Global| Sep 22 2008

Global| Sep 22 2008Chicago Fed Index At Recession Level

by:Tom Moeller

|in:Economy in Brief

Summary

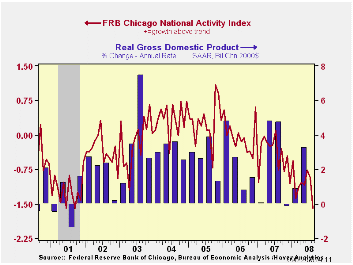

The August National Activity Index (CFNAI) from the Chicago Federal Reserve Bank dropped sharply from July. The reading of -1.59 was its lowest level since the last recession during 2001.The current index level was then associated [...]

The August National Activity Index (CFNAI) from the Chicago Federal Reserve Bank dropped sharply from July. The reading of -1.59 was its lowest level since the last recession during 2001.The current index level was then associated with -1.4% (AR) growth in quarterly real GDP.

The three-month moving average of the index also fell, but the drop was more moderate to -1.09 from -0.92 during July. The latest figure was exceeded, to the downside, during April.

An index level at or below -0.70 typically has indicated negative U.S. economic growth. A zero value of the CFNAI indicates that the economy is expanding at its historical trend rate of growth of roughly 3%. During the last twenty years there has been a 68% correlation between the level of the CFNAI and q/q growth in real GDP.

The complete CFNAI report is available here and the historical data are available in Haver's SURVEYS database.

All of the categories of the August index were indicated to have made negative contribution to the total during August, but the largest came from the production figures.

Inflationary pressure also was indicated to be low for the coming year.

The CFNAI is a weighted average of 85 indicators of economic activity. The indicators reflect activity in the following categories: production & income, the labor market, personal consumption & housing, manufacturing & trade sales, and inventories & orders.

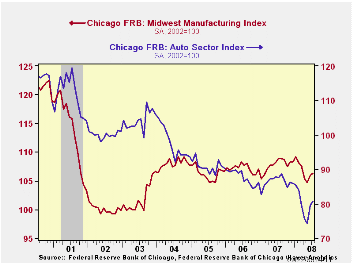

In a separate survey, the Chicago Fed indicated that its Midwest manufacturing index improved again. The July index level was at its highest since this past March. Each of the component series, for the auto sector, machinery and resource sectors, rose and offset deterioration the steel sector index.

The U.S. Economic Situation and the Challenges for Monetary Policy is adapted from speeches made by San Francisco Fed Janet Yellen and it can be found here.

| Chicago Fed | August | July | August '07 | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|

| CFNAI | -1.59 | -0.93 | -0.76 | -0.43 | -0.03 | 0.27 |

| 3-Month Average | -1.09 | -0.92 | -0.30 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates