Global| Jun 20 2014

Global| Jun 20 2014EMU Current Account Surplus Widens on Dangerous Trends

Summary

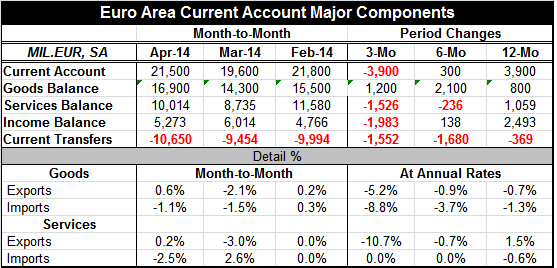

The EMU current account surplus widened month-to-month and is higher year-over-year. The balance of trade in goods is in surplus and it widened month-to-month as well as year-over-year. The services balance is also in surplus and is [...]

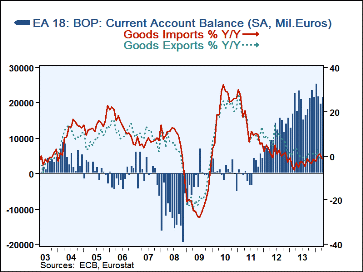

The EMU current account surplus widened month-to-month and is higher year-over-year. The balance of trade in goods is in surplus and it widened month-to-month as well as year-over-year. The services balance is also in surplus and is higher month-to-month and year-over-year, but it has also been slipping over six months. Some of the more local trends in exports and imports show that an erosion of this surplus position may be in the making.

The EMU current account surplus widened month-to-month and is higher year-over-year. The balance of trade in goods is in surplus and it widened month-to-month as well as year-over-year. The services balance is also in surplus and is higher month-to-month and year-over-year, but it has also been slipping over six months. Some of the more local trends in exports and imports show that an erosion of this surplus position may be in the making.

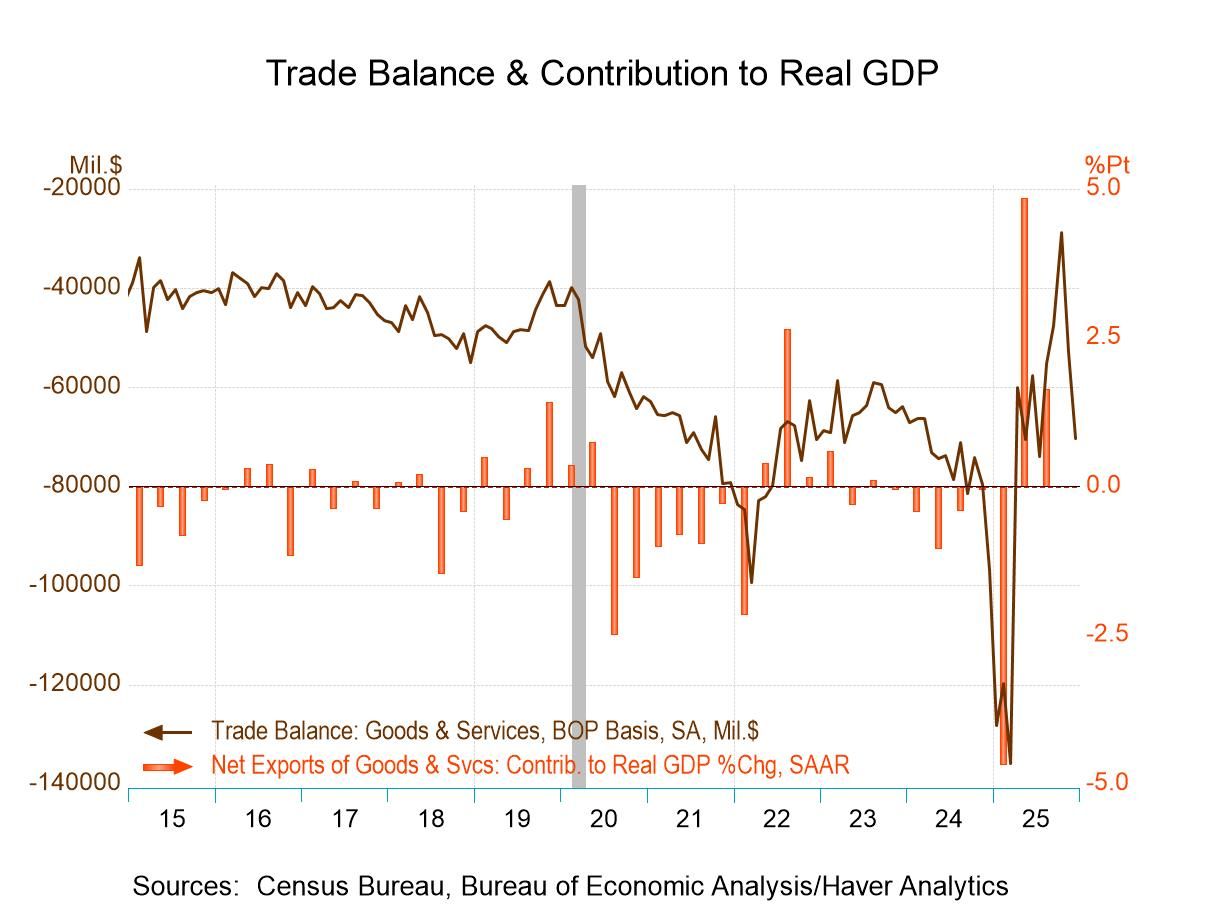

The current account trends are driven mostly by the goods balance. There, imports are chronically weak, falling at an increasingly rapid annual rate pace over shorter time horizons. Export trends are acting the same way but with less vigor.

The weakness in imports is a bad signal about domestic demand strength in the euro area. Even in the last two months imports have had declines of over one percent in each of them. Services import weakness underlines the fact that the weakness in domestic demand of all sorts is real. Goods imports are falling year-over-year for the first time in three months. But prior to that, imports had dropped year-over-year for 14 consecutive months.

This is not the picture we would expect if euro area growth were catching on and showing improvement. If that were in train, imports would be growing. For now the trade data are at odds with some of the other economic reports that show ongoing economic revival. This overall result may not be the relevant picture for each EMU member, but even Germany saw its imports drop over the recent three months while French imports fell at a 17% annual rate.

Trade is important to the euro area as a whole. For the EMU as a whole, the region's current account position is 2.75% of GDP in Q1 2014. This is a consistent position throughout the euro area. Ten of the 12 first euro area members have a surplus on their respective national current accounts. The exceptions are France and Finland. France is in a persistent deficit position while Finland only slipped into the deficit configuration at the end of 2011. However, there are EMU newcomers to the surplus position too.

Italy and Spain, long current account deficit countries, have become surplus countries since Q4 2012. Belgium just began to run a surplus in Q4 2013, the first since Q2 2011. Portugal and Greece ran their first surpluses in a long while: in Q2 2013 for Portugal and in Q3 2013 for Greece. The EMU itself was in deficit position on its current account in Q2 2001 but has moved to surplus ever since.

The fact that many EMU members rely of net exports for growth should make the recent trend in imports and exports worrisome: both are declining. Import weakness may signal weakness in domestic demand. At the same time, the lack of vibrancy in exports and their persistent tendency to decline in recent months is something that Europe should start to have some concerns about. Europe is not growing very strongly and the European Central Bank already has hatched a plan to try to stimulate credit growth and boost inflation up away from the zero bound. With growth so weak in Europe and fiscal expansion out of the question, losing momentum on the trade front or only gaining progress through weakening domestic demand could become very problematic for European policy.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.