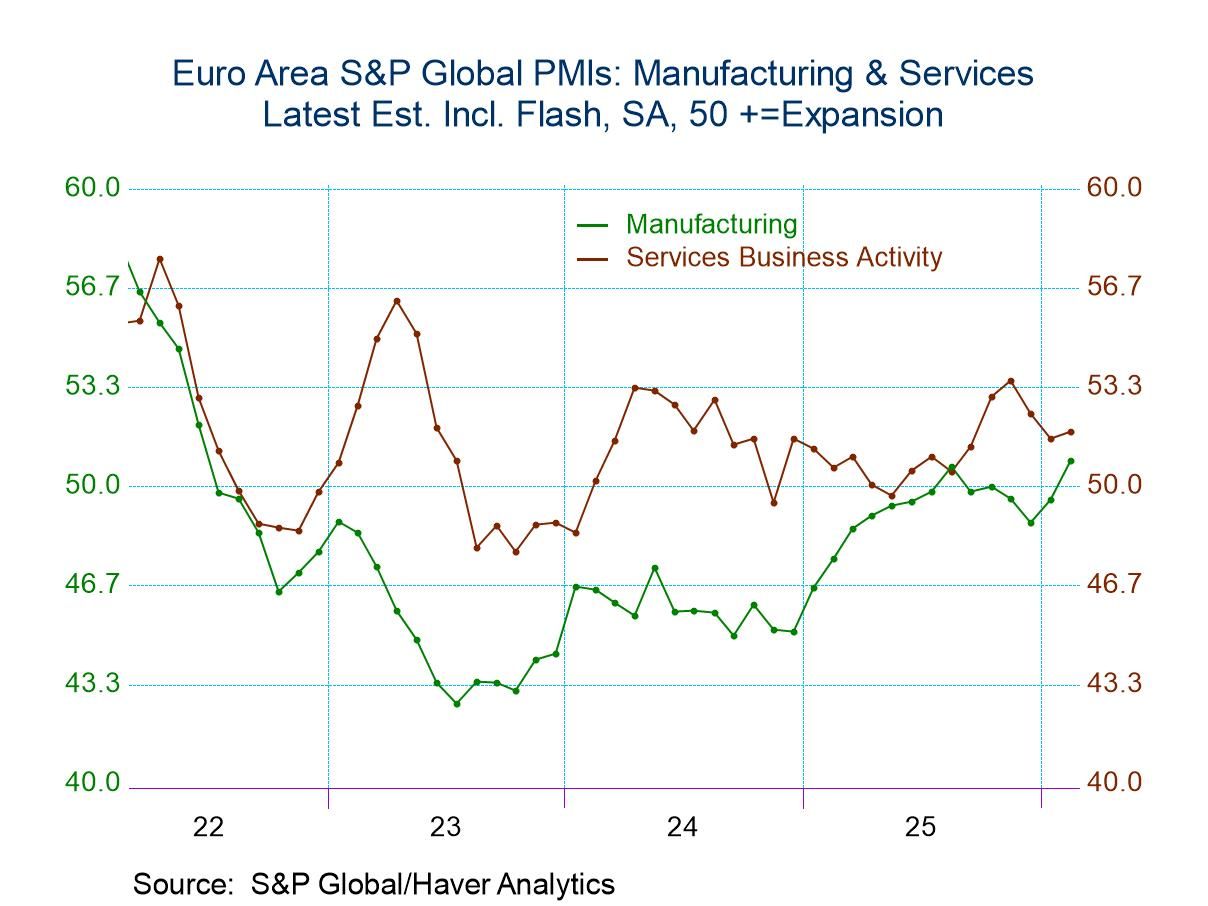

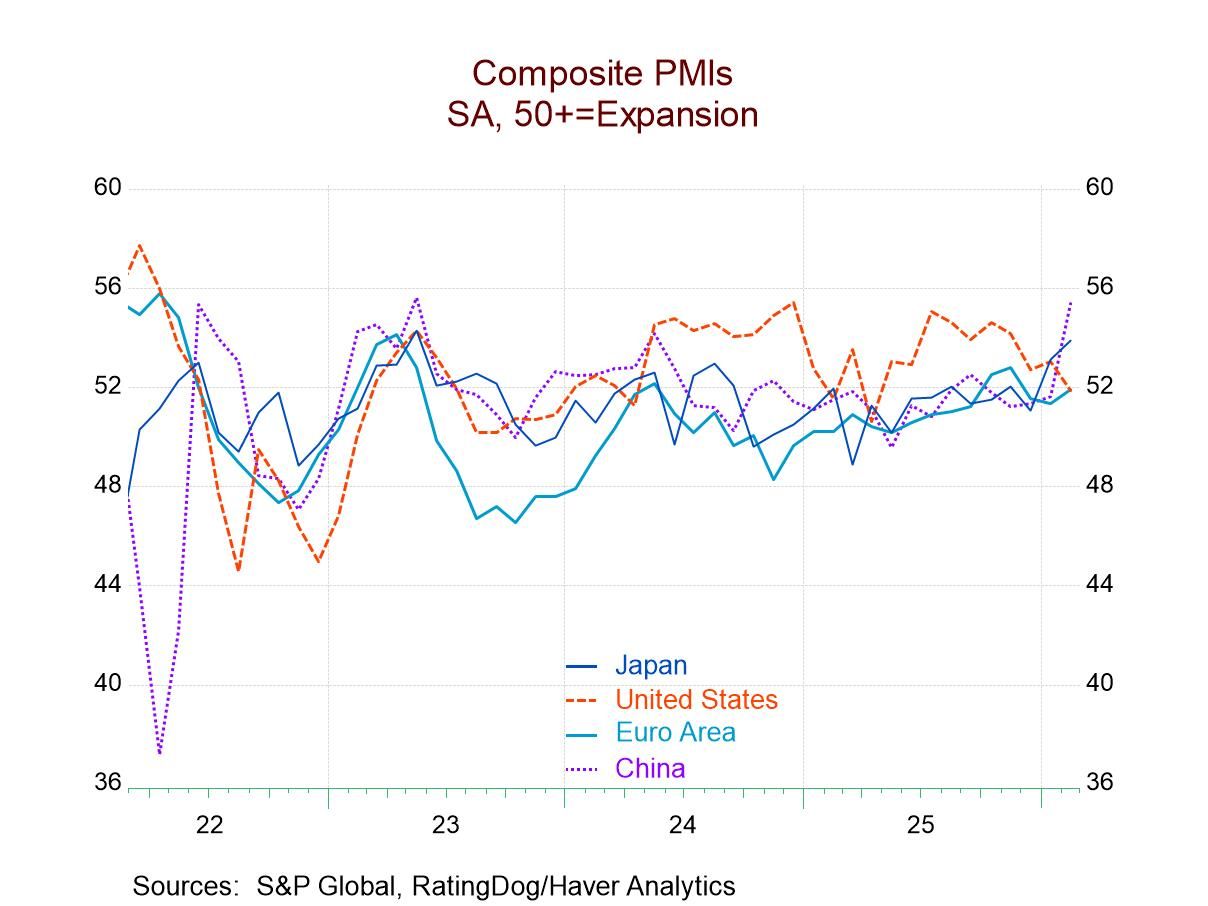

Global

Global