Global| Nov 15 2019

Global| Nov 15 2019Empire State Manufacturing Activity Slowed in November

by:Sandy Batten

|in:Economy in Brief

Summary

The Empire State Manufacturing Index of General Business Conditions edged down to 2.9 in November from 4.0 in October. An increase to 5.0 had been expected by the Action Economics Forecast Survey. This means that activity continued to [...]

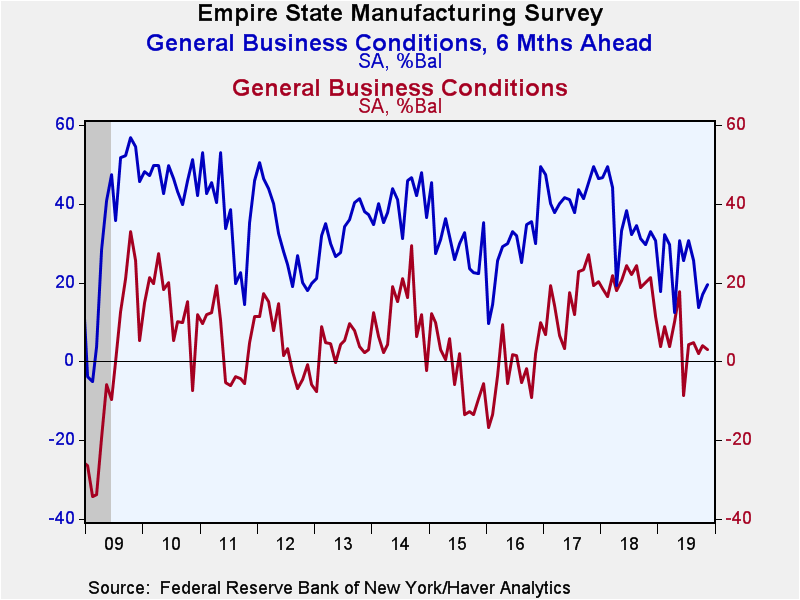

The Empire State Manufacturing Index of General Business Conditions edged down to 2.9 in November from 4.0 in October. An increase to 5.0 had been expected by the Action Economics Forecast Survey. This means that activity continued to increase but at a slower pace than in October. Twenty-eight percent of respondents reported that conditions had improved in November from October while 25.5% reported a worsening. The Empire State data, reported by the Federal Reserve Bank of New York, reflect business conditions in New York state, northern New Jersey and southern Connecticut.

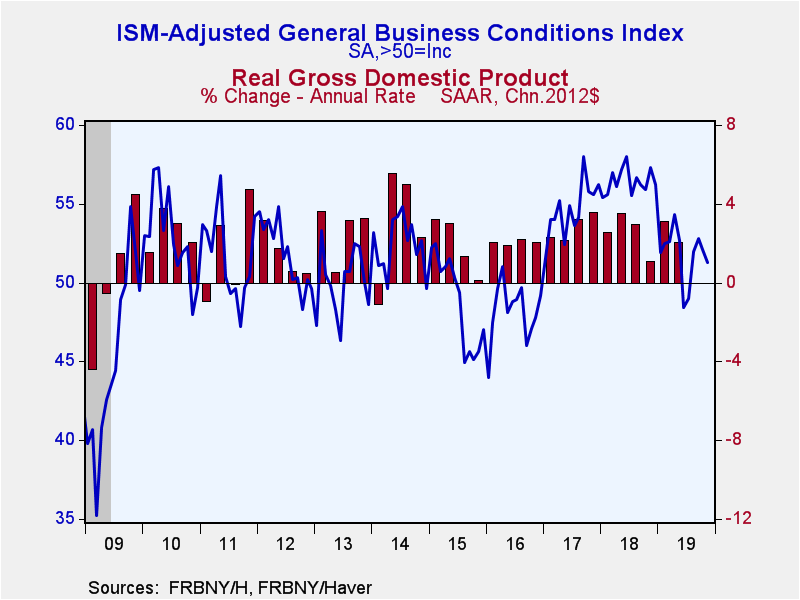

The headline index reflects answers to a separate question. In contrast, the ISM indexes are constructed from the component indexes. Haver Analytics calculates a seasonally adjusted index that is comparable to the headline ISM index from the components of the Empire State index. The ISM-adjusted index eased further to 51.3 in November from 52.1 in October and 52.8 in September but remained in expansion territory and well above the recent low of 48.4 in June. A reading of 50 or greater indicates expansion in business activity. During the past 15 years, there has been a 64% correlation between the index level (which measures change) and the quarter-to-quarter percent change in real GDP.

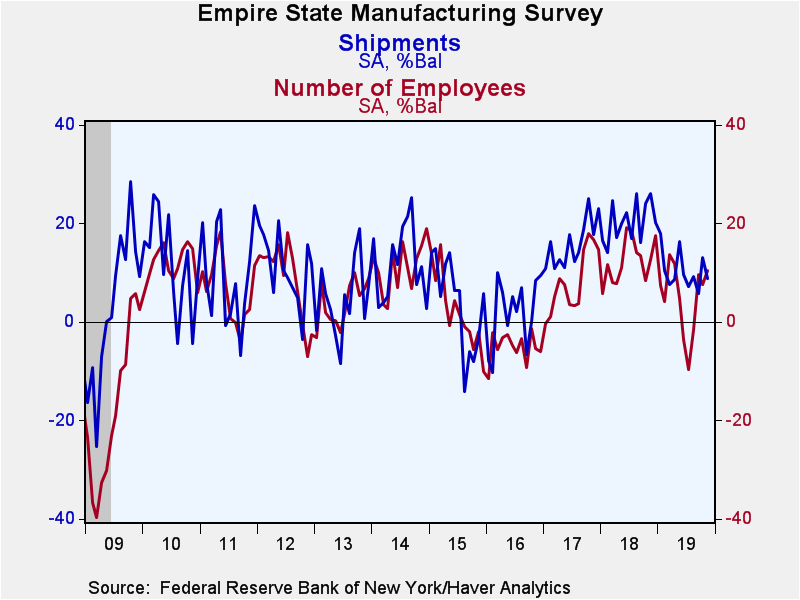

The component series in the Empire State survey continued to demonstrate a mixed performance. The new orders index picked up while the shipments index slowed. Unfilled orders remained negative but less so than in October. Delivery times shortened while inventories were modestly lower.

Labor market conditions in November were solid. Employment continued to expand and at a faster pace than in October. The average workweek also lengthened in November but by less than in October. Twenty-two percent of respondents reported increased jobs while 11.6% report fewer jobs.

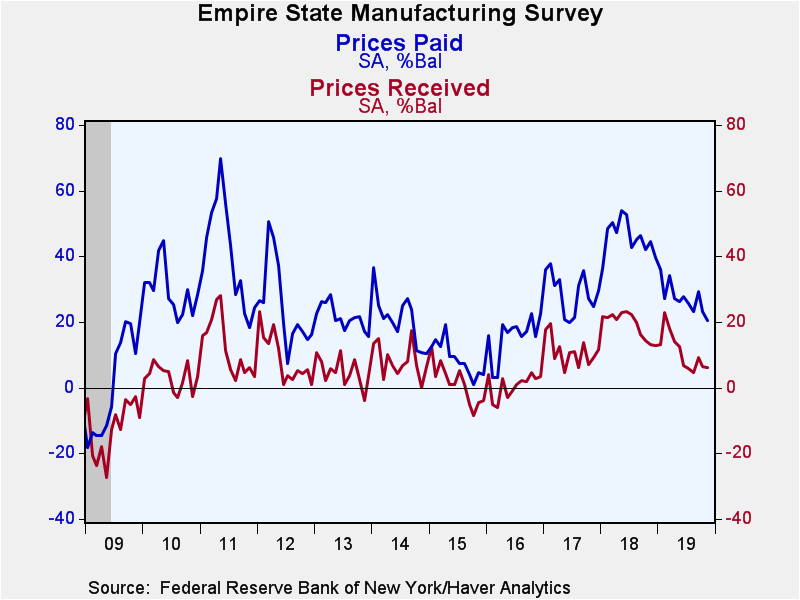

The prices paid index slowed to 20.5 in November from 23.1, indicating that the pace of input price increases slowed. The prices received index was little changed at 6.2 in November (6.3 in October).

The series measuring expectations for business conditions in six months rose for the second consecutive month to 19.4 in November from 17.1 in October. The capital expenditures index jumped 10 points to 19.2 while the technology spending index rose markedly to 15.1 from 8.8.

The Empire State figures are diffusion indexes, which are calculated by subtracting the percentage of respondents reporting declines from the percentage reporting gains. Their values range from -100 to +100. The data are available in Haver's SURVEYS database. The ISM-adjusted headline index dates back to 2001. The Action Economics Forecasts can be found in Haver's AS1REPNA database.

| Empire State Manufacturing Survey | Nov | Oct | Sep | Nov'18 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| General Business Conditions (Diffusion Index, %, SA) | 2.9 | 4.0 | 2.0 | 21.4 | 19.8 | 16.1 | -2.6 |

| General Business Conditions Index (ISM Adjusted, >50=Increasing Activity, SA) | 51.3 | 52.1 | 52.8 | 57.3 | 56.4 | 54.6 | 48.1 |

| New Orders | 5.5 | 3.5 | 3.5 | 18.6 | 16.5 | 14.5 | -0.9 |

| Shipments | 8.8 | 13.0 | 5.8 | 26.1 | 20.4 | 15.9 | 1.9 |

| Unfilled Orders | -8.2 | -12.5 | -2.6 | 0.0 | 3.5 | 1.9 | -8.8 |

| Delivery Time | -5.5 | -2.5 | 0.7 | 4.4 | 9.1 | 6.1 | -4.8 |

| Inventories | -6.2 | -0.6 | 8.5 | 10.9 | 5.9 | 1.5 | -9.6 |

| Number of Employees | 10.4 | 7.6 | 9.7 | 12.7 | 12.4 | 8.1 | -5.1 |

| Average Employee Workweek | 2.3 | 8.3 | 1.7 | 7.9 | 7.8 | 4.6 | -5.1 |

| Prices Paid | 20.5 | 23.1 | 29.4 | 44.5 | 45.8 | 29.0 | 15.7 |

| Prices Received | 6.2 | 6.3 | 9.2 | 13.1 | 19.3 | 11.0 | 0.7 |

| Expectations 6 Months Ahead | 19.4 | 17.1 | 13.7 | 32.9 | 35.2 | 42.7 | 29.0 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.