Global| Jan 30 2015

Global| Jan 30 2015Chicago Purchasing Managers Index Remains Weak; Prices Collapse

by:Tom Moeller

|in:Economy in Brief

Summary

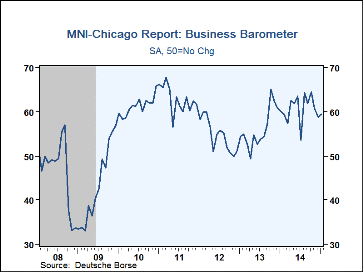

Chicago purchasing managers indicated that their January Business Barometer Index ticked higher to 59.4 but remained down from 64.5 reached three months ago. The reading fell short of expectations for 57.9 in the Action Economics [...]

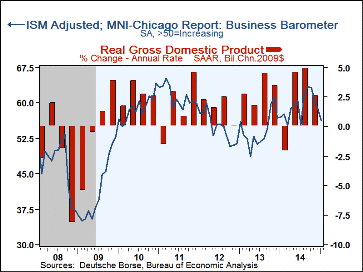

Chicago purchasing managers indicated that their January Business Barometer Index ticked higher to 59.4 but remained down from 64.5 reached three months ago. The reading fell short of expectations for 57.9 in the Action Economics Forecast Survey. Haver Analytics constructs an ISM-Adjusted Index, comparable to the overall ISM index to be released Monday. Our figure declined to 56.2, the lowest level in six months. During the last ten years, there has been a 62% correlation between the adjusted Chicago Purchasing Managers index and real GDP growth.

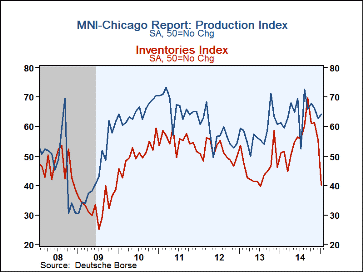

The new orders index improved slightly to 61.6 but remained well below the high of 70.8 in May. The order backlog figure also rose to 51.9 and remained under the 59.6 high last May. Employment improved to 60.1, its highest level since November 2013. During the last ten years, there has been an 82% correlation between the employment figure and the m/m change factory sector employment. The production series also improved moderately. Offsetting these gains was a collapse in the inventories number to 40.1, its lowest level since July 2013. The supplier delivery index also fell to 54.9, indicating the quickest delivery speeds in six months.

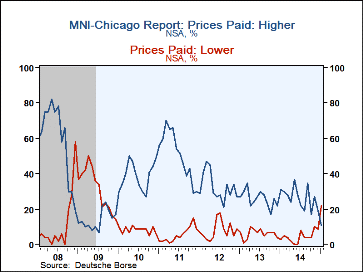

The index of prices paid collapsed to 44.2, the lowest point since the end of the recession in 2009. Only 11 percent (NSA) of respondents reported paying higher prices while 22 percent paid less.

The MNI Chicago Report is produced by MNI/Deutsche Borse Group in partnership with ISM-Chicago. The survey covers a sample of over 200 purchasing professionals in the Chicago area with a monthly response rate of about 50%. The ISM-Adjusted headline index is calculated by Haver Analytics using these data to construct a figure using the ISM methodology. The figures can be found in Haver's SURVEYS database. The Consensus expectations figure is available in AS1REPNA.

| Chicago Purchasing Managers Index (%, SA) | Jan | Dec | Nov | Jan'14 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|

| ISM-Adjusted General Business Barometer | 56.2 | 58.5 | 60.7 | 57.0 | 59.4 | 54.3 | 54.8 |

| General Business Barometer | 59.4 | 58.8 | 60.7 | 60.1 | 60.7 | 56.1 | 54.6 |

| Production | 64.1 | 62.7 | 66.2 | 61.4 | 64.5 | 58.3 | 57.6 |

| New Orders | 61.6 | 59.8 | 61.6 | 64.3 | 63.8 | 59.2 | 55.1 |

| Order Backlogs | 51.9 | 48.0 | 52.3 | 57.6 | 54.2 | 48.9 | 48.0 |

| Inventories | 40.1 | 55.5 | 61.4 | 51.0 | 56.0 | 45.7 | 51.4 |

| Employment | 60.1 | 56.4 | 56.3 | 53.4 | 56.0 | 55.6 | 55.3 |

| Supplier Deliveries | 54.9 | 58.3 | 58.0 | 55.1 | 56.5 | 52.5 | 54.9 |

| Prices Paid | 44.2 | 58.1 | 59.6 | 64.0 | 61.0 | 59.9 | 62.2 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates