Global| Nov 21 2008

Global| Nov 21 2008Euro Area PMIs

Summary

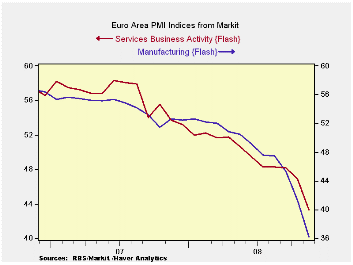

The Markit/NTC readings on conditions in services and MFG in the Euro Area show another chilling story. The indices are down to all time lows that covers 11-Years for the Manufacturing PMI and 10-years for services. The MFG index [...]

The Markit/NTC readings on conditions in services and MFG in

the Euro Area show another chilling story. The indices are down to all

time lows that covers 11-Years for the Manufacturing PMI and 10-years

for services.

The MFG index stands at a level of 36.16 well below the

neutral mark of 50. The services PMI stands at 43.32 a very low reading

for a less volatile sector. The services PMI is only slightly less

volatile than the MFG readings on m/mo levels basis. But the MFG PMI

has a range of variation that is 20% larger. Even so in terms of m/m

changes in the indices services is slightly more volatile.

Compared to the US where the PMIs (ISM) measure MFG and Non

MFG, the MFG and Services sectors in Europe are far more closely

correlated. Their simple correlation is 0.89 compared to 0.78 for the

tow US measures. This suggest the US economy has room for more

independent activity in each sector possibly a better ability to avert

sector contagion, whereas in Europe when one sector does something, the

other is quick to follow. That is bad news when economic growth is

slipping. The US MFG sector is about 25% more volatile than its

European counterpart whereas the US Nonmanufacturing sector is about 4

percent less volatile than its European counterpart. Right now all PMIs

are sinking and are very weak.

| FLASH Readings: Market PMIs for the Euro Area 13 | ||

|---|---|---|

| Manufacturing | Services | |

| Nov-08 | 36.16 | 43.32 |

| Oct-08 | 41.10 | 45.76 |

| Sep-08 | 44.97 | 48.44 |

| Aug-08 | 47.55 | 48.46 |

| Averages | ||

| 3-Month | 44.54 | 46.13 |

| 6-Month | 46.79 | 47.39 |

| 12-Month | 49.50 | 49.66 |

| 125-Mo Range | ||

| High | 60.47 | 62.36 |

| Low | 36.16 | 43.32 |

| % Range | 0.0% | 0.0% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates