Global| Jul 18 2003

Global| Jul 18 2003Consumer Sentiment Up Slightly

by:Tom Moeller

|in:Economy in Brief

Summary

The mid-July reading of Consumer Sentiment from the University of Michigan rose 0.7% from June to 90.3. Consensus expectations were for a reading of 91.0. Consumer Sentiment rose as consumer's read of current conditions jumped 7.8%, [...]

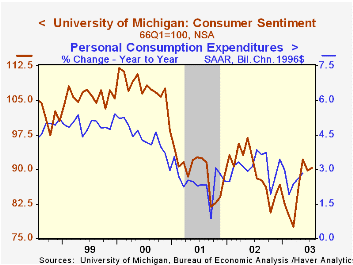

The mid-July reading of Consumer Sentiment from the University of Michigan rose 0.7% from June to 90.3. Consensus expectations were for a reading of 91.0.

Consumer Sentiment rose as consumer's read of current conditions jumped 7.8%, the largest one month rise in over ten years. The index of consumer expectations fell 4.3% for the second consecutive monthly decline.

Over the last ten years there has been a 66% correlation between the level of consumer sentiment and the y/y change in real PCE. The correlation over the last five years has been 82%.

The University of Michigan survey is not seasonally adjusted.It is based on telephone interviews with 250 households nationwide on personal finances and business and buying conditions. The survey is expanded to a total of 500 interviews at month end.

| University of Michigan | Mid-July | June | Y/Y | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Consumer Sentiment | 90.3 | 89.7 | 2.5% | 89.6 | 89.2 | 107.6 |

by Tom Moeller July 18, 2003

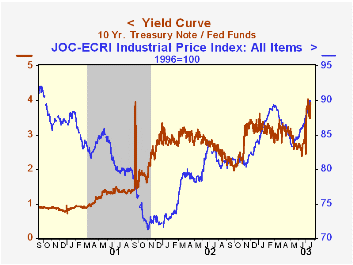

Two "market based indicators of monetary policy" recently have further flashed a signal that the Federal Reserve's attempts to reflate the U.S. economy will succeed.

The yield curve (the ratio of the rate on the 10 year Treasury note to Federal funds) steepened sharply last month then took another leg up earlier this week after Chairman Greenspan suggested that short term interest rates would be held low for some time.

The prepared text of the Chairman's testimony on Tuesday is available here.

A report from the Federal Reserve Bank of San Francisco titled "What Makes the Yield Curve Move? is available here.

Commodity prices also have recently signaled reflation. The price index complied by the Economic Cycle Research Institute (ECRI) is up roughly 7% from its lows this past Spring. Higher prices for metals, textiles and "miscellaneous," including petroleum products, have contributed to the gain.

The higher value of the dollar, up more than 4% since early June, has reversed some of the indication of reflation it flashed earlier this year and in 2002. Much of the rise has been against the Euro and is a reversal of prior sharp declines. But the dollar also is up versus the UK pound and stable versus the Japanese yen.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates