Global| Oct 06 2003

Global| Oct 06 2003ECRI Weekly Leading Indicators Signal Above-Trend Economic Growth

by:Tom Moeller

|in:Economy in Brief

Summary

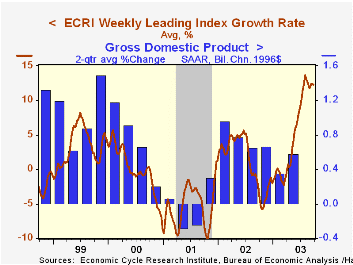

The Weekly Leading Index of the US economy published by the Economic Cycle Research Institute (ECRI) slipped in the last full week of September. Despite the dip, the six-month growth rate of the weekly leading index remained strong at [...]

The Weekly Leading Index of the US economy published by the Economic Cycle Research Institute (ECRI) slipped in the last full week of September.

Despite the dip, the six-month growth rate of the weekly leading index remained strong at 12.3%. During the last ten years there has been a 59% correlation between the six-month growth in the leading index and the two quarter growth in real GDP.

Construction of the ECRI Leading Index differs from the Index of Leading Economic Indicators published by the Conference Board. Nevertheless there has been a 75% correlation between the y/y percent change in the two series over the last 20 years.

The components of the ECRI weekly leading index are money supply plus stock & bond mutual funds, the JOC-ECRI industrial materials price index, mortgage applications, bond quality spreads, stock prices, bond yields, and initial jobless insurance claims.

The median lead of the ECRI index at business cycle peaks has been 10.5 months and at cycle troughs 3.0 months. The sideways movement of the leading index in 2002 may or may not signal something about the economy's growth rate.

For more on ECRI and the Weekly Leading Index go to this link.

A report titled "How Did Leading Indicator Forecasts Perform During the 2001 Recession?" by James H. Stock & Mark W. Watson from the Federal Reserve Bank of Richmond can be found here.

| ECRI Leading Index | 9/26/03 | 9/21/03 | Growth Rate | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|

| Weekly | 128.3 | 128.7 | 12.3% | 1.2% | -5.3% | -0.1% |

| Sept | Aug | |||||

| Monthly | 128.7 | 127.9 | 12.3% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates