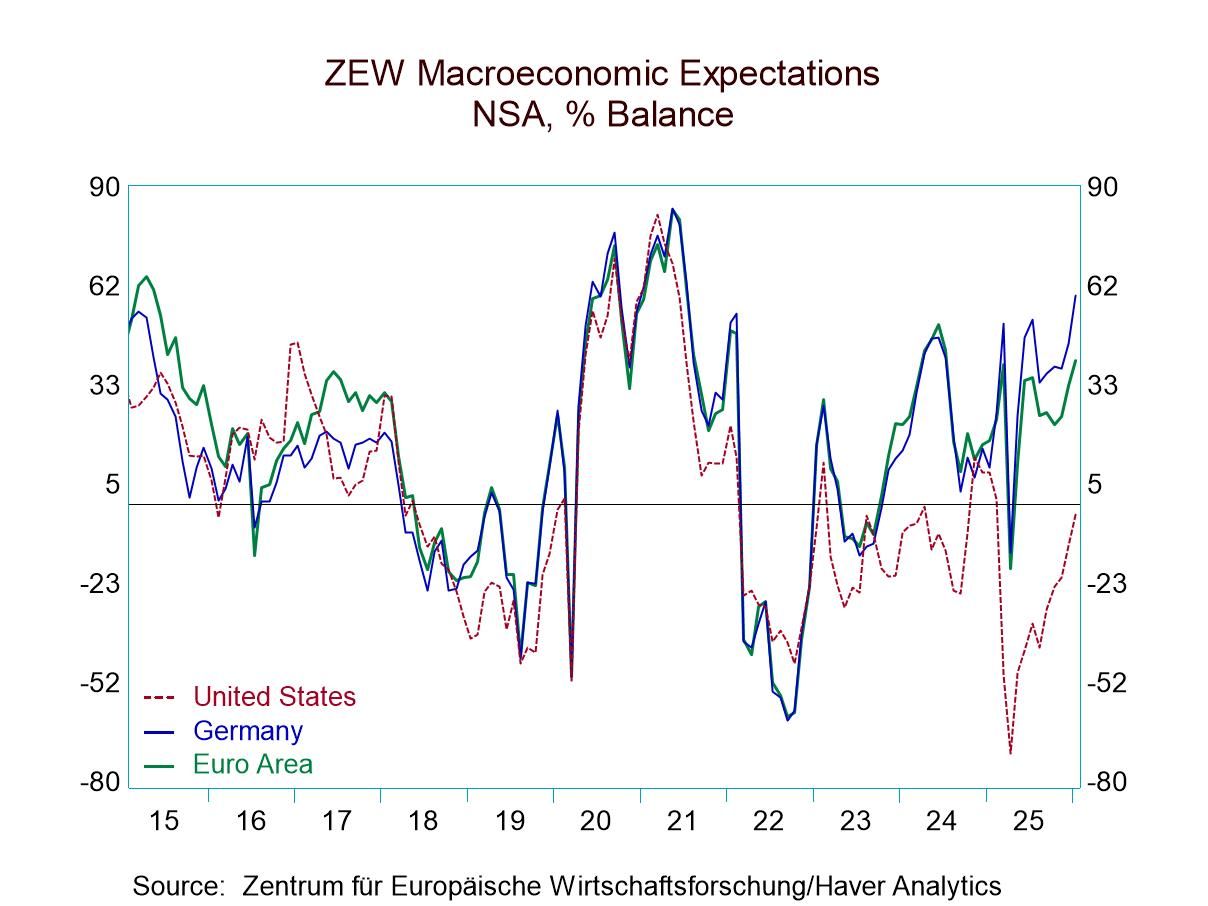

The ZEW survey for January showed improvement all around with both economic expectations and macroeconomic conditions showing improvements in the United States, Germany, and the euro area.

The economic situation in January in the euro area improved to a reading of -18.1 from -28.5 in December. In Germany, the reading improved to -72.7 from -81 in December, while in the United States the reading improved to +17.7 from -0.6 in December. The message here clearly is the month-to-month improvement. Still, the January readings leave the assessments of conditions in these three areas as quite different. The percentile-queue standings place each one of these topical readings in their queue of data back to December 1992, expressing the standing in percentile terms. Viewed in this way, the euro area has a 57.2 percentile standing, the U.S. has nearly a 45-percentile standing, while Germany has a 22.6 percentile standing, leaving each of these areas in their own distinctive positions relative to their historic norms. The euro area has a firm and above-median ranking since the reading is above the 50th percentile (where the median is located). The U.S. is slightly weaker than that, with a reading that's marginally below its median. Germany has a reading between the lower quartile and the one-fifth mark of its historic data, branding it as weak.

Macroeconomic expectations find that Germany in January moved up to a positive reading of 59.6 from 45.8 in December. The U.S. also improved, moving up to -3 from -12 in December. The macro-expectations find Germany and the U.S. in very different places with German expectations in an 80.4 percentile of their queue, placing them in the top 20% while the U.S. has a 45-percentile standing, below its historic median and essentially the same relative position as its current situation ranking. In contrast, Germany has a weak current economic assessment versus a stronger expectations assessment.

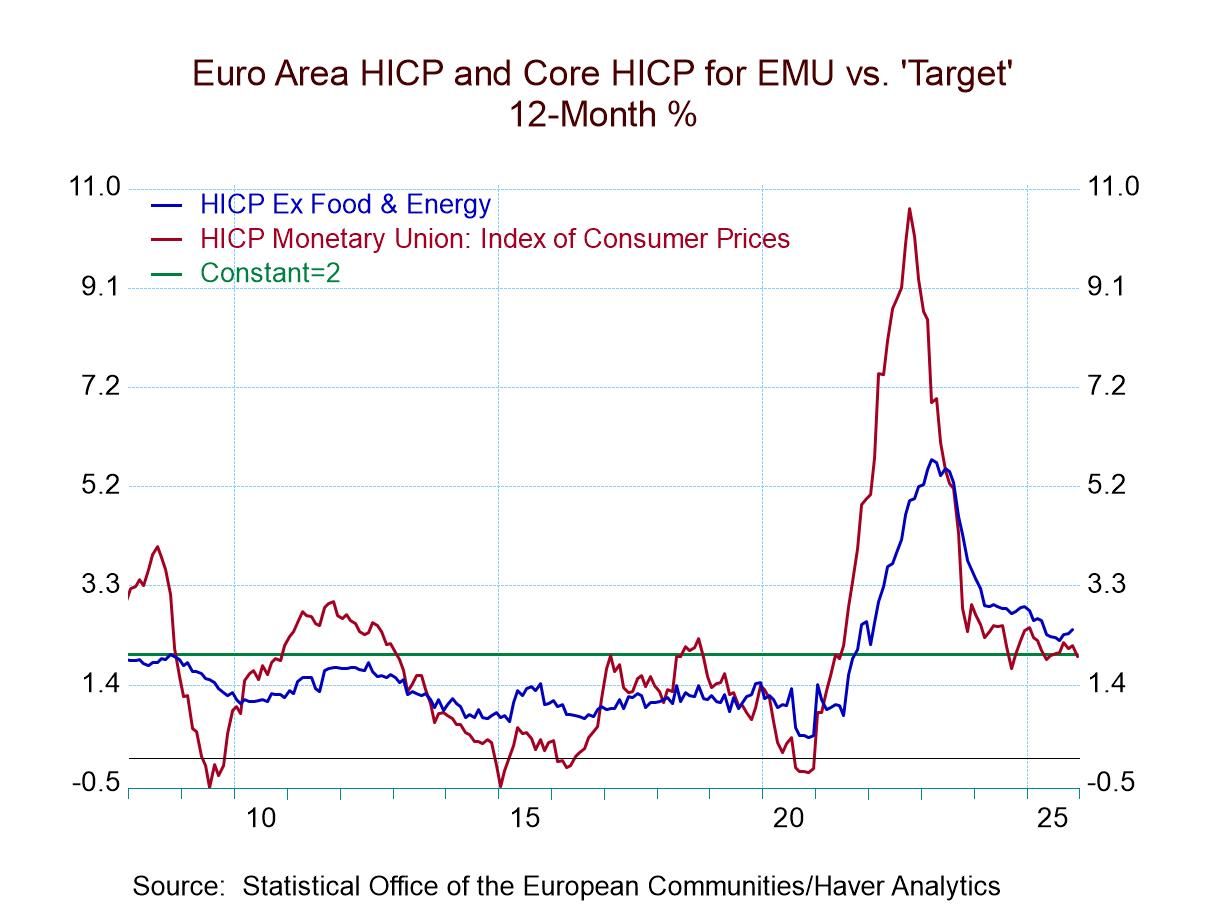

Inflation expectations weaken across the board in January, with the euro area falling to -7.6 from -4.6 in December, Germany falling to -6.0 from -1.7 and the U.S. falling to 44.2 from 54.9. The ZEW experts see a disinflationary environment, and they see that despite the pickup in current conditions and improved macroeconomic expectations. Expectations in the U.S. have a 61.1 percentile standing; the German and the euro area readings are much weaker and closer together, with the German standing at its 31.2 percentile and the euro area at its 25.8 percentile.

On the back of these expectations, short-term interest rates in the euro area are less weak, with the January reading at -7.7, up from -10.8 in December. The U.S. has a -65.6 reading, stronger than Decembers -73.9. On a ranking basis, the euro area’s short-term rates have a 37.4 percentile standing The U.S. has a 9.3 percentile standing. The interest rate assessment is that short-term rates are going to be modest to lower over the outlook.

Long-term interest rates in Germany and the U.S. weaken slightly in January from December to 44.5 in January for Germany, compared to 49.2 in December, and in the U.S., there is a very modest ‘decimal point’ change to 44.1 in January from 44.9 in December. German long-term rates have a 58.8 percentile standing while the U.S. has rates at about a 50-percentile standing, placing them just about on top of their historic median. Neither one of these expectations has long-term expectations different from historic norms.

Stock market expectations from December to January, however, are little changed and mostly weaker, with the euro area gauge falling to 35.2 from 41.3 in December. The German gauge slips to 35.9 from 36.3 in December. The January gauge for the U.S. is ticking slightly higher to 31.5 January from 30.2 in December. The rankings for the January gauges show the U.S. above its median at a 59.3 percentile mark, the euro area slightly below its median with a 44.9 percentile reading; the German stock market still scores as the weakest at a 39.7 percentile standing.

Global

Global