Global| May 14 2007

Global| May 14 2007Euro area Industrial Production Shows Some Signs of Topping

Summary

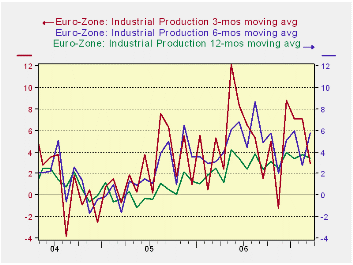

Industrial production in MFG in the Euro area in March rose by 0.3%. But the chart shows that a deceleration is underway. Yr/Yr growth is steady at just under 5.3%. But over the last three months output has lost momentum. The table [...]

Industrial production in MFG in the Euro area in March rose by 0.3%. But the chart shows that a deceleration is underway. Yr/Yr growth is steady at just under 5.3%. But over the last three months output has lost momentum.

The table shows that consumer durables and capital equipment output weakened in March after a strong February showing, slowing the 3-month rate of growth sharply for overall production. Still, growth has only dropped off to a nearly 3% pace from 5% or more previously.

Key EMU countries continue to show strength. The three-month growth rates for output in Germany are still very strong at 8%, France’s 3.5% is a slight acceleration, while output has fallen off sharply in Italy declining at a 5.5% pace. In the UK three-month growth rates for output are negative for 3-mo and for 6-month horizons.

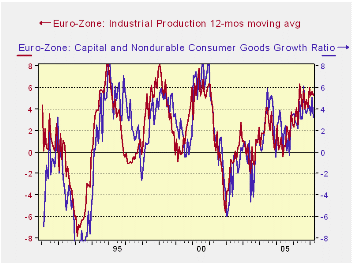

Capital equipment continues to be the leading sector. Consumer output is trailing and is showing no signs of pick up.

The ratio of capital goods output to consumer non-durables output is a directional signal for IP. Note how good the tracking is in the graph to the right. The capital goods sector is the leading sector for European economies. The R-square relationship of this ratio to overall IP growth is 0.67. That’s impressive for this type of indicator. For the moment, the ratio has stopped rising.

For the first quarter IP is still strong. MFG IP is growing at a 5.6% pace. The consumer sector is up at a 2.5% pace, intermediate goods at a 6% pace and capital goods at a 7.8% pace. But all may not continue to be so well…

The President of the EU business association, Business Europe, was quoted as saying on Monday that the strong euro was not causing a slowdown in the European economy. However, also on Monday the European Parliament issued a statement saying that upward trend in the Euro's exchange rate is not sustainable for the euro area's economy. Accordingly the Parliament’s draft report is to be debated in the Economic and Monetary Affairs Committee before being presented to ECB President Jean-Claude Trichet. Another interesting development was in the UK. There, Arm Holdings, the Cambridge-based designer of semiconductors, an industry whose global currency is dollars complained of an ongoing too-strong currency impact. Warren East, chief executive, estimates that the dollar has wiped £1bn from the company’s stock market value. He claims that the last ‘three years’ have been pretty horrid, not just the recent period when the pound and euro both have surged against the dollar. He maintains that seeking a cost base in the weaker dollar is the only solution. Surely, these observations are not compatible with a continuation of the strength we have seen in EU industrial output especially for capital equipment. We will be looking at the ratio of Capital goods IP to consumer nondurable goods IP as an indicator in the months ahead as well as at general IP trends.

| Saar except m/m | Mo/Mo | Mar-07 | Feb-07 | Mar-07 | Feb-07 | Mar-07 | Feb-07 | ||

| Ezone Detail | Mar-07 | Feb-07 | Jan-07 | 3-Mo | 3-Mo | 6-mo | 6-mo | 12-mo | 12-mo |

| MFG | 0.3% | 0.5% | -0.1% | 2.9% | 7.1% | 5.8% | 2.8% | 5.3% | 5.7% |

| Consumer | 0.6% | 0.0% | -0.3% | 1.1% | 3.0% | 4.0% | 2.0% | 3.3% | 2.5% |

| Consumer Durables | -0.2% | 0.6% | -1.5% | -4.2% | -0.1% | 2.7% | -3.5% | 3.9% | 5.0% |

| Consumer Nondurables | 0.7% | -0.1% | -0.2% | 1.5% | 3.6% | 4.1% | 2.3% | 3.1% | 2.1% |

| Intermediate | 0.5% | 0.7% | -0.6% | 2.4% | 9.2% | 7.0% | 1.4% | 6.3% | 7.2% |

| Capital | 0.0% | 0.9% | 0.3% | 5.0% | 8.2% | 6.7% | 5.5% | 6.4% | 7.3% |

| Memo: MFG | |||||||||

| Germany: | 0.3% | 0.8% | 1.0% | 8.8% | 7.7% | 8.0% | 6.7% | 8.6% | 8.1% |

| France: IP excl Construction | 0.2% | 1.2% | -0.5% | 3.5% | 7.2% | 3.3% | 1.6% | 1.1% | 2.5% |

| Italy | 0.4% | -0.2% | -1.6% | -5.5% | -0.8% | 4.0% | 0.2% | 2.5% | 2.2% |

| Spain | 1.9% | -5.2% | 9.3% | 24.2% | 2.3% | 12.8% | -1.8% | 3.1% | 5.3% |

| UK | 0.6% | -0.8% | -0.1% | -1.2% | -3.1% | -0.6% | -1.5% | 0.9% | 1.1% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates