Global| Aug 31 2007

Global| Aug 31 2007EU Index Near a High but Losing Momentum

Summary

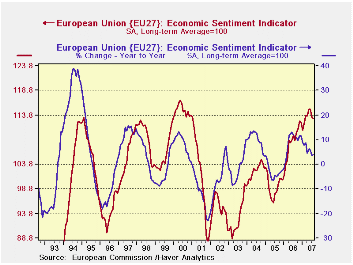

The accompanying chart is the paradox of Europe. Its sentiment index is very high yet there is already a clear loss in momentum. Historically, breaks in momentum have led to significant slow downs. So far this one has been different. [...]

The accompanying chart is the paradox of Europe. Its sentiment index is very high yet there is already a clear loss in momentum. Historically, breaks in momentum have led to significant slow downs. So far this one has been different.

The main EU measures also show some subtle losses in momentum. This softening is reinforced by declines in sentiment indexes across the major EU members. Only France (missing its observations for August) has showed continued increases in sentiment up until now. The retail sector is relatively the strongest with its highest reading to date in August. Financial turmoil appears to have not phased it. The industrial sector is still relatively strong posting its eighth highest reading. But consumer sentiment has slipped and is in its 82nd percentile far from the 90-plus readings for retail and industry. Across the main EMU/EU countries they stand in the 60th to 80th percentiles of their ranges. This means that for EU overall it is the smaller countries that are doing even better. It is reasonable to wonder if they are simply lagging in their slowdown. There is little evidence that the recent turmoil in markets has had an impact since consumer confidence is where we would expect to see it, and that gauge did slip this month, but has been slipping in any event.

| EU | Aug-07 | Jul-07 | Jun-07 | May-07 | Percentile | Rank | Max | Min | Range | Mean | R-SQ w/Confid |

| Overall | 113.2 | 113.3 | 115 | 115 | 91.5 | 20 | 117 | 74 | 43 | 100 | 1.00 |

| Industrial | 5 | 5 | 7 | 6 | 94.1 | 8 | 7 | -27 | 34 | -7 | 0.89 |

| Consumer Confidence | -3 | -2 | -2 | -1 | 82.8 | 27 | 2 | -27 | 29 | -10 | 0.82 |

| Retail | 6 | 5 | 5 | 5 | 100.0 | 1 | 6 | -21 | 27 | -6 | 0.46 |

| Construction | 0 | 0 | 1 | 1 | 93.3 | 13 | 3 | -42 | 45 | -18 | 0.43 |

| Services | 21 | 20 | 21 | 23 | 71.1 | 55 | 32 | -6 | 38 | 17 | 0.80 |

| % m/m | Based on Level | Level | |||||||||

| EMU | -0.9% | -0.6% | -0.4% | 1.0% | 83.1 | 39 | 117 | 74 | 44 | 100 | 0.94 |

| Germany | -0.9% | -0.5% | -0.4% | 0.8% | 73.7 | 26 | 121 | 79 | 42 | 100 | 0.61 |

| France | #N/A | 0.6% | 0.0% | 3.0% | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A |

| Italy | -3.0% | -0.9% | -1.3% | -1.4% | 63.5 | 84 | 121 | 72 | 49 | 100 | 0.79 |

| Spain | 1.1% | -0.9% | 1.2% | -1.2% | 62.3 | 134 | 118 | 67 | 50 | 100 | 0.67 |

| Memo: UK | 4.5% | -5.7% | 1.6% | 3.4% | 90.3 | 8 | 119 | 69 | 50 | 100 | 0.38 |

| Since 1990 except Services (Oct 1996) 208-Count | Services: 126-Count | ||||||||||

| Sentiment is an index, sector readings are net balance diffusion measures | |||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates