Global| Dec 15 2020

Global| Dec 15 2020Empire State Manufacturing Index Slips in December but Components Stronger

by:Sandy Batten

|in:Economy in Brief

Summary

• The headline index eased slightly. • However, components were stronger, showing a slight improvement in activity. • Employment posted its strongest performance in months. The Empire State General Business Conditions Index edged [...]

• The headline index eased slightly.

• However, components were stronger, showing a slight improvement in activity.

• Employment posted its strongest performance in months.

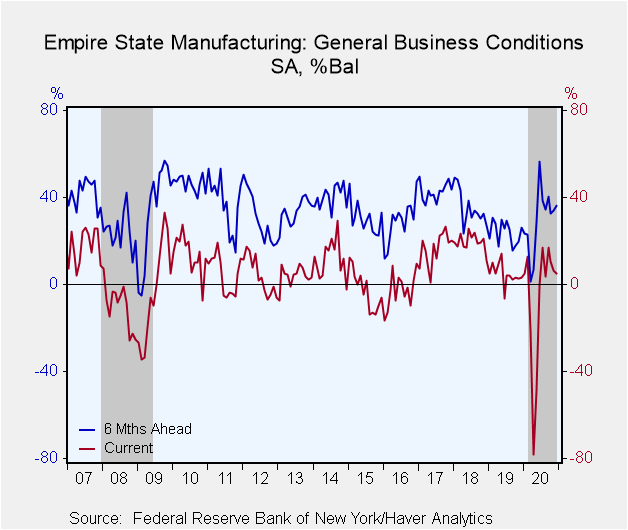

The Empire State General Business Conditions Index edged lower to 4.9 in December from 6.3 in November. This was the sixth consecutive positive reading, indicating that the pace of activity continues to improve. 25.8% of respondents reported increased business conditions in December, down from 30.8% in November, while 20.9% reported a decline versus 24.4% in November. The Business Conditions measure is a diffusion index, constructed by subtracting the percentage decrease from the percentage increase. The Action Economics Forecast Survey expected a slight increase to 6.6. Responses for calculating the index and its components were collected between December 2 and December 9.

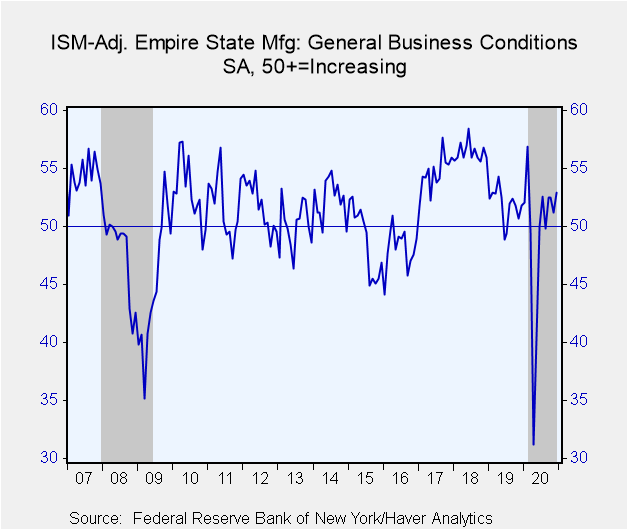

The headline index is constructed from the answer to a single question on business conditions. Haver Analytics calculates an ISM-Adjusted Index from the major components which is similar to the ISM purchasing managers' index. This figure rose to 52.9 in December from 51.2 in November, implying that underlying activity was stronger than implied by the headline index. This was the fourth consecutive month that the index was above 50, which indicates expansion in business activity.

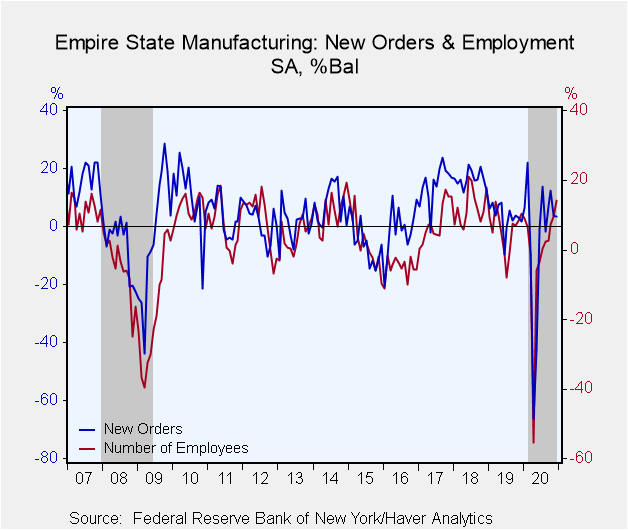

In contrast to the headline index, most of the underlying series strengthened this month. The shipments measure rebounded to 12.1 in December after falling to 6.3 in November, its lowest level since June. Unfilled orders continued to decline but much more slowly in December with its index rising to -3.6 from -11.9 in November. Delivery times lengthened in December with this index rising to 4.3 from 0.7. Inventories continued to fall in December as they have since April, but considerably more slowly. The new orders index eased to 3.4 in December from 3.7, but continued to point to rising orders.

Employment posted its strongest performance since December 2018 as the diffusion index rose to 14.2 in December with the percentage of respondents reducing employees falling to just 6.3% while 20.5% increased employment. The average workweek was unchanged at 4.8 in December with 16.1% of respondents reporting an increase.

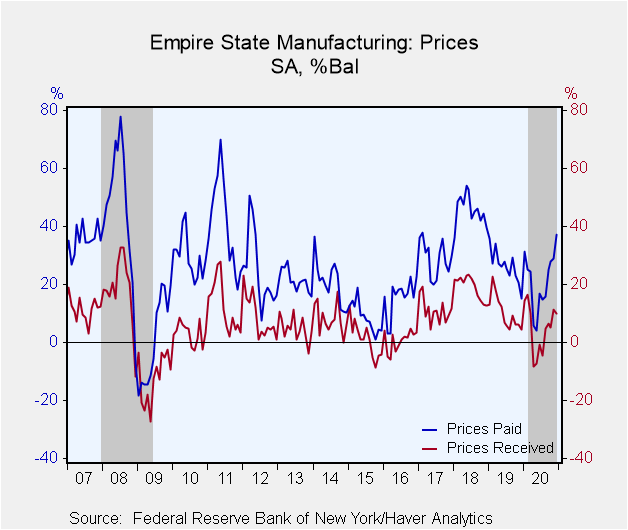

The prices paid index rose further to 37.1 in December, its highest reading since December 2018, from 29.1 in November, indicating that input costs continue to rise. The prices received index slipped to 10.0 in December from 11.3 in November.

Optimism about the future remained positive. The index of general business conditions expected in six months improved to 36.3 in December from 33.9 in November. The December increase was led by improving expectations for shipments, unfilled orders and inventories. Capital expenditure expectations remained elevated but slipped to 16.4 from 17.9.

The Empire State figures are diffusion indexes, which are calculated by subtracting the percentage of respondents reporting declines from the percentage reporting gains. Their values range from -100 to +100. The data are available in Haver's SURVEYS database. The ISM-adjusted headline index dates back to July 2001. The Action Economics Forecasts can be found in Haver's AS1REPNA database.

| Empire State Manufacturing Survey | Dec | Nov | Oct | Dec'19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| General Business Conditions (Diffusion Index, %, SA) | 4.9 | 6.3 | 10.5 | 3.3 | 4.8 | 19.7 | 16.1 |

| General Business Conditions Index (ISM Adjusted, >50=Increasing Activity, SA) | 52.9 | 51.2 | 52.5 | 51.8 | 51.8 | 56.4 | 54.6 |

| New Orders | 3.4 | 3.7 | 12.3 | 1.7 | 3.3 | 16.4 | 14.4 |

| Shipments | 12.1 | 6.3 | 17.8 | 9.5 | 10.5 | 20.3 | 15.8 |

| Unfilled Orders | -3.6 | -11.9 | -6.6 | -13.8 | -6.0 | 3.5 | 1.9 |

| Delivery Time | 4.3 | 0.7 | 2.0 | -5.8 | -0.1 | 9.1 | 6.1 |

| Inventories | -4.3 | -8.6 | -14.6 | 2.2 | -0.9 | 5.9 | 1.5 |

| Number of Employees | 14.2 | 9.4 | 7.2 | 10.4 | 5.4 | 12.3 | 8.0 |

| Average Employee Workweek | 4.8 | 4.8 | 16.1 | 0.7 | 2.3 | 7.8 | 4.6 |

| Prices Paid | 37.1 | 29.1 | 27.8 | 15.2 | 26.3 | 45.8 | 29.0 |

| Prices Received | 10.0 | 11.3 | 5.3 | 4.3 | 10.3 | 19.3 | 11.0 |

| Expectations 6 Months Ahead | 36.3 | 33.9 | 32.8 | 26.1 | 23.9 | 35.2 | 42.6 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.