Global| Feb 14 2006

Global| Feb 14 2006Estimates of GDP Growth in Europe Confirm the Slowdown in Q4, 2005 But Investors Remain Confident That Improvement [...]

Summary

According to flash estimates published today, growth in real gross domestic product of the twenty-five countries of the European Union slowed to 0.4% in the fourth quarter of 2005, down from a 0.6% increase in the third quarter. [...]

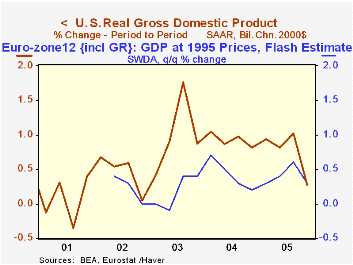

According to flash estimates published today, growth in real gross domestic product of the twenty-five countries of the European Union slowed to 0.4% in the fourth quarter of 2005, down from a 0.6% increase in the third quarter. Growth in the Euro Zone, alone, was 0.3%, down from a 0.6% increase in the third quarter. Incidentally, the slowdowns in the fourth quarter in the Euro Zone and in the EU were less marked than that of the United States, where fourth quarter growth fell to 0.3% from 1.0% in the third quarter. As a result, growth in the Euro Zone equaled the 0.3% quarter-to-quarter growth of the U.S., and growth in the European Union was greater than that of the U.S. for the first time since comparable data on the Euro Zone and EU have been available. The first chart compares the quarter-to-quarter growth rates in GDP in the U.S. and the Euro Zone.

As a result, growth in the Euro Zone equaled the 0.3% quarter-to-quarter growth of the U.S., and growth in the European Union was greater than that of the U.S. for the first time since comparable data on the Euro Zone and EU have been available. The first chart compares the quarter-to-quarter growth rates in GDP in the U.S. and the Euro Zone.

Within the Euro Zone there was a marked slowdown in Germany, from 0.6% growth in the third quarter to practically zero in the fourth. Growth in France also decelerated from 0.7% in the third quarter to 0.2% in the fourth. There were, however, countries where growth picked up in the fourth quarter--Spain and Austria among them.

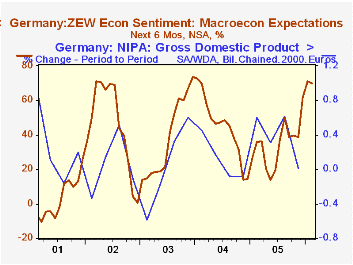

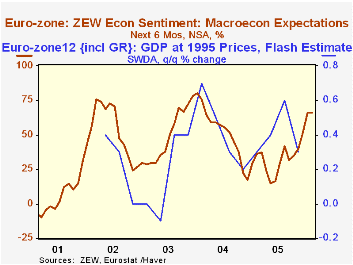

In spite of the fourth quarter slowdown, the institutional investors and analysts of the ZEW survey remain confident that conditions will improve over the next six months. In Germany, the balance of those expecting improvement over those expecting a worsening was 69.8% in February, very little changed from the 71% in January. As recently as May, 2005, the balance of optimists was only 13.9%. The second chart plots the balance of the optimists over the pessimists with the quarterly change in real GDP for Germany. A similar picture is shown in the third chart for the Euro Zone as a whole. The balance of optimists over pessimists was 66.0% in February, virtually identical with January's 66.1% and well above the May 2005 low point of 14.8%.

| Gross Domestic Product (Q/Q % Change) | Q4 05 | Q3 05 | Q2 05 | Q1 05 | -- | -- | -- |

|---|---|---|---|---|---|---|---|

| United States | 0.3 | 1.0 | 0.8 | 0.9 | -- | -- | -- |

| EU (25) | 0.4 | 0.6 | 0.5 | 0.3 | -- | -- | -- |

| Euro Zone (12) | 0.3 | 0.4 | 0.6 | 0.3 | -- | -- | -- |

| Germany | 0.0 | 0.6 | 0.3 | 0.6 | -- | -- | -- |

| France | 0.2 | 0.7 | 0.0 | 0.3 | -- | -- | -- |

| Spain | 0.9 | 0.8 | 0.8 | 0.9 | -- | -- | -- |

| Austria | 0.7 | 0.5 | 0.5 | 0.2 | -- | -- | -- |

| ZEW Financial Market Survey Expectations 6 months ahead (% balance) | Feb 06 | Jan 06 | Dec 05 | Nov 05 | 2005 | 2004 | 2003 |

| Germany | 69.8 | 71.0 | 61.6 | 38.7 | 34.8 | 44.6 | 38.4 |

| Euro zone | 66.0 | 66.1 | 51.2 | 40.0 | 32.3 | 52.1 | 48.1 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates