Global| Jul 31 2019

Global| Jul 31 2019East Meets West... At Slower Pace; All Early EMU GDP Reporters Show Slowing/China'S MFG Contracts

Summary

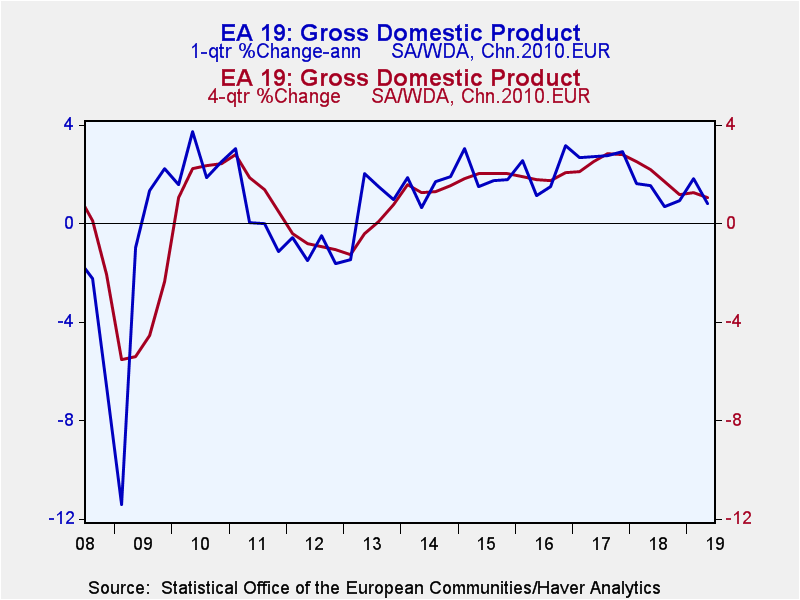

Euro area GDP slowed in Q2 to a Q/Q pace of less than 1%. Year-over-year growth in the EMU, at 1.1%, is the weakest since Q4 2013. And EMU inflation in July is the lowest it has been year-over-year since late-2016. This combination is [...]

Euro area GDP slowed in Q2 to a Q/Q pace of less than 1%. Year-over-year growth in the EMU, at 1.1%, is the weakest since Q4 2013. And EMU inflation in July is the lowest it has been year-over-year since late-2016. This combination is surely one that will not sit well with the ECB whose key rate is already at and below the zero bound and now, with inflation also underpinning an extremely low rate, finds that policy risks have risen. Falling inflation undermines the impact of low rates or causes rates to have to move lower to retain the same degree of stimulus. This is not the moving target that the ECB expected to be shooting at this year.

Euro area GDP slowed in Q2 to a Q/Q pace of less than 1%. Year-over-year growth in the EMU, at 1.1%, is the weakest since Q4 2013. And EMU inflation in July is the lowest it has been year-over-year since late-2016. This combination is surely one that will not sit well with the ECB whose key rate is already at and below the zero bound and now, with inflation also underpinning an extremely low rate, finds that policy risks have risen. Falling inflation undermines the impact of low rates or causes rates to have to move lower to retain the same degree of stimulus. This is not the moving target that the ECB expected to be shooting at this year.

Core inflation in the EMU at 1.2% year-over-year is in the same narrow range it has been in since mid-2017. From early-2016 to mid-2017, the core rate had posted a pace at or below 1% persistently. The core rate has not expanded at pace of 2% or more since December 2008 (although it came very close -and numerically rounded up to 2% - briefly in late-2011 and early-2012). Currently, in view of its past momentum, we look at the EMU core inflation rate as essentially steadying just above the 1% mark. Since inflation will inform the ECB about where interest rates need to be, such low core inflation and a weak headline will prompt the ECB to try to push the inflation rate back up with further stimulus. The ECB policy mandate is wholly focused on attainment of its goal for a bit less than 2% inflation. But the impact of weak GDP growth on inflation at a time that inflation is already seriously undershooting will not be lost on policymakers. New concerns about growth in Germany may even blunt the usual German opposition to the launching of further stimulus.

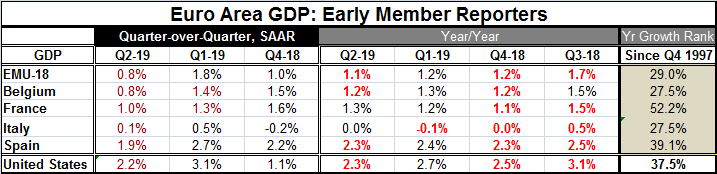

EMU growth already has only a 29% standing among all year-on-year GDP growth rates since 1997. EMU growth has been weaker than its current pace less than 30% of the time. That is not reassuring. Among early reporters, France despite a deceleration in growth quarter-to-quarter has the strongest year-on-year growth rate standing with a positioning in its 52nd percentile. Year-on-year French GDP growth is 1.3% and due to a quirk of past data year-on-year GDP growth even accelerated in Q2. Belgium and Italy also have growth rates that have been lower less one third of the time on this same timeline. Spain's growth ranking is a bit better nearly at its 40th percentile- but still unimpressive and still below its median.

China's MFG PMI improves but not by enough

China's MFG PMI improves but not by enough

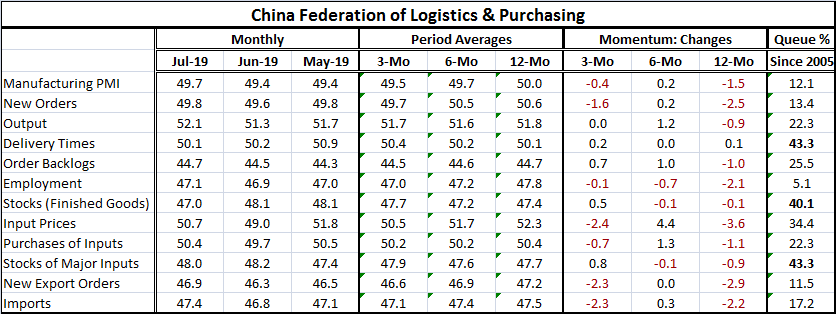

China's manufacturing PMI does improve month-to-month and rises to a value of 49.7 in July from 49.4 in June, but that still leaves it below the so-called boom-bust line of 50. China's manufacturing PMI still averages above 50 over 12 months but it averages below 50 over both six months and three months. The weakness is real.

Good news or worst case scenario in the making?

China and the United States have reopened trade talks. The Trump Administration is turning up pressure on China admonishing it not to try to string out talks to the U.S. elections. News for China is also focusing on how the government is under pressure to create more jobs in the Chinese economy. China has been ramping up credit growth to try to keep economic growth in gear. But from the new reports, it seems that its actions so far have not been sufficient to maintain job market conditions. China would seem to be in a position to want to make a deal sooner rather than later to get its economy in gear. However, it may also have a political calculation that Donald Trump may not win the next election, and may be of the opinion that bargaining with Democrats would be an easier path that would be worth waiting for. Trump is trying to disabuse them of that notion. Is this going to be a stretched out waiting game? That could be a worst case scenario for the global economy.

Manufacturing weakness

The MFG PMI headline for China is weaker on balance over three months (this is this month vs. three-months ago, not a calculation based on average values). Six of 11 components also are weak on balance over three months, with one component unchanged. Over six months the PMI headline improves and only 3 of 11 components decline. But over 12 months the headline deteriorates and 10 of 11 components fall in value.

China's weakness is real

The far right column ranks all the PMI entries on a timeline since 2015. The PMI headline has a queue standing in its 12th percentile on that timeline, weaker than its current value less than 12% of the time. Of course, a contracting reading for Chinese manufacturing would be ‘rare' or unusual over this span when China's economy has been so strong. Still, the Chinese economy is slowing. The slowing may be a bit hard to pin down since all Chinese growth statistics are so strong. But showing outright contraction in manufacturing is a solid signal that there is authentically a slowing in place. It gives credence to reports of job shortages. And it also fits in with regional data showing weakness in a number of adjoining economies.

The global situation

On balance, growth is slowing from Europe to Asia and in the U.S. Today's U.S. ADP report showed a pick-up in job growth month-to-month for that indicator; however, at 156K, job growth was short of its 12-month average gain of 183K. And it has been well short of that average for three-months running. Still, U.S. data are more equivocal than data in other regions. The Fed is meeting today and is expected, for a variety of reasons to cut rates. Even so, global growth is in need of a trade deal between the U.S. and China, much more than it needs a rate cut from the Fed or further easing for the ECB. But sometimes you don't get what you need; but you do get something that can sustain you. That seems to be what is in the cards for this month. The global economy will bide its time and wait for the big structural change that can make a difference in growth: a real trade deal. Meanwhile, central banks will keep us on some version of life support and away from the slippery slope of the zero bound- in the U.S. anyway.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.