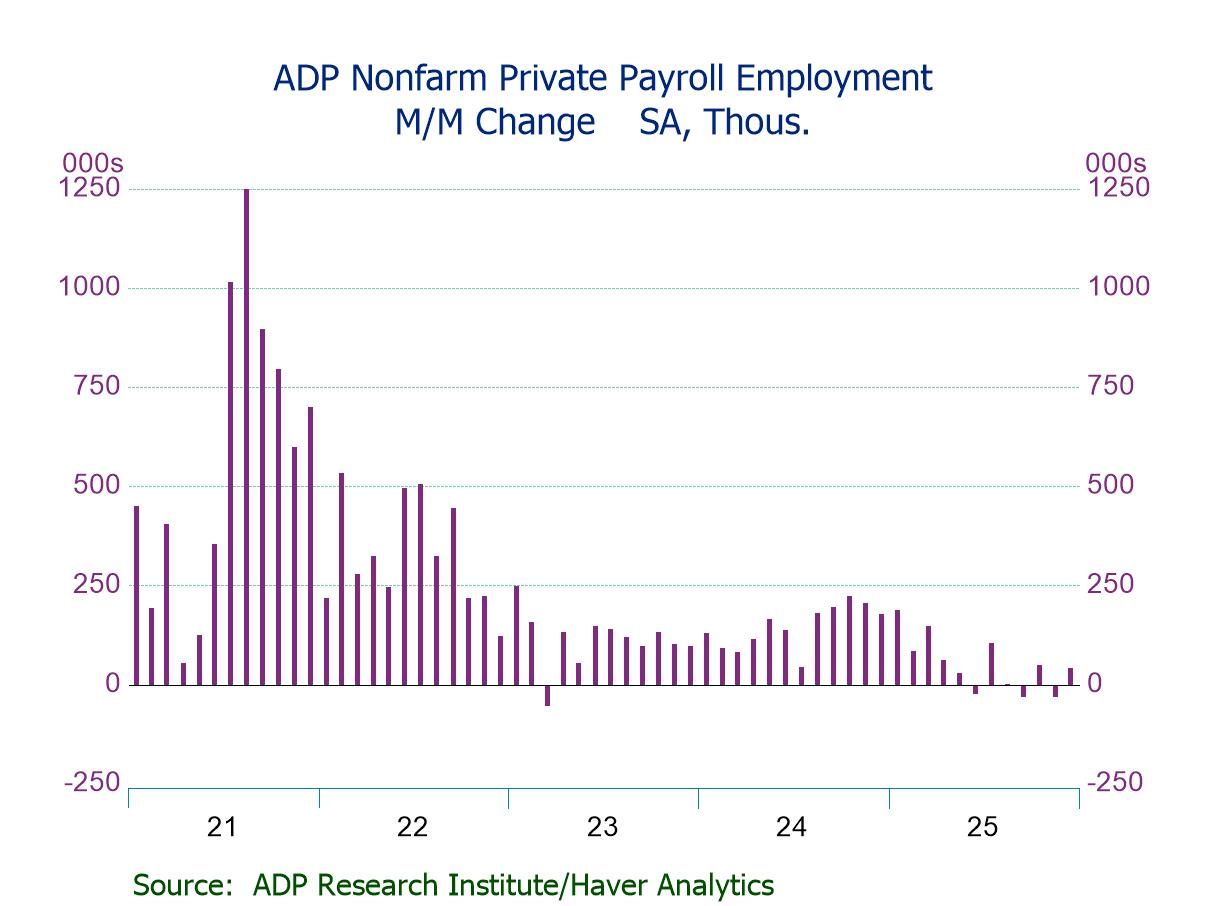

- Private payrolls +41K; second m/m increase in three months.

- Hiring increase is driven by medium-sized businesses (+34K).

- Service-sector jobs up (+44K), led by education & health svs. (+39K) and leisure & hosp. (+24K); goods-producing jobs dip (-3K).

- Wage growth accelerates y/y for job changers (6.6%) but steady for job stayers (4.4%).

Introducing

Winnie Tapasanun

in:Our Authors

Winnie Tapasanun has been working for Haver Analytics since 2013. She has 20+ years of working in the financial services industry. As Vice President and Economic Analyst at Globicus International, Inc., a New York-based company specializing in macroeconomics and financial markets, Winnie oversaw the company’s business operations, managed financial and economic data, and wrote daily reports on macroeconomics and financial markets. Prior to working at Globicus, she was Investment Promotion Officer at the New York Office of the Thailand Board of Investment (BOI) where she wrote monthly reports on the U.S. economic outlook, wrote reports on the outlook of key U.S. industries, and assisted investors on doing business and investment in Thailand. Prior to joining the BOI, she was Adjunct Professor teaching International Political Economy/International Relations at the City College of New York. Prior to her teaching experience at the CCNY, Winnie successfully completed internships at the United Nations. Winnie holds an MA Degree from Long Island University, New York. She also did graduate studies at Columbia University in the City of New York and doctoral requirements at the Graduate Center of the City University of New York. Her areas of specialization are international political economy, macroeconomics, financial markets, political economy, international relations, and business development/business strategy. Her regional specialization includes, but not limited to, Southeast Asia and East Asia. Winnie is bilingual in English and Thai with competency in French. She loves to travel (~30 countries) to better understand each country’s unique economy, fascinating culture and people as well as the global economy as a whole.

Publications by Winnie Tapasanun

- USA| Jan 07 2026

U.S. ADP Private Employment Rebounds in December

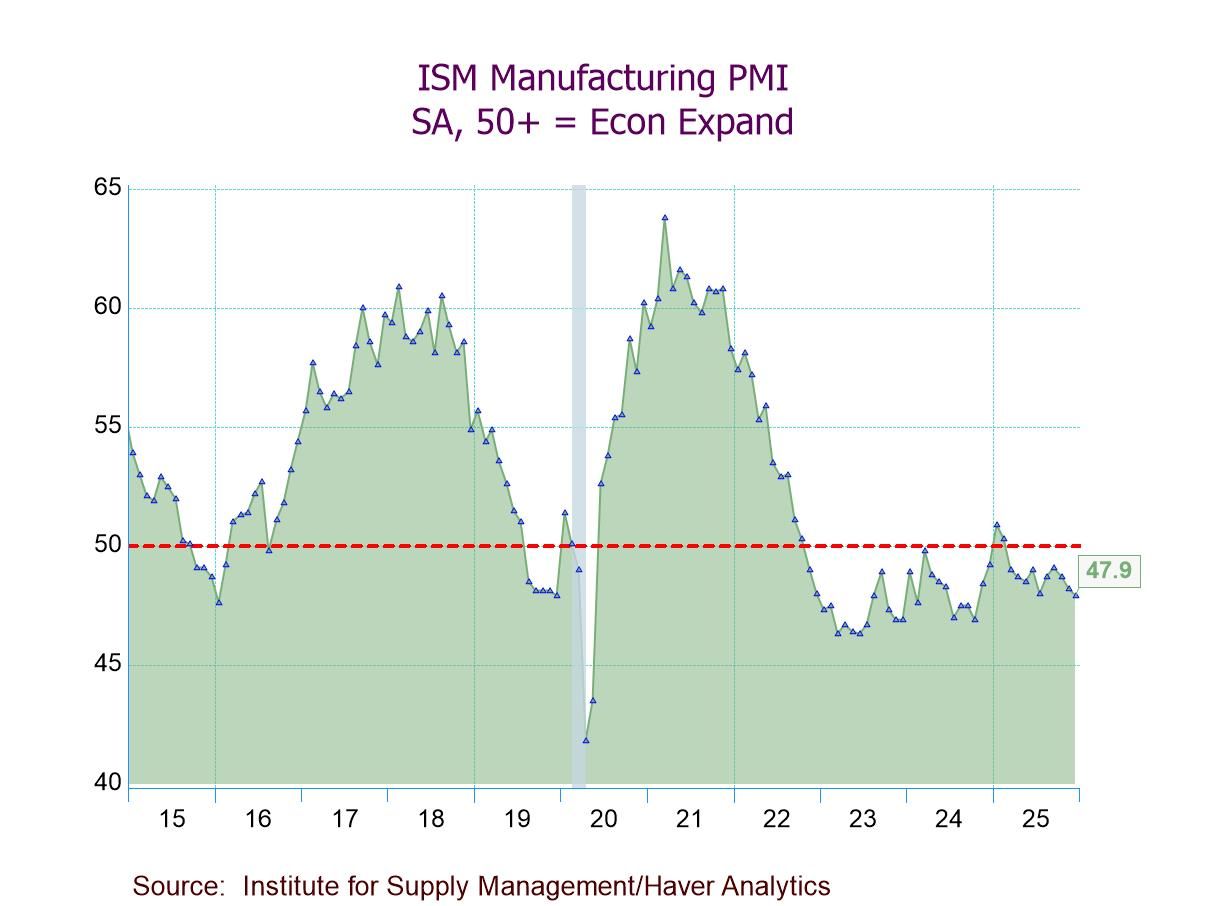

- ISM Mfg. PMI down to 47.9 in Dec., below forecasts; 10th straight month of contraction.

- Production (51.0) expands for the third time in four months.

- New orders (47.7) contract for the fourth successive month.

- Employment (44.9) contracts for the 11th consecutive month.

- Prices Index (unchanged at 58.5) indicates prices rise for the 15th straight month; exports & imports continue to contract.

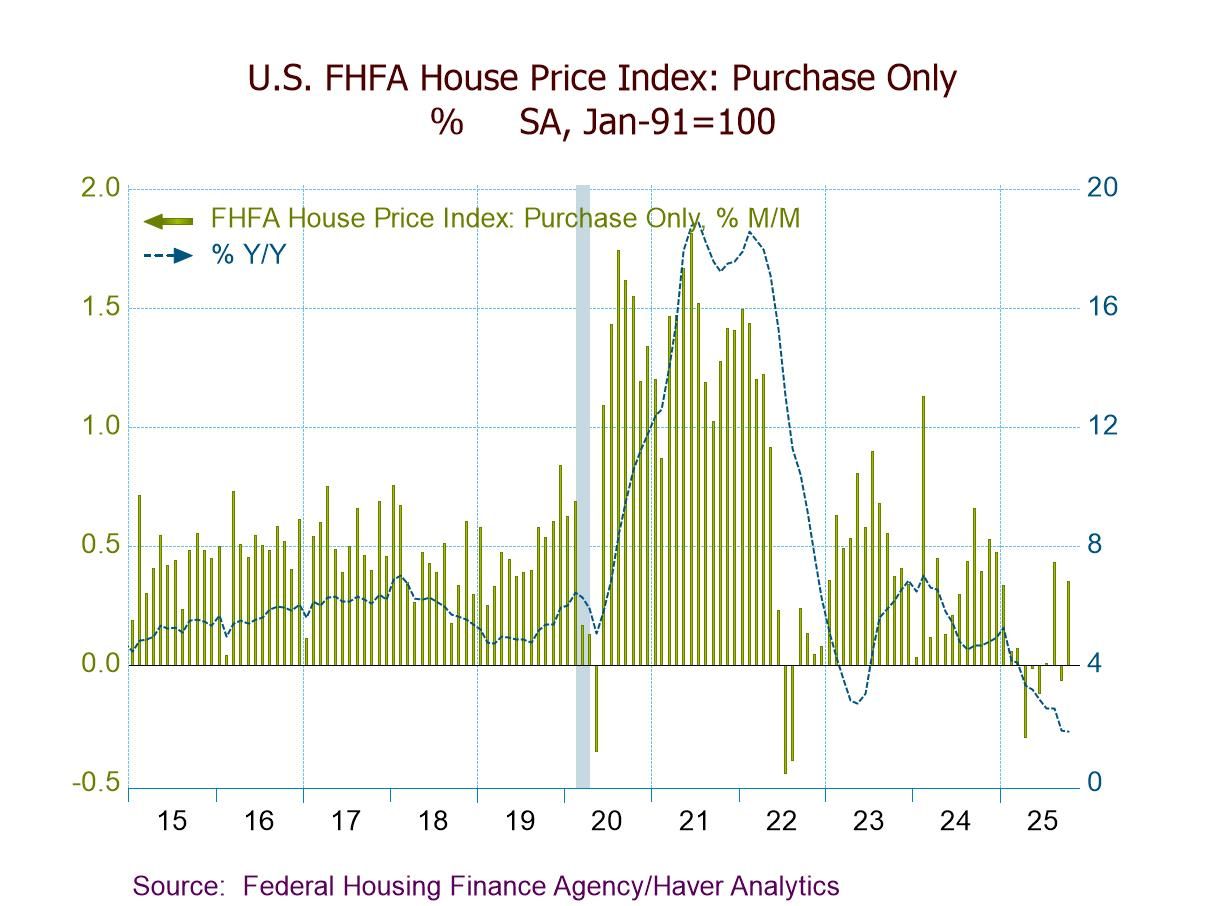

- FHFA HPI +0.4% m/m (+1.7% y/y) in Oct.; second m/m gain in three months.

- House prices up m/m in seven of nine census divisions but down in East South Central (-0.4%) and South Atlantic (-0.2%).

- House prices up y/y in seven of nine regions, led by Middle Atlantic (+5.3%), but down in West South Central (-0.7%) and South Atlantic (-0.5%).

- USA| Dec 29 2025

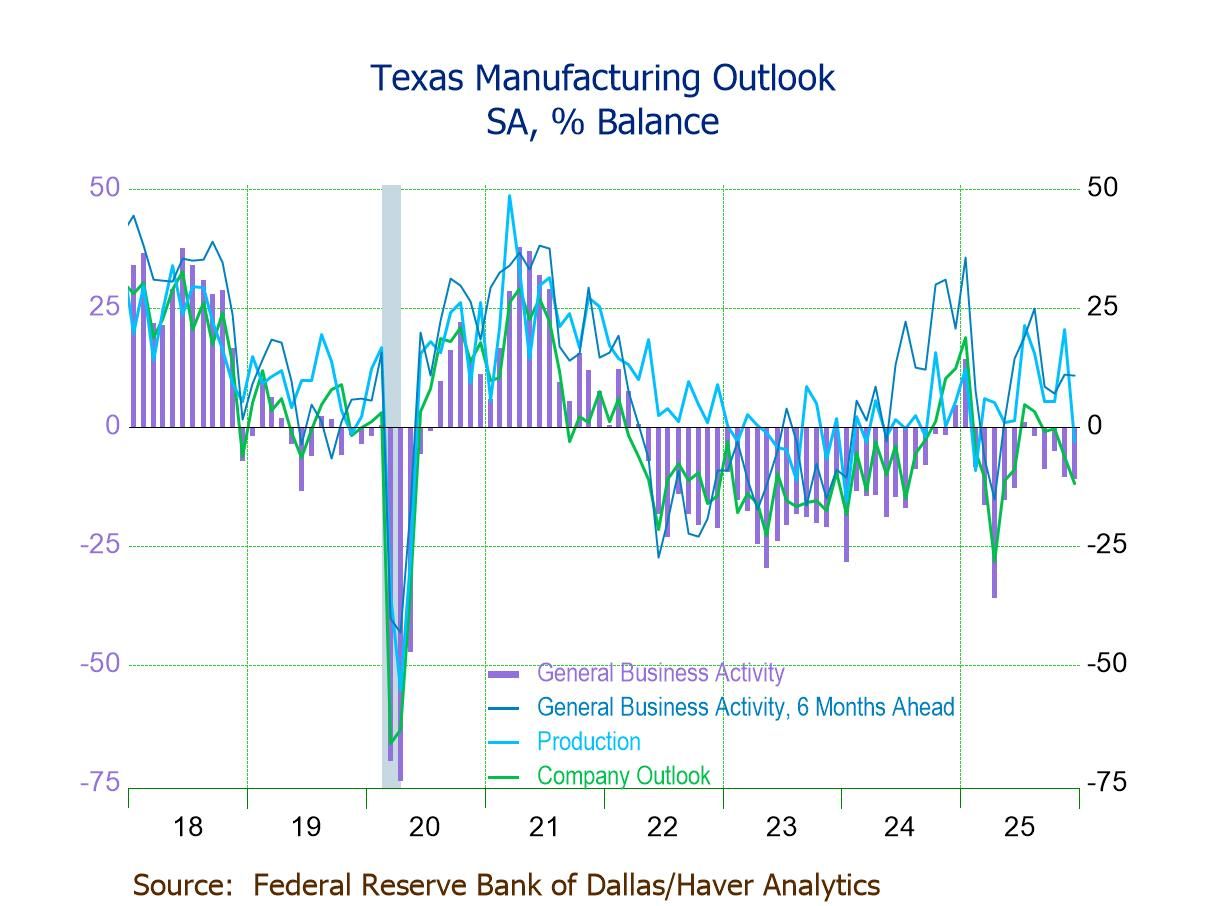

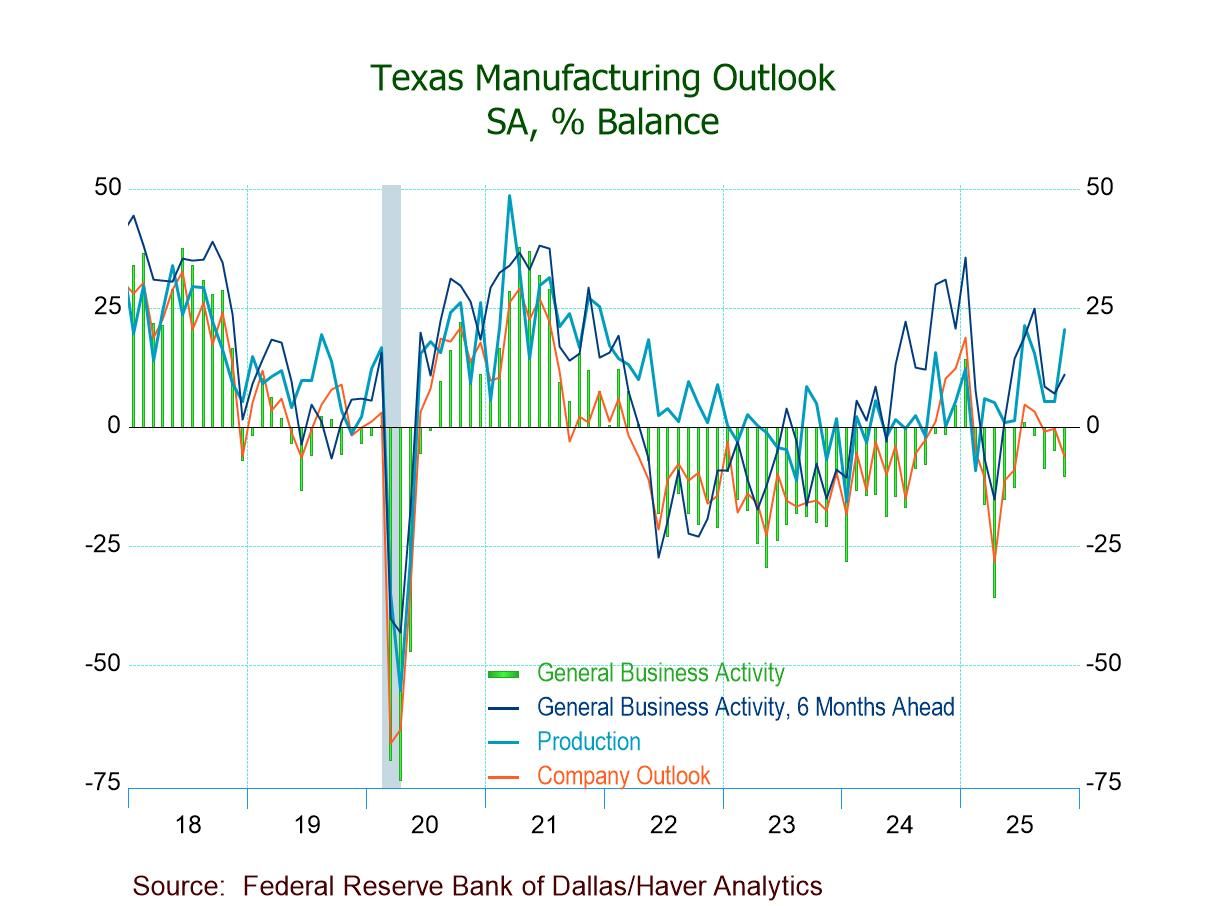

Texas General Business Activity Still Negative in December, But Expectations Remain Positive

- General Business Activity down in Dec. to -10.9, lowest level since June.

- Company Outlook (-11.9) negative for the fourth straight mth. and at an eight-month low; Production (-3.2) negative for the first time since Feb.

- New Orders Growth (-16.0) and New Orders (-6.4) at a six-month low.

- Employment (-1.1) negative for the first time since Sept.

- Prices Received down 2.6 pts. to 8.2; Prices Paid up 0.7 pts. to a three-month-high 36.0.

- Future General Business Activity down to 10.8, still positive for the eighth consecutive mth.

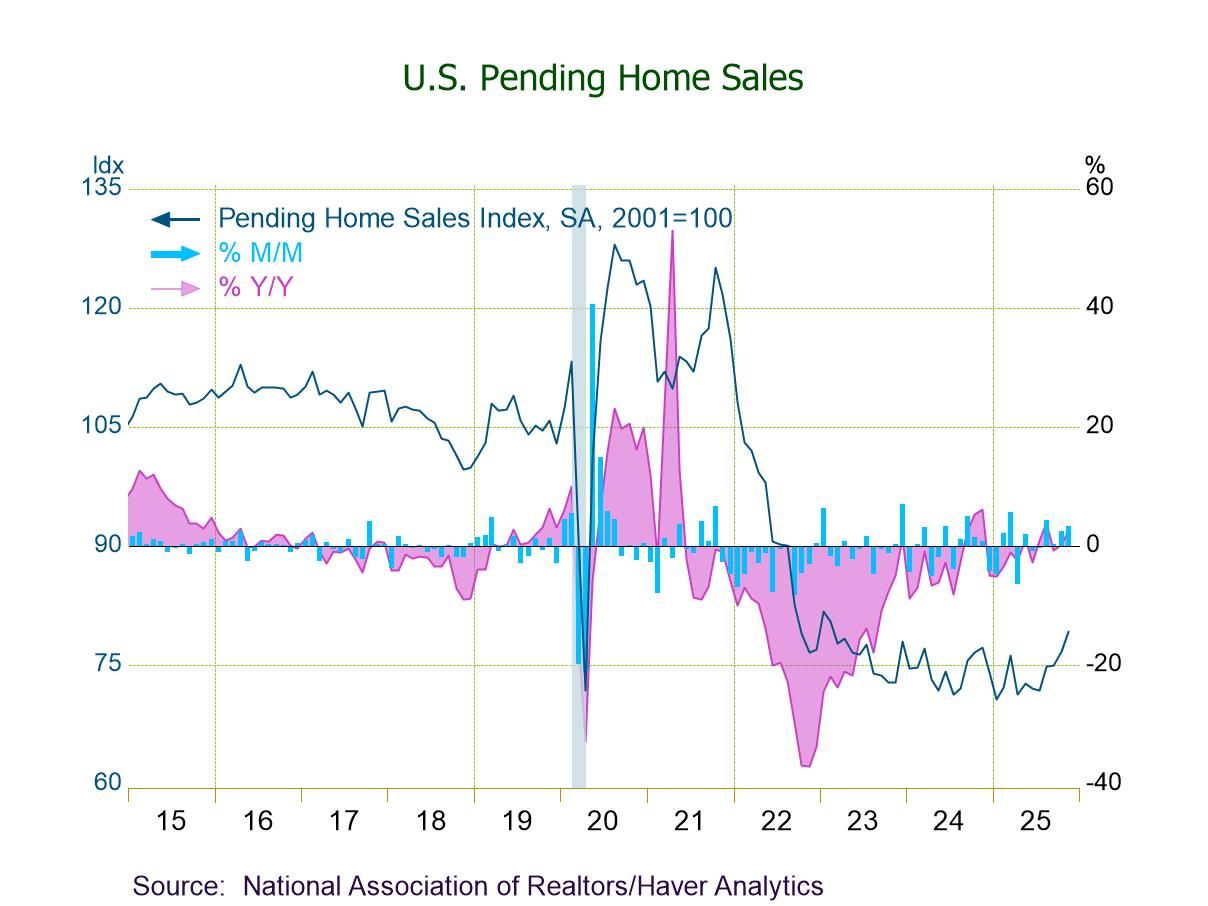

- PHSI +3.3% (+2.6% y/y) in Nov., driven by lower mortgage rates.

- Home sales m/m up in all four major regions, w/ the highest rate in the West (+9.2%).

- Home sales y/y up across all regions, w/ the highest rate in the South (+3.3%).

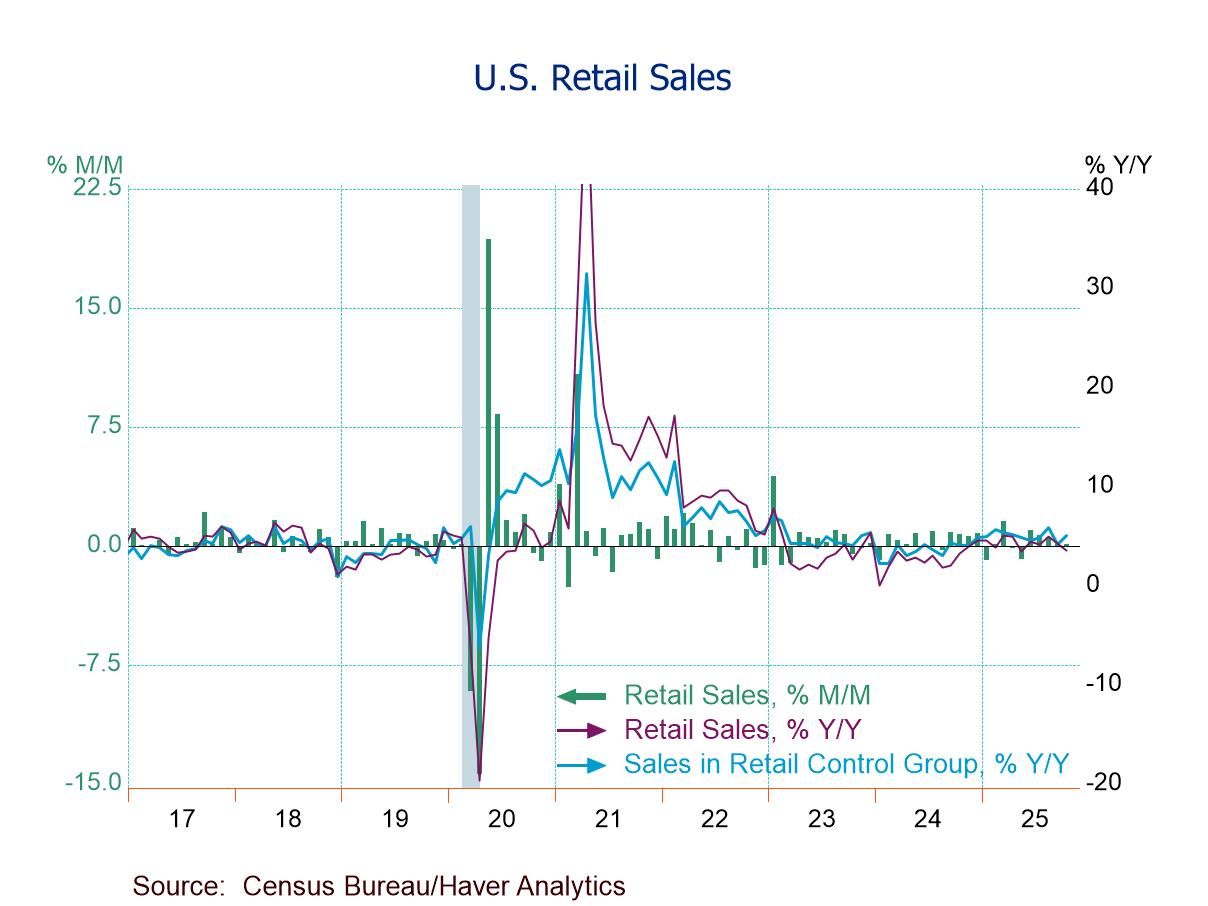

- October total retail sales +0.03% (+3.5% y/y), w/ mixed results across categories.

- Ex-auto sales +0.4% (+4.0% y/y); auto sales -1.6% (+1.2% y/y).

- Sales rebound m/m in department stores (+4.9%) and furniture stores (+2.3%).

- Sales drop m/m in bldg. materials & garden equipt. stores (-0.9%) and gasoline stations (-0.8%).

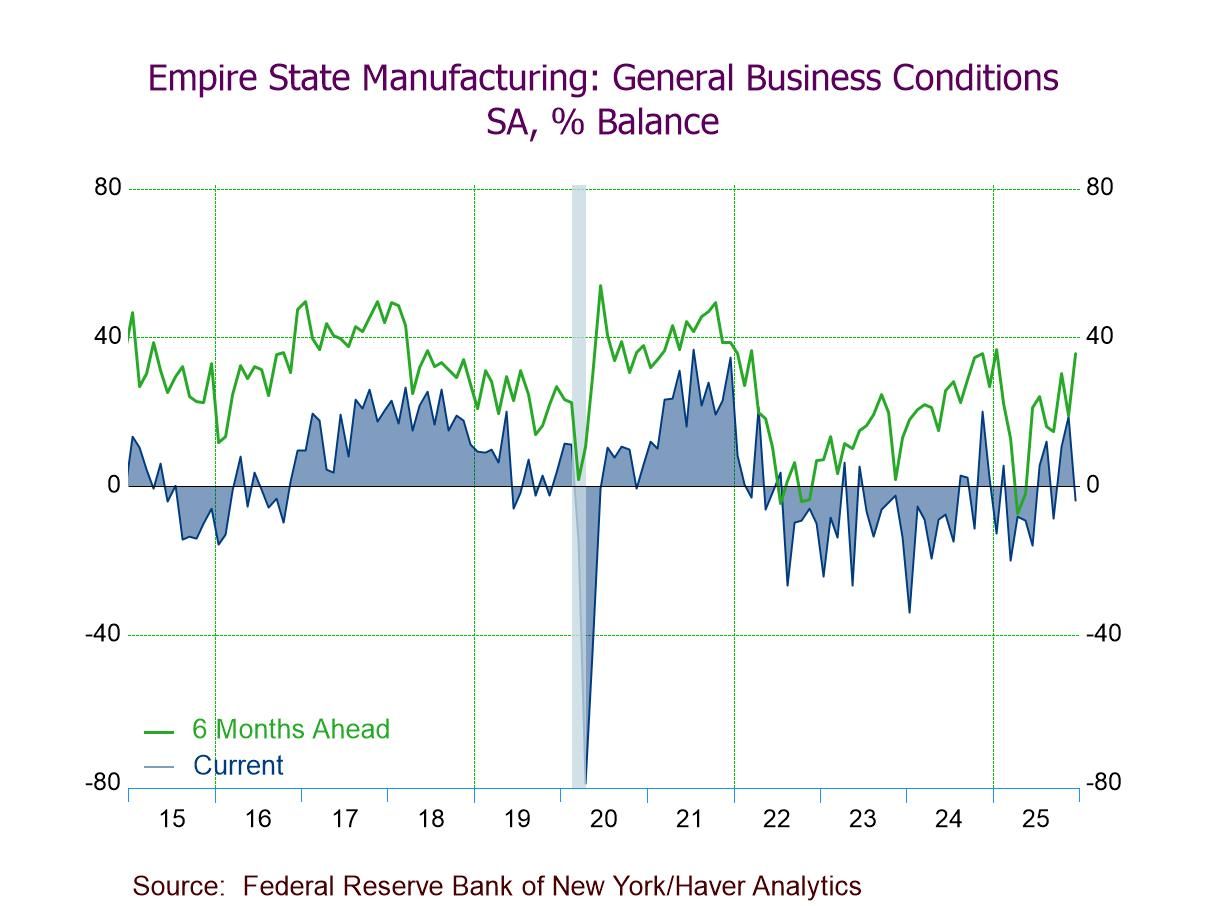

- December General Business Conditions Index down 22.6 pts. to -3.9.

- Unfilled orders (-14.9) and shipments (-5.7) negative; employment (7.3, highest since July) and inventories (4.0) positive; new orders flat (0.0).

- Prices paid at an 11-month-low 37.6 and prices received at a 10-month-low 19.8, still elevated.

- Firms optimistic: Future Business Conditions Index at an 11-month-high 35.7 and future prices paid at an 11-month-low 55.4.

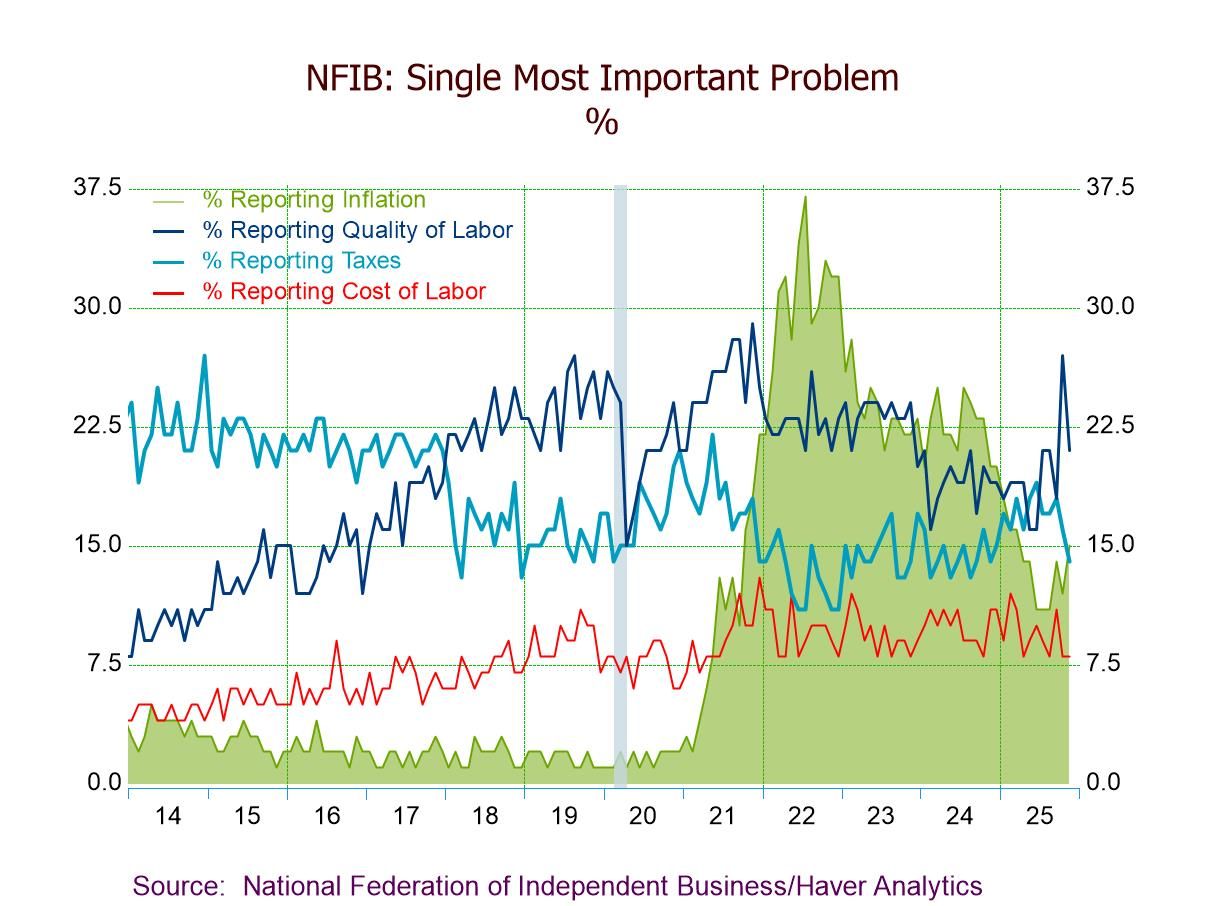

- NFIB Small Business Optimism Idx up 0.8 pts. to 99.0 in Nov., driven by stronger real sales expectations.

- Uncertainty Idx up 3 pts. to 91, reflecting uncertainty about CapEx plans.

- Expectations for economy down 5 pts. to a 7-month-low 15%.

- Expected real sales up 9 pts. to 15%, highest since Jan. ’25.

- Plans to expand business unchanged at 13%.

- Firms raising avg. selling prices up 13 pts. to 34%, highest since March ’23 and largest m/m increase on record.

- Quality of labor (21%), inflation (15%), and taxes (14%) are the top three business concerns.

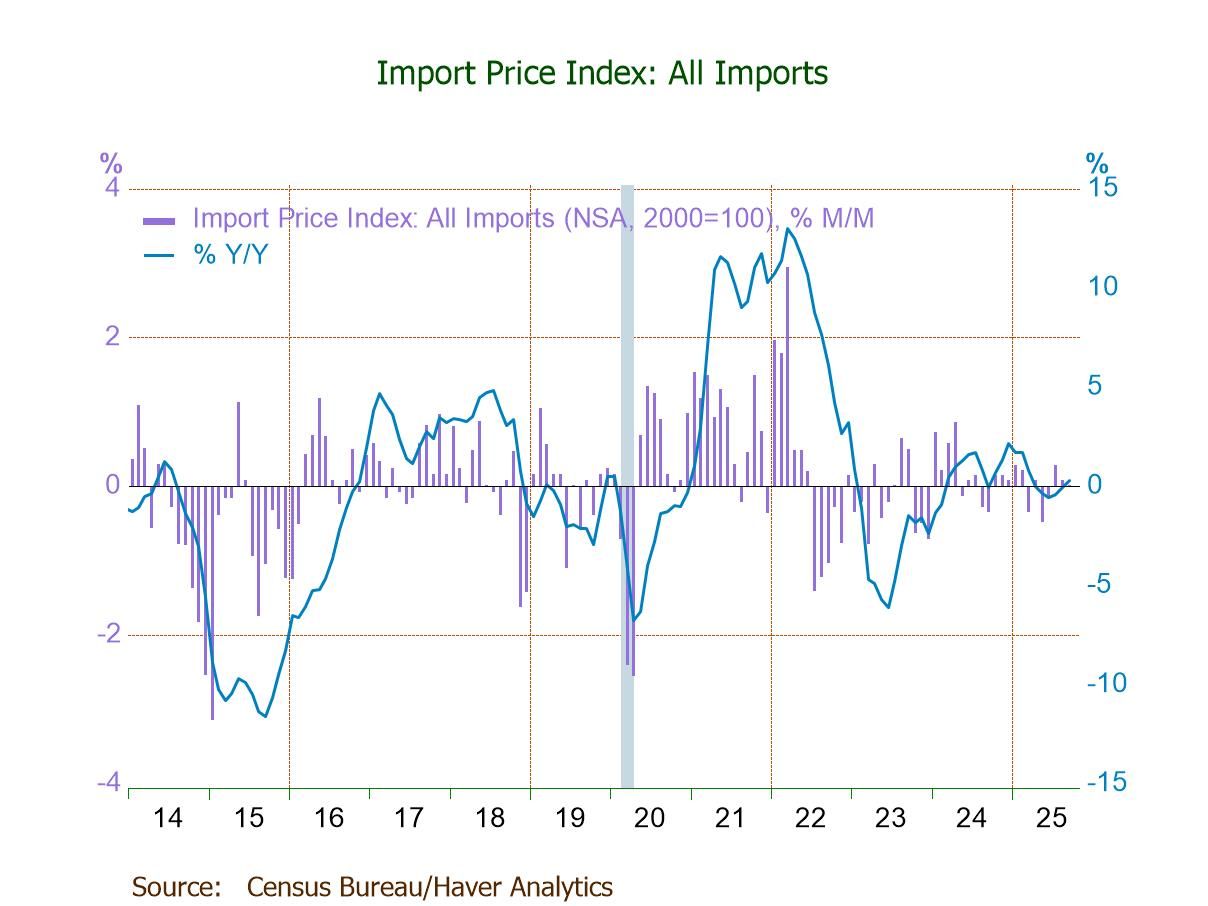

- Import prices unchanged (+0.3% y/y) in Sept. after two straight m/m rises, largely due to a 1.5% drop in fuel import prices.

- Excluding fuels, import prices up 0.2% (0.8% y/y), the third straight m/m increase.

- Export prices unchanged (+3.8% y/y), reflecting a 0.3% rebound in agricultural exp. prices and no change in nonag exp. prices.

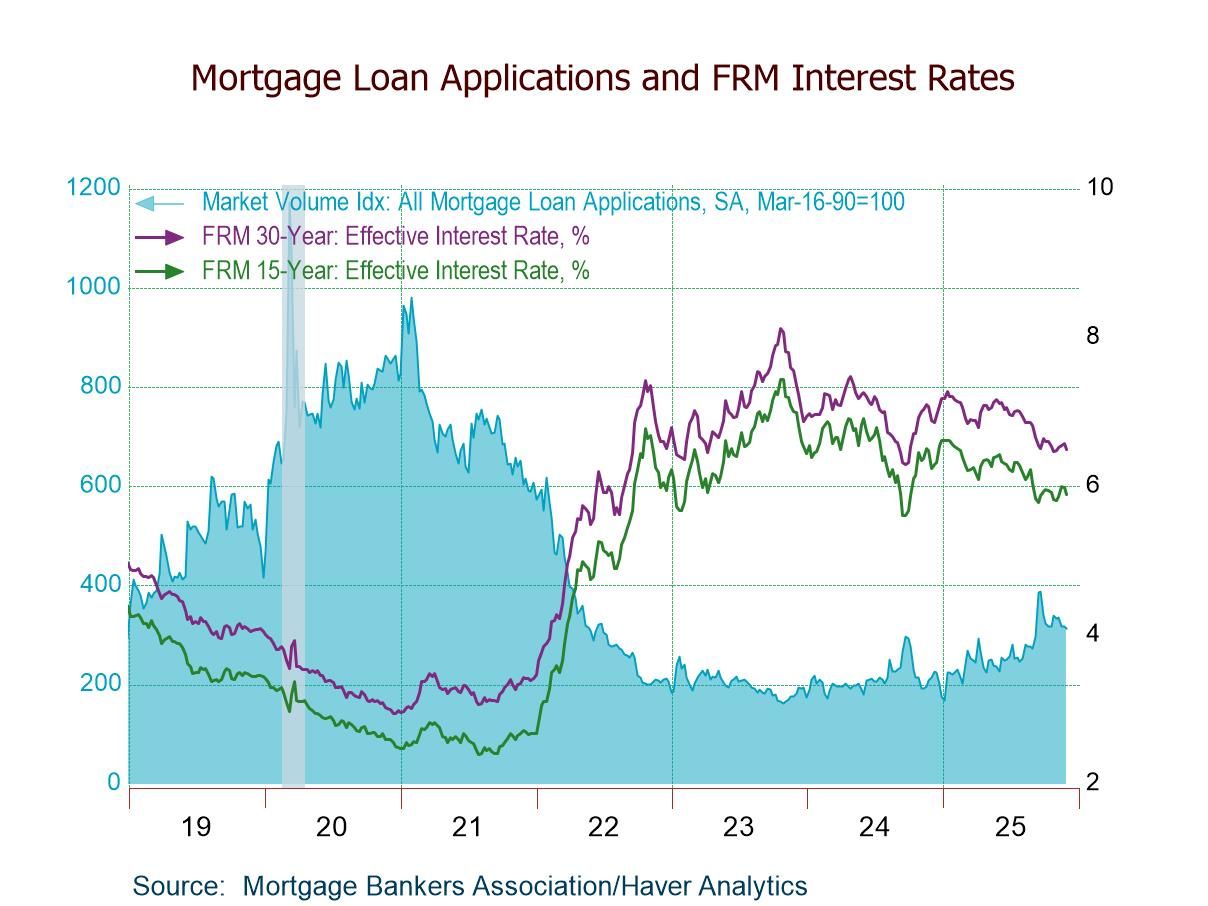

- Purchase applications +2.5% w/w; refinancing loan applications -4.4% w/w.

- Effective interest rate on 30-year fixed loans drops to a four-week-low 6.49%

- Average loan size rises to the highest level since the October 31 week.

- USA| Nov 25 2025

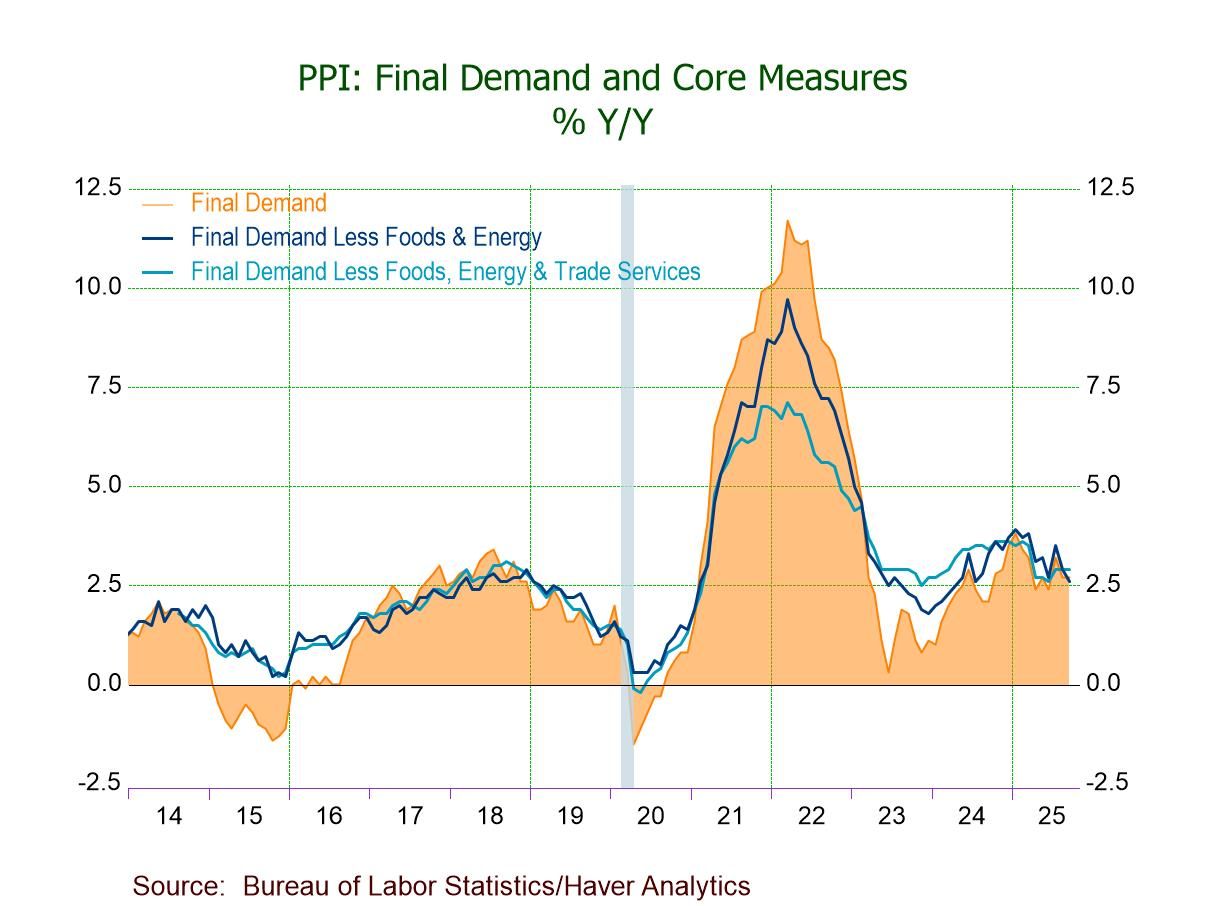

U.S. Producer Prices Rise in September Led by Energy

- Sept. PPI increases 0.3% m/m (+2.7% y/y), driven by price rises of 3.5% in energy and 1.1% in foods.

- PPI ex foods & energy edges up 0.1%; prices for both services and construction hold steady.

- Core goods prices increase 0.2% (+2.9% y/y) after a 0.3% August gain.

- Intermediate demand processed goods prices up for the fifth time in six months.

- USA| Nov 24 2025

Texas General Business Activity Remains Negative in November, But Expectations Stay Positive

- General Business Activity down in Nov. to -10.4, lowest level since June.

- Company Outlook (-6.3) negative for the third straight mth. and at a five-month low; Production (20.5) at a four-month high.

- New Orders Growth (-1.3) still negative, but New Orders (4.8) turns positive after two negative readings.

- Employment (1.2) positive for the sixth time in seven mths.

- Prices Received up 3.1 pts. to 10.8; Prices Paid up 1.9 pts. to 35.3.

- Future General Business Activity up to 11.0, a three-month high.

- of28Go to 2 page