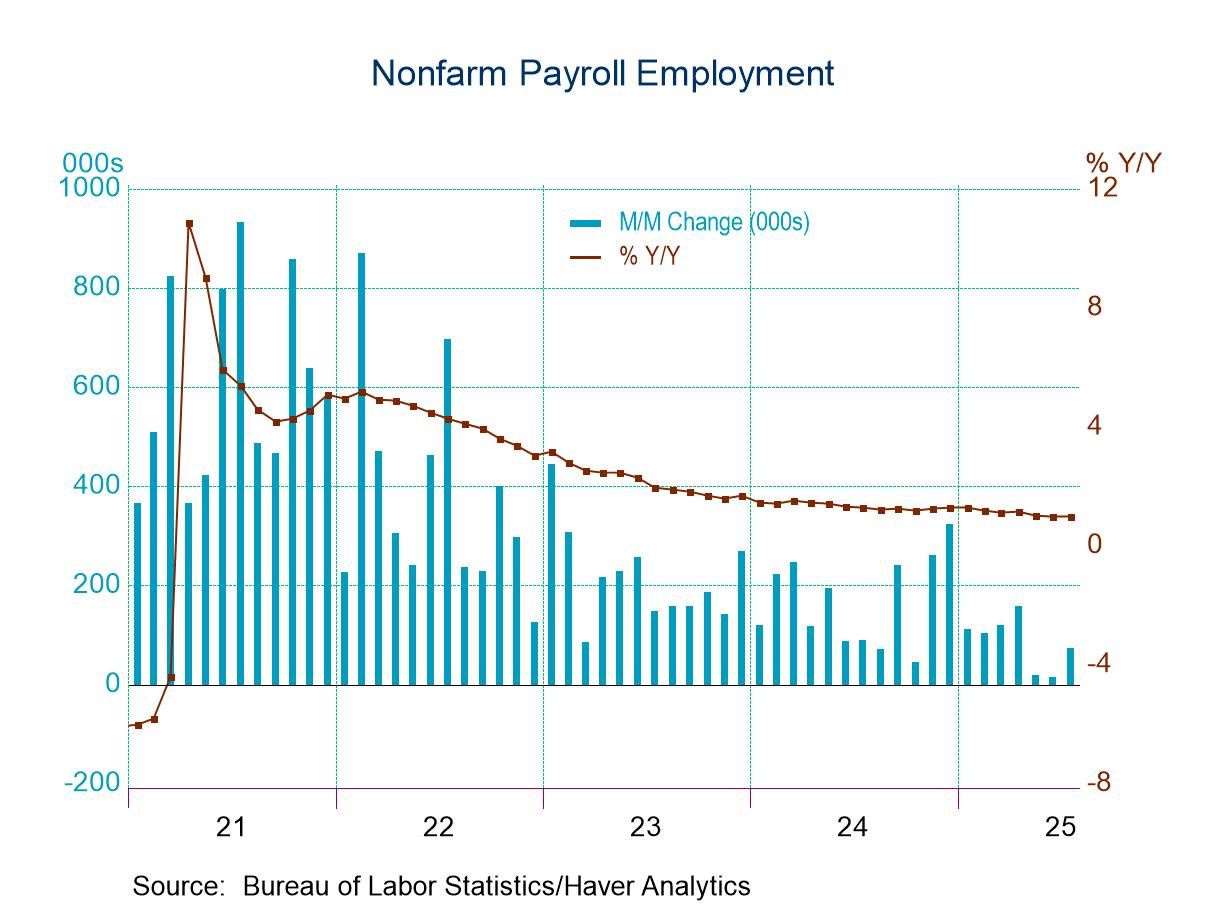

- Recent job growth reduced by fewer factory & government jobs.

- Earnings gain remains steady y/y.

- Jobless rate reverses June decline.

Introducing

Tom Moeller

in:Our Authors

Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

Publications by Tom Moeller

- USA| Aug 01 2025

U.S. Employment Report Shows Weakness in July, While Revisions Reduce Earlier Gains; Jobless Rate Picks Up

by:Tom Moeller

|in:Economy in Brief

- USA| Aug 01 2025

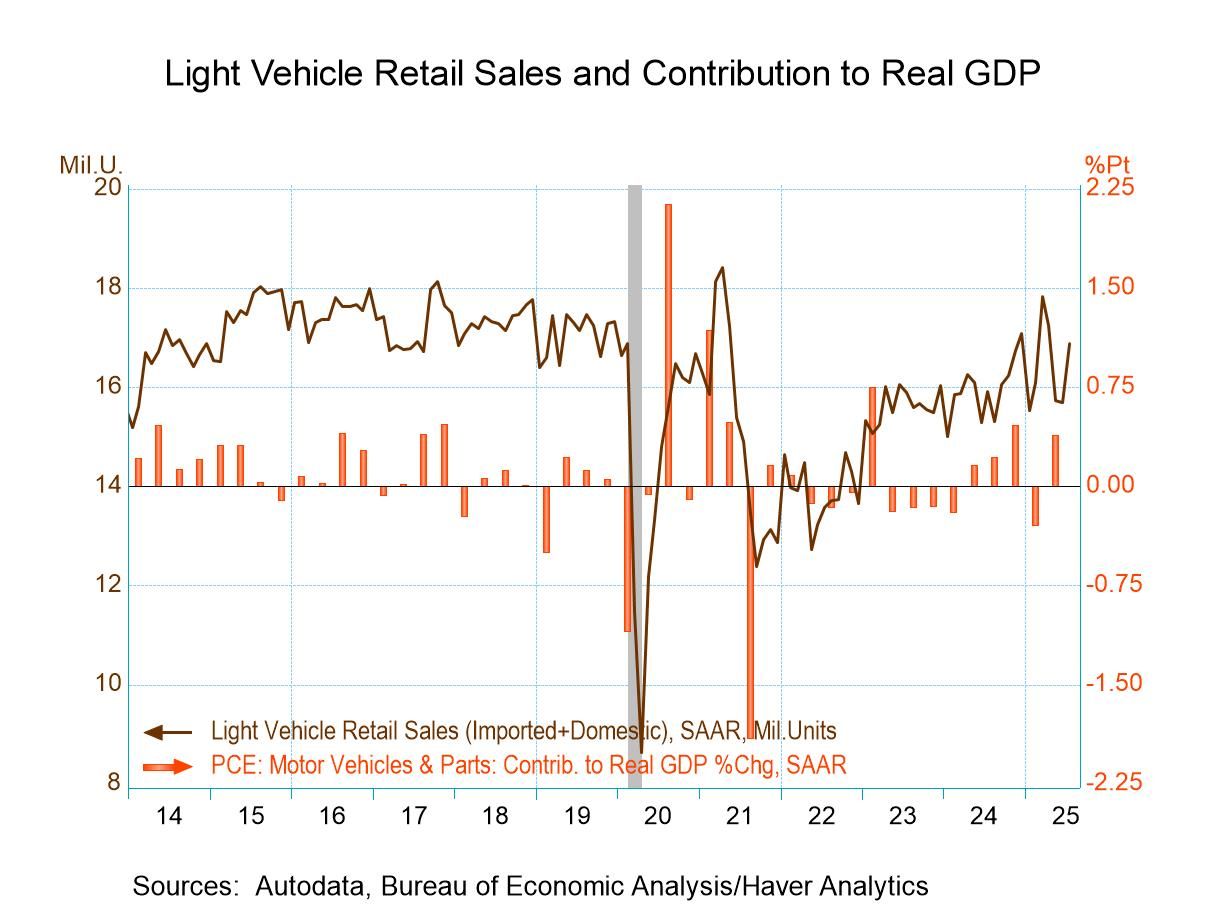

U.S. Light Vehicle Sales Rebound in July

- Both light truck and auto sales recover.

- Domestic and imports each increase.

- Imports' market share steadies.

by:Tom Moeller

|in:Economy in Brief

- Core price increase is strongest in four months.

- Real spending moves slightly higher.

- Real disposable income holds steady along with personal savings rate.

by:Tom Moeller

|in:Economy in Brief

- USA| Jul 30 2025

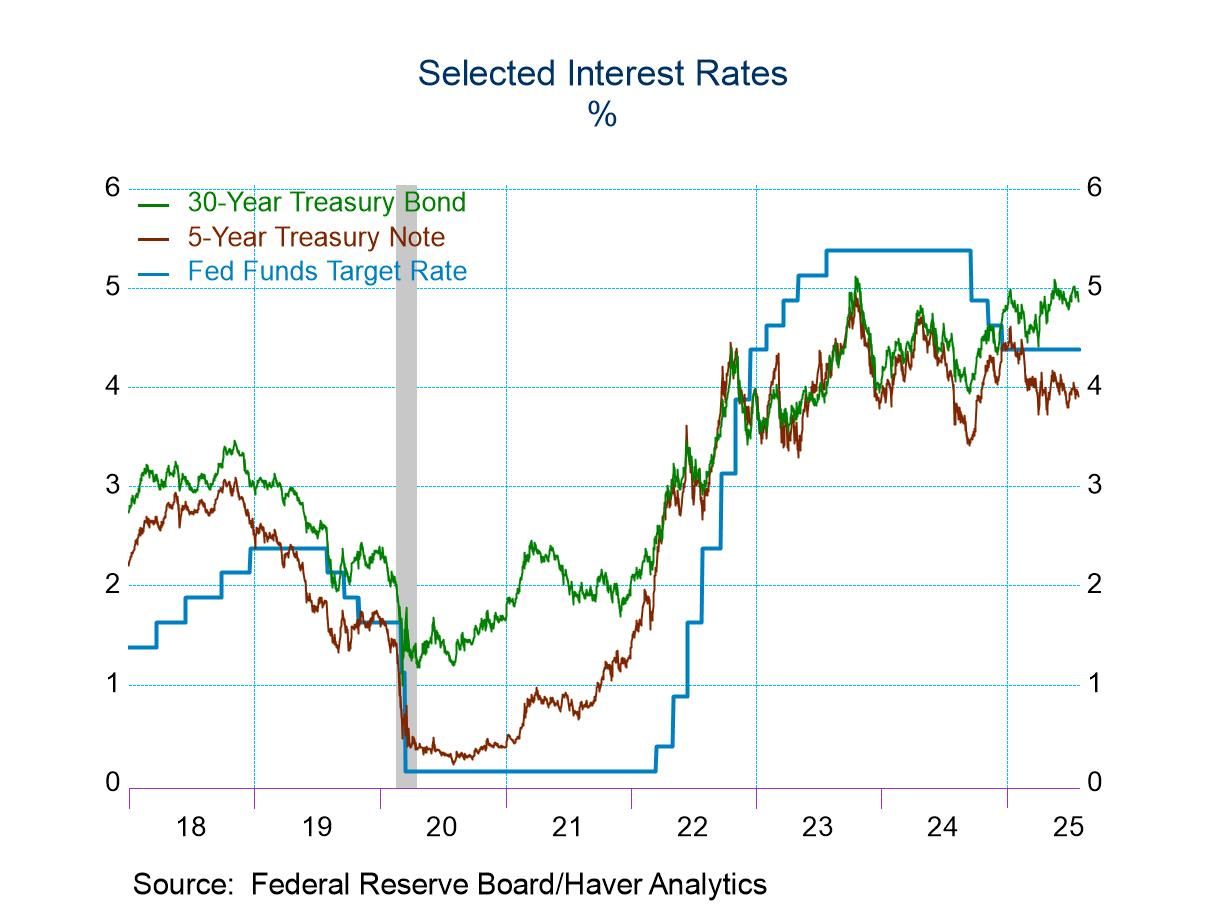

FOMC Targeted Funds Rate Range Is Unchanged

- FOMC holds funds rate target at late-December level.

- Decision was not unanimous with two FOMC members voting for a 25 basis point cut.

by:Tom Moeller

|in:Economy in Brief

- USA| Jul 30 2025

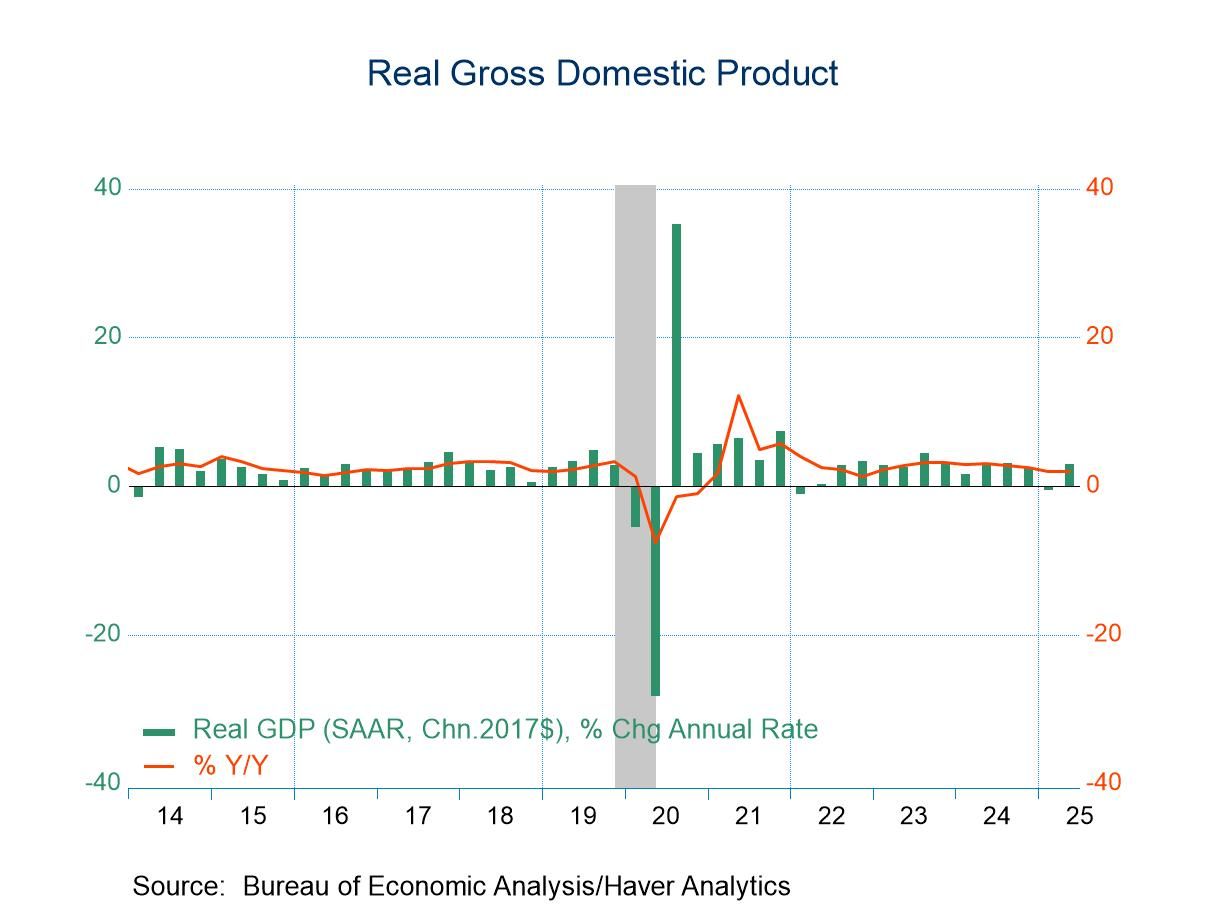

U.S. GDP Q2’25 Shows More Growth, Less Inflation

- Q2 GDP growth more than makes up deterioration in Q1.

- Consumer spending picks up while trade gap deterioration reverses.

- Price index gain roughly halves.

by:Tom Moeller

|in:Economy in Brief

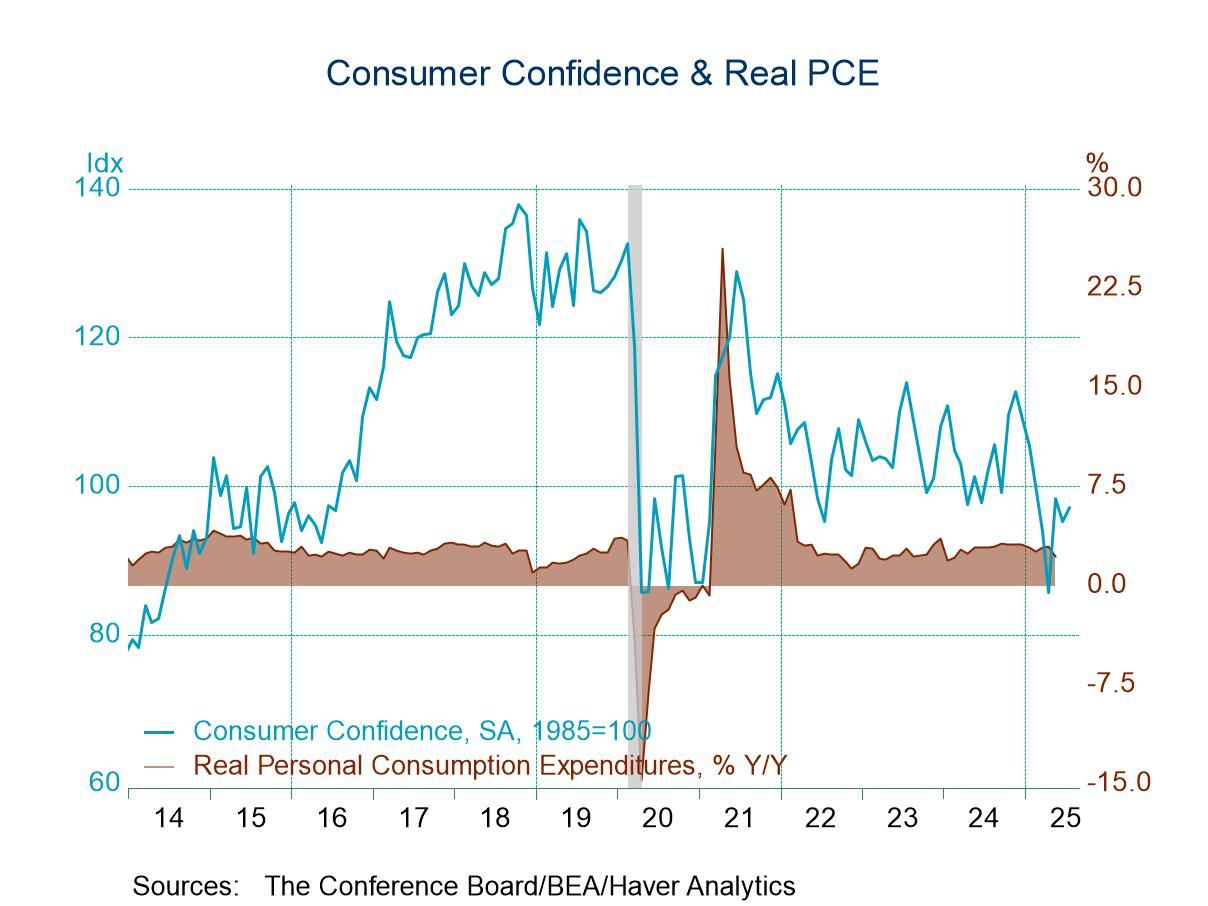

- Decline reverses much of June decline.

- Expectations improve but present situation reading declines.

- Inflation expectations edge down.

by:Tom Moeller

|in:Economy in Brief

- USA| Jul 29 2025

U.S. FHFA House Prices Fall Further in May

- Prices edge lower m/m.

- Annual increase moves to two-year low.

- Price changes are uneven amongst regions.

by:Tom Moeller

|in:Economy in Brief

- USA| Jul 29 2025

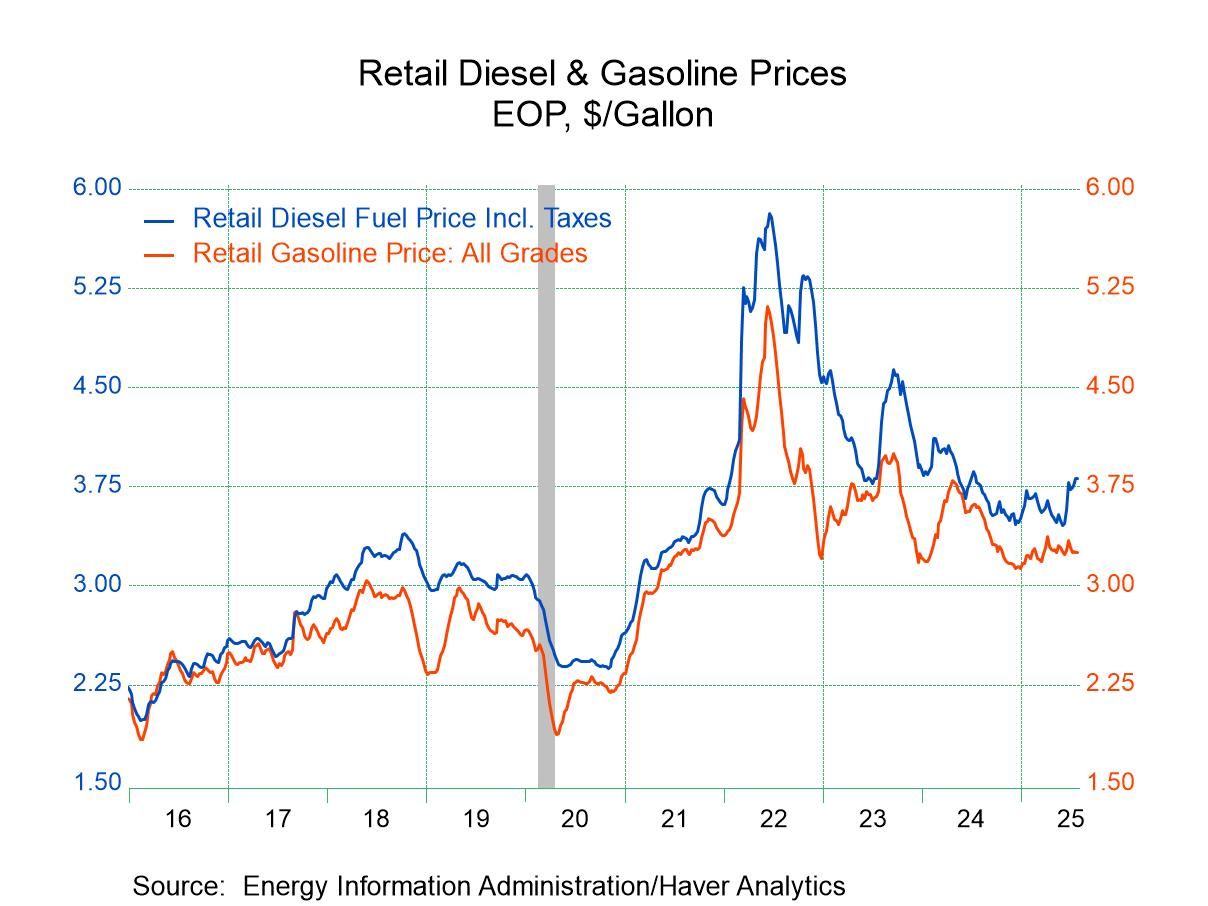

U.S. Energy Prices Are Fairly Stable in Latest Week

- Gasoline prices hold steady.

- Crude oil prices decline.

- Natural gas prices ease.

by:Tom Moeller

|in:Economy in Brief

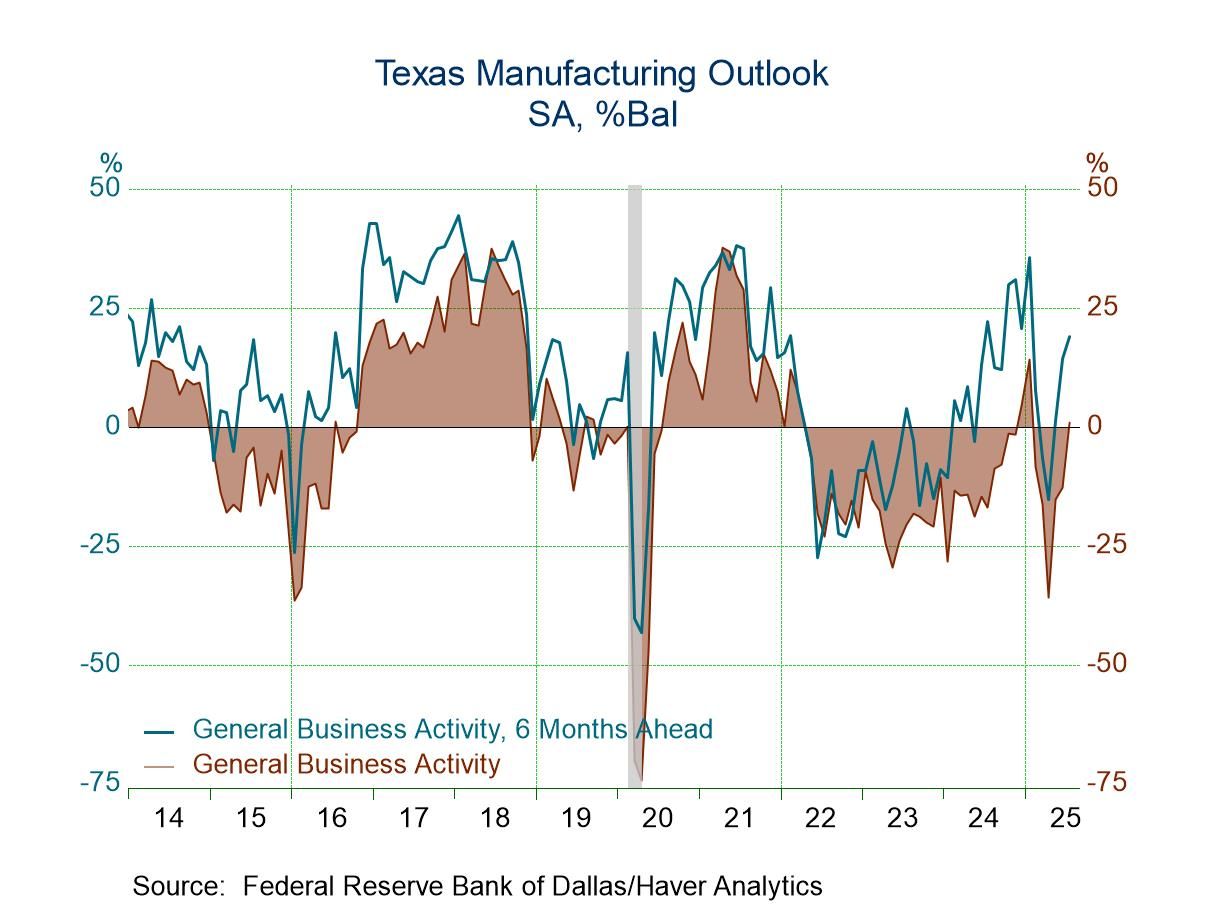

- Survey turns positive for first time in six months.

- Production, employment & hours-worked readings improve.

- Prices and wages & benefits indicators weaken.

by:Tom Moeller

|in:Economy in Brief

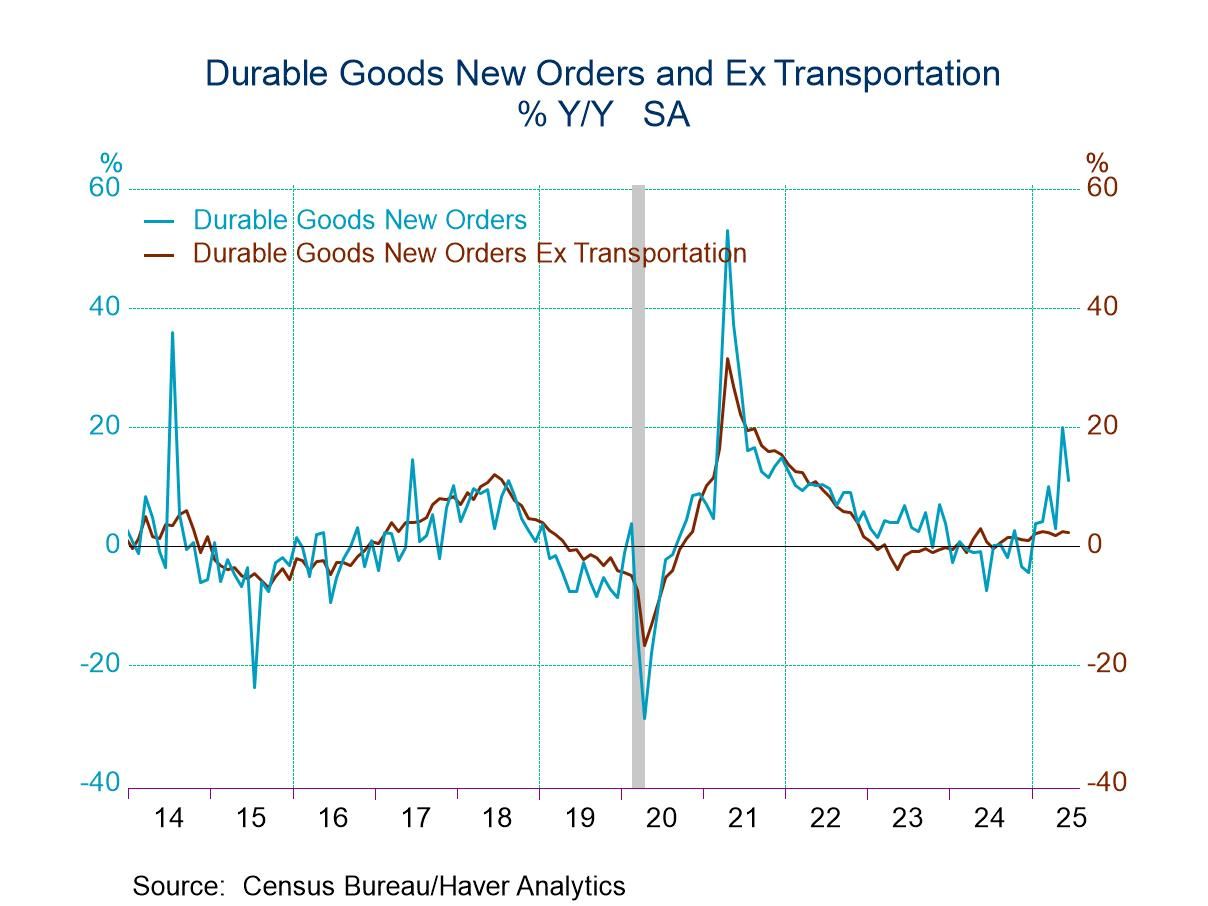

- Orders excluding transportation weaken.

- Shipments strengthen.

- Unfilled orders surge, led by aircraft; inventories increase slightly.

by:Tom Moeller

|in:Economy in Brief

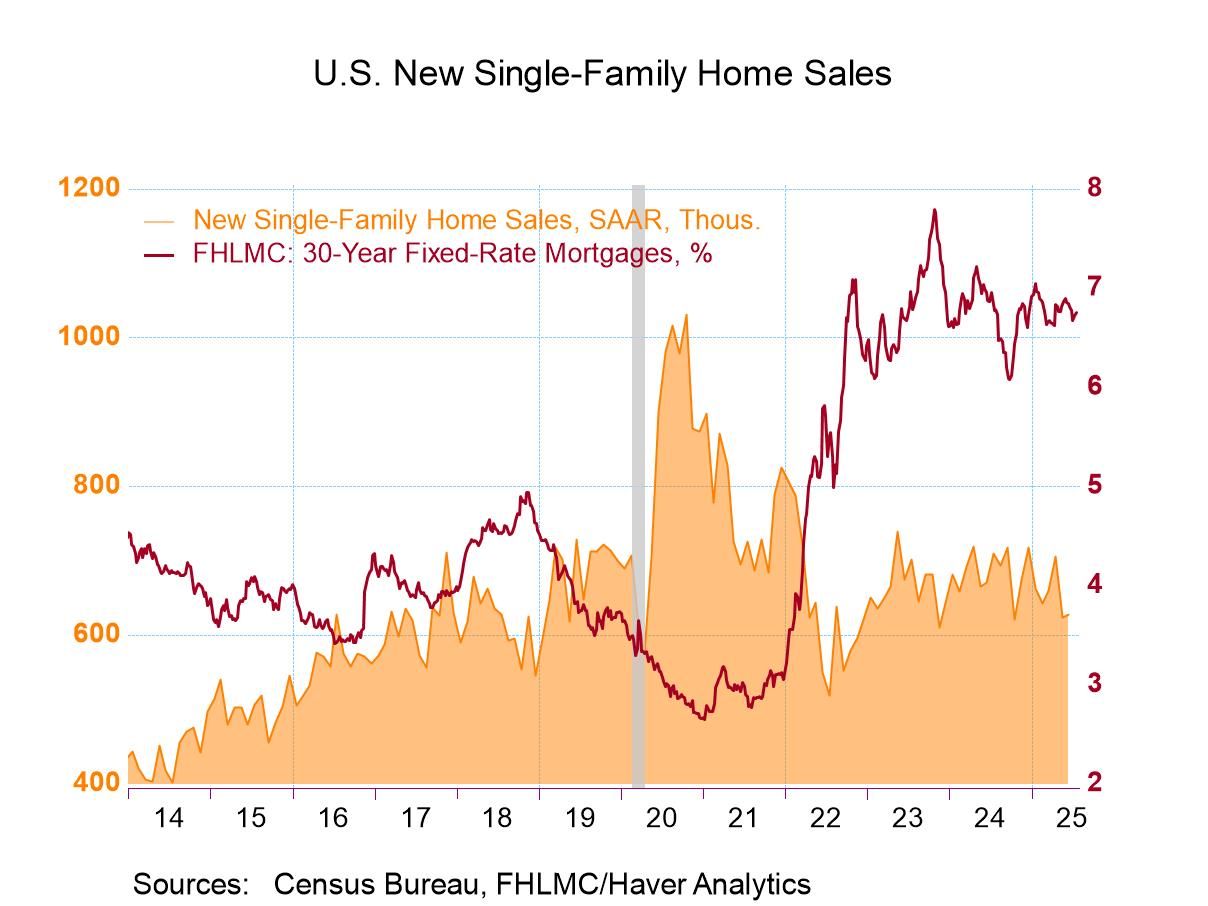

- Small gain in sales follows sharp decline.

- Sales are mixed throughout the country.

- Median sales price is lowest since November.

by:Tom Moeller

|in:Economy in Brief

- USA| Jul 24 2025

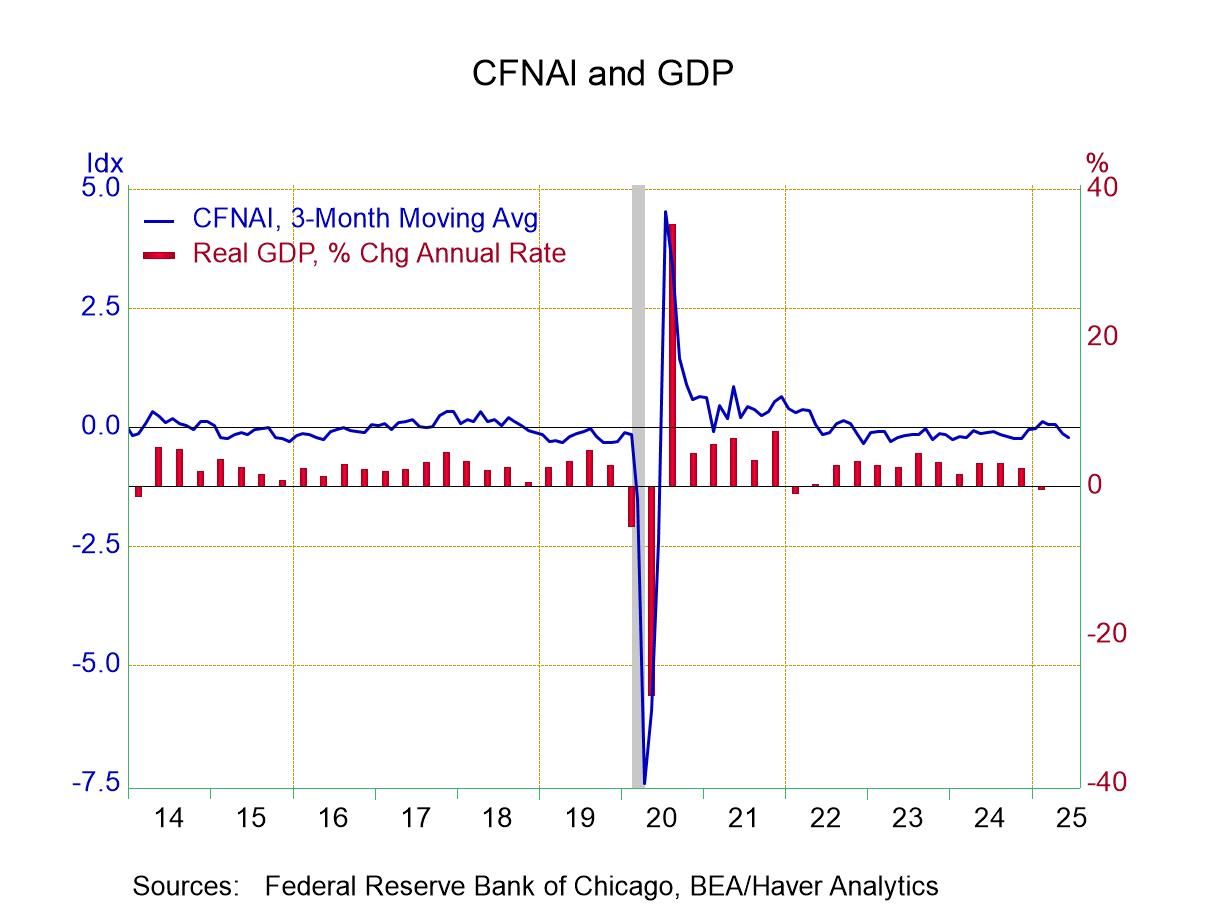

Chicago Fed’s National Activity Index Remains Negative in June

- Latest reading improves versus May.

- Each of four components are negative.

- Three-month trend weakens.

by:Tom Moeller

|in:Economy in Brief

- of1081Go to 11 page