Global| May 28 2020

Global| May 28 2020Durable Goods Orders Collapsed Further in April

by:Sandy Batten

|in:Economy in Brief

Summary

• Durable goods orders collapsed 17.2% m/m in April, the largest decline since August 2014, on top of a downwardly revised 16.6% m/m drop in March. • Transportation orders plummeted 47.3% m/m after a 43.1% m/m fall in March. • Both [...]

• Durable goods orders collapsed 17.2% m/m in April, the largest decline since August 2014, on top of a downwardly revised 16.6% m/m drop in March.

• Transportation orders plummeted 47.3% m/m after a 43.1% m/m fall in March.

• Both core capital goods shipments and orders fell less than expected in April.

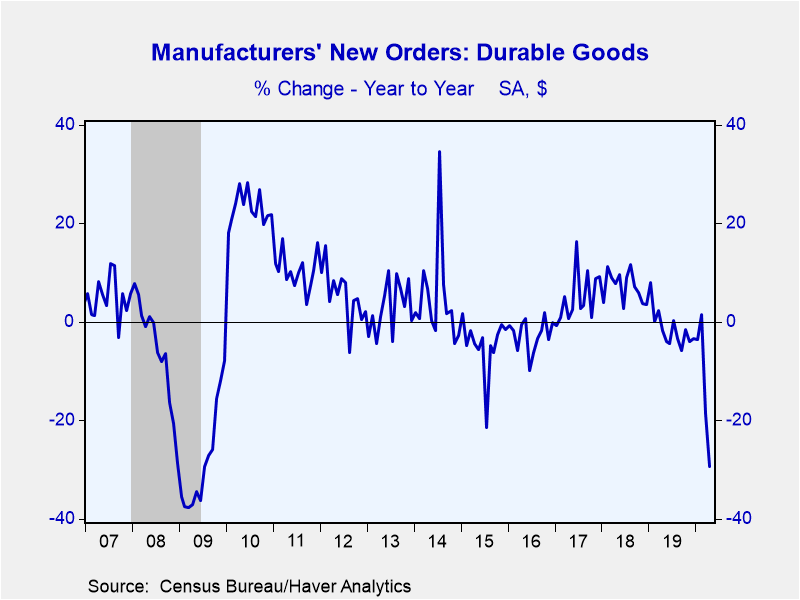

Orders for durable goods fell 17.2% m/m in April (-29.3% y/y) on top of a downwardly revised 16.6% m/m drop (originally -14.4%) in March as the coronavirus lockdown brought economic activity to its knees. The Action Economics Forecast panel had expected a 17.2% m/m decline. Though the April decline was widely spread, it was led by collapsing transportation orders, as in March, which fell 47.2% m/m in April (-67.6% y/y) following a 43.1% m/m drop in March. For March and April, transportation orders are down 70%. Orders excluding transportation orders fell 7.4% m/m in April (-9.3% y/y) after a 1.7% m/m decrease in March.

Orders for primary metals were down 13.8% m/m in April versus a 4.3% m/m decline in March. Orders for fabricated metal products declined 12.0% m/m in April after a 3.5% fall in March. Machinery orders dropped 6.8% m/m following a 1.8% m/m drop in March. Orders for computers and electronic products edged down 0.3% m/m after a 0.7% monthly fall in March. Orders for electrical equipment and appliances fell 7.8% after a 0.7% m/m gain in March. Orders for nondefense aircraft and parts were again negative in April, indicating that more existing orders were cancelled in April than new orders made. Motor vehicle orders plummeted 52.8% in April, the largest monthly decline by a factor of two on record dating back to 1992.

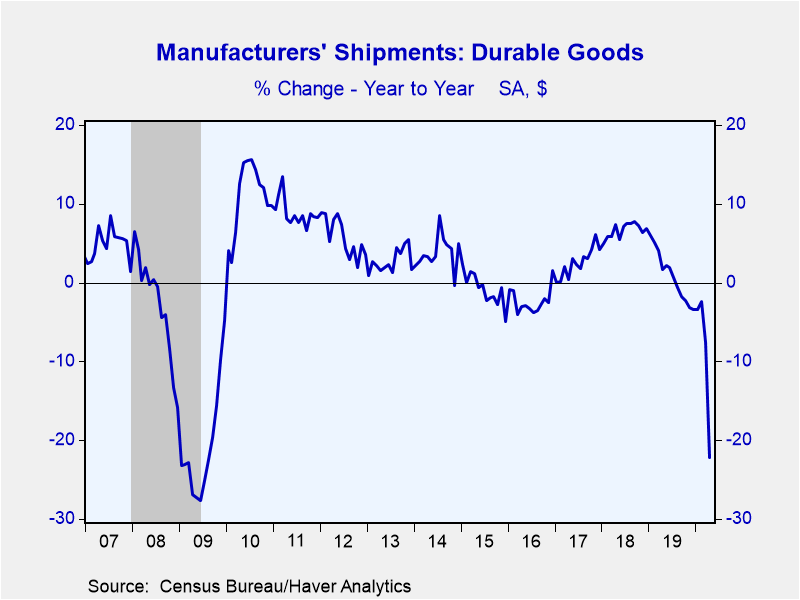

Shipments of durable goods slumped 17.7% m/m in April (-22.2% y/y) after a 5.5% monthly decline in March. As for orders, the April decline in shipments was widely spread but led by weakness in transportation shipments (-42.7% m/m). Motor vehicle shipments plummeted 52.9% m/m while shipments of nondefense aircraft and parts fell 58.3% m/m.

Capital goods orders and shipments were also weak in April, but not as weak as many had feared. Core capital goods shipments (that is, shipments of nondefense capital goods excluding aircraft) are an accurate indicator of real business spending on equipment. These fell 5.4% m/m in April but are down only 6.6% in March and April. If April is the weakest month as many in the markets are expecting, then the Covid-19 hit to business equipment spending may not be as bad as initially feared. This reason for tentative optimism was also reflected in core capital goods orders, which fell a less-than-expected 5.8% m/m in April.

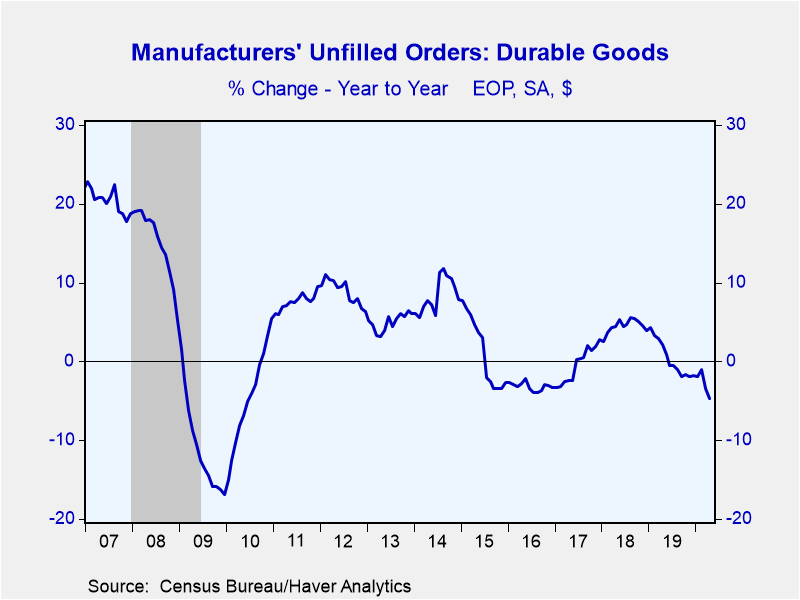

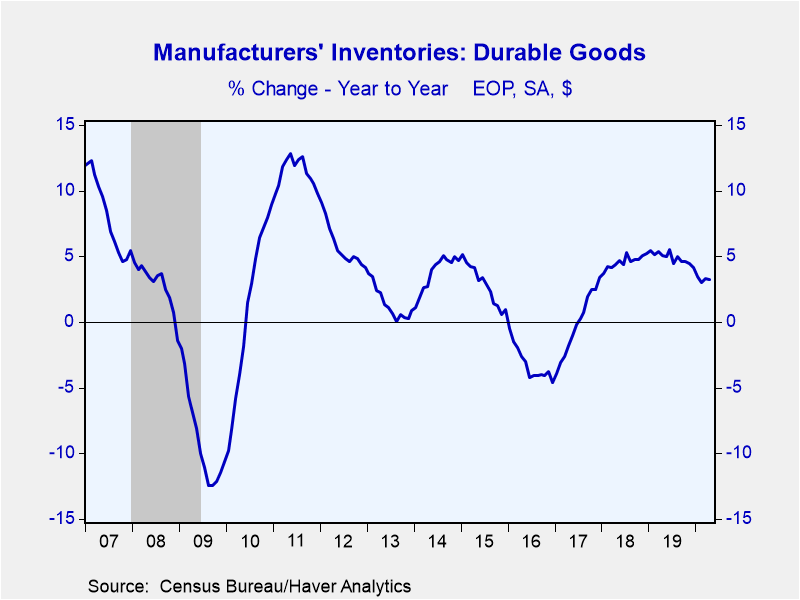

Unfilled orders for durable products declined 1.6% (-4.7% y/y) in April. Inventories of durable goods increased 0.2% m/m (+3.2% y/y) in April.

The durable goods figures are available in Haver's USECON database. The Action Economics consensus forecast figure is in the AS1REPNA database.

| Durable Goods NAICS Classification | Apr | Mar | Feb | Apr Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| New Orders (SA, % chg) | -17.2 | -16.6 | 2.0 | -29.3 | -1.2 | 7.9 | 5.4 |

| Transportation | -47.3 | -43.1 | 6.4 | -67.6 | -4.3 | 9.8 | 3.2 |

| Total Excluding Transportation | -7.4 | -1.7 | -0.3 | -9.3 | 0.4 | 6.9 | 6.5 |

| Nondefense Capital Goods Excl. Aircraft | -5.8 | -1.1 | -0.6 | -6.3 | 0.9 | 6.0 | 6.7 |

| Shipments | -17.7 | -5.5 | 0.8 | -22.2 | 1.2 | 7.1 | 4.0 |

| Nondefense Capital Goods Excl. Aircraft | -5.4 | -1.2 | -0.6 | -6.9 | 2.1 | 6.3 | 5.6 |

| Unfilled Orders | -1.6 | -2.1 | 0.3 | -4.7 | -2.1 | 3.9 | 1.9 |

| Inventories | 0.2 | 0.6 | -0.1 | 3.2 | 4.7 | 4.8 | 4.5 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.