Global| Oct 31 2016

Global| Oct 31 2016Chicago Purchasing Managers Index Declines Sharply

by:Tom Moeller

|in:Economy in Brief

Summary

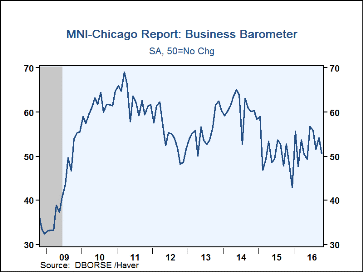

The Chicago Purchasing Managers Business Barometer Index fell to 50.6 during October following an unrevised increase to 54.2 during September. The latest was the lowest level since May. The figure compared to expectations for 53.8 in [...]

The Chicago Purchasing Managers Business Barometer Index fell to 50.6 during October following an unrevised increase to 54.2 during September. The latest was the lowest level since May. The figure compared to expectations for 53.8 in the Action Economics Forecast Survey.

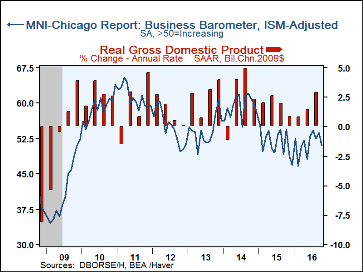

Haver Analytics constructs an ISM-Adjusted Index using the Chicago numbers, comparable to the overall ISM index to be released tomorrow. Our figure declined to 51.0. During the last ten years, there has been a 61% correlation between the adjusted Chicago Purchasing Managers index and real GDP growth.

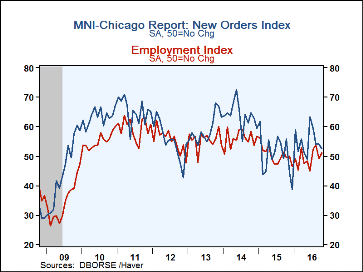

The new orders series eased to 52.5 from 54.1, leaving it at the lowest point since May. The production series dropped sharply to 54.4, the weakest level in three months. Inventories & supplier deliveries also fell, but order backlogs improved.

The employment figure also increased to 51.1, and was above break-even for the third month in the last four. During the last ten years, there has been an 81% correlation between the employment figure and the m/m change in factory sector employment.

The prices paid reading rose to 59.5. The figure compared to a February low of 41.1 and was the highest since November 2014. An increased 21% (NSA) of respondents reported paying higher prices while a steady 8% paid less.

The MNI Chicago Report is produced by MNI/Deutsche Borse Group in partnership with ISM-Chicago. The survey covers a sample of over 200 purchasing professionals in the Chicago area with a monthly response rate of about 50%. The ISM-Adjusted headline index is calculated by Haver Analytics using these data to construct a figure with the ISM methodology. The figures can be found in Haver's SURVEYS database. The Consensus expectations figure is available in AS1REPNA.

| Chicago Purchasing Managers Index (%, SA) | Oct | Sep | Aug | Oct '15 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| General Business Barometer | 50.6 | 54.2 | 51.5 | 52.6 | 50.3 | 60.7 | 56.0 |

| ISM-Adjusted General Business Barometer | 51.0 | 53.7 | 52.5 | 54.5 | 51.6 | 59.3 | 54.2 |

| Production | 54.4 | 59.8 | 52.5 | 58.3 | 52.5 | 64.5 | 58.2 |

| New Orders | 52.5 | 54.1 | 53.9 | 55.6 | 50.4 | 63.8 | 59.1 |

| Order Backlogs | 44.4 | 42.3 | 41.7 | 45.4 | 44.4 | 54.2 | 48.8 |

| Inventories | 45.9 | 50.3 | 49.8 | 58.7 | 52.1 | 55.9 | 45.6 |

| Employment | 51.1 | 49.2 | 53.7 | 49.5 | 50.3 | 56.0 | 55.6 |

| Supplier Deliveries | 51.2 | 55.0 | 52.7 | 50.4 | 52.5 | 56.5 | 52.5 |

| Prices Paid | 59.5 | 55.5 | 54.6 | 43.9 | 46.8 | 61.0 | 59.8 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates