Global| Oct 24 2017

Global| Oct 24 2017EMU Manufacturing Is Off to the Races While Services Lag

Summary

The EMU composite index fell back to 55.9 in October from 56.7 in September. The reading is still strong and it's the sixth highest composite score for the EMU since January 2012. The reading, the result of a manufacturing gauge that [...]

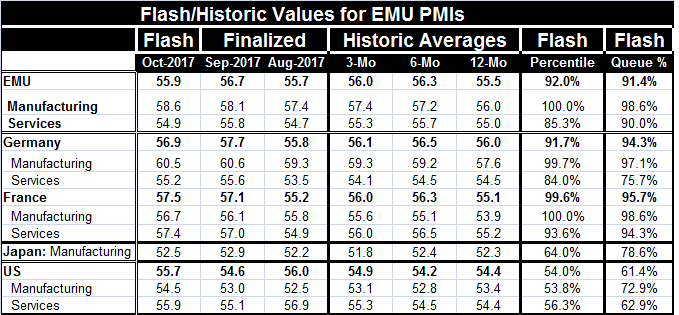

The EMU composite index fell back to 55.9 in October from 56.7 in September. The reading is still strong and it's the sixth highest composite score for the EMU since January 2012. The reading, the result of a manufacturing gauge that has reached a new high reading since January 2012 and a services reading that has backed off this month, is losing some momentum regardless of its still-strong level.

The EMU composite index fell back to 55.9 in October from 56.7 in September. The reading is still strong and it's the sixth highest composite score for the EMU since January 2012. The reading, the result of a manufacturing gauge that has reached a new high reading since January 2012 and a services reading that has backed off this month, is losing some momentum regardless of its still-strong level.

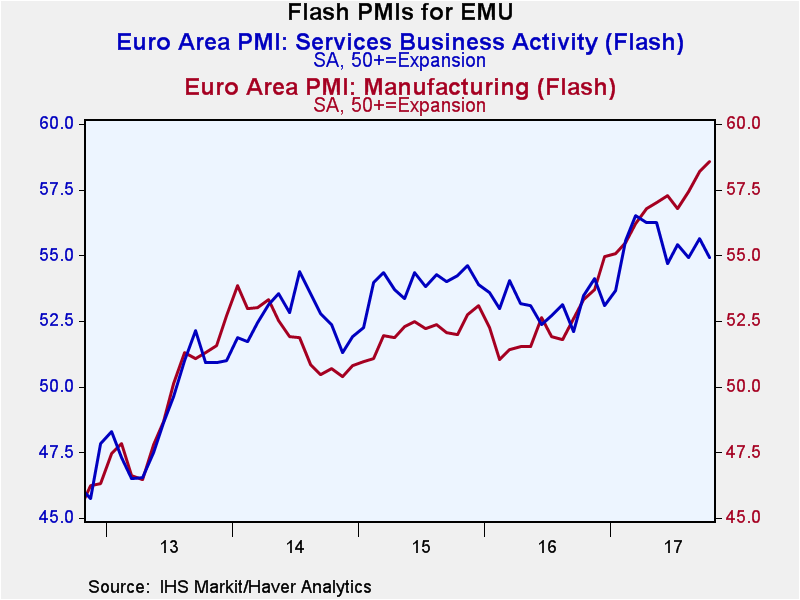

The EMU manufacturing gauge is still on the rise and its 12-month to six-month to three-month moving averages are still gaining. The current monthly reading is above all those averages, indicating that upward momentum is still largely in place for manufacturing. Whereas, for the services reading, the three-month average stands lower than the six-month average and the October reading is below both of them, indicating slipping momentum. Nonetheless, the service sector reading is still strong as it ranks in the 90th percentile of its queue of values since January 2012.

Germany echoes the patterns of the EMU region as its composite is lower in October and its composite moving average is lower over three months than for six months; although for Germany, the October reading is higher than the reading for its three-month average. German manufacturing momentum is ongoing with its sequential moving averages getting stronger and with an October reading that stands above all its moving average readings. Still, manufacturing ticks back on the month as the September reading is the strongest since January 2012; yet, the October reading is right on its heels ranking number two. The German performance for services is far less impressive as its current reading has a queue standing only in its 75th percentile. The 12-month and six-month averages are flat signaling no momentum while the three-month reading is lower signaling momentum loss. The German services gauge at 55.2 in October is lower than the September reading at 55.6 but it is still above its three-month average. So while German momentum has slipped in the services sector, it is not clear if momentum is still slipping.

France shows strong readings which have rankings for the composite manufacturing and services all above the 94th percentile level. Its composite index does slip lower over three months compared to six months, but its October reading is above its three-month and six-month levels. French manufacturing is plowing ahead with the manufacturing index at its highest level since January 2012 and its moving averages moving sequentially higher. Services in France show a backing off in the three-month average compared to the six-month average, but for October the service sector index is higher and also above its six-month index average.

By comparison, Japan (manufacturing only) and the U.S. lack the momentum of Europe (EMU) with queue standings for their available indexes in their respective 70th and 60th percentiles. Japan's manufacturing gauge is lower on the month and has lower diffusion values overall and less momentum than Europe. The U.S. shows uneven manufacturing sector momentum despite a gain in the manufacturing index in October with a rise in services as well. The U.S. services sector shows technically rising momentum from its sequential averages, but the gains are all very modest and their percentile standings are low.

On balance, manufacturing seems to be the driving force for growth with services lagging behind in terms of standing as well as in terms of momentum. Since manufactured goods are tradeable, it is not surprising to see that it is the global manufacturing environment that seems to be improving - based on the data we have in hand. The services sector is not a drag, but it is not advancing in step with manufacturing and in some cases it simply seems to have leveled out (see Chart).

Eyes and ears are shifting their focus to central banks as these data seem good enough to send the ECB down the road of less stimulus when it meets this week. In the U.S., the focus is on the anticipation of a new Fed Chair being appointed and what that will mean for U.S. and global monetary policy. At the same time, China is concluding its Party Congress and has set its focus on a number of internal goals that seem to take it off the road to a greater role of the private sector. The focal point for the meeting has been much more the 'coronation of Xi Jinping' than the elaboration of new economic goals and policies. All of this comes on the heels of a substantial election victory for Japan's PM Shinzo Abe. Germany's Angela Merkel recently has been re-elected but will have to cobble together a weaker coalition than she used to have. There are substantial economic and political changes afoot, but still a lot of work to be done and it is not clear if in the wake of these changes policy cooperation is going to improve or not.

While the PMI data show a pickup in manufacturing, the service sector is huge and did not fare as well. Issues of trade fairness and geopolitical instability still hang in the balance. In perspective, I'd say that the PMI trend is good news but not a game changer.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates