Global| Oct 30 2007

Global| Oct 30 2007Consumer Confidence Tanked as Gasoline Prices Rose & Home Prices Fell

by:Tom Moeller

|in:Economy in Brief

Summary

Consumer confidence fell in October according to the Conference Board Survey. The 3.9% m/m decline was preceded by declines of 5.8% and 5.6% during the prior two months. The decline in the index to 95.6, in fact, was to the lowest [...]

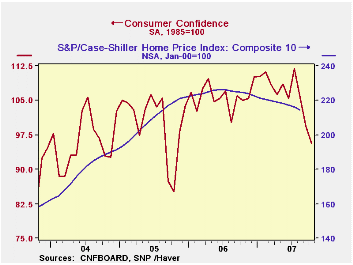

Consumer confidence fell in October according to the Conference Board Survey. The 3.9% m/m decline was preceded by declines of 5.8% and 5.6% during the prior two months.

The decline in the index to 95.6, in fact, was to the lowest level since October 2005. Economists generally had expected a lesser decline to 99.0.

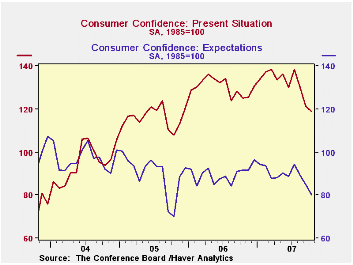

The present conditions fell 2.0% after declines of 6.8% and 5.9% during the prior two months. The decline also was to the lowest level in about two years.

The percentage of respondents who viewed business conditions as good dropped sharply for the third consecutive month while the percentage who viewed jobs as plentiful also fell hard for the third month. Those who felt jobs were hard to get rose to the highest since late 2005.

The expectations index similarly fell sharply by 5.8% m/m to the lowest in two years. Expectations about business conditions and income both fell but expectations about employment rose slightly.

Plans to buy major appliances fell most sharply to the lowest in two years while plans to buy carpet held steady at a low level. The percentage of respondents who would buy a new car fell to the lowest since July.

The expected inflation rate in twelve months remained at 5.1%, equal to expectations during all of last year for inflation in twelve months.

U.S. home prices fell 0.8% m/m in August for the 14th consecutive month, according to the S&P/Case-Shiller home price index composite 10.

The index of just 10 U.S. cities and their surrounding areas is not adjusted for the quality or the size of the home. It fell five percent in August from a year ago.

| Conference Board (SA, 1985=100) |

October | September | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Consumer Confidence Index | 95.6 | 99.5 | -9.0% | 105.9 | 100.3 | 96.1 |

| Present Conditions | 118.8 | 121.2 | -5.0% | 130.2 | 116.1 | 94.9 |

| Expectations | 80.1 | 85.0 | -12.8% | 89.7 | 89.7 | 96.9 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.