Global| Jul 05 2016

Global| Jul 05 2016Euro Area Retail Sales Are Soft and So Is the Outlook

Summary

Retail sales volumes in the euro area in May grew by a solid 0.4% but in the wake of a 0.2% gain in April and after a 0.6% drop in March. Over the last three months, retail sales are still contracting on balance in the EMU. The [...]

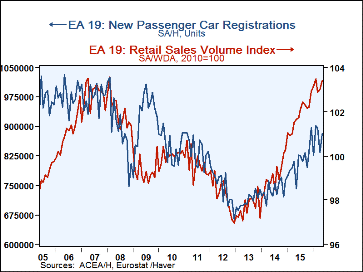

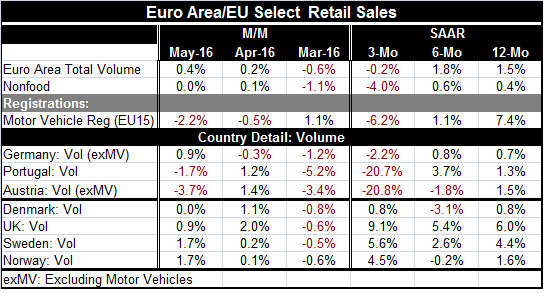

Retail sales volumes in the euro area in May grew by a solid 0.4% but in the wake of a 0.2% gain in April and after a 0.6% drop in March. Over the last three months, retail sales are still contracting on balance in the EMU. The picture is much weaker for nonfood sales where sales are falling at a 4% annual rate over three months and up by only 0.4% over 12 months.

Retail sales volumes in the euro area in May grew by a solid 0.4% but in the wake of a 0.2% gain in April and after a 0.6% drop in March. Over the last three months, retail sales are still contracting on balance in the EMU. The picture is much weaker for nonfood sales where sales are falling at a 4% annual rate over three months and up by only 0.4% over 12 months.

Motor vehicle registrations also show flagging momentum as sales slow more over each subsequently shorter horizon. Over each of the last two months, registrations are lower, falling by 2.2% in May and by 0.5% in April, but after a 1.1% rise in March. Registrations over three months are falling at a 6.2% annual rate.

There is not much here is terms of strength to be reliant on concerning growth. And in the wake of the Brexit vote, all bets on past trends (at least buoyant ones) are off. But there are none of those trends here for overall EMU sales.

Early reporting members in EMU

Early reporting EMU members Germany, Portugal and Austria show sales weak and falling over the last three months. German sales are off at a mild pace comparted to the others as both Portugal and Austria have sales falling over three months at a pace in excess of 20% (annualized). Austria and Germany show a steadily deteriorating pace of sales.

Retail sales trends beyond EMU and Brexit

In the rest of the EU area, we have four early reporters. All but Denmark show solid-to-accelerating sales patterns. Sales in the U.K. were particularly firm in May, but in the wake of the Brexit vote we have to wonder and put that trend on data-watch. A new post Brexit poll finds that British pessimism is up in the wake of Brexit. A YouGov poll finds that 49% of the business respondents are pessimistic after the Brexit vote compared to only 25% polled the week before the vote. Of course, sterling continues to be weak and versus the dollar it has hit a 31-year low.

Putting numbers on the cost of Brexit

The IMF has cranked some numbers and estimates that the U.K. is set to lose between 1.5% and 4.5% in GDP between now and 2019 because of Brexit. Uncertainty is the issue as investment might seize up while firms bide their time to see exactly that will emerge and what firms in the U.K. will be able to do and won't be able to do in terms of unrestricted commerce with EU members in the wake of the `leave' vote.

The Blame for Brexit

As an aside I find it curious that all the blame for Brexit is heaped on the shoulders of the U.K. (well, THEY did vote to leave, some will say...). No one in the EU in any official capacity has hung their head in shame because they gave PM Cameron so little to take back home when he demanded some give-back. Surely if the EU had sweetened the pot a bit more, the U.K. would have felt a bit warmer toward staying. The U.K. vote was close. Anything might have helped. But no one in in the EU is willing to shoulder any blame. It's just another reason why the EU and EMU are struggling and failing. There is no real leadership there. There is no introspection. There are factions. And everyone wants to put a hand into the euro pot to see what goodies they can bring back home. Or alternatively, what results they can get passed to protect some key interests back home that want `integration' but not in their own industry. Europe continues to wrestle with such issues and that its one of the big reasons that the U.K. opted out.

The saga of the euro and its banks

There is another important tug of war in the EMU going on over Italian banks, banks that are woefully undercapitalized. And their stocks are weak: Unicredit (-9.8%), Intesa (-3.4%), Banco Monte dei Paschi (-15.8%) and UBI (-6.1%), all declines for last week alone. The EU wants to keep in place its bank policy set in Cyrus of bail-ins, a policy that causes stock and bond holders to bear the pain ahead of any public injection. But in Italy, PM Renzi wants none of that. He has talked about an injection of public funds putting him at odds with the EU intelligentsia (I use the phrase loosely here). `Newspaper politics' have Renzi's alleged position all over the place after he was first quoted saying he would inject public monies - we no longer can be sure where he stands. But frankly, it would be unthinkable for him to force bail-ins on Italian banks if he ever wanted to hold office anywhere in Italy again. It's one thing to force the harsh medicine down the throats of investors in Cyprus; it's quite another thing to do it in the heart of the euro area where banking sector rules have long been loosely applied.

The Dog Days of EU

The euro saga hardly ended with the U.K. In some ways it has just begun. The EU, in my opinion, played fast and loose with the U.K., offering it little to stay and lost that bet. Would it be so cavalier with Italy over the issue of banks and their safety and soundness? Is the EU really ready to hang Renzi out to dry on this issue? I think there is a real question here about how much the EU leaders want to preserve the Area and how much they want to show that they can flex their muscle no matter how painful and force countries to bend to their will. Heel boy...

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates