Global| May 05 2006

Global| May 05 2006Euro-Zone Banks Ease Credit Standards for Business, See Stronger Loan Demand

Summary

Since 2003, the European Central Bank (ECB) has conducted a bank officers' lending survey similar to the Federal Reserve's "Senior Loan Officer Survey", asking questions about lending policies and credit demand experienced by banks. [...]

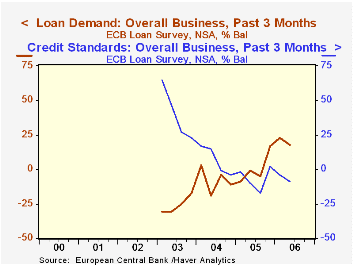

Since 2003, the European Central Bank (ECB) has conducted a bank officers' lending survey similar to the Federal Reserve's "Senior Loan Officer Survey", asking questions about lending policies and credit demand experienced by banks. Results of the ECB survey taken in early April were reported today; we call your attention to them because, while we have felt some concern about European economic conditions (see our note yesterday about sluggish retail trade), it appears that credit conditions have been easing and that credit demand is picking up.

Taken in April, the survey reports that the number of banks easing credit standards for business loans had exceeded those tightening standards by 9 percentage points during the previous three months. The easing trend actually began in mid-2004 and has continued since, except for one quarter. This comes off a period of significant tightening during 2003, with a net of 65 percent of banks making credit criteria more stringent in the first survey in January 2003. Credit demand in that early period was weak, falling at a net of 31 percent of participating banks in the first half of 2003. Now, however, demand for business loans is picking up noticeably, with the latest three quarters averaging +19 percent.

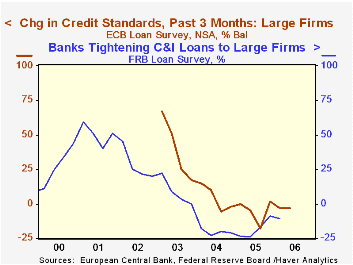

In the table below, we include data for lending to large businesses and in the first graph we compare that to the Fed's series for US bank lending policies covering a comparable set of businesses. The trends are similar, as might well be for large firms, which can choose among financing institutions.

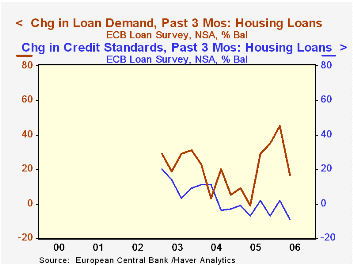

Similar credit policy patterns appear in the data on consumer and housing credit, although the cycle is much less pronounced. Consumer credit lending policies are marginally easier, loosening in the three months before the survey at a net of 5 percent of reporting institutions. This extends a slight easing trend that began in Q4 2004. Interestingly, demand for consumer credit appears strong, rising on balance at 21 and 18 percent of banks in the last two quarters, respectively. In light of recently lackluster retail sales, this bears comparison with actual consumer lending data, but that's a commentary for another day!

Meantime, demand for housing loans may have peaked. After three sharply positive quarters, reaching 45% in the January survey, the balance of banks with increased home purchase lending fell to 17% in this survey. Regarding credit standards, the behavior here is similar to consumer credit, with nearly neutral readings.

Obviously, all of these data want for lack of history, particularly through an entire business cycle. They should become more useful as that history builds. However, at this time, it seems that we can conclude that banks are increasingly willing to lend to businesses, and they are seeing some positive response in lending activity.

| Net Percentages: last 3 months | Q2 2006 | Q1 2006 | Q2 2005 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|

| Overall Business: Tighter Credit Standards | -9 | -4 | -10 | -7 | 7 | 40 |

| Credit Demand | 18 | 23 | -1 | 1 | -8 | -26 |

| Large Businesses: Tighter Credit Standards | -3 | -3 | -5 | -5 | 4 | 40 |

| Credit Demand | 17 | 10 | -6 | -4 | -7 | -21 |

| Consumer Credit: Tighter Standards | -5 | 1 | -7 | -3 | 1 | 15 |

| Credit Demand | 18 | 21 | 0 | 6 | 4 | -3 |

| Housing Loans: Tighter Standards | -9 | 2 | -7 | -3 | 4 | 12 |

| Credit Demand | 17 | 45 | -1 | 18 | 13 | 27 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.