Global| Sep 26 2007

Global| Sep 26 2007Business Confidence Weakens in France & Italy

Summary

Yesterday, Louise Curley described the continuing deterioration in Germany's IFO business climate measures. Somewhat the same is true for similar surveys in France and Italy. In the French INSEE survey, the Business Climate Index has [...]

Yesterday, Louise Curley described the continuing deterioration in Germany's IFO business climate measures. Somewhat the same is true for similar surveys in France and Italy.

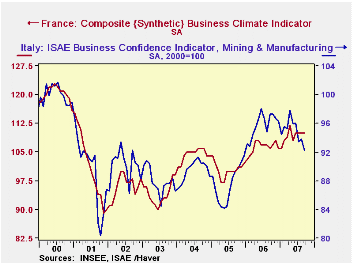

In the French INSEE survey, the Business Climate Index has been stalled at or near 110 for six months. The index is calculated so the long-term average is 100, so a reading of 110, 10 percent above the long-run pace, is hardly poor. However, a gradually improving trend that had been in place since the middle of 2003 has apparently played out. The same pattern is evident in the shape of order books. On a +/- balance measure, these had come up from -34 in June 2003 and finally climbed to +6 just in March. Now they have retreated back to +1. Foreign orders did advance in September's results and are at their peak of +11. But this is a figure first reached in the spring of 2006, suggesting that the export sector reached a plateau long ago.

It's important in assessing these surveys to remember that they only ask if a company's orders or other activities have grown or declined from some prior period, not by how much. Thus, there's not an exact 1:1 correspondence between the survey data and the actual orders series. And we see in this case that the volume of foreign orders at French producers continued to expand at least through June, even though the +/- diffusion index had flattened months before then.

In Italy, business confidence eased 1.6 points in September to 92.2 from August's 93.8. This gauge is a plain time-based index, fixed at 100 in 2000. Italian manufacturers have been experiencing a distinct weakening since this past May. It is clearly evident in their assessment of orders, for which the diffusion measure was only briefly in positive terms, peaking at +3 in April, and sagging back into negative territory this month at -7. Foreign orders only once pierced 0 in this cycle, in May, meaning that otherwise, they never grew at more companies than they fell. Again, though, somewhat similar to the situation in France, actual foreign orders have not broken down. In fact, they rose sharply in June to a new high and held much of that gain in July.

Thus, French and Italian producers seem to be in a kind of limbo, with concerns about their markets, but their actual performance not yet reflecting that. At the same time, the recent surge in the euro would likely hurt their competitiveness, in addition to the pressure from the US housing decline, its attendant impact on financial markets and the persistently high price of crude oil. So one wonders how soon the reality of reported order flows might come into congruence with manufacturers' concerns.

| Industry Surveys, Seas Adj | Sept 2007 | Aug 2007 | July 2007 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| France: INSEE Business Climate* | 110 | 110 | 110 | 106 | 106 | 100 | 104 |

| Manufacturing Orders, % Balance | +1 | +2 | +2 | -5 | -6 | -17 | -14 |

| Export Orders | 11 | 9 | 6 | 4 | 6 | -14 | -10 |

| Italy: ISAE Business Survey, 2000=100 | 92.2 | 93.8 | 93.4 | 97.3 | 95.8 | 87.5 | 89.5 |

| Manufacturing & Mining Order Books, % Balance | -7.0 | -1.0 | -2.0 | 0.0 | -1.4 | -17.6 | -15.2 |

| Export Orders, % Balance | -7.0 | -7.0 | -6.0 | -3.0 | -3.7 | -21.0 | -18.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates