Global| Nov 01 2005

Global| Nov 01 2005Chain Store Sales Finish October Firm as Gasoline Prices Decline

by:Tom Moeller

|in:Economy in Brief

Summary

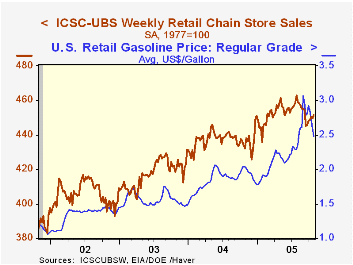

Lower gasoline prices helped raise spending at chain stores. Last week, the retail average price of regular gasoline in the U.S. fell 12 cents for the second consecutive week to $2.48 per gallon (+21.9 y/y). Since the early September [...]

Lower gasoline prices helped raise spending at chain stores. Last week, the retail average price of regular gasoline in the U.S. fell 12 cents for the second consecutive week to $2.48 per gallon (+21.9 y/y). Since the early September peak of $3.07, retail prices are down 19.2% and a 12 cent decline in yesterday's spot market price for gasoline suggests another drop this week.

With a 0.4% rise at the end of October, chain store sales rose for the fifth time in the last six weeks according to the International Council of Shopping Centers (ICSC)-UBS survey. The gains were enough to pull the month's average sales level up 0.1% from September which fell 1.7% from August.

During the last ten years there has been a 56% correlation between the y/y change in chain store sales and the change in non-auto retail sales less gasoline, as published by the US Census Department. Chain store sales correspond directly with roughly 14% of non-auto retail sales less gasoline. The leading indicator of chain store sales from ICSC was unchanged w/w during the latest week (-2.2% y/y) following a 0.9% spurt the prior week.The ICSC-UBS retail chain-store sales index is constructed using the same-store sales (stores open for one year) reported by 78 stores of seven retailers: Dayton Hudson, Federated, Kmart, May, J.C. Penney, Sears and Wal-Mart.

Oil Price Shocks and Inflation from the Federal Reserve Bank of San Francisco is available here.

| ICSC-UBS (SA, 1977=100) | 10/29/05 | 10/22/05 | Y/Y | 2004 | 2003 |

|---|---|---|---|---|---|

| Total Weekly Chain Store Sales | 451.6 | 449.7 | 4.4% | 4.6% | 2.9% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates