Global| Jan 29 2007

Global| Jan 29 2007Chicago Surveys Show Some Reversal in Down Trends

Summary

The Chicago Federal Reserve Bank's Midwest manufacturing index, shown in the attached chart, increased 0.06% in December, reversing the down trend of the past four months. The index covers activity in Iowa, Indiana, Michigan, [...]

The Chicago Federal Reserve Bank's Midwest manufacturing index, shown in the attached chart, increased 0.06% in December, reversing the down trend of the past four months. The index covers activity in Iowa, Indiana, Michigan, Wisconsin and most of Illinois. The bank also publishes indexes for the Auto, Steel, Machinery and Resource industries. As its name suggests, Resource Industries include food and related products, lumber, wood and paper products, chemicals, petroleum, coal, stone and glass.

The index for the auto sector rose 1.8% from November but was 0.5% below December, 2005. The machinery sector increased 1.3% in December and was 4.9% above December, 2005. Comparable figures for the steel sector were -1.2% and 1.0%; and for the resource sector, 1.0% and 1.9%. The Decemberrelease from the bank can be seen here.

| FEDERAL RESERVE BANK OF CHICAGO | Dec 06 | Nov 06 | Dec 05 | M/M % | Y/Y % | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| SURVEY OF MANUFACTURING (Index 2002=100) |

||||||||

| Total | 104.5 | 103.9 | 102.6 | 0.58 | 1.85 | 104.4 | 100.8 | 98.8 |

| Autos | 92.1 | 95.4 | 97.6 | 1.78 | -0.51 | 97.9 | 95.8 | 96.8 |

| Steel | 103.6 | 104.9 | 102.6 | -1.24 | 0..97 | 106.7 | 101.6 | 100.1 |

| Machinery | 112.2 | 110.7 | 106.9 | 1.26 | 4.86 | 109.9 | 103.5 | 99.5 |

| Resource | 106.0 | 105.9 | 104.0 | 0.09 | 1.92 | 105.4 | 102.6 | 99.6 |

by Louise Curley January 29, 2007

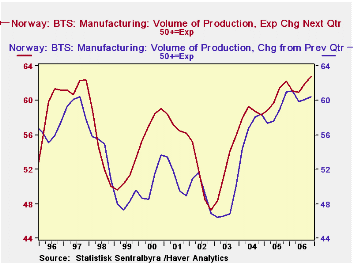

Expectations of business conditions in Norway and Sweden improved in the latest surveys. The data for manufacturing in Norway are expressed in the form of a diffusion index and are reported quarterly. The data for manufacturing in Sweden are expressed in terms of percent balances and are reported monthly.

Both the appraisals of current production and expectations for the next three months are especially strong in Norway. The index for current production reached a peak of 61.1 in the first quarter of 2006, declined in the second quarter to 59.9. but rose in the third quarter to 60.1 and again in the fourth quarter to 60.4. The previous peak in the last ten years was 60.4 in the third quarter of 1997. The index for expectations in the fourth quarter was 62.8 and is the highest value since the fourth quarter of 1997 when the index was 62.4. The first chart shows the diffusion indexes for current and expected production in Norway.

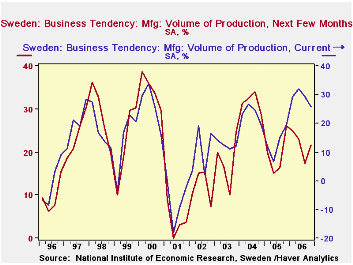

Sweden has expectations data for January figure but not current production data. Partly for this reason and also for comparability with Norway, we have aggregated the data for Sweden on a quarterly basis. The second chart shows the percent balances for current and expected production for Sweden on a quarterly basis. While the excess of optimists over pessimists regarding current production declined by 3 percentage points in the fourth quarter, the excess of optimists over pessimists regarding expectations increased by 5 percentage points. According to the January figure for expected production the excess of optimists over pessimists was 19%.

| SURVEYS OF MANUFACTURING | 4Q 06 | 3Q 06 | 4Q 05 | Q/Q Dif | Y/Y Dif | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Norway (Diffusion Index) | ||||||||

| Current Production | 60.4 | 60.1 | 61.0 | 0.3 | -0.6 | 60.4 | 58.8 | 56.9 |

| Expectations 3 Months Ahead | 62.8 | 62.0 | 62.2 | 0.8 | 0.6 | 61.7 | 60.5 | 58.5 |

| Sweden (Percent Balance) | ||||||||

| Current Production | 26.0 | 29 | 19 | -3 | 7 | 29 | 13 | 24 |

| Expectations 3 Months Ahead | 22 | 17 | 26 | 5 | -4 | 22 | 19 | 32 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates