Global| Jun 23 2014

Global| Jun 23 2014Chicago Fed National Activity Index Indicates Improved Economic Growth

by:Tom Moeller

|in:Economy in Brief

Summary

The Chicago Federal Reserve reported that its National Activity Index (CFNAI) for May gained to 0.21 and recovered the April decline to -0.15, revised from -0.32. The reading indicates that overall U.S. economic activity is on a [...]

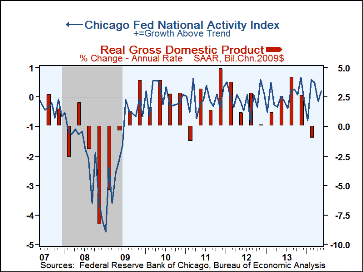

The Chicago Federal Reserve reported that its National Activity Index

(CFNAI) for May gained to 0.21 and recovered the April decline to -0.15,

revised from -0.32. The reading indicates that overall U.S. economic

activity is on a moderate growth track. That follows the weather-induced

shortfall this winter when the January figure fell to -0.79. As of last

month, the three-month moving average stood at 0.18, compared to the low

of -0.13 three months ago. During the last ten years, there has been a 77%

correlation between the Chicago Fed Index and the q/q change in real GDP.

The Chicago Federal Reserve reported that its National Activity Index

(CFNAI) for May gained to 0.21 and recovered the April decline to -0.15,

revised from -0.32. The reading indicates that overall U.S. economic

activity is on a moderate growth track. That follows the weather-induced

shortfall this winter when the January figure fell to -0.79. As of last

month, the three-month moving average stood at 0.18, compared to the low

of -0.13 three months ago. During the last ten years, there has been a 77%

correlation between the Chicago Fed Index and the q/q change in real GDP.

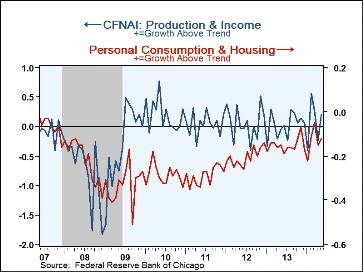

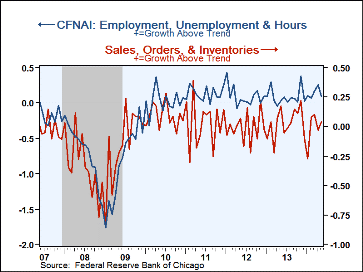

The Production & Income reading improved to 0.20 and recovered its April decline to -0.23. Also recovering was the Sales, Inventories & Orders series to 0.04 from -0.03. The Employment, Unemployment & Hours reading deteriorated to a still-positive 0.10 but the Personal Consumption and Housing figure remained weak at -0.12. The Chicago Fed reported that during May, 52 of the 85 individual indicators made positive contributions to the overall index while 33 made negative contributions.

The CFNAI is a weighted average of 85 indicators of national economic activity. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend and a negative index reading corresponds to growth below trend.

The Chicago Federal Reserve figures are available in Haver's SURVEYS database.

| Chicago Federal Reserve Bank | May | Apr | Mar | May'13 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|

| CFNAI | 0.21 | -0.15 | 0.49 | 0.00 | -0.01 | -0.05 | -0.07 |

| 3-Month Moving Average | 0.18 | 0.31 | 0.10 | -0.20 | -- | -- | -- |

| Personal Consumption & Housing | -0.12 | -0.15 | -0.05 | -0.15 | -0.15 | -0.21 | -0.29 |

| Employment, Unemployment & Hours | 0.10 | 0.26 | 0.17 | -0.03 | 0.09 | 0.10 | 0.13 |

| Production & Income | 0.20 | -0.23 | 0.27 | -0.05 | 0.02 | 0.04 | 0.05 |

| Sales, Orders & Inventories | 0.04 | -0.03 | 0.10 | 0.17 | 0.03 | -0.01 | 0.03 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates