Global| Sep 30 2009

Global| Sep 30 2009Consumer Confidence Spurts in UK

Summary

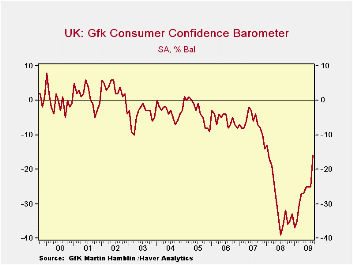

U.K. consumer confidence jumped in September by the most since 1995 as optimism about the economy’s prospects rebounded, according to GfK NOP. The index of confidence jumped by the greatest amount since 1995 and the level reading of [...]

U.K. consumer confidence jumped in September by the most since

1995 as optimism about the economy’s prospects rebounded, according to

GfK NOP. The index of confidence jumped by the greatest amount since

1995 and the level reading of -16 is it’s highest Since January of 2008.

Still the headline reading is only in the 57th percentile of

its 10-Year range. And the headline, at -16, is still negative.

The current and past readings on the index are still sour. The

financial situation over the past 12 months is a bottom 29 percentile

reading while the current financial situation is rated in the 36th

percentile a bare-bones increase. But for the next 12-months the rating

flies up to 71st percentile. Even with that, the environment for making

a major purchase only rises from a 45th percentile response currently

to a 48th percentile response in the future. Improvement? Yes! Much

improvement? No!

The general economic situation is rated in the 27th percentile

over the past 12 months that jumps to the highest reading in at least

10-years over the next 12-months.

Deja-What?

We have seen this sort of thing before. We got exactly the

same sort of response from Italy’s consumers within the last week.

There is a great belief on the part of consumers that in the

next12-months things are going to be much better than they were and

than they are. Meanwhile, although global stock markets are rising

sharply, there is a lot of stock market pessimism and the rise itself

has been accomplished on low volume for the most part. Government

projections for growth are moderate-to-downbeat and private sector

economists have been dragged every step of the way to an improved

forecast by ever improving economic data. It is curious that with

pessimism in the wind in the woodwork everywhere that consumers are so

upbeat. Are they right to be confident –do they know something? Or, are

they just naïve? In Italy we have observed that a day after its

consumers were so upbeat the business sentiment survey there

backtracked.

Expectations…

Very clearly this is a recovery with expectations scattered to the

winds. It is hard to tell what a given group will think and why, let

alone how long, that they will think it. We have markets that

outperform expectations but without believers. After the last 12-months

it is not surprising to have confusion, but despite some very active

government intervention it is strange indeed that consumers are the

most impressed and businesses are skeptical and financial experts seem

apoplectic with the good news to the point to disbelief or even

rejection.

Impact on performance

All of this has to affect how the economy actually performs. We know

that expectations are important but we also know they are not etched in

stone and we can debate how much they affect behavior. For the time

being the consumer seems to be the backbone of whatever optimism we

have. This is clear in the UK and in the Italy; it seems somewhat the

same in the US. Will it be enough to keep the consumer-led expansions

going? Since we depend on the consumers’ spending it may be. But note

the dark side to the UK response on spending; it is different from the

Italian response. In the UK there is skepticism that the buying climate

will improve by much but in Italy a big improvement is expected in that

climate. On balance we can say that consumers appear to be more

optimistic than most but we cannot say that their optimism is for the

same reasons and therefore it might not be well-grounded.

| GFK Consumer Survey | ||||||

|---|---|---|---|---|---|---|

| % of 2Yr | % of 10Yr | |||||

| Sep-09 | Aug-09 | Jul-09 | Jun-09 | Range | Range | |

| Consumer Confidence | -16 | -25 | -25 | -25 | 65.7% | 57.5% |

| Current | ||||||

| Household Financial Situation | 18 | 14 | 15 | 16 | 36.4% | 36.4% |

| Major Purchases | -15 | -26 | -25 | -26 | 59.6% | 45.9% |

| Last 12 Months | ||||||

| Household Financial Situation | -13 | -18 | -19 | -18 | 29.2% | 29.2% |

| General Economic Situation | -63 | -69 | -72 | -73 | 33.3% | 27.5% |

| CPI | 67 | 62 | 65 | 68 | 10.4% | 37.7% |

| Savings | -5 | -10 | -12 | -15 | 29.9% | 29.9% |

| Next 12-Months | ||||||

| Household Financial Situation | 5 | 0 | 0 | 1 | 74.2% | 71.9% |

| General Economic Situation | 4 | -9 | -8 | -8 | 100.0% | 100.0% |

| Unemployment | 46 | 53 | 56 | 57 | 38.8% | 50.8% |

| Major Purchases | -28 | -36 | -36 | -36 | 54.5% | 48.0% |

| Savings | 0 | -1 | 1 | -2 | 13.0% | 11.5% |

| CPI | 58 | 52 | 51 | 49 | 35.3% | 35.3% |

| By Income | ||||||

| Lower | -23 | -30 | -31 | -31 | 59.5% | 51.2% |

| Upper | -12 | -15 | -16 | -15 | 60.6% | 51.3% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates