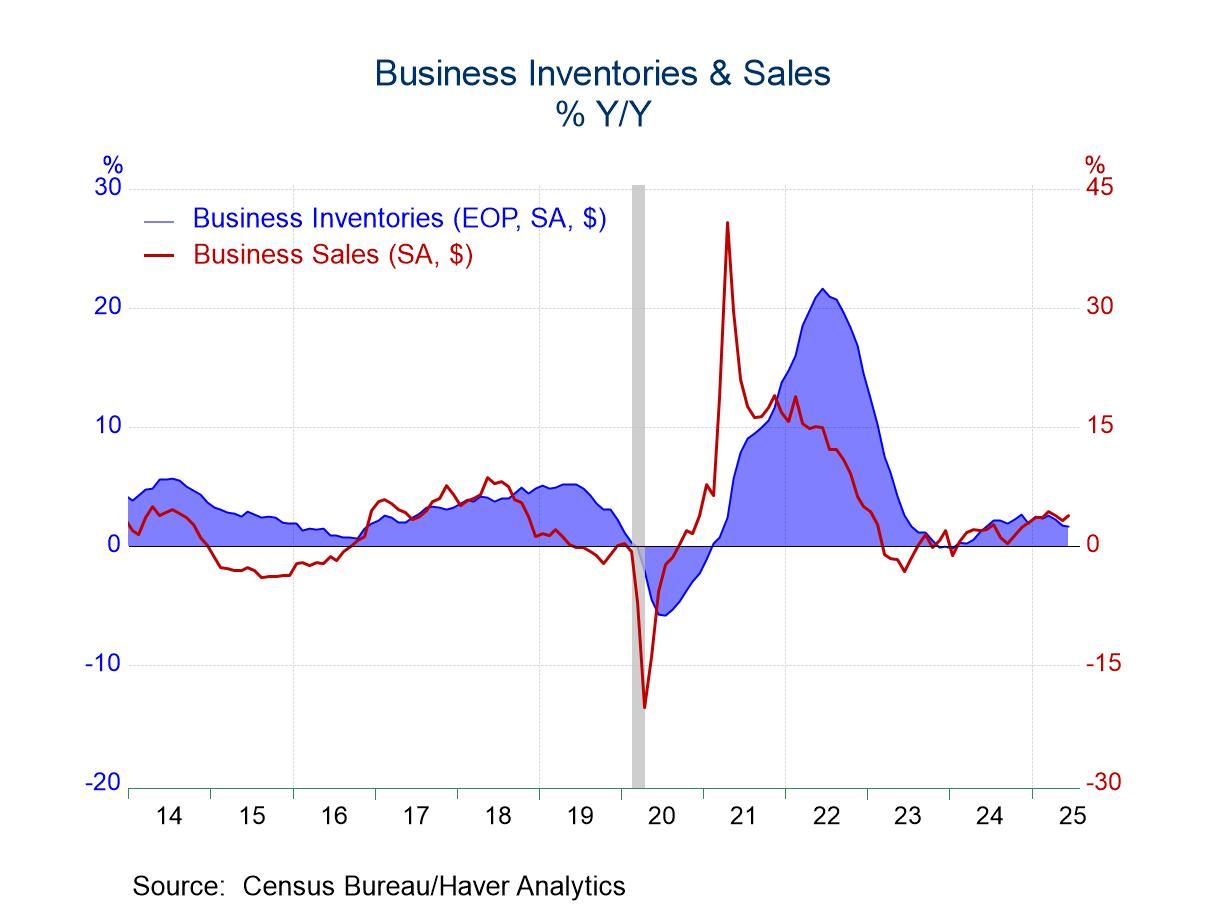

- Inventory increase is first in three months & spread across sectors.

- Sales rise is led by retailers.

- I/S ratios are little changed.

Introducing

Tom Moeller

in:Our Authors

Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

Publications by Tom Moeller

by:Tom Moeller

|in:Economy in Brief

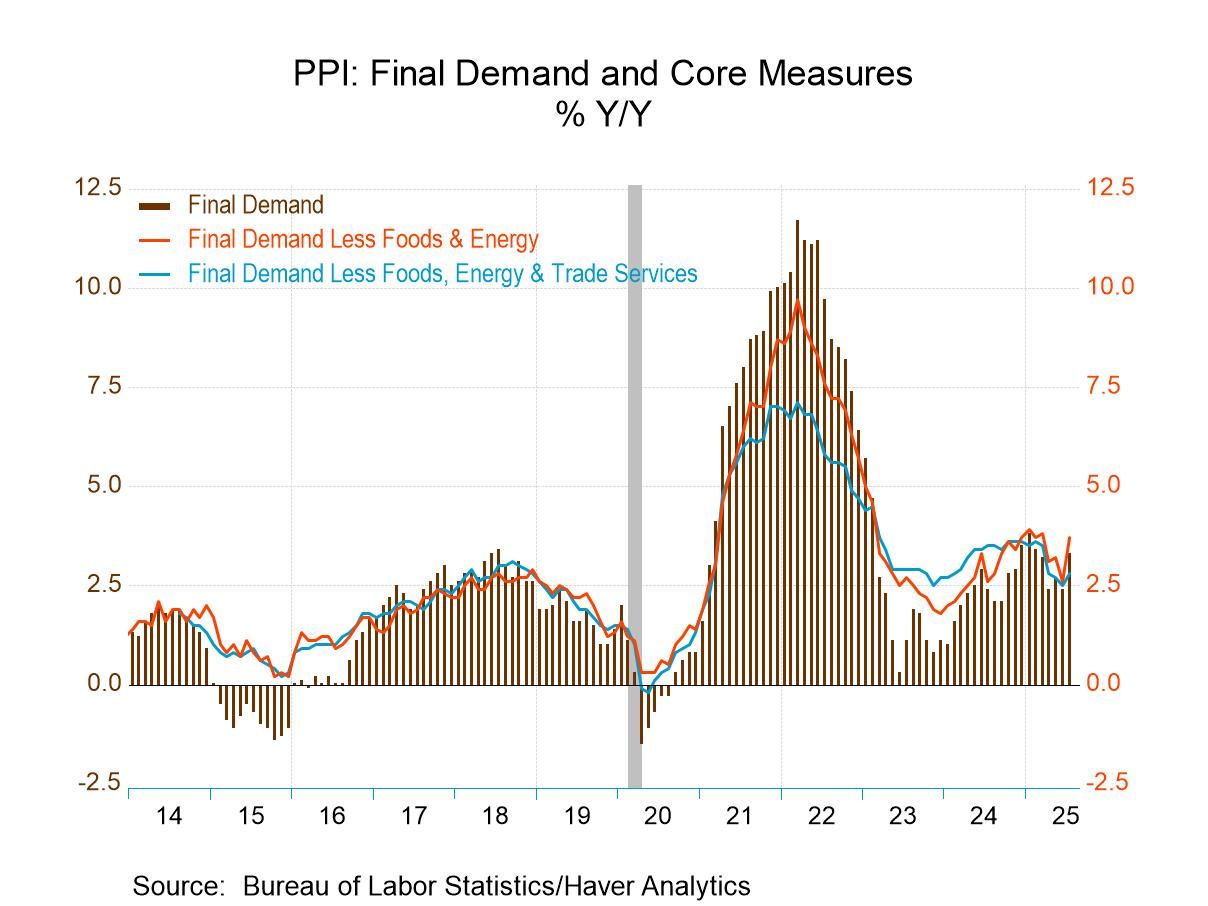

- Core index posts unexpected gain.

- Trade service prices move markedly higher.

- Food & energy price inflation also accelerates.

by:Tom Moeller

|in:Economy in Brief

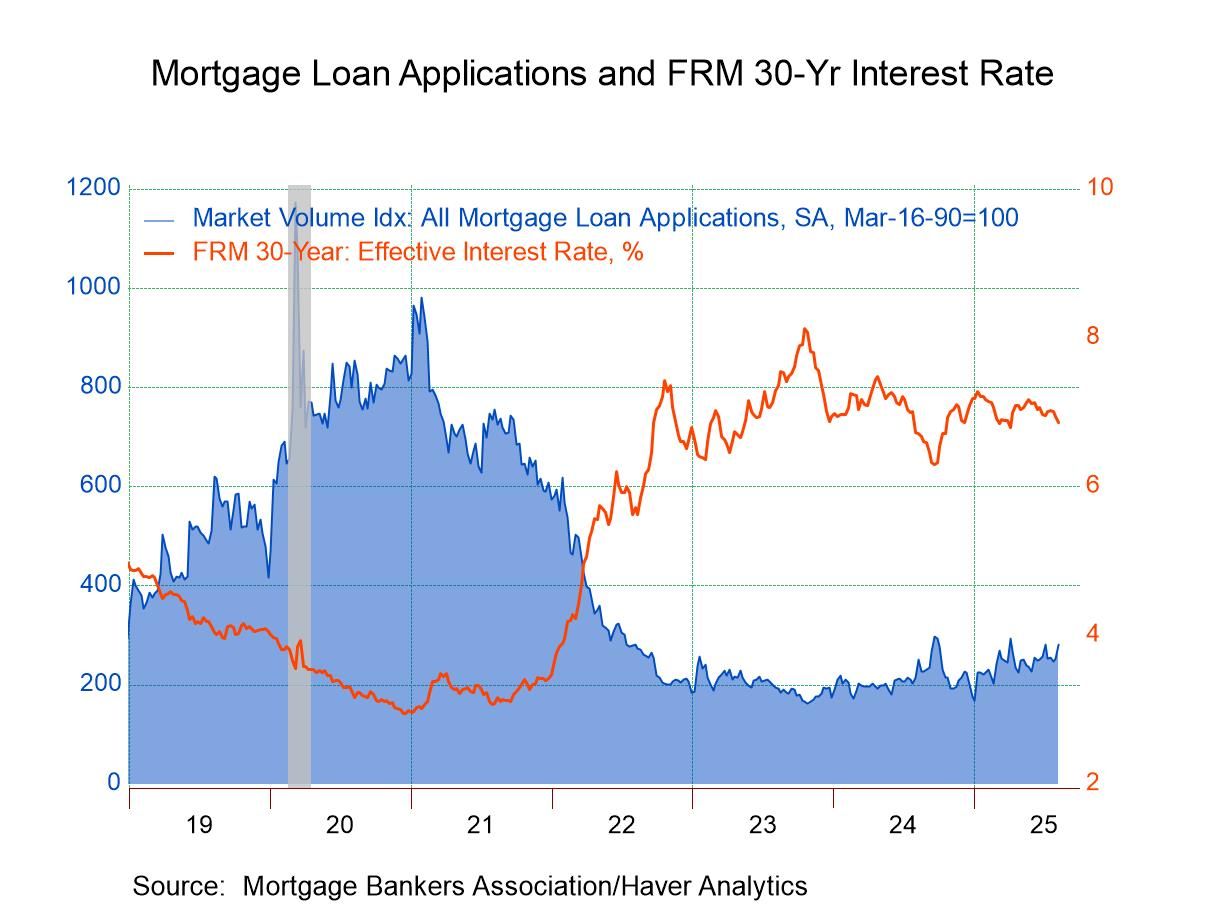

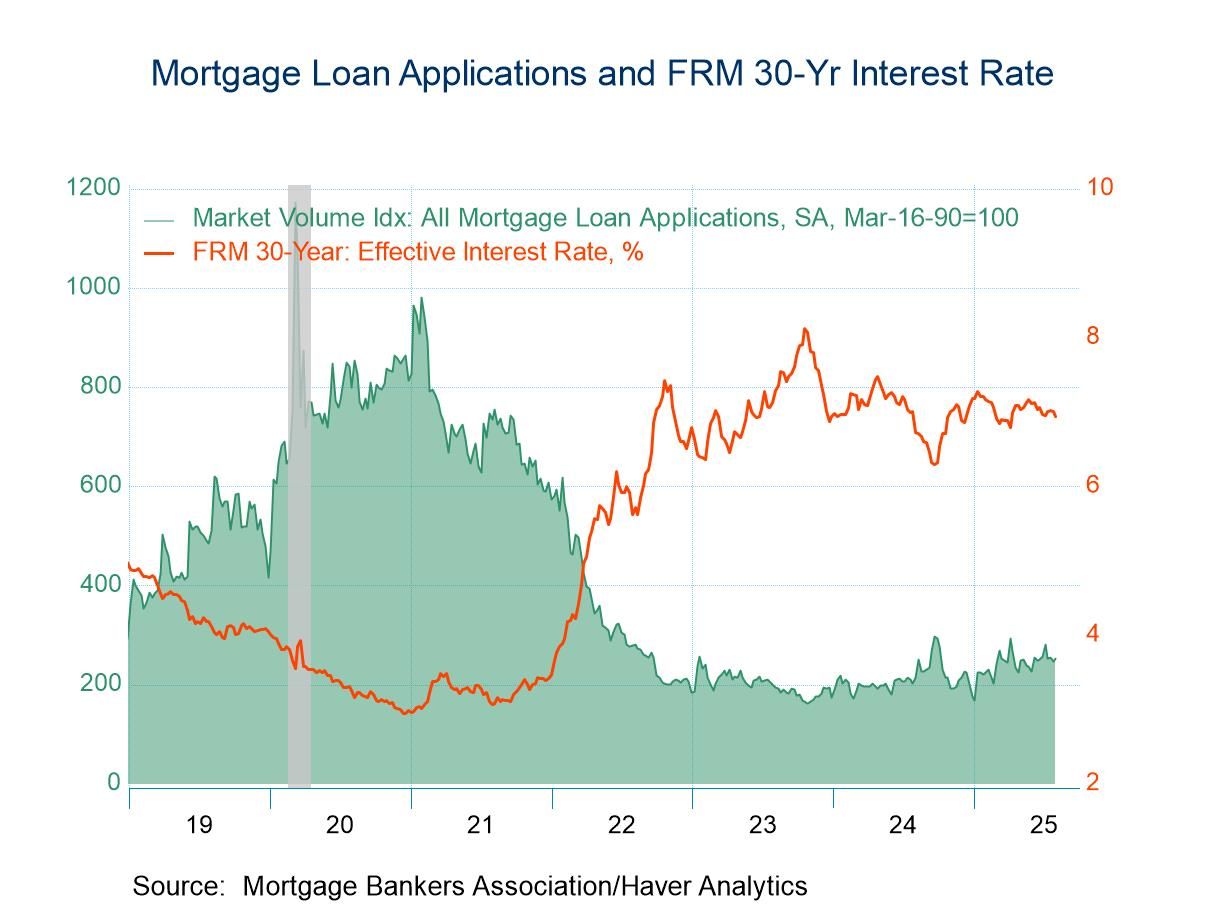

- Loan refinancing continues to strengthen as purchase applications rise slightly.

- Effective fixed-interest rate on 30-year loans falls to four-month low.

- Average loan size continues to increase.

by:Tom Moeller

|in:Economy in Brief

- USA| Aug 12 2025

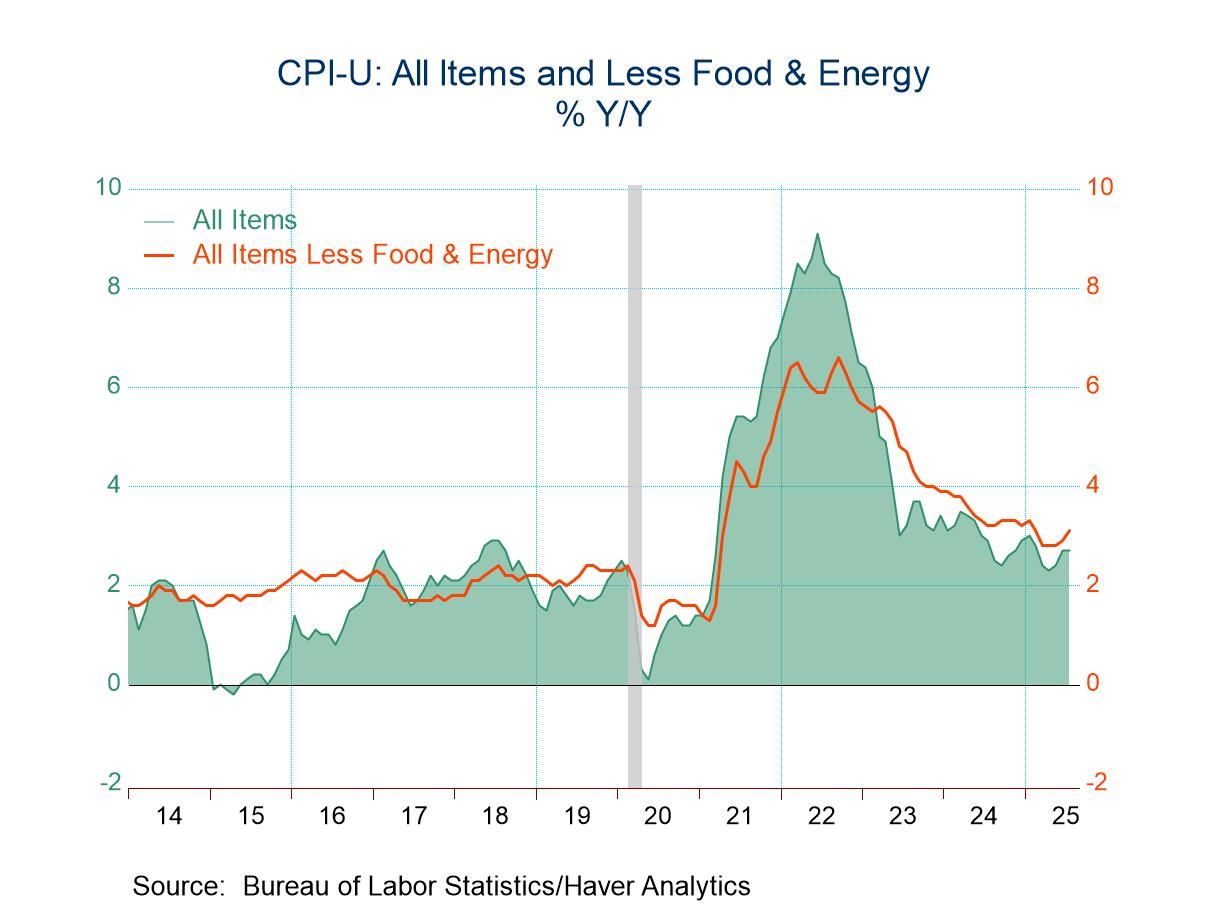

U.S. Consumer Price Inflation Eases in July

- Decline in energy & stable food prices reduce overall strength.

- Core inflation picks up with tariff effects.

- Core goods prices strengthen but core services inflation steadies.

by:Tom Moeller

|in:Economy in Brief

- USA| Aug 12 2025

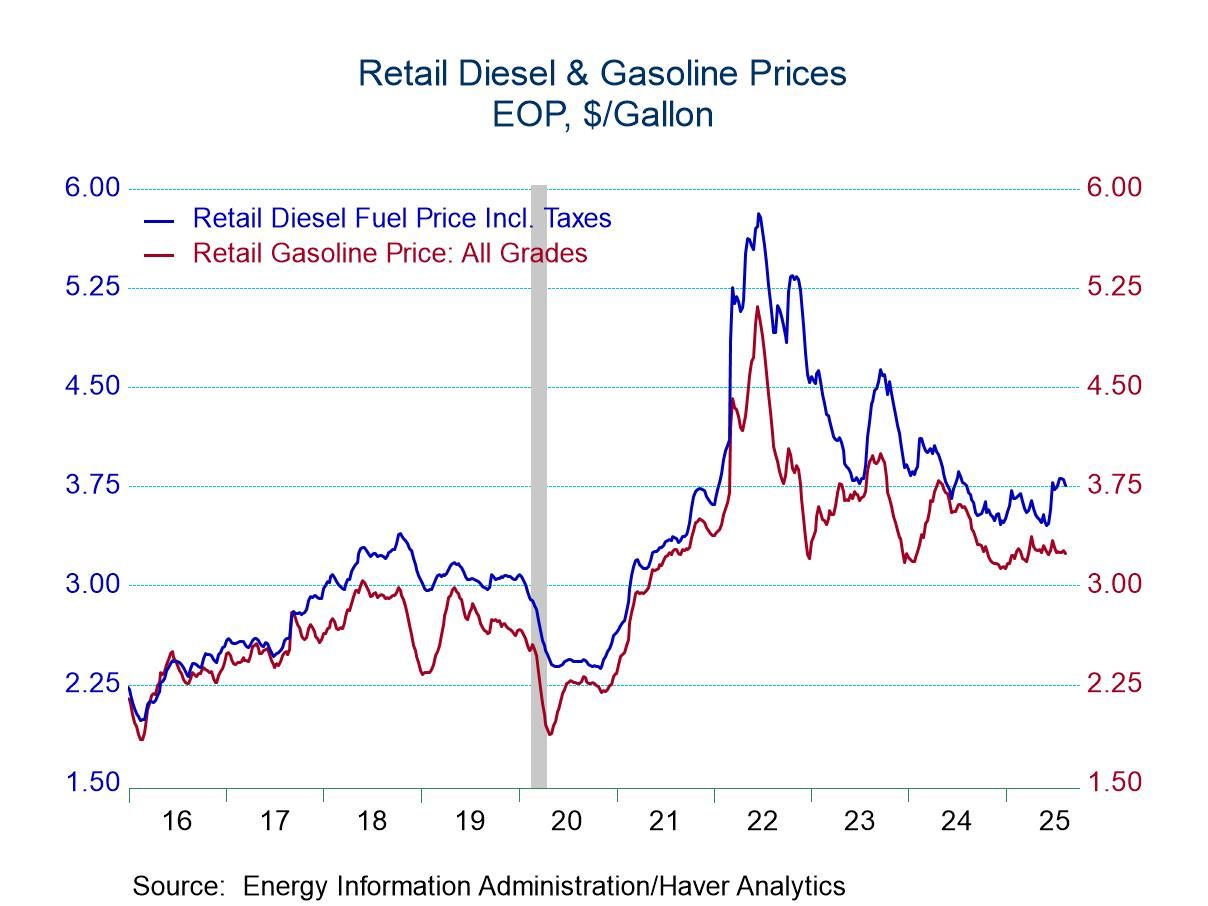

U.S. Energy Prices Fall in Latest Week

- Gasoline prices weaken.

- Crude oil prices decline sharply.

- Natural gas prices ease.

by:Tom Moeller

|in:Economy in Brief

- USA| Aug 11 2025

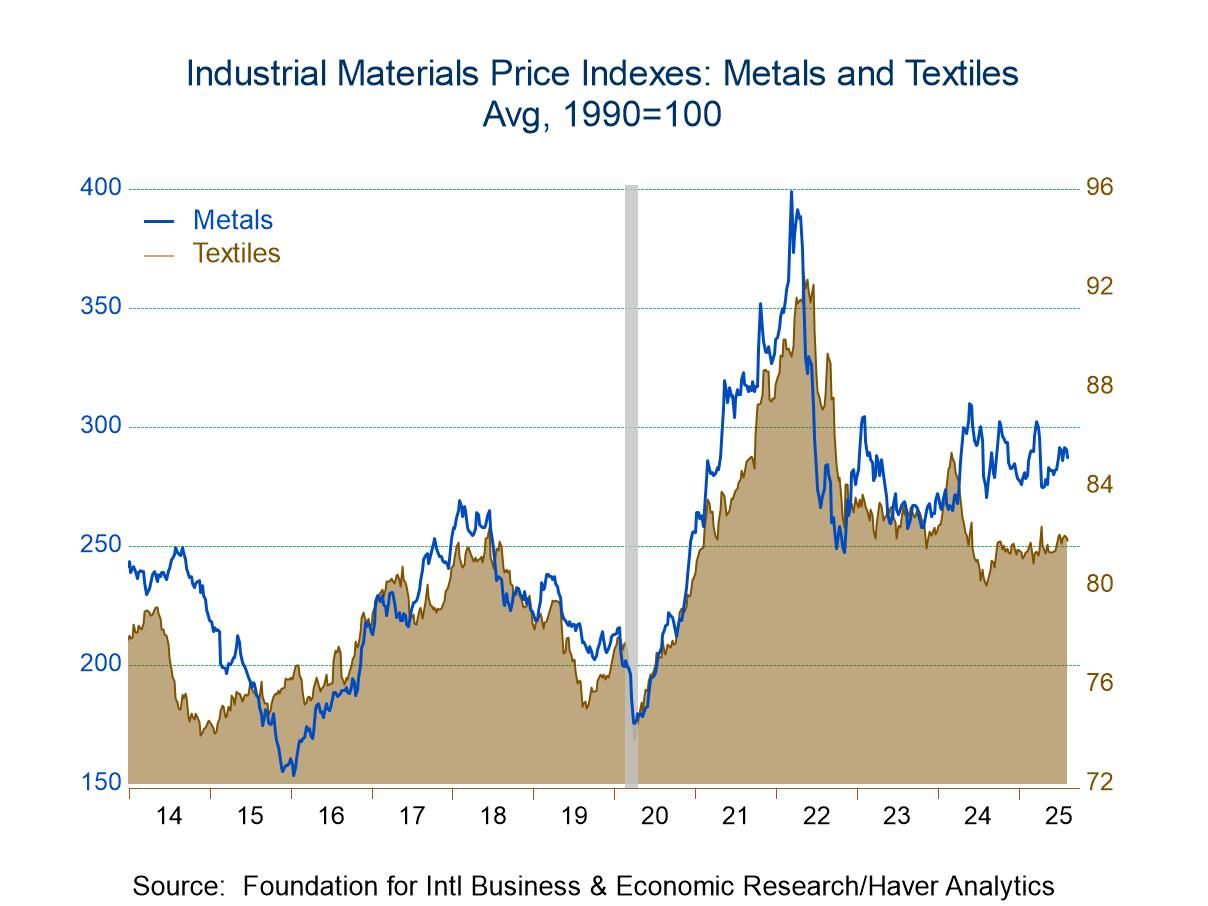

FIBER: Industrial Commodity Prices Retreat in Latest Four Weeks

- Decline is first in three months.

- Crude oil and metals prices move lower.

- Lumber prices improve while textile costs steady.

by:Tom Moeller

|in:Economy in Brief

- USA| Aug 08 2025

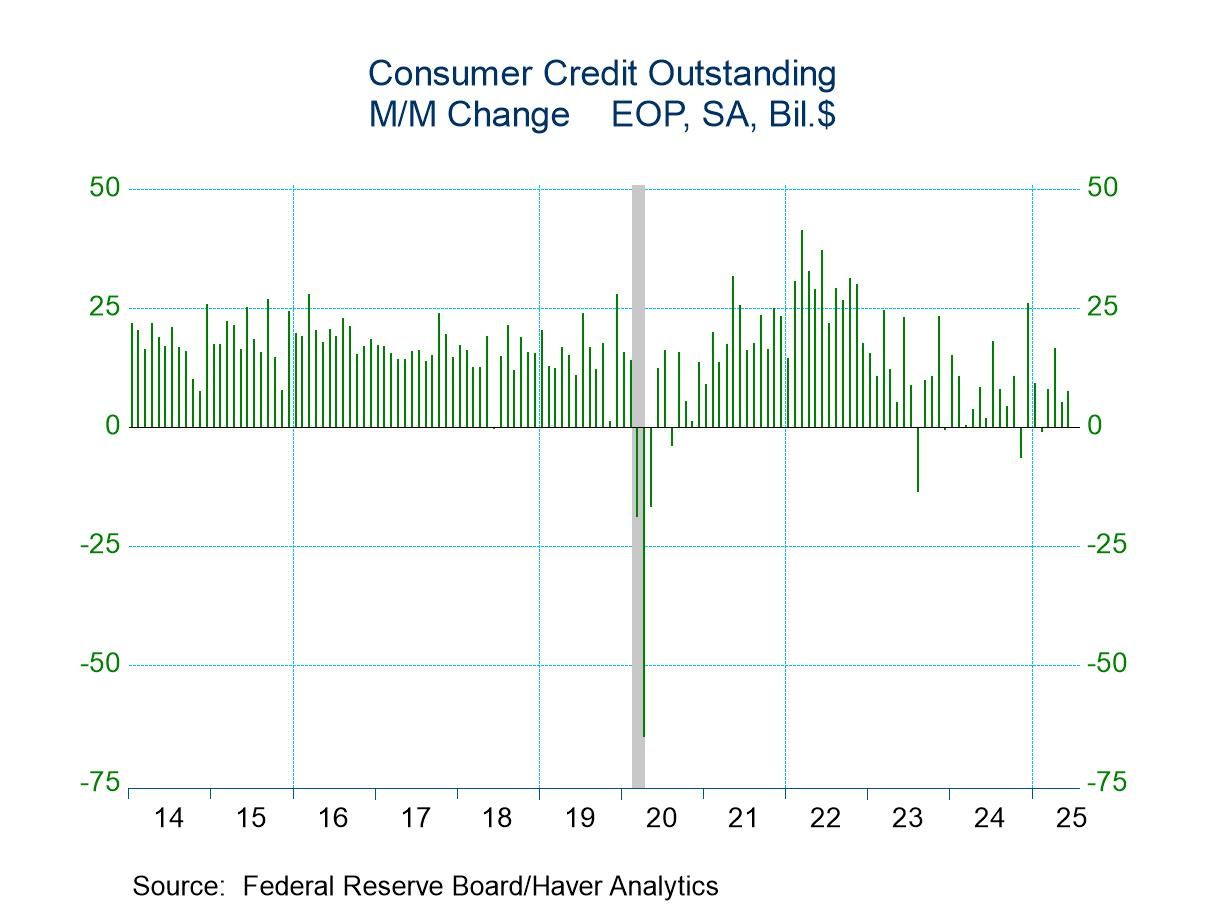

U.S. Consumer Credit Picks Up in June

- Moderate increases in last two months follow strong April gain.

- Nonrevolving credit usage strengthens as revolving credit eases.

by:Tom Moeller

|in:Economy in Brief

- USA| Aug 07 2025

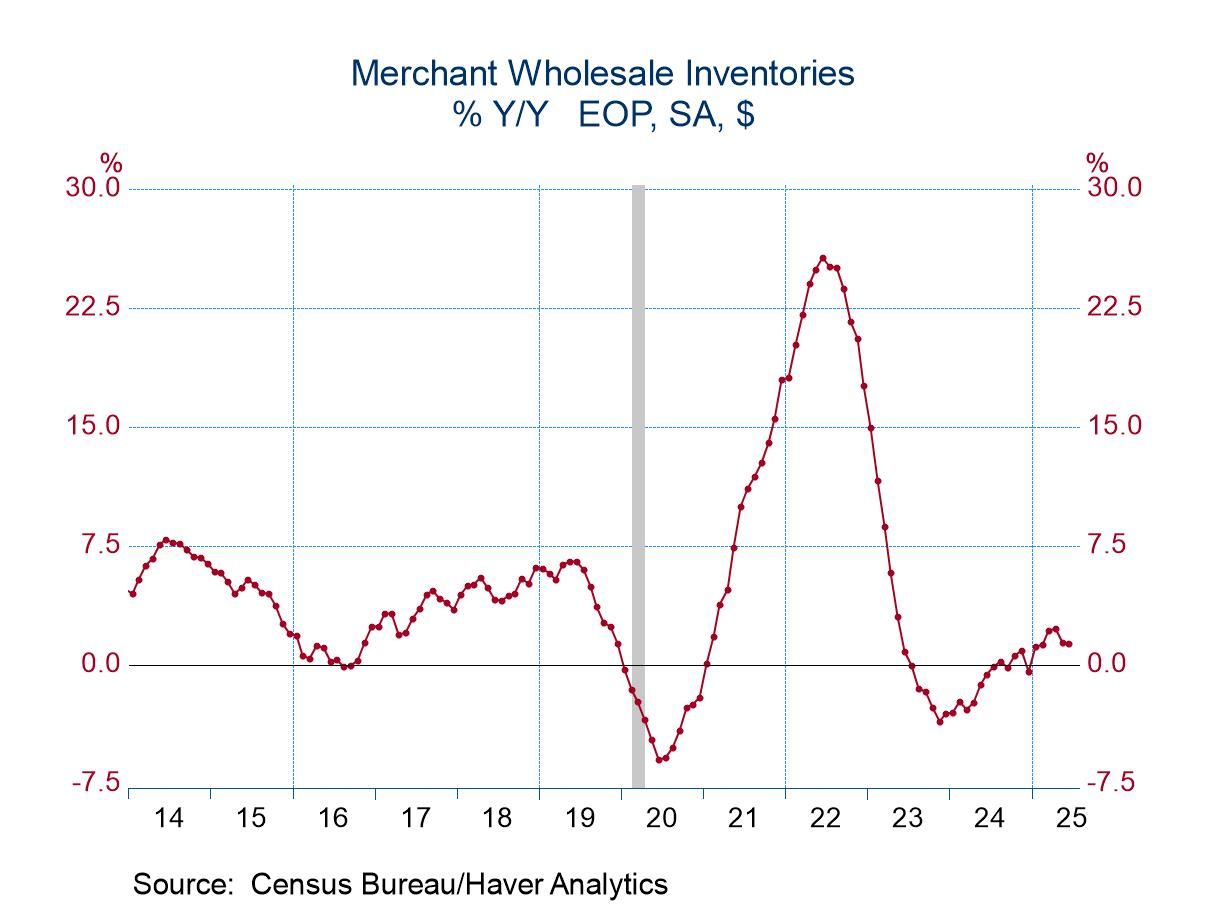

U.S. Wholesale Inventories Edge Higher in June

- Slight inventory gain masks divergent industry patterns.

- Sales increase is first since March.

- I/S ratio steadies at three-year low.

by:Tom Moeller

|in:Economy in Brief

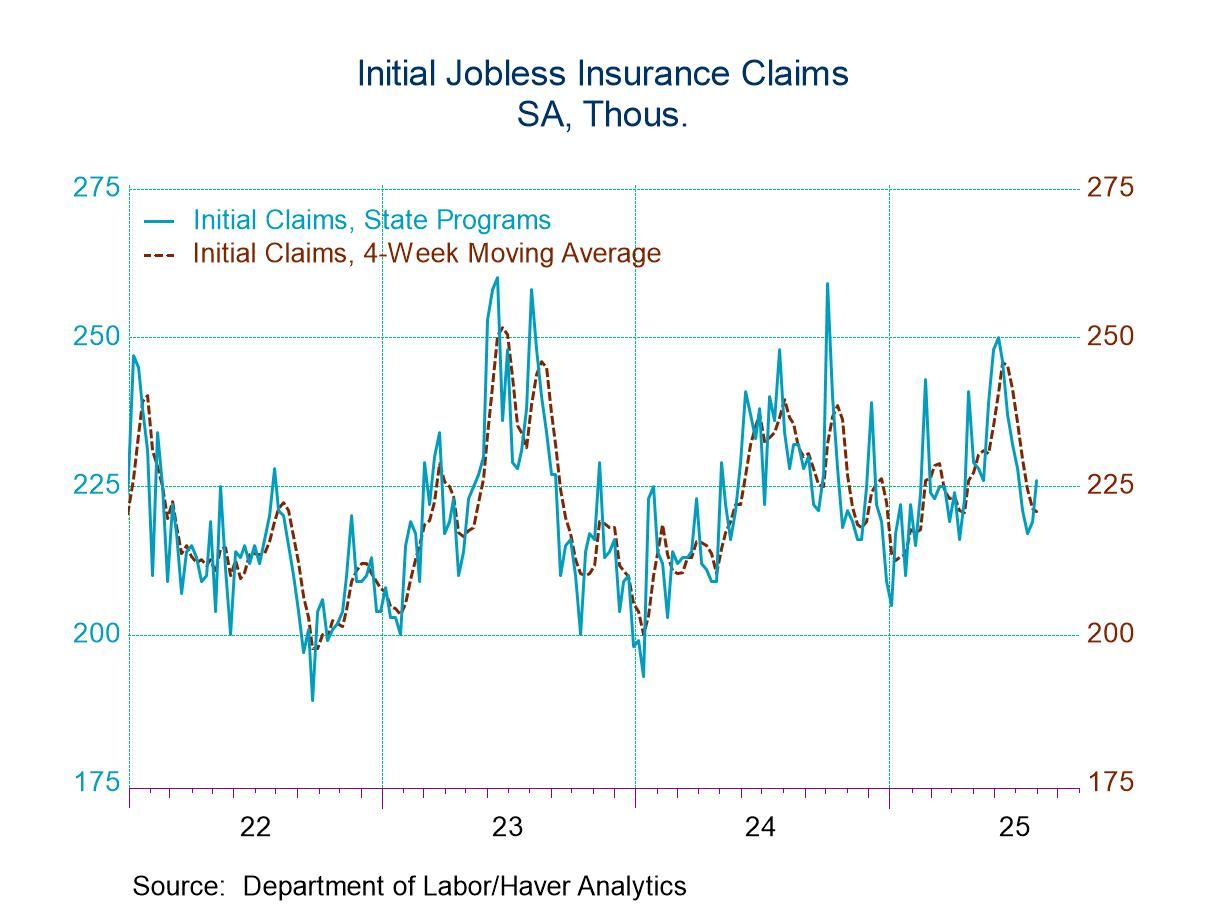

- Initial claims increase to highest in four weeks.

- Continuing claims continue upward trend.

- Insured unemployment rate holds steady.

by:Tom Moeller

|in:Economy in Brief

- USA| Aug 06 2025

U.S. Mortgage Applications Rise Last Week as Interest Rates Slip

- Loan refinancing jumps as purchase applications edge higher.

- Effective fixed-interest rate eases on 30-year loans.

- Average loan size increases again.

by:Tom Moeller

|in:Economy in Brief

- USA| Aug 05 2025

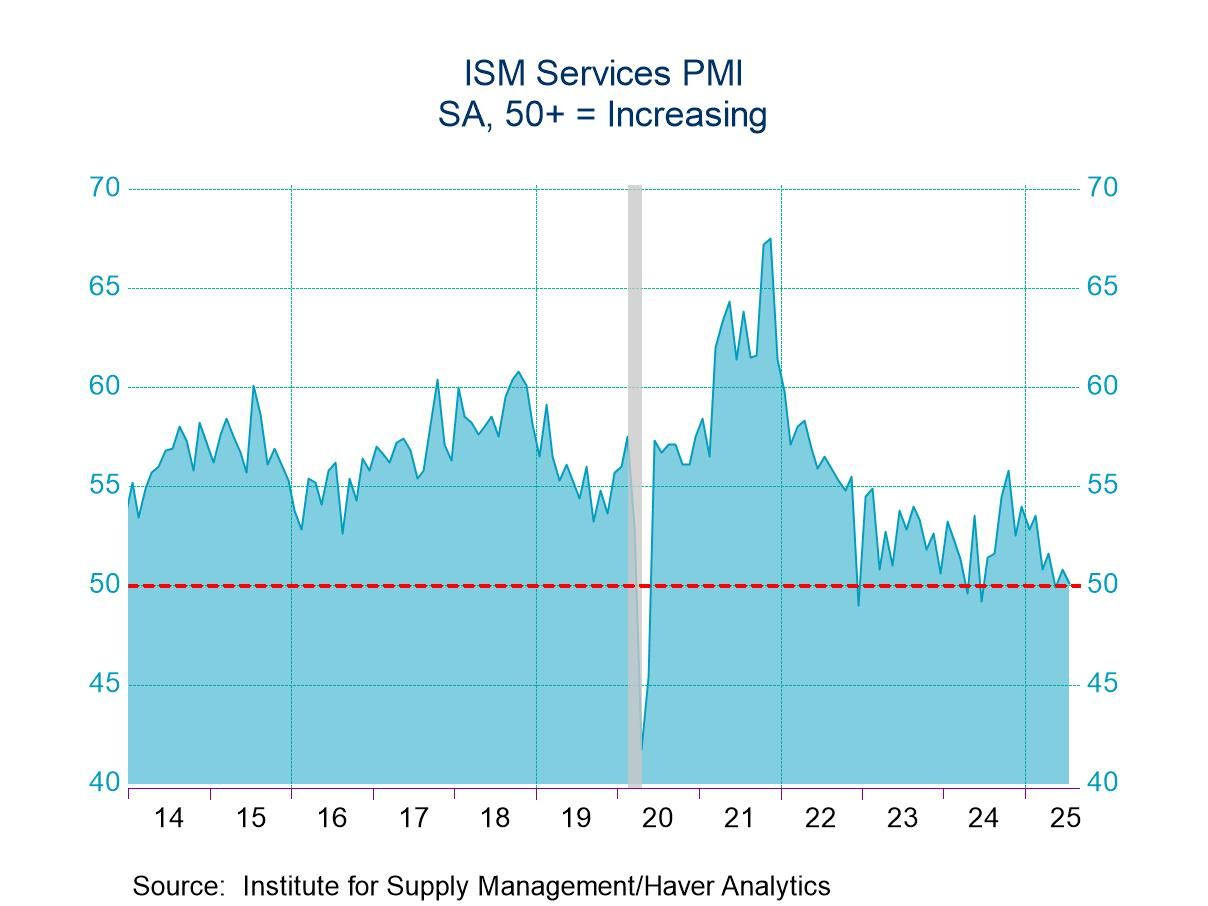

U.S. ISM Services PMI Declines in July; Price Index Increases

- Total index trending lower for nine months.

- Business activity, new orders & employment weaken.

- Prices Index strengthens to highest level since 2022.

by:Tom Moeller

|in:Economy in Brief

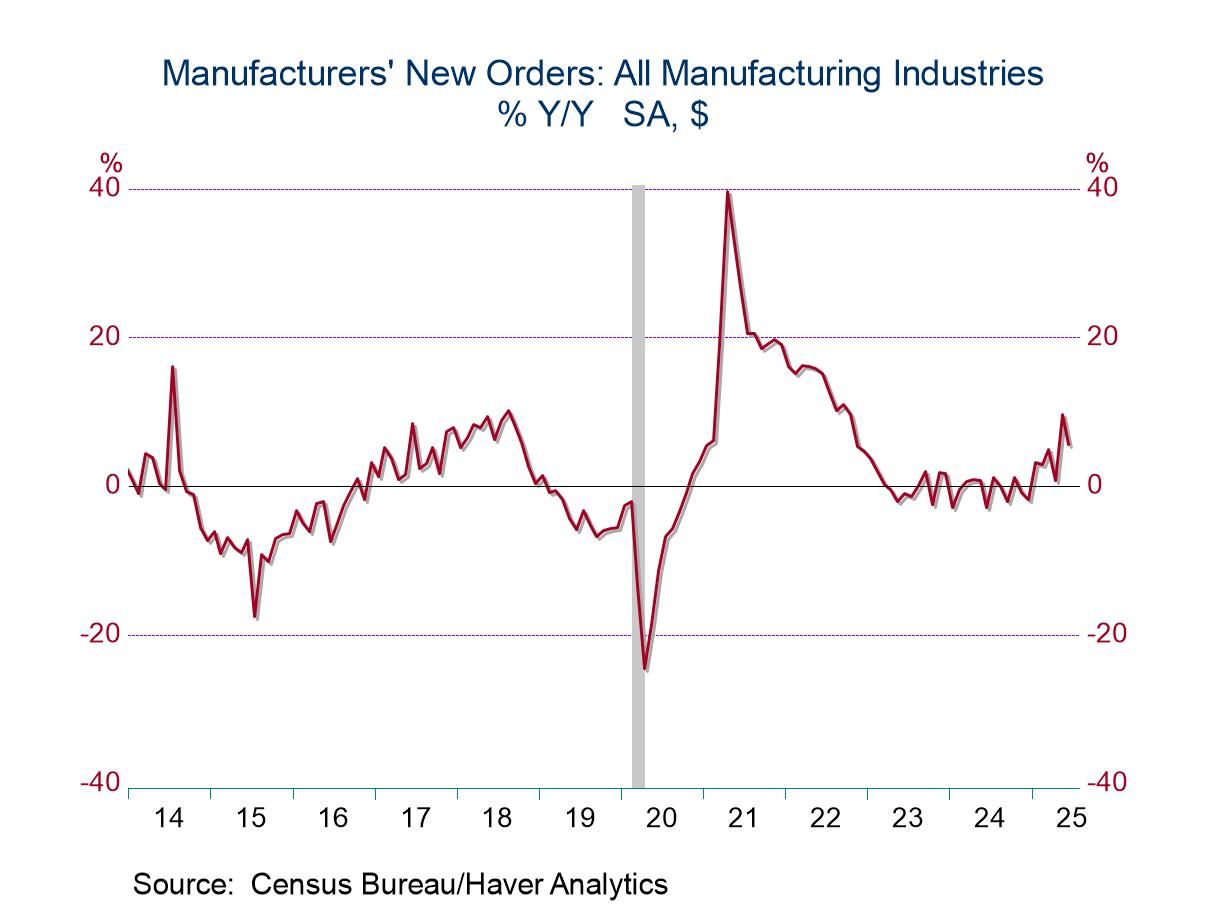

- Total orders less transportation rise moderately.

- Shipments pick up.

- Unfilled orders surge as inventories rise modestly.

by:Tom Moeller

|in:Economy in Brief

- of1081Go to 10 page