Global| Nov 18 2011

Global| Nov 18 2011"BED" Data Show Fewer Job Gains, but Job Losses Fall to All-Time Low

Summary

There is job growth, despite the subjective impressions among observers that there is not. Yesterday (November 17), yet another such indicator was reported by the Bureau of Labor Statistics (BLS). Their quarterly Business Employment [...]

There is job growth, despite the subjective impressions among observers that there is not. Yesterday (November 17), yet another such indicator was reported by the Bureau of Labor Statistics (BLS). Their quarterly Business Employment Dynamics (BED) series was published for March 2011. Granted, there is a long lag in this compilation, but it is a count of private sector jobs, not a sample. These data are taken from the quarterly submissions of firms for the unemployment insurance program, the same data collection effort that produces the benchmark figures for the monthly establishment employment data.

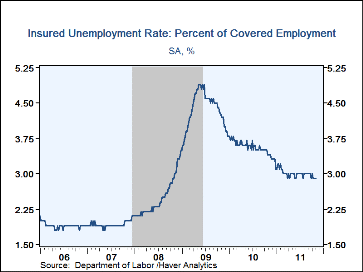

In the three months from December 2010, 6,338,000 jobs were added at business establishments, while 6,086,000 jobs were lost, for a net gain of 252,000. Both of these figures are down from the previous quarter, although as evident in the first graph, the number of job gains has generally recovered from the recession lows. More significant is that the number of job losses not only extended the downtrend of the post-recession period, but reached an all-time low in the 19-year history of these data. As a colleague suggested on seeing the smaller numbers of layoffs, "the bleeding has stopped".

Surely, the employment situation remains tenuous, as the accompanying tally of establishments shows that 1,777,000 of them had job gains, but 1,789,000 establishments lost jobs. The relative sluggishness of job gains has resulted from a continuing decline in the opening of new establishments; in the three months to March, there were 340,000 new establishments, down from 388,000 in the previous quarter and only modestly more than the recession low of 333,000 in the first quarter of 2009. There is some growth in the number of establishments that are expanding. The numbers of contracting or closing establishments are both well below recession highs, but they have stopped falling over the last three quarters.

There is much discussion currently that "small business" is the job engine. It is the case that job gains at small businesses are big; in Q1, firms (not establishments) with fewer than 50 employees added 2,931,000 jobs, more than 55% of total job gains at all firms. However, job losses at those companies ran to 2,836,000, 57% of all job losses counted by firms. Over the last four quarters, large firms with 250 or more employees have actually averaged the largest net gains, 188,000 per quarter versus 105,000 for small firms.

These "BED" data are contained in Haver's USECON database. A state breakdown appears in the REGIONAL database. The national data include industry detail.Net Change by Firm Size:

1-49 EmployeesCarol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates