Global| Oct 23 2006

Global| Oct 23 2006Bank of Israel Keeps Interest Rate at 5.5%

Summary

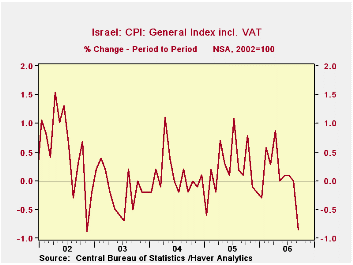

The bank of Israel kept its key interest rate at 5.5% today. Speculation that the rate might have been cut was fed by the sharp decline in the September seasonally unadjusted consumer price index that declined by almost 0.9% from [...]

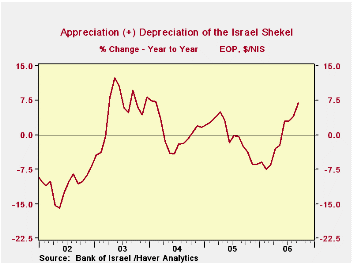

The bank of Israel kept its key interest rate at 5.5% today. Speculation that the rate might have been cut was fed by the sharp decline in the September seasonally unadjusted consumer price index that declined by almost 0.9% from August, and the recent strengthening of the exchange rate.

The first chart shows the month to month changes in the consumer price index. The second, shows the exchange rate expressed as Dollars per the New Israel Shekel (NIS). This is the inverse of the typical quotation of the exchange rate--NIS per Dollar. A positive percentage change in this series represents an appreciation of the shekel against the dollar and a negative, a depreciation. In the case of the typical exchange rate--NIS per Dollar--the percentage changes show appreciation and depreciation of the dollar against the shekel.

The Bank, however, apparently did not take into account the September decline in consumer prices. In its press release, the Bank referred only to the August consumer price index, stating that the rate of inflation over the past twelve months at 2.2% was consistent with the necessary path for meeting the inflation target. The Bank seemed to put more emphasis on data that suggested a sharp rebound in activity after the drop in activity in the third quarter resulting from the war in Lebanon.The Bank estimates that as a result of the war, Gross Domestic Product this year will be 4%, instead of the 5.4% that was expected before the fighting and in 2007 to be 4%, a tenth of a percent, above the 3.9% estimated before the fighting.

The data in the charts and other background data for Israel can be found in the Haver data base--EMERGEMA. The country sourced data in this data base are frequently more up-to-date than data for Israel found in the IFS data base. For example, the trade in goods data released to day for September are in the EMERGEMA data base and not in the IFS data base. The same is true of the exchange rate and consumer prices that were released earlier this month.

| Israel | Sep 06 | Aug 06 | Sep 05 | M/M % | Y/Y % | 2005% | 2004 % | 2003 % |

|---|---|---|---|---|---|---|---|---|

| Consumer Price Index (2002=100) | 103.9 | 104.7 | 103.0 | -0.86 | 1.99 | 1.33 | -0.41 | 0.72 |

| Exchange Rate (End of Period) | ||||||||

| Dollars per NIS | .2325 | .2291 | .2175 | 1.48 | 6.90 | -6.42 | 1.62 | 8.20 |

| NIS per Dollar | 4.302 | 4.364 | 4.598 | -1.42 | -6.44 | 6.85 | 1.62 | -7.56 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates